Bitcoin Eyes $93K Rally as Fed Rate Cut Bets Jump to 67% for December

Barclays Research highlights that the Federal Reserve’s December meeting remains finely balanced, yet Chair Jerome Powell...

Quick overview

- Barclays Research indicates a balanced Federal Reserve meeting in December, with a 67% chance of a 25 basis points rate cut.

- Treasury Secretary Scott Bessent has alleviated recession fears, attributing inflation to service sector costs rather than imported goods.

- Bitcoin has rebounded over 8% from recent lows, with analysts predicting it could surpass $90,000 if positive trends continue.

- Maintaining weekly closes above $86,000 could lead Bitcoin toward $93,000, setting the stage for a potential market rally.

Barclays Research highlights that the Federal Reserve’s December meeting remains finely balanced, yet Chair Jerome Powell may sway the committee toward another 25 basis points (bps) reduction. Recent commentary from Fed governors indicates a split: Stephen Miran, Michelle Bowman, and Christopher Waller favor easing, while St. Louis Fed President Alberto Musalem and Kansas City President Jeffrey Schmid lean toward holding rates steady.

Other Fed officials, including Vice Chair for Supervision Michael Barr and Boston Fed President Susan Collins, remain undecided, with slight bias toward the current 3.75%-4% policy range. Governors Lisa Cook and John Williams await additional data but appear receptive to a further cut if economic conditions justify it.

- CME FedWatch shows a 67% likelihood of a December rate cut, up from 33% previously.

- Market sentiment shifted after Fed Williams hinted at easing.

- October CPI data is still pending; November CPI is set for December 18.

Treasury Sec. Bessent Eases Recession Fears

Treasury Secretary Scott Bessent has dismissed concerns over rising inflation or an imminent recession in the U.S. economy. He noted that while inflation in imported goods has remained stable, service sector costs drive current price increases, unrelated to tariffs.

This reassurance has fueled optimism in risk assets, including Bitcoin, as investors weigh Fed policy signals against robust economic indicators. Bessent’s remarks contrast with earlier cautionary narratives, signaling confidence in the U.S. economic outlook.

- Inflation in imported goods: flat

- Service economy inflation: primary contributor

- Recession risk: minimal according to Treasury data

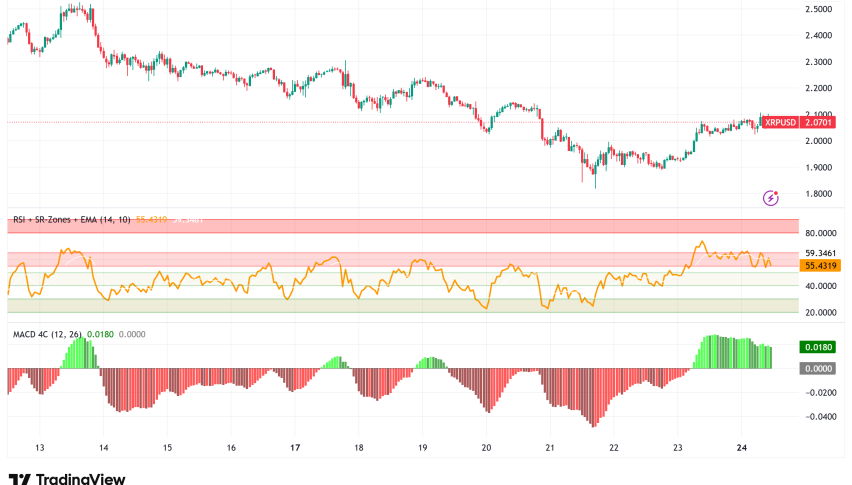

Bitcoin Rebounds Toward $93K

Bitcoin (BTC) has surged more than 8% from recent lows near $81,000, spurred by rising Fed rate cut expectations. Analysts see momentum building for BTC to surpass $90,000 if positive tailwinds persist, including the potential approval of spot Bitcoin ETFs and sustained whale buying activity.

Michael van de Poppe highlighted a CME gap at $85,200, suggesting a minor pullback before BTC ascends toward $90K-$96K. Rekt Capital notes that maintaining weekly closes above $86,000 could propel Bitcoin toward $93,000, with support and resistance levels forming a key trading range.

- Current BTC price: ~$86,700

- 24-hour low/high: $85,404 / $88,038

- Trading volume: +45% in the last 24 hours

If Bitcoin sustains above $86K and breaks past $93K resistance, analysts forecast that a new market base may emerge, potentially setting the stage for the next major rally in the crypto sector.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account