CoreWeave CEO Sends CRWV Stock Up 30% Weekly, but the Balance Sheet Still Looms

CoreWeave has started 2026 with an eye-catching rebound, but beneath the rally, heavy leverage, persistent cash burn, and execution risk...

Quick overview

- CoreWeave has rebounded sharply in 2026, rising nearly 30% recently, but concerns about heavy leverage and cash burn persist.

- Despite positive developments, such as involvement in the U.S. Department of Energy's Genesis mission, financial realities remain challenging.

- Goldman Sachs has initiated coverage with a Neutral rating, citing execution risks and high debt levels as significant concerns.

- CoreWeave's impressive revenue growth is overshadowed by widening net losses and substantial capital expenditures, raising questions about long-term sustainability.

CoreWeave has started 2026 with an eye-catching rebound, but beneath the rally, heavy leverage, persistent cash burn, and execution risk continue to cloud confidence in the long-term economics of AI infrastructure.

A Strong Start Masks a Fragile Foundation

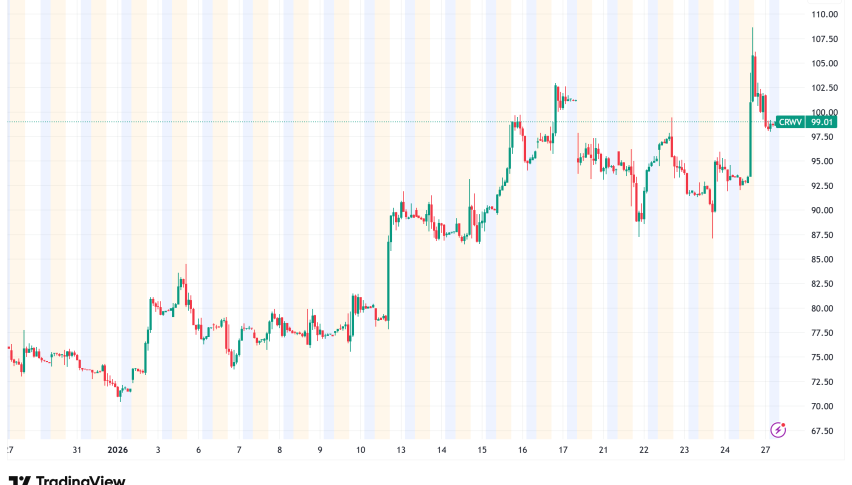

CoreWeave entered 2026 with momentum that few would have expected just months earlier. After collapsing through the second half of 2025, the stock has staged a sharp recovery, rising above $100 earlier this year and gaining nearly 30% in the latest week alone. Part of that move was driven by broader enthusiasm following TSMC’s earnings surprise, which reignited optimism across the AI hardware and infrastructure complex.

Yet the rally has done little to resolve the deeper concerns surrounding CoreWeave’s business model. Investors remain divided between those betting on AI’s explosive long-term demand and those wary of the financial strain required to supply it at scale. For now, the stock’s rebound looks more like a sentiment-driven bounce than a structural reset.

Relief Rally or Turning Point?

Year-to-date, CoreWeave is up roughly 27%, including a single-session jump of more than 10% late last week. That surge followed public remarks by CEO Michael Intrator, who forcefully rejected claims that the company’s financing relies on circular arrangements with Nvidia. Speaking on a podcast, Intrator called such accusations “ridiculous,” arguing they ignore the scale of CoreWeave’s capital structure.

He noted that Nvidia’s $300 million investment represents a small fraction of CoreWeave’s more than $25 billion in total capital, supporting a valuation north of $40 billion. According to management, this context undermines the idea that the company is financially dependent on a single strategic backer.

The market reacted positively to the clarity, but skepticism remains. A rally sparked by messaging does not automatically translate into a re-rating, particularly when leverage and cash flow pressures remain unresolved.

Debt Engineering Under the Microscope

Management has repeatedly emphasized that CoreWeave’s debt is structured in a way that limits risk at the corporate level. Much of the borrowing is housed in special purpose vehicles, with revenue from long-term contracts—primarily with Microsoft and Meta—earmarked to service operating costs and lenders before flowing upstream.

This project-finance-style approach is common in traditional infrastructure, such as energy or transportation. In theory, it provides lenders with predictable cash flows while insulating the parent company from isolated failures.

In practice, the market is still uneasy. AI infrastructure evolves faster than traditional assets, and concerns persist around hardware depreciation, contract renewal risk, and technological obsolescence. The structure may limit downside in isolated cases, but it does not eliminate systemic risk across the platform.

A Painful Second Half Still Shapes Perception

Despite the strong start to 2026, the shadow of last year’s collapse remains long. From mid-2025 onward, CoreWeave lost roughly two-thirds of its market value, slicing through technical support levels as sentiment turned decisively negative.

That selloff coincided with tighter financial conditions, rising rates, and a growing realization that AI infrastructure providers may not enjoy the same margin profiles as software or semiconductor designers. Investors began to question whether capital intensity, rather than technological leadership, would define returns.

By the time 2025 ended, CRWV was trading at levels that reflected caution rather than confidence—a context that still matters when evaluating today’s rebound.

Government Validation, Limited Financial Impact

Earlier this week, CoreWeave received a boost from its involvement in the U.S. Department of Energy’s Genesis mission, a high-profile initiative integrating AI, advanced computing, and scientific research to support national energy and security objectives.

Participation in Genesis reinforces CoreWeave’s technical credibility and signals trust from federal institutions. It also strengthens the narrative that the company is strategically important to the future of U.S. AI infrastructure.

However, the announcement does little to alter near-term financial realities. Government affiliations may enhance reputation, but they do not meaningfully reduce leverage, capex requirements, or ongoing cash burn.

Executive Reassurance vs. Market Math

CEO Intrator and Chief Strategy Officer Brian Venturo have also attempted to calm fears around GPU depreciation and asset lifespan. In recent interviews, they argued that concerns about rapid obsolescence are overstated and fail to account for how GPUs are redeployed across workloads over time.

While the explanation helped stabilize sentiment, investors remain focused on returns rather than utilization narratives. The central issue is not whether GPUs retain some value, but whether returns on tens of billions of dollars in infrastructure investment can exceed the cost of capital.

So far, the numbers—not the words—continue to dominate investor judgment.

Wall Street’s Cautious Stamp

Adding to the tension, Goldman Sachs initiated coverage with a Neutral rating and an $86 price target, below current trading levels near $88–$90. While acknowledging CoreWeave’s purpose-built architecture and strong positioning in high-end AI compute, Goldman flagged execution risk and what it described as “outsized debt.”

Leverage is estimated at roughly six times net debt to trailing EBITDA, leaving little margin for operational missteps. At that level, even minor disruptions—contract delays, pricing pressure, or higher financing costs—could force difficult strategic choices.

The stock’s move above Goldman’s target reflects optimism, but it also increases downside risk if expectations slip.

Insider Selling Rekindles Doubt

Confidence took another hit following disclosures that Brian Venturo sold more than 280,000 shares in late December at prices between $79 and $81. While insider sales can be routine, timing matters—especially in a stock already struggling to regain trust.

Thin holiday liquidity amplified the impact, reinforcing the perception that management’s confidence may not fully align with market expectations. For investors already cautious, the sale added another layer of uncertainty.

Technical Levels Still Define the Battlefield

From a technical standpoint, CoreWeave remains vulnerable. The 20-week moving average, once a support level, has flipped into resistance near $112. Until buyers can reclaim and hold above that level, rallies are likely to be treated as tactical rather than structural.

CRWV Chart Weekly – The 20 SMA Is the Line in the Sand

Above that, the $150 zone—last tested in October—remains a critical hurdle. Previous attempts to sustain gains above that area failed decisively, trapping momentum buyers and reinforcing bearish reflexes.

For now, the chart suggests volatility, not confirmation.

Capital Intensity Remains the Core Problem

Operationally, CoreWeave continues to deliver staggering revenue growth. Third-quarter revenue more than doubled year-over-year to $1.21 billion, driven by relentless demand for AI compute.

But the cost of that growth is immense. Net losses widened to nearly $291 million, while quarterly capital expenditures approached $3 billion. Forward estimates suggest annual capex could reach $20–$23 billion—a scale that transforms growth into a financial burden unless margins improve sharply.

Planned financing, including $2 billion in convertible senior notes, only reinforces concerns around dilution and fixed obligations.

Between Strategic Importance and Financial Strain

CoreWeave sits at the center of the AI infrastructure boom, supplying the computational backbone of the next technological cycle. That strategic relevance explains why every positive headline sparks outsized rallies.

Yet the balance sheet tells a more sobering story. Until leverage moderates, cash flow improves, and returns on capital become clearer, investor confidence is likely to remain fragile.

For now, CRWV is less a pure AI growth play and more a high-stakes test of how much financial strain the market is willing to tolerate in pursuit of long-term technological dominance.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM