Ethereum’s $2,200 Support Under Fire: Vitalik Buterin’s L2 Pivot and Mounting Macro Pressures

Ethereum (ETH) is trading around $2,200, down 2.75% in the past 24 hours and continuing a painful slump that has seen the cryptocurrency

Quick overview

- Ethereum is currently trading around $2,200, down 2.75% in the last 24 hours and 25% over the past week, marking its lowest level since June 2025.

- Vitalik Buterin has shifted his stance on layer-2 scaling solutions, advocating for a focus on specialized use cases rather than general scalability.

- Despite the price decline, Ethereum's on-chain activity has surged, with active addresses increasing by 45% and transaction volume rising by 40% in the past month.

- Analysts predict further losses for Ethereum, with $2,000 as the next key support level, while a recovery above $2,400 could signal a potential bottom.

Ethereum ETH/USD is trading around $2,200, down 2.75% in the past 24 hours and continuing a painful slump that has seen the cryptocurrency plunge 25% over the past week. The price action has dropped ETH to its lowest level since June 2025, wiping away almost $2 billion in leveraged long bets and leaving investors pondering whether the bottom is in approaching.

Buterin Abandons Layer-2 Scaling Philosophy

Adding to market uncertainty, Ethereum co-founder Vitalik Buterin issued a big strategic turnaround on Tuesday, claiming that the network’s long-held objective of scaling primarily through layer-2 solutions “no longer makes sense.” “If you create a 10,000 TPS EVM where its connection to L1 is mediated by a multisig bridge, then you are not scaling Ethereum,” Buterin said, criticizing many layer-2 networks, such as Arbitrum, Optimism, Base, and Starknet, for failing to adequately decentralize. Buterin called for layer-2s to shift toward specialized use cases like privacy, identity, finance, and AI rather than general scalability.

Instead, Buterin is pushing native rollups and gas limit rises as the route forward. The mainnet might reach 10,000 transactions per second in ten years, a significant increase from the present 15–30 TPS, as Ethereum developers just raised the gas cap from 60 million to 80 million and intend to incorporate zero-knowledge EVM proofs directly into the foundation layer.

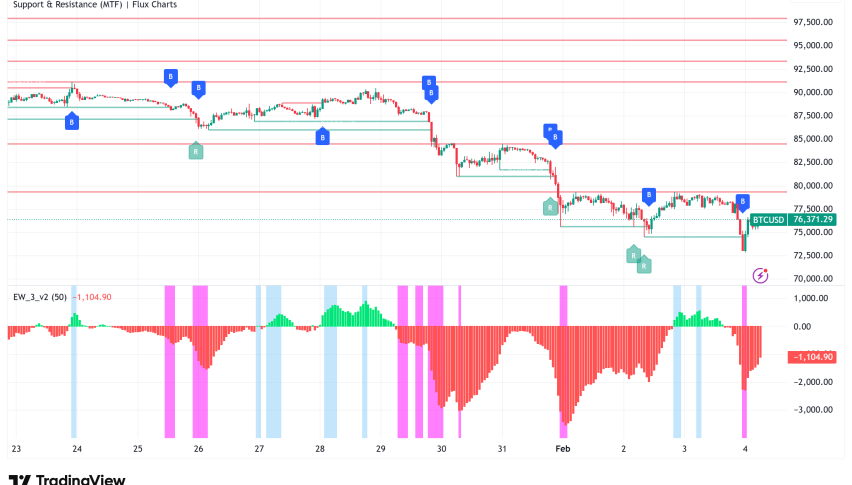

ETH/USD Technical Analysis: Bearish Signals Point to Further Downside

Despite these long-term technical improvements, ETH’s price action offers a negative short-term story. The cryptocurrency has fallen below important support levels, including the 61.8% Fibonacci retracement at $2,753 and both the 50-day moving average and Supertrend indicator—all bearish signs in technical analysis.

The formation of a bearish pennant pattern on the daily chart signals continuation of the downturn, with analysts eyeing $2,000 as the next significant support level. The ETH permanent futures funding rate has turned negative, indicating that short sellers are dominant and long positions have fled amid tremendous panic.

Institutional Outflows and Macro Headwinds

Despite ongoing accumulation by some corporations, US-listed Ethereum spot ETFs had $447 million in net outflows over a five-day period, adding to the pessimistic mood. Investors have turned to safe havens like gold and silver, which saw gains of 6% and 9%, respectively, due to broader macro concerns, such as dismal corporate profits and fears of a Federal Reserve recession.

Ethereum Network Activity Surges Despite Price Collapse

Paradoxically, Ethereum’s on-chain analytics depict an image of increased acceptance even as prices fall. Active addresses climbed 45% over the past 30 days to over 15 million, while transaction volume jumped 40% to over 68 million—the highest levels in years. Decentralized exchange volumes on Ethereum hit $52.8 billion in January, albeit this marks a 47% fall from October’s $98.9 billion peak.

The network’s involvement in real-world asset tokenization continues expanding, with big firms like Fidelity, JPMorgan, and Janus Henderson building on Ethereum. The platform’s distributed asset value has climbed 15% in 30 days to $14.4 billion, while stablecoin market capitalization hit $165 billion.

Ethereum Price Prediction: More Pain Ahead

With technical indications going downward, negative funding rates indicating strong pessimistic sentiment, and macroeconomic uncertainty persisting, Ethereum appears ready for additional losses. Analysts are targeting the $2,000 psychological support level as the next halt in this slump. Only a significant break above $2,400 and recovery of the 50-day moving average would invalidate the bearish picture and show a substantial bottom has formed.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM