Prices Forecast: Technical Analysis

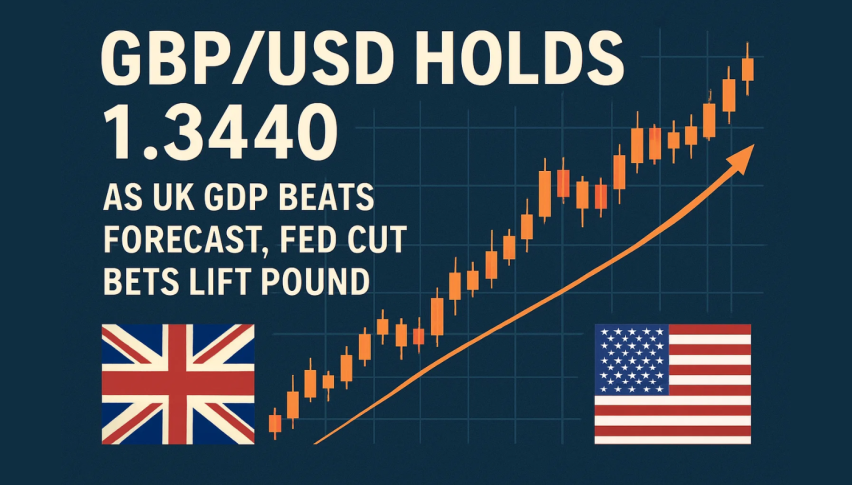

The GBP/USD pair is currently trading at 1.3143, with a predicted daily closing price of 1.3150 and a range between 1.3100 and 1.3200. For the week, the forecast suggests a closing price of 1.3180, with a range from 1.3100 to 1.3250. The RSI at 37.9455 indicates a bearish trend, suggesting the pair is oversold, which could lead to a potential rebound. The ATR of 0.0093 points to moderate volatility, while the ADX at 37.5235 suggests a strong trend. The MACD line is below the signal line, reinforcing the bearish sentiment. However, the proximity to the pivot point at 1.32 suggests potential support, which could limit further downside.

Fundamental Overview and Analysis

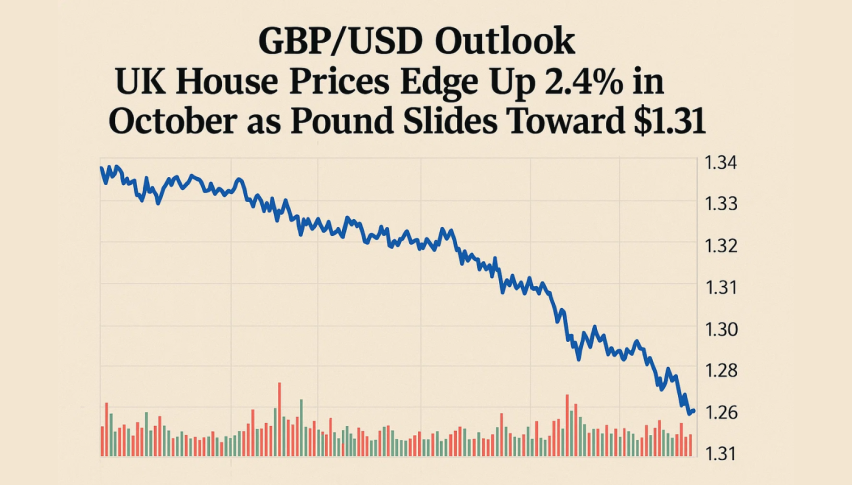

Recently, GBP/USD has been under pressure due to a stronger USD, driven by positive US economic data. The pair’s decline is also influenced by Brexit uncertainties and the UK’s economic outlook. Market participants are cautious, with investor sentiment leaning towards risk aversion. Opportunities for GBP/USD include potential UK economic recovery and favorable trade deals post-Brexit. However, risks such as political instability and global economic slowdown pose challenges. Currently, the pair appears undervalued, given the oversold RSI, suggesting a potential correction. Traders should watch for economic indicators and geopolitical developments that could impact the pair’s valuation.

Outlook for GBP/USD

In the short term, GBP/USD is expected to remain volatile, influenced by economic data releases and geopolitical events. The pair may trade within a range of 1.3100 to 1.3250 over the next 1 to 6 months, with potential upside if UK economic data improves. Long-term forecasts suggest gradual appreciation, contingent on economic recovery and stable political conditions. External factors like US monetary policy and global trade dynamics could significantly impact the pair. Investors should remain vigilant, considering both macroeconomic trends and technical indicators when making trading decisions.

Technical Analysis

**Current Price Overview:** The current price of GBP/USD is 1.3143, slightly below the previous close of 1.3141. Over the last 24 hours, the pair has shown a bearish trend with moderate volatility, as indicated by the ATR.

**Support and Resistance Levels:** Key support levels are at 1.3100, 1.3050, and 1.3000, while resistance levels are at 1.3200, 1.3250, and 1.3300. The pair is trading below the pivot point of 1.32, indicating bearish sentiment.

**Technical Indicators Analysis:** The RSI at 37.9455 suggests a bearish trend, while the ATR indicates moderate volatility. The ADX at 37.5235 shows a strong trend. The 50-day SMA and 200-day EMA do not show a crossover, suggesting a continuation of the current trend.

**Market Sentiment & Outlook:** Sentiment is bearish, with the price below the pivot, a low RSI, and a strong ADX. The lack of a moving average crossover further supports this view.

Forecasting Returns: $1,000 Across Market Conditions

The table below outlines potential returns on a $1,000 investment in GBP/USD under different market scenarios. Investors should consider these scenarios when making trading decisions, as they highlight the potential risks and rewards associated with each market condition.

| Scenario | Price Change | Value After 1 Month |

|---|---|---|

| Bullish Breakout | +5% to ~$1.3800 | ~$1,050 |

| Sideways Range | 0% to ~$1.3200 | ~$1,000 |

| Bearish Dip | -5% to ~$1.2500 | ~$950 |

FAQs

What are the predicted price forecasts for the asset?

The daily forecast for GBP/USD is a closing price of 1.3150, with a range between 1.3100 and 1.3200. The weekly forecast suggests a closing price of 1.3180, with a range from 1.3100 to 1.3250.

What are the key support and resistance levels for the asset?

Key support levels for GBP/USD are at 1.3100, 1.3050, and 1.3000, while resistance levels are at 1.3200, 1.3250, and 1.3300. The pair is currently trading below the pivot point of 1.32.

Disclaimer

In conclusion, while the analysis provides a structured outlook on the asset’s potential price movements, it is essential to remember that financial markets are inherently unpredictable. Conducting thorough research and staying informed about market trends and economic indicators is crucial for making informed investment decisions.