Prices Forecast: Technical Analysis

Given the current technical indicators, the daily closing price for Pepe is predicted to remain at 0.0 USD, with a potential range between 0.0 USD and 0.0 USD. For the weekly forecast, the closing price is also expected to be 0.0 USD, with a similar range of 0.0 USD to 0.0 USD. The RSI value of 67.1268 suggests a bullish momentum, indicating that the asset might be approaching overbought conditions. However, the ATR remains at 0.0, indicating no volatility, which suggests that price movements are stagnant. The ADX value of 18.8167 indicates a weak trend, which aligns with the lack of price movement. The absence of data for moving averages and other indicators further supports the prediction of a stable price range. The economic calendar shows no significant events that could impact the price, reinforcing the expectation of minimal price fluctuations.

Fundamental Overview and Analysis

Pepe’s recent price trends have shown no movement, with all historical prices recorded at 0.0 USD. This stagnation suggests a lack of trading activity or market interest. Factors such as supply and demand, technological advancements, or regulatory changes do not appear to be influencing the asset’s value at this time. Investor sentiment seems neutral, as there is no significant news or events driving market behavior. Opportunities for growth are limited unless there is a change in market dynamics or increased interest from investors. Risks include continued market disinterest and potential regulatory challenges. Currently, Pepe appears to be fairly priced at 0.0 USD, given the lack of movement and external influences.

Outlook for Pepe

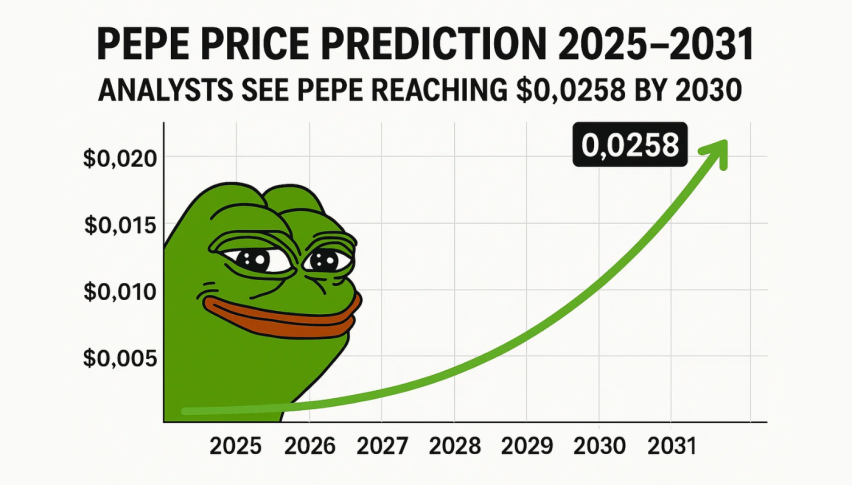

The future outlook for Pepe remains uncertain due to the lack of price movement and trading activity. Current market trends show no significant changes, with historical prices consistently at 0.0 USD. Factors such as economic conditions, supply and demand, and technological advancements are not currently influencing the asset’s price. In the short term (1 to 6 months), the price is expected to remain stable at 0.0 USD unless there is a significant market event or change in investor sentiment. Long-term forecasts (1 to 5 years) are difficult to predict without changes in market dynamics or increased interest. External factors such as geopolitical issues or industry innovations could impact the asset’s price, but there are no indications of such events at this time.

Technical Analysis

Current Price Overview: The current price of Pepe is 0.0 USD, unchanged from the previous close. Over the last 24 hours, the price has shown no movement, indicating a lack of volatility or notable patterns. Support and Resistance Levels: With all prices at 0.0 USD, support and resistance levels are also at 0.0 USD. The pivot point is 0.0 USD, and the asset is trading at this level, indicating a neutral position. Technical Indicators Analysis: The RSI of 67.1268 suggests a bullish trend, but the ATR of 0.0 indicates no volatility. The ADX of 18.8167 shows a weak trend, and there are no moving average crossovers to note. Market Sentiment & Outlook: Sentiment is neutral, with price action at the pivot, a bullish RSI, and a weak ADX. The lack of volatility suggests a stable outlook.

Forecasting Returns: $1,000 Across Market Conditions

The table below outlines potential returns on a $1,000 investment in Pepe under various market conditions. Given the current lack of price movement, scenarios are hypothetical and assume potential changes in market dynamics. Investors should consider these scenarios as part of a broader strategy and remain cautious given the current market stagnation.

| Scenario | Price Change | Value After 1 Month |

|---|---|---|

| Bullish Breakout | +10% to ~$0.0 | ~$1,100 |

| Sideways Range | 0% to ~$0.0 | ~$1,000 |

| Bearish Dip | -10% to ~$0.0 | ~$900 |

FAQs

What are the predicted price forecasts for the asset?

The daily and weekly closing prices for Pepe are predicted to remain at 0.0 USD, with no expected range due to the lack of price movement. Technical indicators suggest stability with no significant changes anticipated.

What are the key support and resistance levels for the asset?

All support and resistance levels for Pepe are at 0.0 USD, as the asset’s price has shown no movement. The pivot point is also at 0.0 USD, indicating a neutral trading position.

What are the main factors influencing the asset’s price?

Currently, there are no significant factors influencing Pepe’s price. The lack of trading activity and market interest has resulted in a stable price at 0.0 USD, with no external influences affecting its value.

What is the outlook for the asset in the next 1 to 6 months?

In the short term, Pepe’s price is expected to remain stable at 0.0 USD unless there is a significant market event or change in investor sentiment. The current lack of movement suggests a neutral outlook.

Disclaimer

In conclusion, while the analysis provides a structured outlook on the asset’s potential price movements, it is essential to remember that financial markets are inherently unpredictable. Conducting thorough research and staying informed about market trends and economic indicators is crucial for making informed investment decisions.