JSE Top 40 Jumps 1.3% as Index Breaks 116,000 ZAR and Eyes 118,500

South African equities opened the week on firm footing, with the FTSE/JSE All-Share Index rising 1.33% to 123,913 ZAR, marking...

Quick overview

- South African equities saw a strong start to the week, with the FTSE/JSE All-Share Index rising 1.33% to 123,913 ZAR, its best performance in weeks.

- The bond market showed improving signals, with the 2035 government bond yield falling to 8.1%, indicating stronger demand for South African debt.

- The South African rand strengthened against the US dollar, trading at its highest level in over three years, supported by a rally in precious metals like gold and platinum.

- Attention is now on the upcoming South African Reserve Bank policy decision, with economists divided on whether rates will remain steady or see a slight cut.

South African equities opened the week on firm footing, with the FTSE/JSE All-Share Index rising 1.33% to 123,913 ZAR, marking its strongest daily advance in weeks. The rally was broad-based, reflecting renewed confidence in local assets as commodity prices climbed and financial conditions showed signs of easing.

The move was reinforced by improving signals from the bond market. The 2035 government bond yield fell 4.5 basis points to 8.1%, pointing to stronger demand for South African debt. Rising equity prices alongside falling yields suggest investors are gradually repositioning toward risk after a prolonged period of subdued performance.

Key drivers behind the advance included:

- Renewed inflows into domestic equities

- Lower long-term yields improving risk appetite

- Strength across commodity-linked sectors

Rand Strength and Metals Lift Sentiment

The South African rand added to the positive tone, trading at its strongest level against the US dollar in more than three years. The currency is now up over 3% year-to-date and roughly 14% over the past year, supported by a sharp rally in precious metals.

Gold surged above $5,100 per ounce, while platinum also reached fresh record highs. As a major exporter of both metals, South Africa benefits through improved trade balances and rising foreign interest. Malcolm Charles, portfolio manager at Ninety One, noted that South Africa now offers some of the highest real yields in emerging markets, a key attraction for global investors.

Rates in Focus Ahead of SARB Decision

Attention now turns to the South African Reserve Bank’s first policy decision of 2026. Economists remain divided, with most expecting rates to hold steady, while a minority see scope for a 25-basis-point cut to 6.50%.

Inflation remains contained at 3.6% year-on-year, within the SARB’s target band. A firm rand and easing bond yields give policymakers flexibility, while Goldman Sachs has suggested that eventual rate relief could support domestically focused sectors if growth momentum softens.

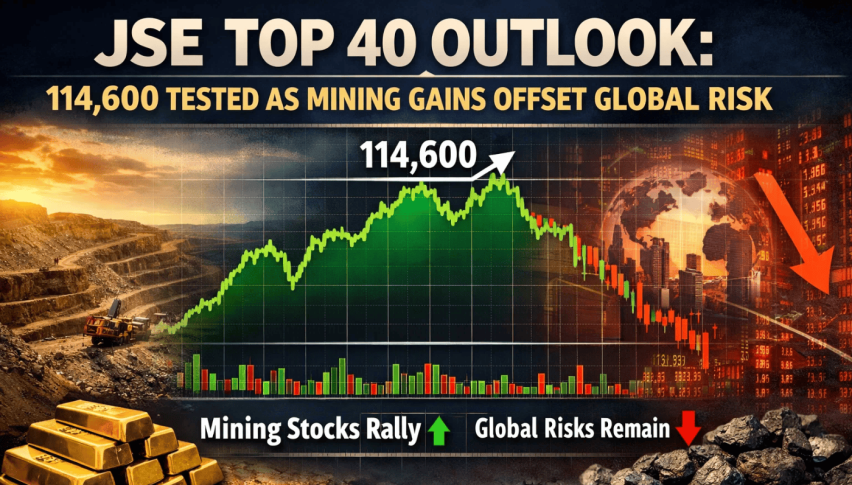

JSE Top 40 Breaks Above 116,000 ZAR

From a technical perspective, the JSE Top 40 is trading near 116,050 ZAR, confirming a breakout above the 115,300–115,800 ZAR resistance zone. Recent candles show wide bullish bodies with shallow wicks, signaling steady accumulation rather than short-term speculation.

The index remains anchored to a rising trendline from early January and continues to trade within an ascending channel. Former resistance near 113,950 ZAR now acts as first support, with deeper support around 112,600 ZAR. On the upside, resistance sits near 117,400 ZAR, followed by the upper channel boundary around 118,500 ZAR. RSI near 77 reflects strong momentum, a condition that historically leads to shallow pullbacks rather than trend reversals when structure remains intact.

If this setup holds, short-term dips may continue to attract buyers, keeping the broader outlook constructive as the index tests higher ground.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM