XRP Holds $2.12 as Ripple Wins EU EMI Nod, Eyeing $2.31–$2.41 Breakout

Ripple has made a significant leap in its European footprint by receiving preliminary approval for an Electronic Money Institution (EMI)...

Quick overview

- Ripple has received preliminary approval for an Electronic Money Institution licence from Luxembourg's CSSF, enhancing its presence in Europe.

- The licence will enable Ripple to offer regulated electronic money services across the EU, including stablecoin payments and blockchain transaction settlements.

- This strategic move aligns with Europe's MiCA framework, simplifying regulatory compliance for crypto institutions.

- Ripple's growing regulatory footprint, now with over 75 licences globally, positions it as a credible player in the cross-border payments market.

Ripple has made a significant leap in its European footprint by receiving preliminary approval for an Electronic Money Institution (EMI) licence from Luxembourg’s financial regulator, the CSSF. This came by way of a formal “green light” letter – the kind of confirmation that shows the regulator has a fair bit of confidence in Ripple’s setup, even before the licence is all tied up with final conditions.

Once the licence is fully sorted, Ripple will be able to offer fully regulated electronic money services right across the EU – including payments based on stablecoins and tools for settling transactions on the blockchain. Luxembourg is a strategic location – it’s a major financial hub – and this means that Ripple gets to take advantage of the EU’s passporting rules, which let services scale across all member states without needing to get separate approvals for each country.

All this plays right in with Europe’s MiCA framework, which aims to make it simpler to put rules in place for crypto and digital assets across the whole EU. For institutions that are looking at crypto, that clarity really matters.

Why the EMI License is such a big deal for Payments

Now that the EMI licence is in place, Ripple will be able to grow its cross-border payments network under a fully regulated structure – in other words, it’s fully legitimate. Banks, fintechs, and big companies get easier, faster, and lower-cost international payments without having to navigate a whole load of different compliance rules.

The benefits of the licence are pretty straightforward:

- Regulated access to electronic payments across the whole of the EU.

- Support for stablecoins and blockchain-based settlement.

- Faster, more efficient cross-border transactions overall.

Ripple’s payments platform has already handled over $95 bn in transaction volume globally, so the addition of an EU licence gives it even more credibility with big institutions.

UK and EU Approvals Show Up a Clear Strategy

This Luxembourg approval follows hot on the heels of Ripple’s EMI licence and crypto registration from the UK’s FCA. Putting together the UK and EU moves shows a deliberate strategy to get a foothold in major regulatory jurisdictions.

Ripple President Monica Long has said that Europe’s early regulatory clarity is the kind of thing that’s going to push institutions from just messing around with pilots to actually using crypto in real life. By providing a platform that handles liquidity, compliance & settlement simultaneously, Ripple aims to make blockchain payments much simpler for businesses that don’t want to build their own infrastructure from scratch.

Globally, Ripple now has 75+ licences and registrations in place, which just underscores its focus on growing the business in a fully regulated way.

XRP Price Outlook as Market Takes a turn for the better

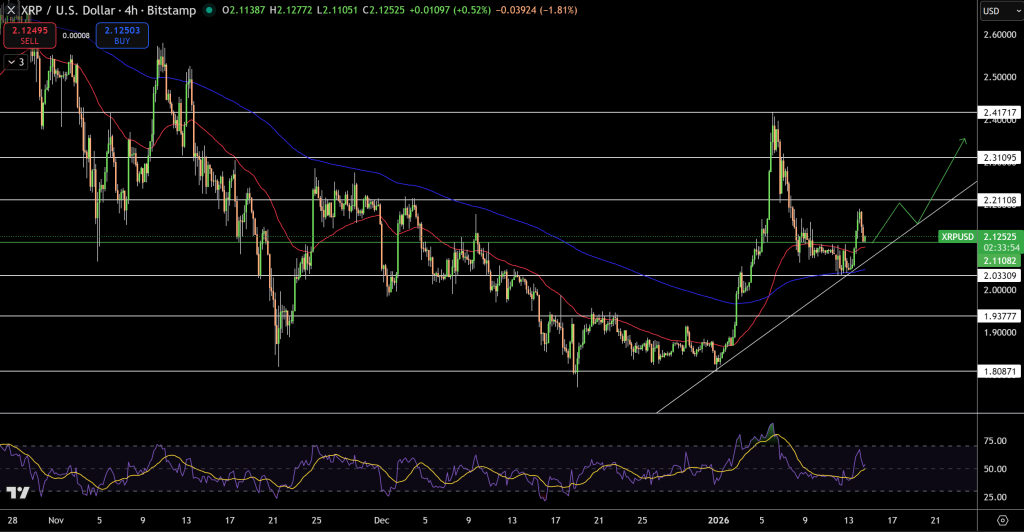

XRP is trading at about $2.12, having bounced back strongly from its early January lows of $1.81. On the 4-hour chart, the price is still supported by an upward trendline, and the 200-period moving average is at $2.03-$2.05, acting as a key level of support.

The resistance is near $2.21, then $2.31; a break above that could open the door to $2.41. Momentum is neutral, with the RSI in the mid-40s to mid-50s, suggesting there’s still room for the price to keep moving rather than running out of steam.

Trade idea: Buy into any pullbacks at $2.05, stop just below $1.94, and target $2.31-$2.41.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM