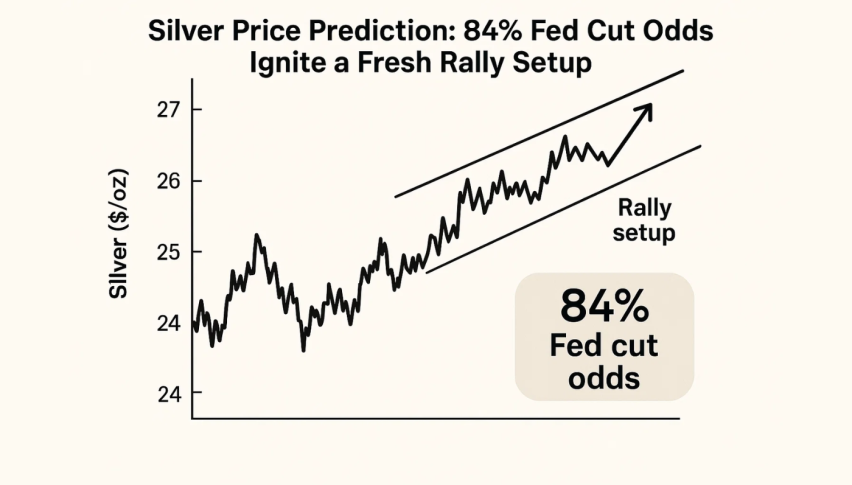

Silver Price Prediction: 84% Fed Cut Odds Ignite a Fresh Rally Setup

Silver extended its advance on Wednesday as traders increasingly price in a December interest-rate cut, lifting demand...

Quick overview

- Silver prices are rising as traders anticipate a December interest-rate cut, driven by weaker US economic data.

- The probability of a rate cut has surged to 84%, bolstered by dovish remarks from Federal Reserve officials.

- Silver is showing positive momentum, with key support levels holding and potential resistance at $52.19.

- The market outlook for silver remains constructive, with expectations of further gains if economic conditions continue to soften.

Silver extended its advance on Wednesday as traders increasingly price in a December interest-rate cut, lifting demand for haven assets across the metals market. New US economic data showed retail sales growing less than expected in September, while annual producer inflation held at 2.7%—adding to the case that economic momentum is losing pace.

The shift in tone from Federal Reserve officials has further reinforced rate-cut expectations. Tim Waterer, Chief Market Analyst at KCM Trade, said the market’s outlook is being shaped by “a chorus of dovish remarks” and soft macro data, which continue to support non-yielding assets such as silver. The dollar, meanwhile, fell to a one-week low as investors bet the next Fed chair could favor more accommodative policy. Ten-year Treasury yields also hovered near one-month lows, underscoring weakening rate pressure.

Traders now assign an 84% probability of a December cut, up sharply from 50% just last week, according to the CME FedWatch tool. Lower yields and a softening dollar have provided a supportive backdrop for silver, even as China’s latest import data showed a sharp 64% drop in gold flows through Hong Kong—evidence of shifting physical demand dynamics across the metals sector.

[[XAG/USD-graph]]

Silver Builds Momentum Above Key Supports

Silver is attempting to extend its rebound after reclaiming the $51.26 support area and crossing back above the 20-EMA. The move follows a series of higher lows from last week’s pivot zone, signaling early accumulation. The RSI near 61 reflects improving momentum without flashing exhaustion, giving bulls more room to test overhead levels.

On the chart, price is pressing against resistance at $52.19. A decisive close above this zone would open the door for a move toward $53.23, followed by the broader breakout target near $54.44. The rising trendline from late October continues to hold firm, keeping downside pressure contained.

Failure to break higher could pull silver back toward $50.44, where buyers previously stepped in with conviction. A break below $49.06 would weaken the broader structure and hint at a deeper pullback.

Key Technical Levels

- Support: $51.26, $50.44, $49.06

- Resistance: $52.19, $53.23, $54.44

Market Outlook

Silver’s outlook hinges on the Fed’s December meeting. With rate-cut odds now above 80% and risk sentiment still cautious, the metal retains a constructive bias. If economic data continues to cool, silver may attempt a bullish extension toward multi-week highs, supported by strengthening technical structure and easing rate pressure.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM