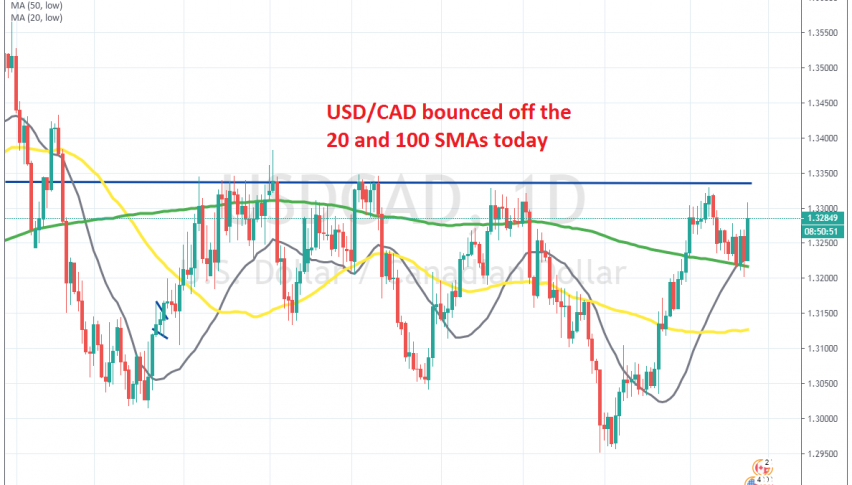

USD/CAD Bounces Off MAs As Crude Oil Turns Bearish Again

USD/CAD was finding support at the 20 SMA and the 100 SMA last week, but it has bounced off of them today

Crude Oil turned quite bearish on January, after tensions between US and Iran dissipated quite quickly, diminishing fears for a disruption of Oil production. The coronavirus added further fuels to the downtrend, as the sentiment turned negative and Chinese demand for Oil fell.

As a result, the CAD turned bearish, since it is closely correlated to Oil prices and USD/CAD turned quite bullish last month. US WTI crude broke below $50 earlier this month, but returned back up, climbing close to $55 last week, as coronavirus was being contained mainly inside China.

But, the outbreak of the virus in Italy over the weekend has turned the sentiment negative again and crude Oil has lost more than $3 today. USD/CAD has was finding support at the 20 SMA (grey) and the 100 SMA (green) on the daily chart, above 1.32 but has bounced around 100 pips higher today. So, buyers are back in control, although it remains to be sen whether they will push above the resistance zone around 1.3350.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account