The NVDA Stock Tests Support Pre Nvidia’s Earnings, Break Lower or Bounce?

NVIDIA's unprecedented success has been overshadowed by a haze of policy risk and decreasing enthusiasm, leading to a stock decline as trade

Quick overview

- NVIDIA's record earnings failed to boost investor confidence, leading to a significant stock pullback amid growing policy risks.

- The company's market capitalization dropped from $5 trillion to approximately $4.6 trillion, with shares falling 4.5% to $185.

- Concerns over U.S.-China trade tensions and SoftBank's recent sale of 32.1 million shares have heightened market unease.

- The broader semiconductor sector is also experiencing declines as fears of trade restrictions and a cooling AI market take hold.

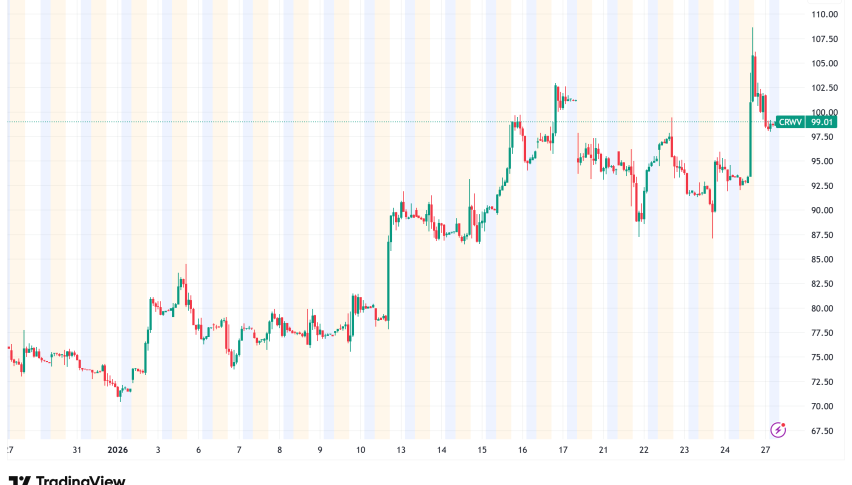

Live NVDA Chart

[[NVDA-graph]]NVIDIA’s unprecedented success has been overshadowed by a haze of policy risk and decreasing enthusiasm, leading to a stock decline as traders prepare for more drops.

Market Optimism Evaporates Despite Blowout Results

NVIDIA’s latest “historic” earnings release did little to calm a market increasingly exhausted by policy threats, pricing pressure, and speculation of a fading AI boom. Instead of celebrating another round of record profits, investors responded with a swift retreat, wiping out billions in market value within hours. The reaction underscored what many traders have feared for weeks: the narrative has shifted from admiration to apprehension.

After briefly touching the $5 trillion valuation milestone, NVIDIA saw its market capitalization collapse back toward $4.6 trillion as the stock plunged 4.5% on Thursday, sliding to $185. The dramatic selloff—occurring in spite of unprecedented profitability—revealed how fragile sentiment has become. Even more concerning, sellers are aggressively probing the 50-day simple moving average, a key technical support line. Should this level fail, downside targets of $165 and even $153 could come into play. Although a short-term bounce is possible, the stock’s tone has undeniably turned more defensive.

Technical Outlook: Support Weakening Under Pressure

The broader environment for AI-linked equities has deteriorated as bubble warnings grow louder. With NVIDIA preparing to release fiscal Q3 results next week, expectations for the company remain sky-high—perhaps dangerously so.

NVDA Chart Daily – Retesting the 50 SMA

After a meteoric climb above the $5 trillion mark last week, NVIDIA’s market cap slid back to $4.6 trillion at the moment as shares tumbled 4.5% on thursday, falling to $185 . The decline came despite another quarter of record-breaking profit, highlighting how investor focus has shifted from earnings strength to policy uncertainty. Now sellers are retesting the 50 daily SMA (yellow) again. If it breaks, then it will open the door for $165 and then $153, but we might see a rebound as well because this MA has been acting as support since early September .

Nvidia Earnings Next Week

Analysts anticipate earnings of $1.25 per share on revenue of $54.8 billion for the quarter ending October 26. While those numbers represent extraordinary annual growth of more than 50% in both revenue and profit, the market appears less impressed than before. Technical traders note that repeated retests of key support zones suggest weakening demand and growing exhaustion among buyers who once viewed every dip as an opportunity.

SoftBank Dump

Part of the unease stems from unusual market activity. SoftBank recently unloaded 32.1 million NVIDIA shares to bolster its liquidity, a move that—despite SoftBank’s insistence that it still believes in the long-term story—set off alarm bells. The selling contributed to pre-market weakness earlier this week, reinforcing the perception that even major backers are stepping away at current valuations.

Policy Risks Dampening Confidence

Investor anxiety has intensified following renewed U.S.–China policy friction. Reports suggesting Washington could block exports of NVIDIA’s advanced Blackwell AI chips to China triggered another wave of fear-driven selling. The White House later confirmed that no approval for such shipments is currently planned, deepening concerns about abrupt revenue losses from one of NVIDIA’s most important international markets.

Although CFO Colette Kress attempted to reassure markets by noting that a proposed 15% tariff on AI chip exports has not yet taken effect, her comments did little to restore confidence. The ambiguity—combined with shifting geopolitical priorities—continues to cast a dark shadow over NVIDIA’s outlook.

Wider Semiconductor Sector Feels the Strain

The negative ripple effect has spread far beyond NVIDIA. Semiconductor stocks across the board have slumped as traders prepare for potential trade restrictions and a cooling phase in the once-booming AI infrastructure cycle. Even prominent firms like Palantir found themselves caught in the downturn, amplified by short-seller Michael Burry’s high-profile bets against major tech companies.

Conclusion: Despite phenomenal financial performance, NVIDIA now finds itself battling a toxic combination of geopolitical uncertainty, valuation fatigue, and weakening technical momentum. Until clarity returns, the stock—and the semiconductor sector at large—may continue to face sustained downward pressure.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM