Ethereum Braces for $5,000 Surge as Bitmine Treasury Hits 4.1 Million ETH Milestone

Ethereum (ETH) is trading above $2,900, down 2.7% in the last 24 hours. This is normal for the cryptocurrency market at the end of the year

Quick overview

- Ethereum is currently trading above $2,900, experiencing a 2.7% decline in the last 24 hours, which is typical for year-end market behavior.

- Bitmine Immersion has significantly increased its Ethereum holdings by acquiring 44,463 ETH, bringing its total to over 4.1 million ETH, indicating strong institutional interest.

- A recent shift in Ethereum's validator admission queue suggests a potential price rally, with historical data indicating significant price increases following similar trends.

- Technical analysis shows that if Ethereum maintains support above $2,750, it could potentially rise to $5,120, despite short-term volatility.

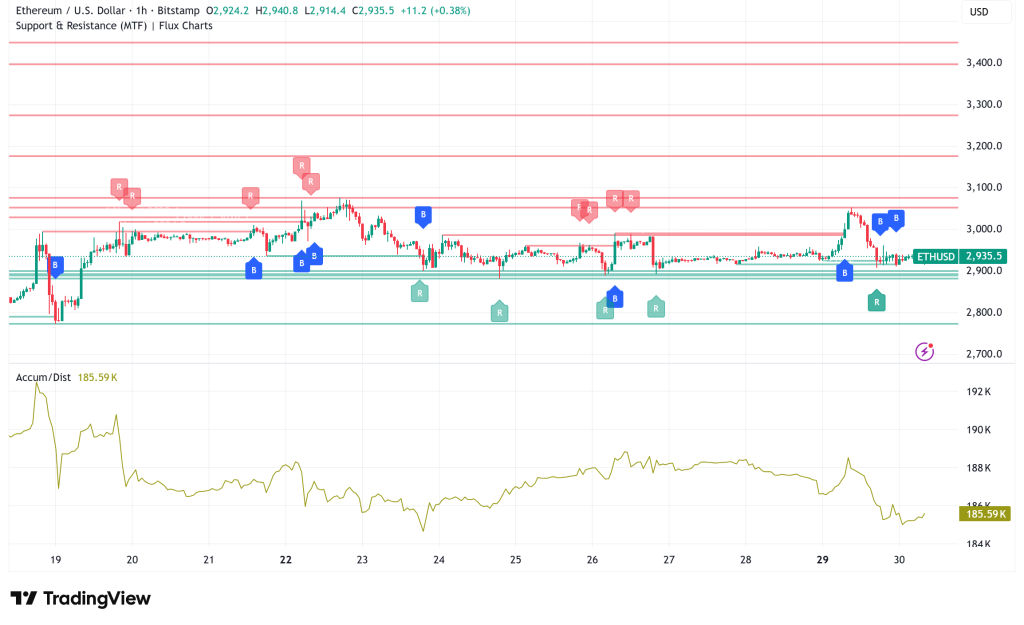

At the time of writing, Ethereum ETH/USD is trading above $2,900, down 2.7% in the last 24 hours. This is normal for the cryptocurrency market at the end of the year. Even if the price is under a lot of pressure right now, there are a lot of institutional investors buying up the second-largest cryptocurrency by market value, and on-chain measures imply that the price might go up.

Bitmine Immersion Accumulates 44,463 ETH in Strategic Year-End Acquisition

Bitmine Immersion has revealed that it has significantly increased its Ethereum holdings, adding 44,463 ETH in just the previous week. This smart purchase takes the company’s total holdings to an amazing 4,110,525 ETH, which is almost 3.41% of all the ETH that is currently in circulation. Bitmine has staked 408,627 ETH from this large cache, showing that they believe in the network’s value proposition for the long term.

As the year comes to a close, trading activity usually slows down, according to Tom Lee, Chairman of Fundstrat and a major figure at Bitmine. Lee said that Bitmine is still the biggest “fresh money” buyer of ETH in the world. He also said that the recent drop in cryptocurrency prices is due to year-end tax-loss selling, which usually happens between December 26 and December 30. The company’s main goal is still to increase shareholder value by buying more ETH per share and getting the most out of its Ethereum holdings.

Historic ETH Staking Queue Flip Suggests 120% Rally Potential

Market watchers are paying attention to a big change on the blockchain: for the first time since June 2024, the validator admission line for Ethereum has overtaken the exit queue. The admission queue has grown to 745,619 ETH, which is worth $2.2 billion at the moment, and the leave queue is at 360,528 ETH, which is worth $1.06 billion. This is the most Ether that has been queued for staking since November 30, 2024.

ValidatorQueue says that there are more than 983 million active validators on the network right now. 29.3% of the total ETH supply, or about 35.5 million ETH, is now staked. The most recent Pectra upgrade made staking easier for users and raised the maximum number of validators, making it easier for holders with big balances to restake.

DefiIgnas pointed out how important this change is, saying that most validators are choosing to keep their ETH, which lowers selling pressure. Abdul, who is in charge of DeFi at the Monad Foundation, said that Ethereum’s price increased soon after the last queue flip in June. TradingView’s historical data shows that similar trends in March and June 2024 came before price increases of 90% and 126%, respectively.

ETH/USD Technical Analysis Points to $5,000 Target in 2026

From a technical point of view, the way Ethereum’s price is set up right now is very similar to how it was set up before its Q4 2024 rise. The asset is holding steady between $2,750 and $3,200, which is similar to the accumulation phase between $2,260 and $2,750 that happened from July to October 2024. When ETH went above $2,750 in that last case, it went up 74.5% to $4,100 in December 2024.

Titan of Crypto, an analyst, said that ETH has dropped 61.8% from its last big move and is now at a level where price reactions have happened in the past. The analyst said that $2,750 is the most important support level to watch over the next several weeks. If the price stays above this level, it may rise 75% from where it is now to $5,120.

Short-Term Ethereum Price Outlook and Key Levels

Ethereum’s price will stay the same for now as long as it stays over the support line of a symmetrical triangle formation. On Monday, bears tried to knock the price below the moving averages, but buyers stopped them. If sellers can pull ETH below the triangle’s support line, it might mean that the downtrend has started again, which could cause the price to drop to $2,623 and then $2,373.

On the other hand, if the price bounces off the current support level and breaks above the moving averages, it would show that there is substantial buying interest at lower levels. In this case, ETH could rise toward the triangle’s resistance line, but bears are likely to fight hard to keep that level. The combination of more institutional accumulation, good staking dynamics, and technical settings suggests that Ethereum’s medium-term path might be quite bullish if historical patterns repeat, even though short-term volatility will continue.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM