Gold Price Prediction: FED Rate Cuts, Growing Reserves and Risk Keep XAU Bullish

Even as interest-rate expectations shift and global tensions fluctuate, gold continues to prove why it remains the ultimate store of...

Quick overview

- Gold remains a stable safe-haven asset amid shifting interest rates and global tensions.

- Despite a brief pullback, gold prices surged to a record $4,381 per ounce, reflecting ongoing market anxiety.

- The Federal Reserve's accommodative stance and bullish forecasts from major banks support a positive long-term outlook for gold.

- Central bank demand has reached new heights, with gold-backed ETFs attracting significant inflows and central banks holding more gold than U.S. Treasuries.

Live GOLD Chart

Even as interest-rate expectations shift and global tensions fluctuate, gold continues to prove why it remains the ultimate store of stability.

Gold Remains Resilient in a Turbulent Macro Environment

Despite changing assumptions around Federal Reserve policy, fragile trade relations, and persistent market volatility, gold continues to attract capital as a safe-haven asset. The precious metal surged to a record $4,381 per ounce in late October before easing back under the $4,000 mark as nerves temporarily settled across financial markets. This short-lived pullback followed signs of easing tension in the U.S.–China relationship, including paused tariffs and renewed discussions around rare-earth exports.

However, the cooling in sentiment did not last long. Demand for gold quickly re-emerged, highlighting the market’s underlying anxiety and the continued appeal of defensive positioning.

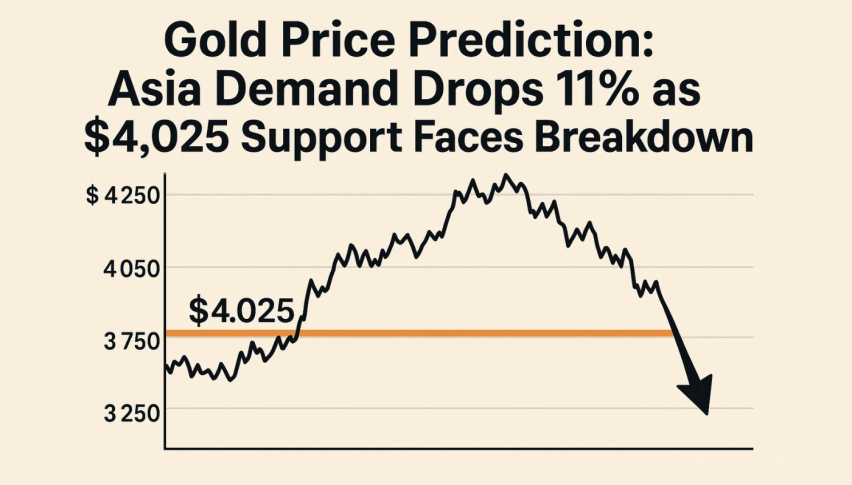

Technical Structure Reinforces Support

The recent weakness in gold was shallow and orderly. Following the reopening of the U.S. government and the Federal Reserve’s 25 basis-point rate cut, buyers stepped back in with conviction, lifting prices toward $4,245. Even as global stocks suffered a broad selloff on Friday, gold steadied at its 20-day Simple Moving Average, a key technical zone that once again provided a solid floor.

XAU Chart Daily – The 20 SMA Acting As Support Now

This behavior reinforces gold’s reputation as a stabilizing asset during periods of uncertainty. Each dip continues to attract buyers, and the structure of higher lows on the chart suggests that underlying demand remains intact.

Fed Policy Keeps the Long-Term Trend Intact

The Federal Reserve’s recent shift toward a more accommodative stance has played a critical role in gold’s broader uptrend. Since late August, when the metal was trading near $3,300, expectations for easier monetary conditions have provided a powerful tailwind.

Although Fed Chair Jerome Powell maintains a cautious, data-dependent approach, historical patterns show that even gradual rate reductions tend to support gold — particularly in an environment of lingering inflation pressures and elevated government debt.

In contrast to earlier market caution, sentiment shifted meaningfully after New York Fed President John Williams stated that the central bank could still reduce interest rates in the near term without drifting away from its inflation goal. These remarks were seen as supportive for further gains in gold.

As a result, traders have now increased the perceived probability of another rate cut at the Fed’s next meeting to 74%, up sharply from just 40% earlier in the week.

Bullish Forecasts From Major Banks Strengthen Conviction

Top investment banks are echoing the positive long-term outlook:

- UBS expects gold to reach $4,200 over the next 12 months

- Goldman Sachs projects prices could climb to $4,900 by late 2026, driven by steady institutional demand and portfolio diversification

With a packed calendar of upcoming U.S. data releases — including Consumer Confidence, Richmond Fed surveys, and Retail Sales — short-term swings are likely. Still, the broader trend remains upward.

Central Bank Demand Anchors the Market

Institutional and sovereign demand continues to form a powerful base under gold. During Q3, gold-backed ETFs attracted $26 billion in inflows, pushing total ETF holdings to a new record of $472 billion.

In a notable shift, global central banks now hold more gold than U.S. Treasuries for the first time since 1996, underlining a structural change in reserve strategies worldwide.

While China’s move to remove VAT rebates on domestic gold purchases may temporarily soften local retail demand, ongoing buying from central banks, sovereign wealth funds, and institutional investors is expected to more than absorb any short-term slowdown.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account