Bitcoin Tests Critical $74K Support as Credit Stress Signals Loom Over Market

As the top cryptocurrency consolidates at $76,000 after a steep 3% drop during the previous day, Bitcoin is navigating choppy waters. The

Quick overview

- Bitcoin is currently consolidating at $76,000 after a 3% drop, with a critical support level identified at $74,400 that could dictate its future price movement.

- Elliott Wave researcher Gert van Lagen suggests that maintaining support above $74,400 could lead to a significant rally, potentially pushing Bitcoin's price to between $260,000 and $400,000.

- Broader market volatility and tightening lending conditions are impacting Bitcoin, with recent declines linked to concerns over AI infrastructure costs and upcoming earnings reports from major companies.

- Despite current challenges, there are signs of diminishing selling pressure, and if Bitcoin holds above the critical support level, it may enter a strategic accumulation phase by mid-2026.

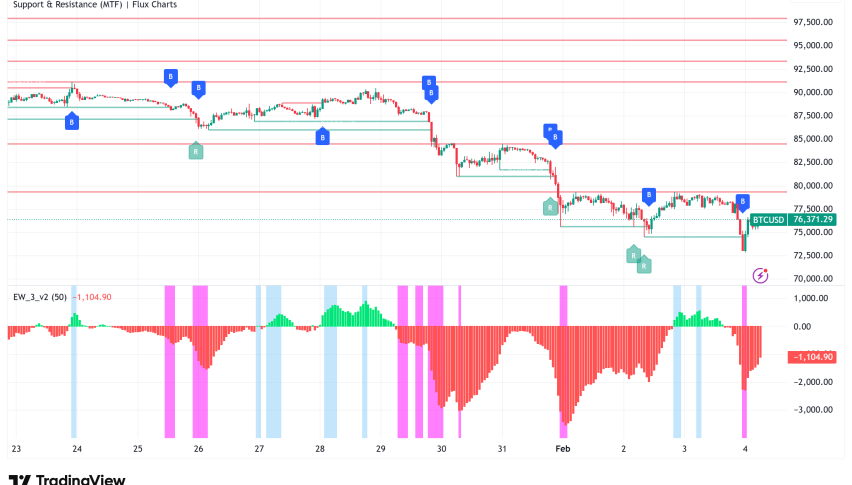

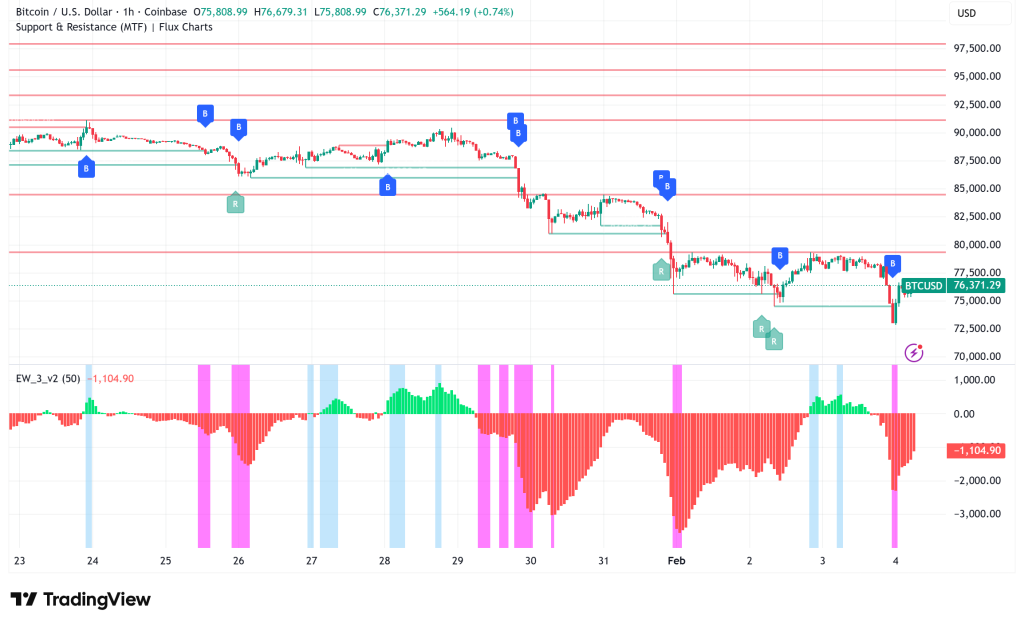

As the top cryptocurrency consolidates at $76,000 after a steep 3% drop during the previous day, Bitcoin BTC/USD is navigating choppy waters. The digital coin briefly struck a 2026 low of $72,945 on Tuesday before recovering, leaving traders and analysts anxiously eyeing a vital support zone that might determine whether BTC embarks on its next bullish run or confronts deeper losses.

BTC/USD Technical Analysis Points to Make-or-Break $74,400 Level

Elliott Wave researcher Gert van Lagen has identified $74,400 as the important level separating Bitcoin’s bull market continuation from a probable structural breakdown. Van Lagen’s study indicates that Bitcoin is finishing an extended Wave IV correction, which is not the start of a protracted bear market but rather a healthy reset after a multi-year gain.

The present price movement is consistent with past trends from previous cycle stages, in which Bitcoin underwent significant retracements prior to experiencing more robust rallies. As long as BTC retains support above $74,400, the broader bullish pattern stays intact. Van Lagen’s calculations show that holding this level might start a new impulsive Wave V rally, potentially taking Bitcoin toward $260,000-$320,000 in sub-wave 3, with a final cycle objective of $400,000—representing a spectacular 410% leap from current levels.

Order book data from TRDR.io shows strong bid liquidity thickening between $71,800 and $63,000, indicating where buyers may jump in if selling increases. But a sharp decline below $74,400 would compel analysts to reevaluate the whole structure of the Bitcoin market.

Macro Headwinds: Credit Spreads and Stock Market Turbulence

Bitcoin’s recent decline corresponds with broader market volatility, as investors nervously await earnings reports from over 100 S&P 500 businesses this week. Major indexes are trading down 0.70% to 1.77%, with AI heavyweights like NVIDIA (-3.4%), Microsoft (-2.7%), and Amazon (-2.7%) driving the decline. Concerns about AI infrastructure costs and whether revenue can justify stratospheric valuations have affected confidence across risk assets.

The cryptocurrency market has also suffered from cascading liquidations, with Bitcoin longs having $127.25 million forced halted and Ethereum longs absorbing $159.1 million in losses. Year-to-date, Bitcoin trades at a 15% loss and remains roughly 45% behind its $126,267 all-time high.

However, Joe Burnett, Strive’s vice president of Bitcoin strategy, maintains that the current price action stays within historical averages. The 45% drawdown matches closely with prior volatility patterns and represents typical behavior for a “rapidly monetizing asset,” according to Burnett.

More problematic for long-term Bitcoin trend may be tightening lending conditions notwithstanding elevated US debt levels. The ICE BofA US Corporate Option-Adjusted Spread sits at 0.75, its lowest since 1998, suggesting risk remains underpriced even as government debt surpasses $38.5 trillion and the 10-year Treasury yield climbs to 4.28%.

Analyst Joao Wedson observes that in past cycles (2018, 2020, 2022), Bitcoin formed local bottoms only after credit spreads began expanding, often with a three-to-six-month delay. If Treasury yields continue forcing credit markets into the 1.5%-2% spread area through April, an accumulation window may appear after July 2026.

Bitcoin Price Prediction: Cautious Optimism Above $74K

While short-term whale activity reveals higher exchange inflows, with investors of 1,000+ BTC depositing around 5,000 BTC on Monday, longer-term selling pressure looks to be diminishing. CryptoQuant’s spent output profit ratio (SOPR) has slipped toward 1, its lowest in a year, signifying likely seller weariness.

If Bitcoin successfully defends the $74,400 support zone and credit market stress materializes as projected, the cryptocurrency might begin a strategic accumulation phase in the second half of 2026, laying the way for van Lagen’s grandiose multi-hundred-thousand-dollar ambitions. A deeper correction toward the $63,000–$71,800 demand zone, where stronger hands may eventually intervene to purchase what many experts believe to be significantly undervalued Bitcoin, might be triggered if this crucial level is not maintained in the face of persistent economic uncertainty.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM