Bitcoin Reclaims $70,000 as Institutional “Dip-Buying” Clashes With Bear Market Fears

Bitcoin (BTC) is trading around $70,000, posting a modest 1.3% gain over the past 24 hours as the cryptocurrency navigates a turbulent

Quick overview

- Bitcoin is currently trading near $70,000, reflecting a slight increase amidst concerns over quantum computing and bearish technical indicators.

- CoinShares argues that fears regarding quantum computing's threat to Bitcoin security are exaggerated, with only a small fraction of Bitcoin at risk.

- Institutional interest remains strong, with significant inflows into Bitcoin ETFs despite recent price declines, as investors see opportunities below $70,000.

- Technical analysis suggests potential support between $58,000 and $68,000, with predictions of a possible bottom below $50,000 if current trends continue.

As the cryptocurrency moves through a tumultuous time characterized by institutional accumulation, worries over quantum computing, and bearish technical indications that mirror the 2022 bear market, Bitcoin BTC/USD is currently trading at almost $70,000, registering a slight 1.3% increase over the previous day.

Quantum Computing Threat Largely Overblown, CoinShares Argues

CoinShares, a digital asset management, has made an effort to allay growing concerns about how quantum computing can affect Bitcoin’s security framework. Only 10,230 BTC, or about $719 million at current prices, of the 1.63 million quantum-vulnerable coins, according to research lead Christopher Bendiksen, are in wallets worth targeting.

According to Bendiksen, even in the “most outlandishly optimistic scenario” of quantum development, it would take a millennium to breach each wallet containing less than 100 BTC, which is where the majority of at-risk Bitcoin is kept. Bitcoin’s elliptic-curve cryptography is still millions of qubits away from being seriously threatened by current quantum computers, such as Google’s 105-qubit Willow machine.

The Bitcoin community is still split, though. Charles Edwards of Capriole Investments sees quantum as a “existential threat” that necessitates proactive network upgrades through post-quantum signatures, while others like Michael Saylor and Adam Back reject immediate quantum risks.

Institutions See Opportunity Below $70K While Technical Warnings Flash

The sub-$70,000 price level, according to Bitwise CEO Hunter Horsley, is allowing institutions a “new crack at the apple,” since his company had inflows of over $100 million while Bitcoin was trading at about $77,000. Despite the 22.6% monthly loss, BlackRock’s spot Bitcoin ETF had $231.6 million in inflows on Friday, indicating that institutional interest is still strong.

Horsley notes that the asset is “getting swept up” as investors sell liquid holdings across the board, attributing Bitcoin’s downturn to broader macro liquidation. Silver has dropped 36% from its highest levels, while gold has fallen 11.4% from its January highs.

BTC/USD Technical Analysis Points to Potential $50K Bottom

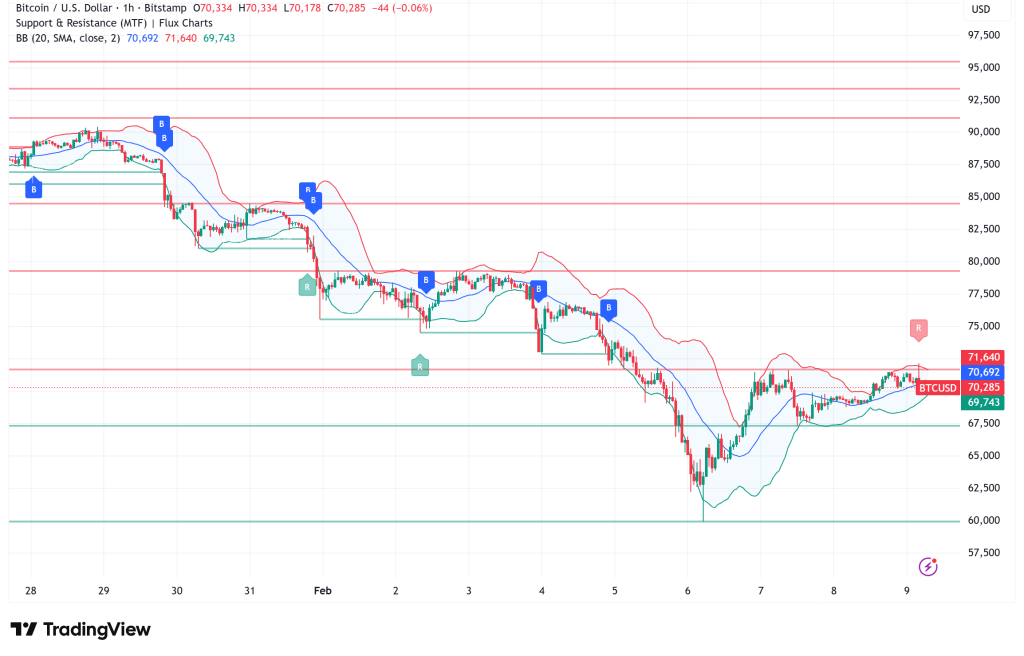

Bulls continue to have concerns about the technical picture. Bitcoin is currently trading below its 50-week exponential moving average around $95,300, a pattern that has historically foreshadowed additional declines, according to independent expert Filbfilb’s comparison to the bear market of 2022.

The “final capitulation hasn’t happened yet,” according to trader BitBull, who predicts a “real bottom” below $50,000, where the majority of ETF buyers would be in the red. Checkonchain data shows that the average cost basis of US spot Bitcoin ETFs is currently $82,000.

Cubic Analytics’ Caleb Franzen points out that Bitcoin has retested the 200-week moving average cloud between $58,000 and $68,000, pointing up uncanny parallels to May 2022, when a failed recovery ultimately resulted in a crash. Should 2022 recur, the current extended wick and cloud retest may indicate a reversal point or another leg lower.

Bitcoin Price Prediction: Testing Support Before Potential Recovery

- Short-term view (one to three months): The 200-week moving averages’ $68,000–$58,000 range provides crucial support for Bitcoin. A breakdown might focus on the $50,000–$55,000 range, where value buyers might be drawn to deeper capitulation.

- Medium-term scenario (three to six months): Bitcoin may hold between $65,000 and $85,000 before making an effort to regain $100,000 levels later in the year, provided institutional accumulation persists and quantum worries subside.

An uncommon situation where patient buyers may discover opportunity in volatility that shakes out overleveraged positions is created by the combination of negative technical patterns and high institutional interest.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM