South Africa Fuel February: Diesel and Petrol Prices to Drop Again Offsetting Grocery Hikes

South African motorists are set for another round of fuel price drop in February, supported by a stronger rand despite rising global...

Quick overview

- South African motorists can expect a fuel price drop in February, with petrol prices projected to decrease by 66 to 69 cents per litre.

- Diesel prices are also set to fall, with forecasts indicating a reduction of 63 to 71 cents per litre.

- The anticipated cuts are smaller than earlier estimates due to increased volatility in global oil markets amid geopolitical tensions.

- The strong performance of the rand against the U.S. dollar is helping to cushion fuel prices from global shocks.

South African motorists are set for another round of fuel price drop in February, supported by a stronger rand despite rising global uncertainty.

Fuel Price Cuts Lined Up for February

The latest figures from the Central Energy Fund (CEF) indicate that petrol and diesel prices are likely to fall again in February, offering welcome relief to consumers. Based on spot recovery data through the third week of January, fuel prices are currently showing a sizeable over-recovery, paving the way for lower pump prices next month.

According to the CEF’s updated projections for February 2026, petrol prices are expected to decline by between 66 and 69 cents per litre. Diesel users should also benefit, with wholesale diesel prices forecast to drop by between 63 and 71 cents per litre. Illuminating paraffin is similarly expected to see a reduction of around 60 cents per litre.

Savings Narrow Compared to Earlier Expectations

While the anticipated cuts are positive, they fall short of earlier estimates. Previous projections pointed to petrol price reductions of more than R1.15 per litre and diesel cuts of up to R1.63 per litre. The smaller adjustments reflect increased volatility in global oil markets, driven by economic uncertainty and rising geopolitical risks.

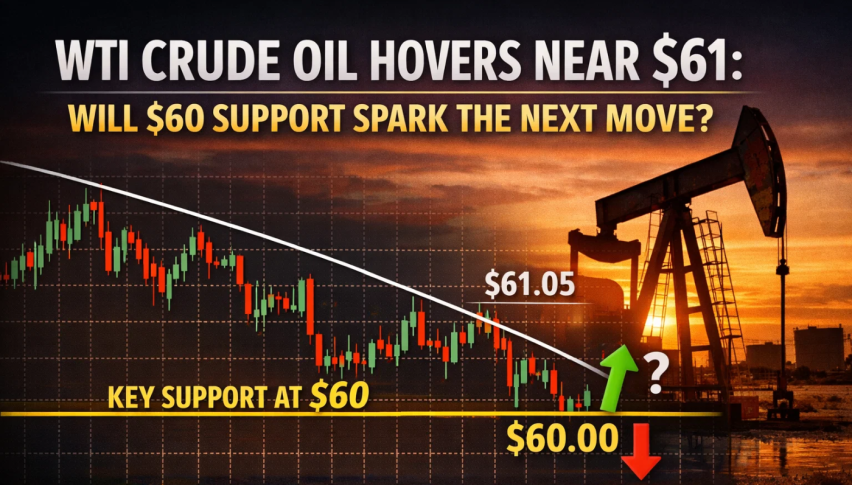

Recent tensions involving Venezuela, renewed U.S. military positioning near Iran, and speculation around possible intervention have pushed oil prices higher, with Brent crude rising from around $62 to $65 per barrel during the review period.

Oil Pressures Offset by Currency Strength

Despite the uptick in oil prices, South Africa’s fuel outlook remains favourable largely due to the rand’s strong performance. A softer U.S. dollar—linked to geopolitical developments and policy uncertainty—has helped the rand strengthen to around R16.09 per dollar, its firmest level in more than three years.

Domestic improvements have also contributed to currency resilience, cushioning fuel prices from global shocks.

Outlook: Relief Continues, But Risks Remain

Looking ahead, the International Energy Agency expects global oil prices to trend lower over the year due to significantly increased supply. If this materialises and the rand remains firm, further fuel price relief could follow—though ongoing geopolitical risks suggest volatility is unlikely to disappear anytime soon.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM