Discovery Share Price Jumps 1%: ZAR 24,000 in Focus as Momentum Builds

Discovery Limited shares are trading close to ZAR 23,085, continuing their steady rebound from January lows. This recovery has helped...

Quick overview

- Discovery Limited shares are rebounding, trading close to ZAR 23,085, reflecting improved investor confidence.

- The company's earnings per share have grown at a 19% annual rate over the past three years, indicating strong financial performance.

- Insider ownership of approximately R15 billion aligns management interests with long-term shareholders, enhancing investor trust.

- Wider economic conditions, including a stronger rand and supportive commodity prices, create a favorable environment for financial stocks.

Discovery Limited shares are trading close to ZAR 23,085, continuing their steady rebound from January lows. This recovery has helped boost investor confidence in the company’s growth. The stock rose almost 1% in the latest session, backed by strong fundamentals and better market sentiment.

Discovery’s strong financial record continues to attract investors. Over the past three years, earnings per share have grown at a 19% annual rate. Operating efficiency is also improving, with EBIT margins rising from 16% to 18%. This shows better cost control and scalable operations in South Africa and the UK.

Investor alignment is also important. Insiders are estimated to own about R15 billion in shares, which helps ensure management’s interests match those of long-term shareholders. With steady revenue growth and stable margins, Discovery is seen as a high-quality financial services company, not just a short-term trade.

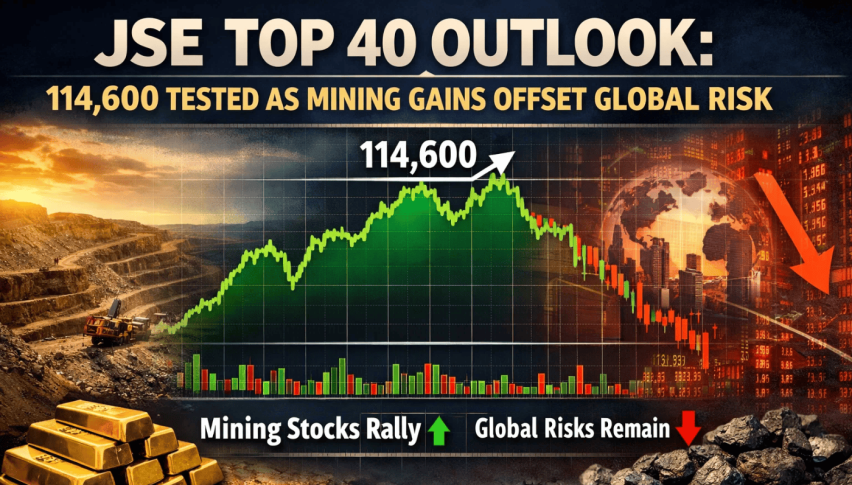

Stronger Rand and Bullion Rally Shape the Backdrop

Wider economic conditions are now more supportive. The South African rand recently reached its strongest level against the US dollar in over three years, helped by record gold prices and high silver prices. The JSE All-Share Index has also hit new highs.

This environment helps financial stocks by reducing inflation pressure and improving consumer finances. However, investors are still watching for risks that could change market sentiment:

- US Federal Reserve policy shifts that could lift the dollar

- Currency pressure on exporters from a stronger rand

- Geopolitical uncertainty affecting global risk appetite

Lower imported inflation and steady commodity revenues create a supportive environment, but volatility is still a concern.

Interest Rates and Policy Expectations in Focus

Expectations for monetary policy are changing. Goldman Sachs and Morgan Stanley expect the SARB to lower its 2026 inflation forecast by 0.2 to 0.3 percentage points, bringing it closer to the Treasury’s 3% target. Economists are split on when this might happen. Some expect a 25-basis-point rate cut, while others advise caution because of global risks.

For Discovery, lower interest rates would help boost credit growth and consumer demand. Even if rates stay the same, the overall environment remains positive.

Discovery Share Price Outlook and Key Levels

From a technical perspective, Discovery is still in a strong position. The price has followed an upward trend since mid-December, with buyers often stepping in around ZAR 21,950 to 22,000. The stock is trading above the 200-period moving average near ZAR 22,500, and the 50-period average is flattening and starting to rise, which suggests stabilization.

There is resistance around ZAR 23,300 to 23,400. If the price breaks above this level, it could move up to ZAR 23,700, and then to the ZAR 23,950 to 24,000 range. The RSI is near 58, showing steady momentum and a positive outlook as long as support levels hold.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM