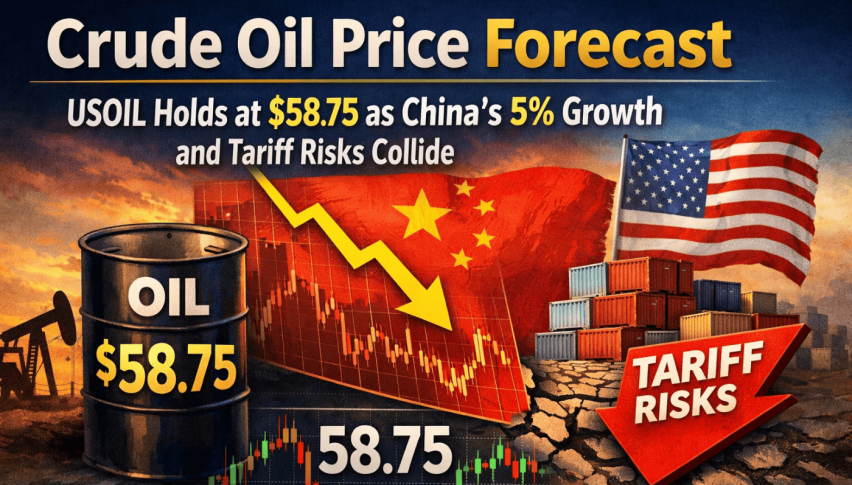

Crude Oil Price Forecast: USOIL Hold at $58.75 as China’s 5% Growth and Tariff Risks Collide

Oil markets were stuck in a holding pattern on Tuesday as traders tried to get a grip on what President Donald Trump's...

Quick overview

- Oil markets are experiencing uncertainty due to President Trump's tariff threats on European imports, which could impact oil prices.

- Despite global trade tensions, China's economy grew by 5% last year, boosting demand for oil and benefiting refiners and producers.

- Venezuela's oil industry is under U.S. control, with discounts being offered to Chinese buyers, altering the oil supply landscape.

- WTI Crude Oil prices are showing bearish momentum, with potential support levels indicating further downside risk if prices do not recover.

Oil markets were stuck in a holding pattern on Tuesday as traders tried to get a grip on what President Donald Trump’s renewed threats of tariffs on Europe – warning Denmark, Norway, Sweden, France, Germany, the Netherlands, Finland and even the UK that imports could be hit with 10% levies from February 1st and rising to 25% by June if there’s no deal on Greenland – will actually mean.

This uncertainty is keeping investors on their toes, and while oil prices have held steady against a backdrop of investors getting cautious, when it comes to making big decisions, those guys at ING have pointed out that the weaker US dollar is actually helping out by making dollar-denominated oil contracts a bit more affordable for international buyers.

China’s Got the Power to Keep Things Going

Despite all the gloom and doom, China’s economy actually grew at a respectable 5% last year and that’s a big help to global demand – And refiners and oil producers are reaping the rewards in China – with refiners running through more crude than ever before (4.1% increase year on year) and oil production reaching a record high too (1.5% up year on year). Some of the chaps at IG reckon that’s a big help in offsetting the impact of these trade wars on the oil market.

- China’s GDP growth: 5% last year was the magic number

- Refinery throughput has increased by 4.1% year on year

- And crude oil output is up by 1.5% year on year

That shows us just how resilient Chinese demand is even in the face of a global trade war.

Venezuela’s Price Tagging Issues

Adding to all the uncertainty in the market is the fact that Trump’s said the US will be taking control of Venezuela’s oil industry now that President Nicolas Maduro is in a tight spot – and Vitol’s reportedly been offering crude to Chinese buyers at a discount of around $5 a barrel compared to the ICE Brent price for April delivery. This is a game-changer in the world of oil supply.

WTI Crude Oil Price Forecast

WTI Crude Oil was trading at $58.75 yesterday – and slipped right on through the key $60.05 support line. It’s probably a sign of bearish momentum at the moment, with immediate support down at $57.26. And with the 50 and 200 period moving averages starting to level out, it looks like we’re weakening out of a consolidation phase – and both the RSI readings are very low, which points to even more downside risk.

If the price of oil fails to return to $60.05, though, it’s possible we’ll see a move down to $55.97 and even to $54.99. On the other hand, if it does bounce back, then it’s back up to the $60.05 to $61.08 resistance range again – and it’s anyone’s guess what’s going to happen next. Still, it’s probably a good idea to keep an eye on volume trends and what the big macro news is saying.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account