Macron Wins, Europe Is Saved… And Opening Prices In Forex

After Brexit, nationalists all across Europe became more vocal. They now have a model to refer to, from one of the biggest EU members.

Everyone began getting worried about the threats coming from the inside. Besides that, there are plenty of threats coming from the outside, such as Trump and Putin trying to break up the Block, Erdogan to some extent, terrorism etc.

But now the inside threats are diminishing after the right wing candidates lost in the Netherlands and now in France. Macron looks like he wants to work towards getting the EU and its citizens closer, while Merkel is expected to win in Germany and Orban of Hungary seems to have learned a lesson.

That´s good news for the EU and obviously for the Euro, although that´s a long term opinion, so don´t go jumping on the Euro.

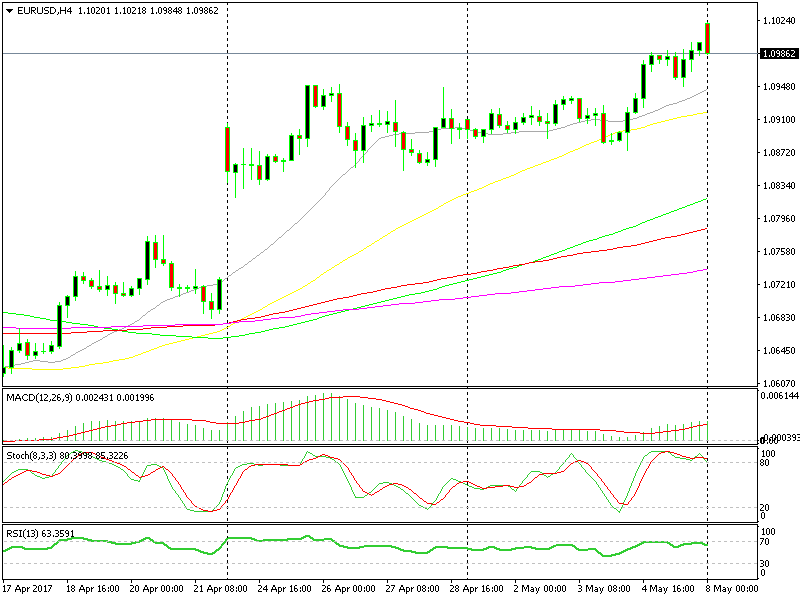

Euro pairs did open about 20 pips higher at the Tokyo open though. EUR/USD finally crossed over the 1.10 resistance level. That´s another gap and these two gaps are waiting to be filled.

Liquidity is thin and we might see some sharp moves ahead, but this was more or less priced in by the market. Therefore, chances are that we see the Euro fall in the coming sessions/days. You remember the saying “buy the rumor, sell the fact”? This would be the case in my opinion.

One gap already closed

One gap already closed

We might not turn around right now and reach 1.0330 (which was the low in January), but 1.07 and 1.06 are not too far. We remain short on EUR/USD with a long term sell forex signal from around 1.09.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account