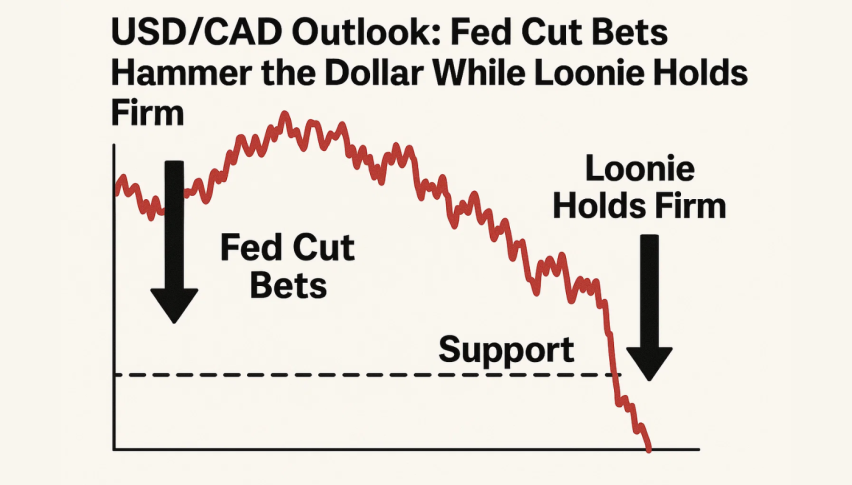

USD/CAD Outlook: Fed Cut Bets Hammer the Dollar While Loonie Holds Firm

During the European trading session, the USD/CAD pair drifted toward 1.4080, pressured by renewed expectations that the Federal Reserve...

Quick overview

- The USD/CAD pair is under pressure as expectations grow for a Federal Reserve rate cut in December, with the US Dollar trading cautiously.

- The US Dollar Index has dropped, with an 85.3% probability of a 25 bps rate cut, influenced by dovish comments from New York Fed President John Williams.

- The Canadian Dollar remains stable following the Bank of Canada's indication of an end to its tightening cycle, despite some forecasts for future rate cuts.

- Technical analysis shows USD/CAD is attempting to stabilize above 1.4090, facing resistance at 1.4140–1.4170, with traders looking for a confirmed breakout.

During the European trading session, the USD/CAD pair drifted toward 1.4080, pressured by renewed expectations that the Federal Reserve may cut rates in December. The US Dollar is trading cautiously, while the Canadian Dollar remains relatively stable, supported by the Bank of Canada’s (BoC) steady outlook.

Fed Rate Cut Speculation Pressures the Dollar

The US Dollar Index (DXY) held near 99.70, extending Tuesday’s losses as traders increased their bets on a December rate cut. According to CME FedWatch, the probability of a 25 bps cut has surged to 85.3%, up sharply from 50.1% last week.

Dovish comments from New York Fed President John Williams fueled this shift, noting that policy remains “modestly restrictive” and hinting at room for adjustment due to softer economic growth and cooling labor conditions.

Recent economic releases reinforced this view. Core producer inflation slowed in September, while Retail Sales increased only modestly, signaling weaker consumption. As a result, the Dollar continues to face downward pressure as markets price in an earlier easing cycle.

Steady Canadian Dollar Backed by BoC Guidance

The Canadian Dollar has remained calm following the BoC’s October meeting, where policymakers signaled the end of the tightening cycle after cutting rates to 2.25%. While some banks, including Citi, expect further reductions in 2026, current market sentiment views the Loonie as stable.

Thus, the recent pullback in USD/CAD reflects Dollar weakness more than broad CAD strength.

USD/CAD Price Forecast – Technical Analysis

USD/CAD is attempting to stabilize above 1.4090, but the chart continues to respect a broad contracting structure that has shaped movement throughout November. The pair recently completed an ABCD corrective pattern, with point C forming a higher low at 1.3972, reinforced by a rising dotted trendline.

That rebound generated a strong advance toward 1.4140, where price stalled, producing several small-bodied candles, spinning tops, and short rejection wicks, signaling hesitation rather than a full reversal. Momentum remains mixed: the RSI sits near 50, recovering from oversold territory, while price holds above the 20-EMA, which is beginning to turn upward.

However, USD/CAD remains capped below the 1.4140–1.4170 resistance band, a zone that has repeatedly rejected buyers. A decisive breakout above 1.4140, ideally with a bullish engulfing candle, could open the path toward 1.4214, a significant supply level.

For traders, the structure is clear: a long opportunity activates only on a confirmed close above 1.4140, targeting 1.4214, with protection placed below 1.4040. A drop under 1.4040 would weaken the bullish setup and expose the pair to a retest of 1.3972.

USD/CAD Outlook – Looking Ahead

Traders will monitor upcoming US data releases and fresh Fed remarks for short-term direction. Continued easing in inflation or weak consumer data could deepen Dollar pressure, while any signs of economic resilience may offer temporary support. USD/CAD sits at a technical crossroads — buyers are defending higher lows, but resistance continues to challenge their momentum.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account