TradeQuo Review

- Overview

- Fees, Spreads, and Commissions

- Account Types and Minimum Deposit

- How to Open a TradeQuo Account

- Safety and Security

- Trading Platforms and Tools

- Markets available for Trade

- Deposits and Withdrawals

- Research and Education

- TradeQuo Awards and Recognition

- Deposit Bonus

- TradeQuo IB and Ambassador Programs

- TradeQuo vs GTCFX vs Capital.com - A Comparison

- Customer Support

- Pros and Cons

- In Conclusion

TradeQuo is a multi-entity broker that’s grown fast since launching in 2020. The brand operates and is regulated in South Africa and the UAE, plus offshore in Dominica. It mixes retail trading access with regional flexibility, offering accounts and support tailored to different client groups.

★★★★ | Minimum Deposit: $1 Regulated by: FSCA,SCA Crypto: Yes |

Overview

TradeQuo positions itself as an ambitious global broker that blends wide market access with region-specific flexibility. It delivers MetaTrader platforms, diverse account choices, and transparent trading conditions. The broker’s safety features, proof of reserves, and rapid withdrawals create a confident environment that appeals to both new and experienced traders.

Frequently Asked Questions

What makes TradeQuo stand out among global brokers?

TradeQuo stands out because it combines strong regional licensing with a flexible trading environment. It offers multiple account types, deep market coverage, and reliable safety features. The broker’s proof of reserves model and instant withdrawals further increase trader confidence while keeping the overall user experience transparent.

Is TradeQuo suitable for beginners?

TradeQuo suits beginners because its structure prioritizes accessibility. The broker provides low entry deposits, simple account choices, and around-the-clock multilingual support. Traders can also use familiar MetaTrader platforms, which reduces complexity and offers a smoother learning curve while ensuring that charting and execution remain efficient.

Our Insights

TradeQuo delivers a compelling mix of global reach, transparent conditions, and trader-first safety measures. Its strong reputation, proof of reserves, and instant withdrawals create confidence, while flexible accounts and platforms keep trading accessible. The broker offers a reliable environment suited to both casual and advanced traders.

★★★★ | Minimum Deposit: $1 Regulated by: FSCA,SCA Crypto: Yes |

Fees, Spreads, and Commissions

TradeQuo delivers a clean, transparent pricing structure built around raw spreads and a true zero-markup model. Traders benefit from competitive spreads, low commissions, and clear swap policies. Although costs vary by account and instrument, the overall fee environment remains highly cost-efficient for both frequent and long-term traders.

| Category | Key Details | Notes | Impact |

| Pricing Model | Zero markup raw pricing | Market-driven spreads | Lower trading costs |

| Account Spreads | Standard Raw Zero Limitless | From 0.0 to 1.0 pips | Supports multiple strategies |

| Commission Model | Raw and Zero accounts | Fixed per-side fees | Transparent structure |

| Non-Trading Fees | No deposit or withdrawal charges | Inactivity fee after 12 months | Easy to manage |

Frequently Asked Questions

How does TradeQuo keep trading costs competitive across different accounts?

TradeQuo keeps trading costs low by offering raw, unmarked prices supported by tight spreads that vary by account type. Commission-based accounts provide the tightest spreads, which helps active traders reduce costs. This structure allows both casual and high-volume traders to choose the most efficient pricing setup.

Are there any hidden non-trading charges I should worry about?

TradeQuo maintains a transparent non-trading fee structure. Deposits and withdrawals are free of broker-imposed charges, although external payment providers may add fees. The only notable non-trading cost is a small inactivity fee after 12 months, which is easy to avoid with minimal account activity.

Our Insights

TradeQuo delivers a fee structure that favors transparency, flexibility, and low-cost execution. Its spreads remain competitive, commissions are clearly defined, and non-trading fees are minimal. Traders looking for predictable and cost-effective pricing across short-term and long-term strategies will find TradeQuo’s model highly appealing.

★★★★ | Minimum Deposit: $1 Regulated by: FSCA,SCA Crypto: Yes |

Account Types and Minimum Deposit

TradeQuo delivers a diverse set of account types that suit beginners, cost-focused traders, and high-volume professionals. Each option maintains consistent market access, yet cost structures differ meaningfully. Consequently, traders can match spreads, commissions, or leverage preferences to their strategy without compromising execution quality or platform features.

Frequently Asked Questions

Which TradeQuo account is best for beginners?

New traders typically benefit most from the Standard account because it removes commissions and keeps pricing straightforward. The spreads are slightly wider, although the predictable cost structure helps beginners control expenses. Additionally, the identical market access across all accounts ensures they do not sacrifice trading opportunities while learning.

How does the TradeQuo demo account help new traders?

The TradeQuo demo account mirrors live conditions, allowing traders to practice with realistic spreads, commissions, and execution. Virtual balances and adjustable leverage help recreate personal trading scenarios. Since Expert Advisors and hedging are fully supported, beginners can safely test strategies before risking real capital.

Our Insights

TradeQuo’s range of accounts offers clear flexibility for different trading needs. RAW and Zero accounts appeal to cost-sensitive and high-volume traders, while Standard simplifies pricing. Limitless∞ stands out for extreme leverage under offshore setups. Overall, the structure supports beginners and advanced traders seeking transparent and versatile conditions.

★★★★ | Minimum Deposit: $1 Regulated by: FSCA,SCA Crypto: Yes |

How to Open a TradeQuo Account

Opening a TradeQuo account is quick and fully online. You must verify your identity, confirm your address, and fund your account before placing live trades.

1. Step 1: Begin Registration

Visit the TradeQuo Sign Up page and create a Member Area profile.

2. Step 2: Confirm Email

Click the verification link sent to your inbox to activate the account.

3. Step 3: Complete Personal Profile

Fill in Personal Details and the Economic Profile inside your dashboard.

4. Step 4: Upload Documents

Provide Proof of Identity and Proof of Address for KYC.

5. Step 5: Wait for KYC Review

Allow time for the KYC Review until your status updates to Verified.

6. Step 6: Open Live Account

Choose account type, platform, and base currency, then open the live account.

7. Step 7: Deposit Funds

Add funds using your preferred payment method to start trading.

Log in with your profile credentials and trade. Finally, submit withdrawals only after your verification status is active.

★★★★ | Minimum Deposit: $1 Regulated by: FSCA,SCA Crypto: Yes |

Safety and Security

TradeQuo operates under multiple regulatory frameworks, creating a layered safety structure for traders. Each entity adheres to its region’s financial rules, which strengthens oversight and operational transparency. Consequently, traders gain a clearer understanding of the firm’s compliance standards and potential risk exposure across both local and offshore jurisdictions.

| Entity | Region | Regulator | License/Status |

| TradeQuo (Pty) Ltd | 🇿🇦 South Africa | FSCA | FSP 54827 |

| TradeQuoMarkets Ltd | 🇩🇲 Dominica | Financial Master Management Ltd | 2023/C0010-0001 |

| TradeQuomarkets Financial Services L.L.C | 🇦🇪 United Arab Emirates | SCA | 20200000320 |

Frequently Asked Questions

Is TradeQuo regulated, and does it follow proper compliance standards?

TradeQuo maintains regulatory oversight through three entities. 🇿🇦 South Africa supervises TradeQuo (Pty) Ltd under the FSCA, 🇩🇲 Dominica oversees the offshore CFDs dealer licence, and 🇦🇪 United Arab Emirates regulates advisory activities via the SCA. This combination supports structured compliance and increased operational transparency for traders.

What does TradeQuo’s offshore licence mean for traders?

The 🇩🇲 Dominica offshore licence enables TradeQuo to provide CFDs internationally with flexible trading conditions. Although it broadens service availability, offshore oversight can carry lighter regulatory protections. Therefore, traders should understand the difference between offshore and locally regulated environments to match their risk tolerance appropriately.

Our Insights

TradeQuo demonstrates a balanced regulatory footprint with strong local supervision in 🇿🇦 South Africa and expanded offshore coverage through 🇩🇲 Dominica and 🇦🇪 United Arab Emirates. The structure supports varied client needs while maintaining core compliance standards. Overall, the framework offers reasonable transparency for traders seeking multi-jurisdictional protection.

★★★★ | Minimum Deposit: $1 Regulated by: FSCA,SCA Crypto: Yes |

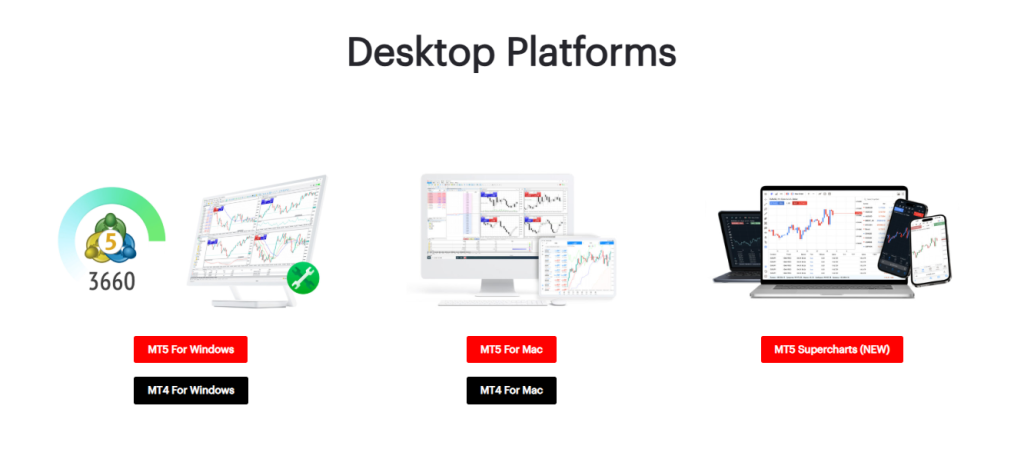

Trading Platforms and Tools

TradeQuo delivers a versatile platform suite designed for different trading styles, offering MT4, MT5, and two enhanced MT5 variants. Each platform maintains consistent pricing and seamless device compatibility. Consequently, traders gain flexibility, improved charting tools, and intuitive execution workflows that support both simple and advanced strategies.

| Platform | Access | Key Features | Instruments |

| MT4 | Web Desktop Mobile | Stable charts copy trading | Major FX and CFDs |

| MT5 | Web Desktop Mobile | DOM strategy tester | 350 plus instruments |

| MT5 SuperCharts | Web | One-click charts custom layouts | 350 plus markets |

| MT5 TradingView | Web | TradingView charting with MT5 execution | Matches MT5 offering |

Frequently Asked Questions

Which TradeQuo platform is best for beginners?

Beginners often gravitate toward MT4 due to its simple layout, familiar structure, and stable execution. It includes streamlined gold charting and copy trading access, which helps new traders develop strategies more confidently. Although MT5 offers more tools, MT4’s ease of use makes it ideal for learning.

What makes MT5 SuperCharts or MT5 TradingView different from standard MT5?

MT5 SuperCharts and MT5 TradingView enhance the MT5 experience with web-based charting upgrades, one-click trading, and customizable layouts. TradingView adds advanced visuals and integrated calculators. Since both connect directly to MT5 execution, traders can enjoy upgraded charting without losing pricing accuracy or platform features.

Our Insights

TradeQuo’s platform offering suits every skill level, from MT4 simplicity to MT5’s advanced tools and upgraded charting interfaces. The browser-based SuperCharts and TradingView setups create added convenience without compromising execution quality. Overall, the platform mix ensures consistency, strong functionality, and flexible access across devices.

★★★★ | Minimum Deposit: $1 Regulated by: FSCA,SCA Crypto: Yes |

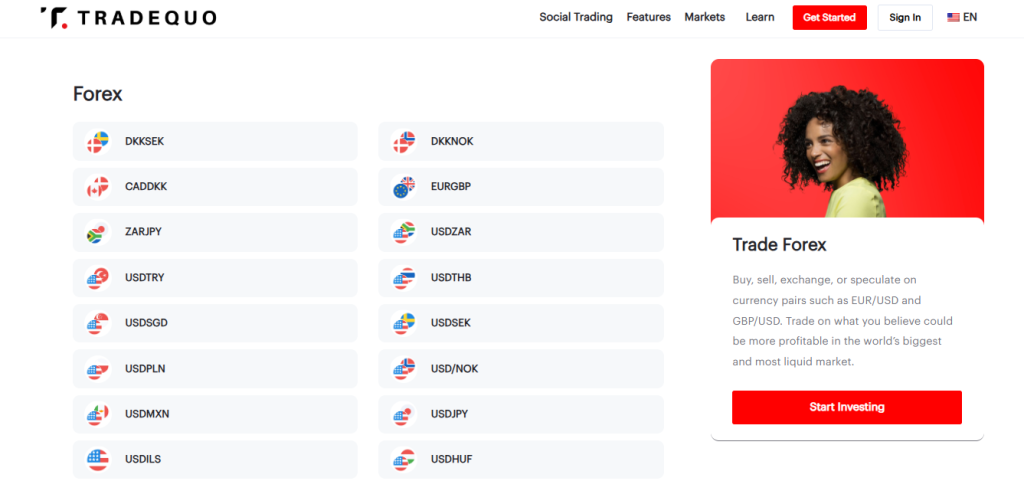

Markets available for Trade

TradeQuo delivers wide market access that supports short and long-term strategies across forex, commodities, indices, crypto, stocks, and synthetic assets. The diverse selection helps traders pursue varied opportunities, and the dynamic margin structure ensures flexibility. Consequently, users can tailor their portfolio to changing conditions with ease.

| Market Category | Highlights | Margin | Notes |

| Forex | 90 plus pairs | Dynamic | Majors minors exotics |

| Indices | 🇺🇸 S&P 500 🇩🇪 DAX 🇯🇵 Nikkei | From 0.2 percent | 15 plus global benchmarks |

| Crypto | 80 plus CFDs | 2 percent | Zero commission |

| Stocks | Global companies incl. 🇺🇸 US | Varies | One-share contract sizes |

Frequently Asked Questions

Which markets are most popular among TradeQuo traders?

Most traders gravitate toward forex and indices due to tight spreads, strong liquidity, and flexible leverage. The offering includes more than 90 forex pairs and major global benchmarks such as the 🇺🇸 S&P 500, 🇩🇪 DAX, and 🇯🇵 Nikkei 225. This range allows for strong market diversification.

Does TradeQuo offer emerging market exposure?

TradeQuo provides emerging market access through forex exotics, stock CFDs, and NDFs such as 🇺🇸/🇧🇷 USD/BRL, 🇺🇸/🇮🇳 USD/INR, and 🇺🇸/🇰🇷 USD/KRW. Although these markets offer attractive volatility, margin requirements are higher. Therefore, traders should approach them with careful position sizing and a clear risk plan.

Our Insights

TradeQuo’s market coverage is broad and strategically constructed, delivering forex, commodities, metals, indices, crypto, stocks, and specialty instruments. The flexible margin structure enhances accessibility, while contract size variety helps beginners and active traders. Overall, the platform offers a highly competitive environment for diverse, global market participation.

★★★★ | Minimum Deposit: $1 Regulated by: FSCA,SCA Crypto: Yes |

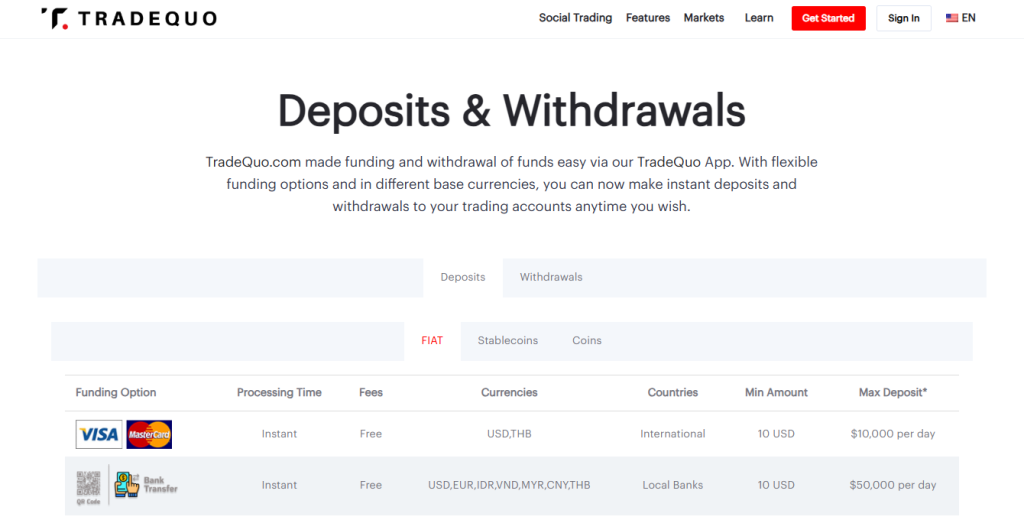

Deposits and Withdrawals

TradeQuo offers a highly flexible funding system with cards, bank transfers, mobile money, e-wallets, stablecoins, and major cryptocurrencies. Processing times are near-instant across all methods, which gives traders seamless access to capital. Consequently, funding and withdrawals remain efficient, transparent, and suitable for global users with varied currency needs.

| Category | Methods | Deposit Time | Min Deposit |

| Cards and Bank | Visa Mastercard Local Bank | Instant | 1 USD |

| E-Wallets | Neteller Skrill Dragonpay | Instant | 1 USD |

| Mobile Money | Safaricom MTN M-Pesa | Instant | 1 USD |

| Crypto or Stablecoins | USDT USDC BTC ETH, more | Blockchain-dependent | 1 USD equivalent |

Frequently Asked Questions

How fast are deposits and withdrawals at TradeQuo?

TradeQuo processes most deposits instantly across cards, e-wallets, mobile money, and many crypto networks. Withdrawals are also completed within minutes once approved. Although blockchain transactions may vary slightly, the platform still maintains rapid processing. This speed lets traders manage capital efficiently during fast-moving market conditions.

Do I need to use the same method for deposits and withdrawals?

TradeQuo follows a Money-In-Money-Out policy, which means withdrawals must use the same method originally used for deposits. This rule enhances security and aligns with AML requirements. Therefore, traders should choose funding methods carefully to ensure easy, consistent access to both deposits and future withdrawals.

Our Insights

TradeQuo delivers a robust, globally accessible funding system with fast processing, low minimums, and support for traditional and digital payment methods. The platform’s flexibility benefits new and professional traders alike. Overall, the funding structure is efficient, secure, and clearly designed to simplify money movement across regions.

★★★★ | Minimum Deposit: $1 Regulated by: FSCA,SCA Crypto: Yes |

Research and Education

TradeQuo delivers a broad research and education suite covering trading basics, advanced strategy, calculators, live sessions, and quick market updates. The material supports beginners and experienced traders alike. Consequently, users gain structured learning paths, practical decision-making tools, and timely insights for consistent skill development.

| Tool or Education | What It Offers | Who It Is For | Format |

| Investing 101 | Basics of CFDs ETFs inflation | New traders | Guides |

| Forex or Crypto Education | Strategy and blockchain insights | Skill builders | Articles |

| Webinars or Videos | Live sessions and short tutorials | Visual learners | Video or Live |

| Calculators | Margin and PnL tools | All traders | Interactive tools |

Frequently Asked Questions

Does TradeQuo offer education suitable for complete beginners?

TradeQuo provides beginner-friendly learning through Investing 101, glossary tools, video lessons, and platform tutorials. These resources introduce CFDs, diversification, trading terms, and platform setup. Because the content is simple and structured, new traders can build foundational skills before moving to more advanced materials with confidence.

What research tools help with daily trading decisions?

Daily traders benefit from the economic calendar, trading calculators, Snaps market updates, and the regularly updated blog. These tools support risk management, news tracking, and fast market interpretation. Therefore, traders can maintain awareness of volatility events and position sizing while reacting quickly to changing market conditions.

Our Insights

TradeQuo offers an impressive blend of educational content and practical trading tools. The resources cover every stage of the trading journey, from beginner education to professional-grade calculators and webinars. Overall, the research suite enhances trader confidence, market understanding, and day-to-day execution quality.

★★★★ | Minimum Deposit: $1 Regulated by: FSCA,SCA Crypto: Yes |

TradeQuo Awards and Recognition

Since its launch in 2020, TradeQuo has quickly established a reputation for excellence in the trading industry. The broker has already earned several notable accolades:

- Best Trading Conditions – Awarded by World Finance Forex Awards (2026).

- Fastest Growing FX Broker – Announced by TradeQuo via official channels (2024–2025).

- Fastest Growing Crypto Broker – Announced by TradeQuo via official channels (2024–2025).

- Best Partner Program – Recognized by TradeQuo’s affiliate division (2024).

- Best Forex CEO of the Year – Industry award shared on LinkedIn (2023).

- Runner-Up for Highest Client Numbers – Acknowledged at a Vanuatu Financial Services Commission event (2023).

These awards reflect TradeQuo’s commitment to superior trading conditions, rapid growth, and strong leadership, positioning it as a rising force in global financial markets.

★★★★ | Minimum Deposit: $1 Regulated by: FSCA,SCA Crypto: Yes |

Deposit Bonus

TradeQuo offers a deposit bonus designed to enhance trading potential for new verified clients. With rates from 10 to 30 percent, the bonus applies to Standard or Raw accounts with a minimum deposit of 100 USD. Consequently, traders can start with additional capital while managing risk effectively.

| Feature | Details | Minimum Deposit | Maximum Bonus |

| Eligible Accounts | Standard, Raw | 100 USD | 2,000 USD per account |

| Bonus Rate | 10%, 20%, 30% | 100 USD | 5,000 USD per client |

| Bonus Validity | 90 days | 100 USD | 5,000 USD per client |

| Usage | Trading only | 100 USD | 2,000 USD per account |

Frequently Asked Questions

Who is eligible for the TradeQuo deposit bonus?

The bonus is available only to new verified clients who open a Standard or Raw account. A minimum deposit of 100 USD is required, and the bonus must be claimed using a valid promo code. This ensures that only active, verified traders benefit from the promotion.

How long is the deposit bonus valid, and are there limits?

Bonus funds are valid for 90 days from the date of deposit and can only be used for trading. The maximum bonus per client is 5,000 USD, while individual accounts are capped at 2,000 USD. This structure encourages timely use and responsible risk management.

Our Insights

TradeQuo’s deposit bonus provides new traders with extra trading capital to explore strategies and markets. With flexible bonus rates and clear validity terms, it enhances the initial trading experience. Overall, the offer is straightforward, well-structured, and adds tangible value for verified clients.

★★★★ | Minimum Deposit: $1 Regulated by: FSCA,SCA Crypto: Yes |

TradeQuo IB and Ambassador Programs

TradeQuo offers structured partnership programs for influencers, educators, and financial professionals. Ambassadors can earn commissions via referrals, while IB partners manage clients and leverage full trading infrastructure. Consequently, these programs provide flexible income opportunities and business growth potential while maintaining access to TradeQuo’s technology and support.

| Program | Target Audience | Key Benefits | Earning Potential |

| Ambassador | Creators bloggers educators | Referral commissions, exclusive bonuses | Per client introduced |

| IB (Business) | Professionals companies | Full trading infrastructure, client management | Multi-tier commission and revenue sharing |

Frequently Asked Questions

Who can join the TradeQuo Ambassador program?

The Ambassador program is designed for content creators, bloggers, educators, and comparison sites. Participants share unique referral links and earn commission for introducing new clients. Additional perks include exclusive bonuses, early updates, and direct access to the TradeQuo team for collaboration and marketing insights.

What benefits do IB partners receive?

IB partners gain full access to TradeQuo’s trading infrastructure, including portal and back-office tools. They can manage clients, earn multi-tier commissions, and enjoy tailored revenue-sharing models. Dedicated onboarding support and access to platform technology allow professionals and companies to expand operations efficiently under TradeQuo’s framework.

Our Insights

TradeQuo’s IB and Ambassador programs deliver flexible earning potential for individuals and businesses. Ambassadors benefit from referral commissions and exclusive updates, while IB partners can scale operations with advanced infrastructure. Overall, the programs are well-structured, transparent, and provide meaningful incentives for long-term collaboration.

★★★★ | Minimum Deposit: $1 Regulated by: FSCA,SCA Crypto: Yes |

TradeQuo vs GTCFX vs Capital.com – A Comparison

| Broker | TradeQuo | GTCFX | Capital.com |

| Founded | 2020s (recent entrant) | 2012 | 2016 |

| Regulation | South Africa (FSCA) Dominica UAE (SCA) | FSCA SCA FCA FSC VFSC | FCA CySEC ASIC SCB FSA |

| Account Types | RAW STANDARD ZERO LIMITLESS Swap-Free Demo | Standard Pro ECN Islamic Demo | Retail, Professional, Swap-Free, Demo |

| Leverage | Up to 1:10,000,000, or “Limitless” under offshore | Up to 1:2000 (tiered) | Up to 1:30 retail 1:300 pro |

| Minimum Deposit | From $1 (varies by payment system) | None (Standard) $50 (Pro) $3,000 (ECN) | From $10 (card) €50 (bank transfer) |

| Trading Platforms | MT4 MT5 MT5 SuperCharts TradingView | MT4 MT5 | Web Mobile MT4 TradingView |

| Instruments | Forex Metals Indices Crypto Commodities | 27,000+ (Forex, Metals, Indices, Shares, Crypto CFDs) | 3,000+ (Shares, Indices, Commodities, Forex, Crypto, ETFs) |

| Spreads | From 0.0 pips | From 0.0 pips | From 0.6 pips |

| Negative Balance Protection | Yes (all accounts) | Yes (retail accounts) | Yes (retail accounts) |

| Awards (2024–2025) | Fastest Growing FX Broker, Best Trading Conditions | Best Liquidity Provider, Most Trusted FX Broker | Best CFD Provider, Best App, Best Education |

| Swap-Free Islamic Accounts | By request, includes extended swap-free | Available, must apply, monitored for misuse | Available by request, subject to eligibility and region |

★★★★ | Minimum Deposit: $1 Regulated by: FSCA,SCA Crypto: Yes |

Customer Support

TradeQuo provides clear and accessible contact channels across email, phone, social media, and in-person offices. Clients can send messages, request callbacks, or follow updates via verified platforms. Consequently, users benefit from responsive support and multiple ways to interact with the broker efficiently and transparently.

Frequently Asked Questions

How can I contact TradeQuo for support?

Clients can reach TradeQuo via verified email addresses ([email protected], [email protected]) or phone (+357 2512 3894 for Cyprus, +248 432 1630 for global support). Additionally, the broker offers a callback request form on its website and active social media channels for updates and general inquiries.

Where are TradeQuo’s offices located?

In addition to its headquarters in the Seychelles, TradeQuo has offices around the world, including Limassol, Dubai, Kuala Lumpur, Bangkok, and Medellin.

Our Insights

TradeQuo offers multiple, clearly listed support channels that enhance accessibility and transparency. Email, phone, social media, and callback options ensure users can resolve issues quickly. Overall, the broker demonstrates a strong client support infrastructure that promotes confidence and smooth communication for all account holders.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Fast registration and KYC linked to platform access | Regional limits on leverage and account access |

| Offers a deposit bonus with transparent terms | Education stays basic, light on advanced material |

| Leverage up to 1:10,000,000 or limitless for risk-takers | $10 inactivity fee after 12 months |

| Spreads from 0.0 pip on Zero and tight Raw pricing | Bonuses expire after 90 days and can be revoked |

References:

In Conclusion

TradeQuo is a good fit for traders who want a wide range of markets without a high minimum deposit. It’s multiple account types that suit different trading styles, and you can trade forex, metals, indices, and crypto with 24/7 support. The main drawbacks are its offshore regulation and spreads that improve mostly on higher-tier accounts.

Faq

Yes, TradeQuo is regulated by the FSCA in South Africa and the SCA in the UAE. TradeQuoMarkets Ltd also has a Master License in Dominica. Client accounts are kept under segregation rules to protect funds.

From $1, depending on the payment method you use.

Yes, the demo mirrors live conditions on MT4 and MT5 with virtual balances between $10,000 and $100,000.

You can use cards, bank transfers, e-wallets, mobile money, or crypto. Most deposits are instant, and withdrawals are processed within a few minutes.

Instant, usually up to 4 minutes.

Yes, available on MT4 and MT5 by request and approved after review.

You can trade forex, metals, indices, commodities, stocks, cryptocurrencies, synthetic indices, NDFs, and soft commodities.

No, TradeQuo does not accept clients from the USA or other restricted countries.

Yes, all accounts include negative balance protection.

No, TradeQuo is a broker without any markup added to spreads. The only extra cost may be a $10 inactivity fee after 12 months.

- Overview

- Fees, Spreads, and Commissions

- Account Types and Minimum Deposit

- How to Open a TradeQuo Account

- Safety and Security

- Trading Platforms and Tools

- Markets available for Trade

- Deposits and Withdrawals

- Research and Education

- TradeQuo Awards and Recognition

- Deposit Bonus

- TradeQuo IB and Ambassador Programs

- TradeQuo vs GTCFX vs Capital.com - A Comparison

- Customer Support

- Pros and Cons

- In Conclusion