HOOD Stock Finds Support at $100 and Eyes New Uptrend on Robinhood Q3 Earnings Data

After losing a third of its value in November, Robinhood has remained over $100. This spectacular comeback increases the likelihood that its

Quick overview

- Robinhood has rebounded from a significant drop in November, recovering from below $100 to around $115.

- The stock's recent performance is supported by technical indicators, including the 20-day Simple Moving Average acting as support.

- Robinhood's Q3 earnings report exceeded expectations, driven by a substantial increase in cryptocurrency trading revenue.

- While momentum is returning, challenges such as competition and regulatory uncertainties remain for the company.

After losing a third of its value in November, Robinhood has remained over $100. This spectacular comeback increases the likelihood that its upward trajectory will resume.

Robinhood Recovers After A Sharp Drop

Robinhood Markets (NASDAQ: HOOD) endured a difficult November, losing roughly one-third of its value as the stock fell from around $150 to below $100. But on Friday, the stock found strong support in that key zone, and buyers stepped in decisively. As of today, Robinhood has climbed back toward $115, a move that indicates the pullback may be coming to an end and that the broader uptrend could be resuming.

HOOD Stock Chart Daily – The 20 SMA Pushing the Price Higher

Technical Setup Points To Strength

From a technical standpoint, the recent bounce suggests renewed confidence. The stock’s daily chart shows it is pushing higher, and the 20-day Simple Moving Average (SMA) is now acting as support and helping fuel upward momentum. However, Robinhood faces a key test just ahead — the 100-day SMA (green) around $115, which could act as resistance. Beyond that, the 50-day SMA (yellow) around $130 represents the next major hurdle if the rally continues.

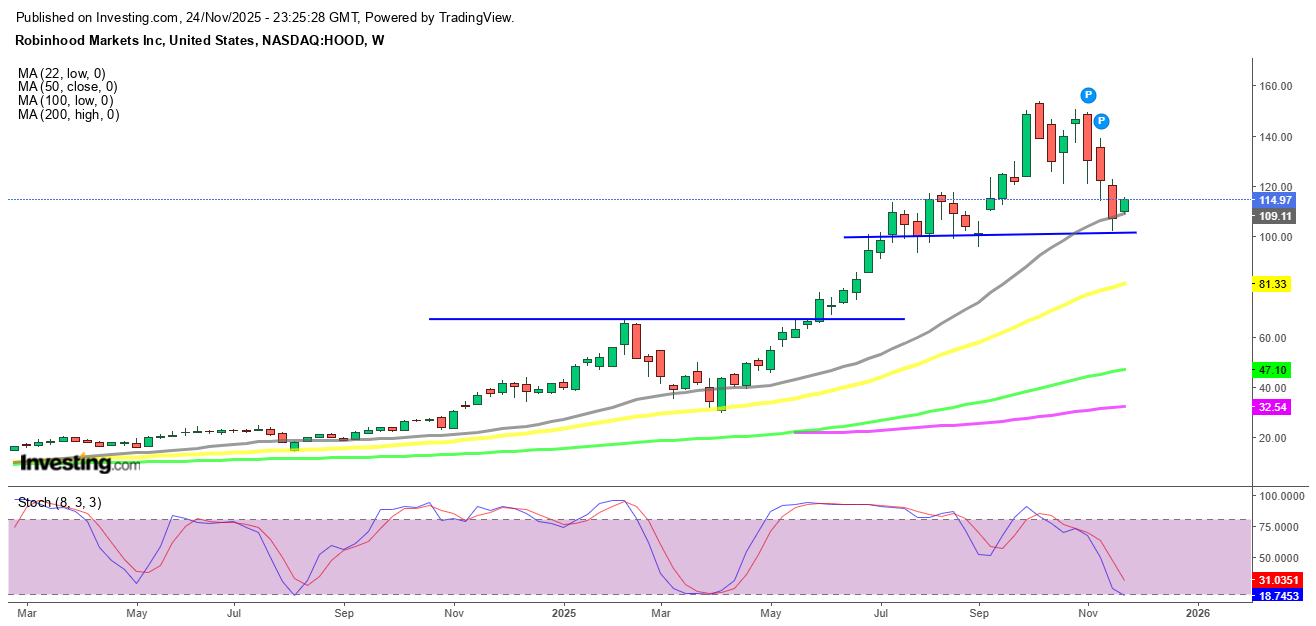

HOOD Stock Weekly – The 20 SMA Holds As Support

On the weekly chart, the picture also supports a rebound. Technical indicators such as the stochastic oscillator suggest the stock was oversold, and the 20-week SMA (gray) provided a stable base. Combined with last Friday’s bounce off the $100 support zone, these signals point to a healthy consolidation rather than a breakdown.

Q3 Results Underscore Robinhood’s Fintech Strength

Robinhood’s recent Q3 2025 earnings report raised confidence further. The company posted Earnings Per Share (EPS) of $0.61, above Wall Street expectations of $0.53, and generated $1.27 billion in net revenue — a 100% year-over-year increase, surpassing forecasts of $1.2 billion.

A major driver of this performance was Robinhood’s cryptocurrency business, which saw trading revenue jump by more than 300% to $268 million, even though that came in slightly below the $287.2 million some analysts had projected. Equities revenue grew by 132%, showcasing strong engagement across its core services.

In that same earnings release, Robinhood revealed leadership changes: CFO Jason Warnick will retire in Q1 next year, handing the reins to Shiv Verma. This transition appears to be part of Robinhood’s broader maturity as a publicly traded fintech powerhouse.

Crypto Strategy And Global Ambitions Drive Growth

Robinhood’s crypto business remains a cornerstone of its strategy. The nearly 98% year-over-year increase in crypto trading revenue demonstrates how successfully the company has pivoted toward digital assets. This business is helping Robinhood evolve into a full-service financial platform.

On top of that, Robinhood is focused on global growth. By expanding international offerings and leveraging its digital-first model, the company aims to deepen its foothold in markets beyond the U.S. This combination of crypto innovation and global expansion positions Robinhood as more than just a trading app — it’s becoming a central player in modern financial services.

Momentum Returns, But Risks Remain

Robinhood’s bounce back from $100 to $115 suggests renewed strength, but the road ahead remains challenging. Investors will closely watch whether HOOD can clear the 100-day SMA and push toward $130. If that happens, it could mark the beginning of a sustainable uptrend.

However, risks are still present. Competition in fintech is fierce, regulatory uncertainties persist, and cryptocurrency markets remain volatile. The strength of Robinhood’s rebound will depend not only on its earnings and strategy, but on its ability to execute as a scaled, diversified fintech leader.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM