Ethereum Consolidates Above $3,100, Technical Indicators Point to Potential 20% Rally Amid Record ETF Inflows

Ethereum is showing a lot of strength as it stays over the $3,100 threshold. At the time of writing, it was trading at about $3,166, which

Quick overview

- Ethereum is currently trading above $3,100, showing strength compared to Bitcoin due to strong institutional demand.

- Record inflows into Ethereum ETFs, particularly BlackRock's iShares Ethereum Trust, indicate a shift in institutional investment strategies.

- Technical analysis suggests a bullish trend for Ethereum, with recent price movements indicating a potential breakout above key resistance levels.

- Analysts predict Ethereum could reach between $5,000 and $15,000 by 2025, driven by increased network usage and favorable market conditions.

Ethereum ETH/USD is showing a lot of strength as it stays over the $3,100 threshold. At the time of writing, it was trading at about $3,166, which is only 1% down than it was 24 hours ago. Even though it has dropped somewhat every day, the second-largest cryptocurrency by market capitalization is doing better than Bitcoin BTC/USD. This is because of strong institutional demand and better technical structures that imply a big rally may be coming.

Spot Ethereum ETFs Dominate December Flow Data

The most interesting story behind Ethereum’s current position is the huge change in how institutional investors are putting their money to work. According to Farside Investors, Ethereum ETFs saw a record $2.1 billion in inflows in December 2024, almost twice the $1 billion that came in in November. Over the previous two weeks, spot ETH ETFs have raised three times as much money than their Bitcoin counterparts, with $360 million in net inflows compared to BTC’s $120 million.

BlackRock’s iShares Ethereum Trust (ETHA) has become the most popular way for institutions to get exposure, bringing in over $3.5 billion in net inflows in 2024. With $1.5 billion in total inflows, Fidelity’s Ethereum Fund (FETH) has also done well. Grayscale’s Ethereum Trust (ETHE) saw a lot of money leave, $3.6 billion, but the overall net positive flow into the ETF ecosystem shows that institutional investors are changing how they are betting on Ethereum’s future.

This institutional buying pressure comes at a crucial time for Ethereum, which has had a hard time breaking past resistance levels for most of late 2024. The steady flow of money into ETFs suggests that smart investors are building up their positions in anticipation of a price rise.

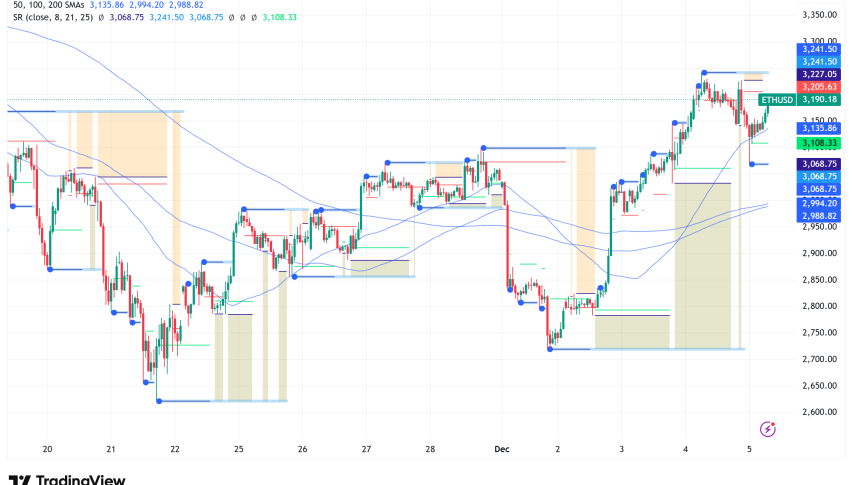

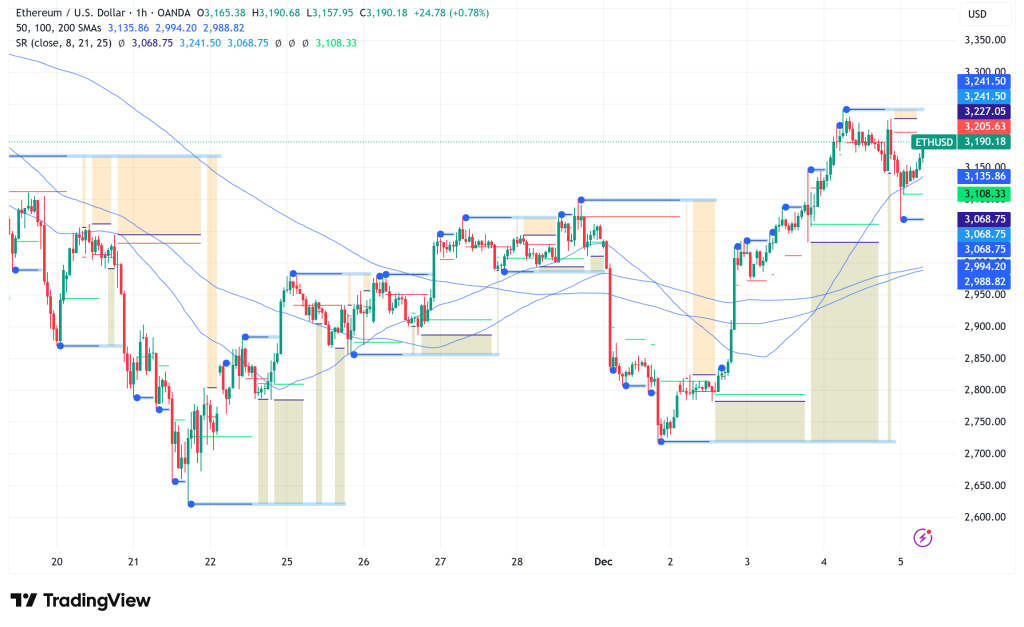

ETH/USD Technical Analysis: Break of Structure Signals Trend Reversal

Ethereum has set up a clearer high-time-frame chart than Bitcoin, which gives traders more confidence in the asset’s path. ETH recently broke through a structure by rising above $3,200 for the first time in 20 days. This shows that buyers have turned previous resistance zones into fresh support. This technical change shows that the market structure has changed in favor of bulls, and sellers are slowly losing influence.

The ETH/BTC trading pair makes this advantage even stronger. The pair just broke out of a 30-day consolidation zone where supply had frequently stopped upward attempts. The 200-day simple moving average (SMA) was successfully retested, which helped this breakout. This trend baseline has been strong since July. In the past, when Ethereum regained the 200-day SMA compared to Bitcoin and broke out of multi-week consolidation ranges, it usually led to long periods of ETH outperforming.

Ethereum has shown a lot of strength on the weekly chart by getting back into the $3,150-$3,200 range, which had turned into resistance during November’s sell-off. Last week’s candle had a long lower wick, which shows that there is a lot of buying activity in the $2,700-$2,800 range. This range has been a big demand zone during long corrections in the past.

If Bitcoin stays over $94,000 and closes above $96,000 every day, it will relieve some of the pressure on the altcoin market. In this case, Ethereum is in a good place to continue its fresh uptrend by testing the $3,650 swing high again. If momentum picks up over that point, the next target for expansion is $3,900, which is about 20% higher than current prices. This is where external liquidity clusters are now.

On-Chain Metrics Signal Market Balance and Accumulation Phase

Ethereum’s Net Unrealized Profit/Loss (NUPL) indicator is currently around 0.22, which means the market is balanced and supports the bullish technical hypothesis. This number shows that investors are still making a moderate profit without becoming too excited. This is a good sign that prices could keep going up instead of being too high because of speculation.

NUPL has not dropped below zero, which is very important because it shows that holders are still fundamentally robust and lowers the chance of cascading selling pressure. Market watchers usually see NUPL readings above 0.20 as a sign that a rebound is possible once the right conditions are met, as there aren’t a lot of unrealized losses that would cause people to panic and sell.

The spot average order size measure from CryptoQuant shows that Ethereum markets are changing their behavior. When ETH fell below $2,700 on November 21, retail buyers jumped in quickly, causing a rapid comeback in demand. This trend is similar to past accumulation phases, especially the March-May period, when early retail activity came before deeper declines and then greater rallies.

In the past, retail-driven rebounds at local lows have typically led to last liquidity revisits that shake away late purchasers before longer-lasting upward advances happen. This change signals that ETH may yet have a controlled retreat to reset positions and take in any lingering supply before starting a long-term rise.

Ethereum Price Prediction: Analysts Eye $6,000 Target for 2025

Several well-known analysts have made positive predictions for Ethereum’s success in 2025 based on record ETF inflows, better technical structures, and balanced on-chain measures. VanEck, a large asset management company, thinks that ETH might hit $6,000 during the next cycle peak in 2025. This is because more people are using the network and more AI agents are working on Ethereum and its Layer 2 scaling networks.

The $3,500 level is still a strong level of resistance in the near future. A clear breach above this level would cause crypto exchanges to close down more than $1 billion in leveraged short positions, which might cause prices to rise quickly. Conservative estimates for 2025 put ETH between $5,000 and $7,000, while more optimistic scenarios have it reaching $15,000, depending on how the industry as a whole, regulations, and institutional adoption trends change.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM