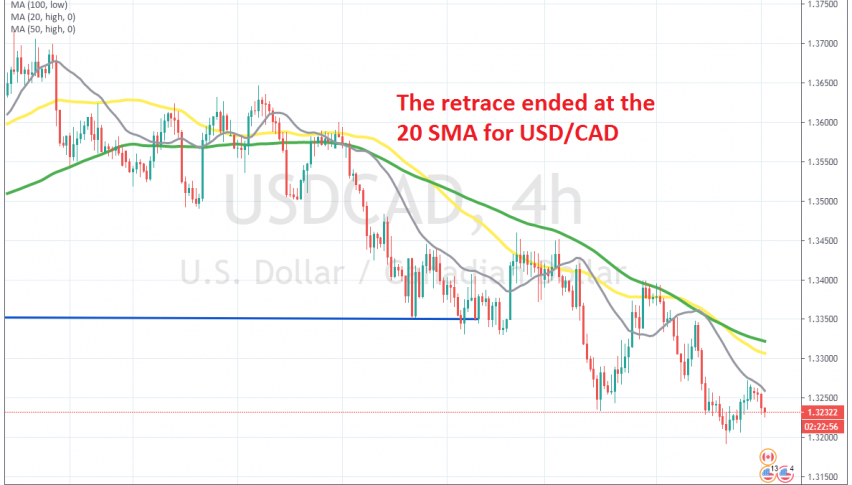

MAs Keep USD/CAD Bearish

USD/CAD retraced higher on Friday, but the 20 SMA stopped the climb and reversed this pair down

[[USD/CAD]] has been bearish since when it started to turn bearish, after forming a doji candlestick on the daily chart, which was a bearish reversing signal, after the 15 cents climb in the previous weeks. Since then, this pair has lost around 14.50 cents, from top to bottom.

The downtrend has been quite contsant, with moving averages providing resistance during pullbacks, thus keeping a lid on this pair. The 100 SMA (green0 as done a good jop providing resistance when the trend slowed down, while the smaller MAs such as the 20 SMA (green) provided resistance when the trend picked up pace.

The trend picked up pace recently and smaller moving averages are doing their job now. Last Friday we saw a pullback higher on USD/CAD but the 20 SMA scared the buyers away. The price formed some doji candlesticks and USD/CAD reversed lower from there, resuming the bearish trend. We missed the opportunity since the reversal took place overnight, but will try to sell on another retrace higher.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account