Forex.com Review

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open a Forex.com Account

- Safety and Security

- Trading Platforms and Tools

- Markets Available for Trade

- Deposit and Withdrawal

- Education and Resources

- Customer Support

- Insights from Real Traders

- Customer Reviews and Trust Scores

- Discussions and Forums about FOREX.com

- Employee Overview of Working for FOREX.com

- Pros and Cons

- In Conclusion

Forex.com is a trustworthy broker that provides Contracts for Difference (CFDs) and low spreads on 5500+ tradable symbols. Forex.com is regulated by five tier-1 regulators (highest trust) and one tier-3 regulator. Forex.com has a trust score of 82 out of 100.

★★★ | Minimum Deposit: $100 Regulated by: CIRO, CySEC, NFA, CFTC, CIMA, FCA, FSA, MAS, ASIC Crypto: Yes |

Overview

FOREX.com positions itself as a trusted global broker with robust regulatory oversight and transparent pricing. It delivers a compelling blend of cutting-edge trading platforms, tight spreads, and rapid execution speeds. Additionally, its strong security measures and dedicated support give traders confidence and flexibility in managing their forex investments.

Frequently Asked Questions

Is FOREX.com a regulated broker?

Yes, FOREX.com is fully regulated by multiple global authorities, including 🇰🇾 Cayman Islands Monetary Authority and 🇺🇸 CFTC. The broker enforces strict compliance standards to ensure client fund security, offering transparency and robust oversight across all operational jurisdictions worldwide.

How fast are FOREX.com trade executions?

FOREX.com prides itself on exceptional execution speed, averaging 0.003 seconds. Additionally, 100% of trades are processed in under one second, ensuring traders benefit from minimal slippage and access to competitive pricing. The broker’s in-house execution model enhances reliability and accountability.

Our Insights

FOREX.com stands out as a leading forex broker with strong regulation, advanced platforms, and tight spreads. Its impressive execution speed and client-focused approach make it a reliable choice for serious traders seeking security, efficiency, and premium trading conditions in a transparent environment.

★★★ | Minimum Deposit: $100 Regulated by: CIRO, CySEC, NFA, CFTC, CIMA, FCA, FSA, MAS, ASIC Crypto: Yes |

Fees, Spreads, and Commissions

FOREX.com offers a clear and competitive pricing model with tight spreads and optional commission-based accounts. Traders can choose between standard accounts with no commissions or RAW Spread accounts with ultra-low spreads and a small commission per lot. This flexibility ensures cost-efficient trading for every strategy and experience level.

| Pricing Model | Spreads | Commission |

| Standard Account | From 1.0 pips | None |

| RAW Spread Account | From 0.0 pips | $5 USD per $100k traded |

Frequently Asked Questions

What are the spreads and commissions on FOREX.com?

FOREX.com provides spreads as low as 0.0 pips on RAW Spread accounts with a USD 5 commission per $100k traded. Standard accounts have no commission and offer competitive spreads starting from 1.0 pips. This combination allows traders to choose the pricing model that fits their strategy.

Does FOREX.com charge any hidden fees?

No, FOREX.com maintains a transparent pricing policy. All costs are disclosed upfront, and there are no hidden fees for trading. The only additional charges are clearly stated, such as the USD 5 commission for RAW Spread accounts. This ensures traders know exactly what they pay.

Our Insights

FOREX.com delivers a transparent fee structure that caters to both standard and active traders. With low spreads, clear commissions, and no hidden costs, it creates a fair trading environment. This competitive pricing approach makes FOREX.com an attractive option for cost-conscious traders worldwide.

★★★ | Minimum Deposit: $100 Regulated by: CIRO, CySEC, NFA, CFTC, CIMA, FCA, FSA, MAS, ASIC Crypto: Yes |

Minimum Deposit and Account Types

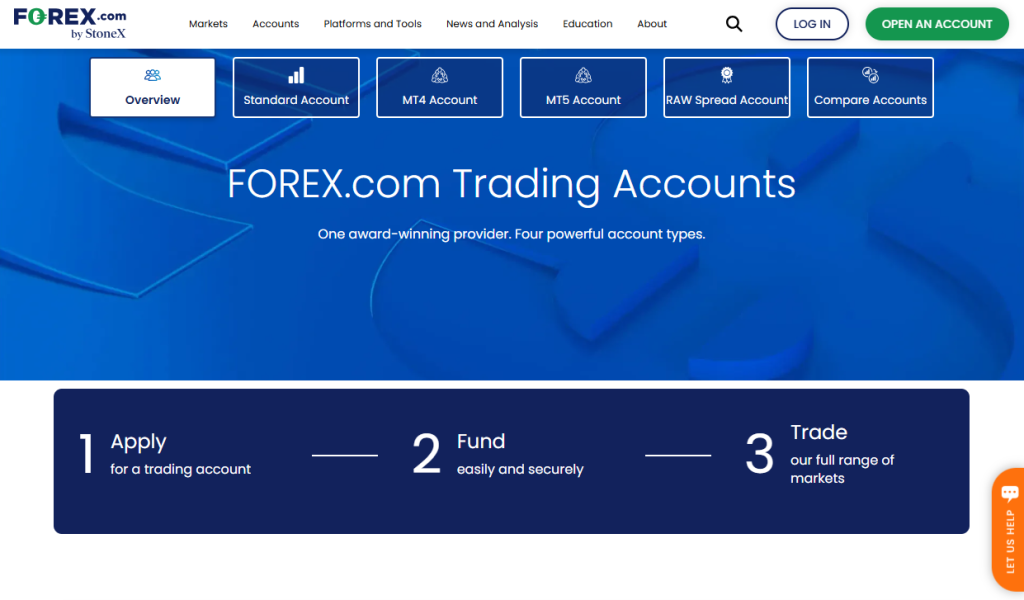

FOREX.com provides multiple account types, including Standard, RAW Spread, and MetaTrader options, to suit different trading needs. With competitive spreads, advanced tools, and tailored features, these accounts allow traders to trade efficiently. The broker also offers specialized accounts for corporate, joint, and professional traders.

Frequently Asked Questions

What account types does FOREX.com offer?

FOREX.com offers Standard, RAW Spread, and MetaTrader accounts, each with unique benefits. Standard accounts feature no commission and competitive spreads, while RAW Spread accounts provide ultra-low spreads with a small commission. MetaTrader accounts integrate advanced tools and exclusive benefits for experienced traders.

What is the minimum deposit for FOREX.com accounts?

FOREX.com maintains a low entry barrier, allowing traders to start with a minimum deposit of $100. This flexibility makes the platform accessible to beginners while still offering professional-grade tools and features for advanced traders across different account types.

Our Insights

FOREX.com excels in offering diverse account types with reasonable deposit requirements. This flexibility empowers traders to select an account that aligns with their strategy. Combined with advanced platforms and competitive features, these options make FOREX.com a strong choice for both novice and seasoned traders.

★★★ | Minimum Deposit: $100 Regulated by: CIRO, CySEC, NFA, CFTC, CIMA, FCA, FSA, MAS, ASIC Crypto: Yes |

How to Open a Forex.com Account

Opening a FOREX.com account is fast, secure, and fully online. With a few documents and a minimum deposit of 100 USD, you’ll be ready to trade within days. This guide walks you through each step to ensure a smooth setup.

1. Step 1: Start Your Application

Visit the official FOREX.com site and click “Open an Account”. Select your country of residence and preferred platform (their proprietary web platform or MetaTrader).

2. Step 2: Complete the Online Form

Provide personal details including name, address, date of birth, and tax ID (SSN or ITIN for US clients). Disclose financial background, employment status, income, net worth, and trading experience.

3. Step 3: Choose Account Type and Currency

Pick from account types: Standard, RAW Spread, MetaTrader, corporate, or joint accounts. Select your base currency (USD, EUR, GBP, PLN, CHF, SGD).

4. Step 4: Verify Identity and Address

Upload a valid government ID (passport, driver’s license) and proof of residence (utility bill or bank statement). Identity verification is often instant, with full approval taking 1–3 days.

5. Step 5: Fund Your Account

Deposit at least $100 via bank transfer, credit/debit card, or e-wallet. Ensure the amount aligns with your chosen base currency to avoid conversion fees.

Once funded and approved, log in to your chosen platform. Begin trading forex, CFDs, indices, commodities, cryptocurrencies, and more.

★★★ | Minimum Deposit: $100 Regulated by: CIRO, CySEC, NFA, CFTC, CIMA, FCA, FSA, MAS, ASIC Crypto: Yes |

Safety and Security

FOREX.com, a subsidiary of StoneX Group Inc., stands out for its financial resilience and transparent operations. Backed by over $7.8 billion in assets, strict regulatory oversight, and advanced risk management measures, it delivers a secure environment for traders worldwide. This solid foundation instills confidence and ensures long-term reliability.

| Aspect | Details | Strength Indicator | Parent Company |

| Total Assets | $7.8 Billion | Fortune 100 Company | StoneX Group Inc. |

| Equity Capital | $1.88 Billion | Financially Stable | NASDAQ-listed (SNEX) |

| Regulation | Multi-Jurisdiction (7 Regions) | High Trust Compliance | N/A |

| Customer Accounts | 400,000+ Retail 54,000+ Institutional | Global Reach | N/A |

Frequently Asked Questions

Why is FOREX.com considered financially strong?

FOREX.com benefits from the financial power of its parent company, StoneX Group Inc., a Fortune 100 firm with over 100 years of experience. With more than $7.8 billion in assets and $1.88 billion in equity capital, the broker ensures stability and security for its clients’ funds.

How does FOREX.com protect client funds?

All client funds are held in segregated accounts with top-tier banks, ensuring they are never mixed with company funds. Additionally, the broker does not engage in proprietary trading and adheres to strict regulatory standards worldwide, including audits and compliance with anti-money laundering protocols.

Our Insights

FOREX.com provides traders with unmatched trust and security, reinforced by StoneX Group’s century-long financial track record. With global regulatory compliance, segregated client funds, and robust risk management, it is a strong choice for traders seeking a secure, transparent, and dependable forex trading environment.

★★★ | Minimum Deposit: $100 Regulated by: CIRO, CySEC, NFA, CFTC, CIMA, FCA, FSA, MAS, ASIC Crypto: Yes |

Trading Platforms and Tools

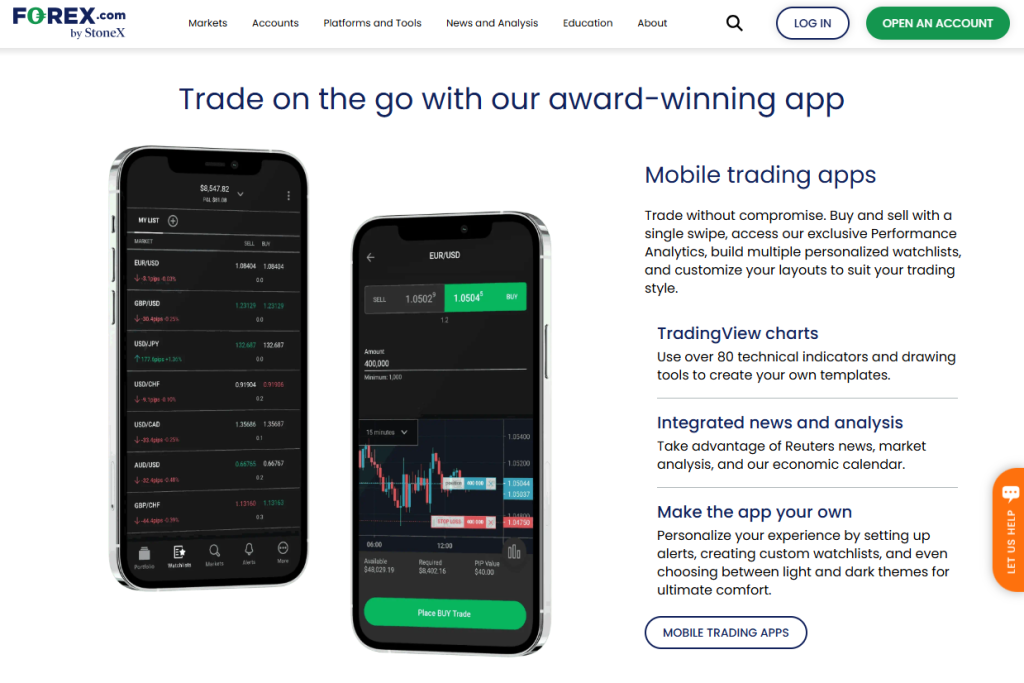

FOREX.com delivers cutting-edge trading technology through intuitive web platforms and award-winning mobile apps. With lightning-fast execution, customizable interfaces, and access to advanced tools like TradingView charts and Performance Analytics, traders experience flexibility and efficiency on every device. This commitment ensures seamless trading for beginners and seasoned professionals alike.

| Feature | Details | Benefit |

| Trading Platforms | Web Mobile MetaTrader 5 | Flexible access options |

| Charting | TradingView with 80+ indicators | Advanced analysis tools |

| Execution Speed | 0.003 seconds avg. | Reduced slippage |

| Integrated Tools | Reuters news, risk management | Informed and secure trading |

Frequently Asked Questions

What features make FOREX.com trading platforms stand out?

FOREX.com offers platforms with advanced charting powered by TradingView, integrated Reuters news, smart trade tickets, and over 80 technical indicators. Users can personalize layouts, set alerts, and trade from charts, ensuring a tailored experience for all trading styles.

How fast are trade executions on FOREX.com platforms?

FOREX.com boasts an average execution speed of 0.003 seconds, with 100% of trades (excluding MetaTrader) executed in under one second during normal market conditions. This swift execution minimizes slippage and enhances pricing accuracy for traders.

Our Insights

FOREX.com platforms combine speed, usability, and innovation. From mobile convenience to advanced web functionality, traders enjoy powerful tools and real-time execution. With integrated analytics and customizable layouts, these platforms empower users to trade smarter and faster, making them a strong choice for any trading strategy.

★★★ | Minimum Deposit: $100 Regulated by: CIRO, CySEC, NFA, CFTC, CIMA, FCA, FSA, MAS, ASIC Crypto: Yes |

Markets Available for Trade

FOREX.com provides traders access to a wide range of markets, including forex, indices, stock CFDs, commodities, and cryptocurrencies. Its award-winning platforms and strong regulatory framework ensure security and reliability, while fast execution and customizable tools enhance the overall trading experience.

| Feature | Details |

| Markets Offered | Forex Stock CFDs Indices Commodities Cryptos |

| Platforms | WebTrader Mobile Apps MetaTrader 5 |

| Regulation | 🇰🇾 Cayman Islands Monetary Authority |

| Execution Speed | 0.003 seconds average |

Frequently Asked Questions

What markets can I trade with FOREX.com?

You can trade over 80 forex pairs, global stock CFDs, major indices, commodities like metals and energy, and popular cryptocurrency CFDs such as Bitcoin, Ethereum, and Litecoin. This variety allows you to diversify your trading portfolio effectively.

Is FOREX.com a regulated broker?

Yes, FOREX.com is regulated by the 🇰🇾 Cayman Islands Monetary Authority under the Securities Investment Business Law. It is also part of StoneX Group Inc., a NASDAQ-listed company, ensuring a secure and transparent trading environment.

Our Insights

FOREX.com remains a strong choice for traders who want access to global markets, fast execution, and advanced tools. Its regulatory backing and industry experience make it a trusted platform, while its comprehensive market range suits both beginners and experienced traders.

★★★ | Minimum Deposit: $100 Regulated by: CIRO, CySEC, NFA, CFTC, CIMA, FCA, FSA, MAS, ASIC Crypto: Yes |

Deposit and Withdrawal

FOREX.com offers secure and flexible funding and withdrawal methods, including credit cards, wire transfers, and e-wallets like Neteller and Skrill. The broker ensures zero internal deposit fees, quick processing, and strict fund protection under 🇰🇾 CIMA regulations for your peace of mind.

| Method | Minimum Deposit | Max Limit | Processing Time |

| Credit/Debit Card | 100 USD | 10,000 USD | Immediate |

| Wire Transfer | None | Unlimited | 1–2 Business Days |

| Neteller/Skrill | 100 USD | 10,000 USD | Immediate |

Frequently Asked Questions

How can I fund my FOREX.com account?

You can fund your account through credit or debit cards, wire transfers, or e-wallets like Neteller and Skrill. All methods are processed through MyAccount for secure and convenient deposits, with no internal fees and quick processing times.

How are withdrawals processed at FOREX.com?

Withdrawals are returned to the original funding source, starting with cards, then e-wallets, followed by wire transfers. Requests are processed within 24 to 48 hours, though banks may take additional time to credit funds.

Our Insights

FOREX.com provides a reliable funding and withdrawal process with flexible options and strong security standards. While PayPal is not accepted, most traders will find the methods convenient and processing times competitive.

★★★ | Minimum Deposit: $100 Regulated by: CIRO, CySEC, NFA, CFTC, CIMA, FCA, FSA, MAS, ASIC Crypto: Yes |

Education and Resources

FOREX.com Trading Academy actively equips traders at all levels with structured learning resources. It offers beginner, intermediate, and advanced courses, along with quizzes, tutorials, and self-assessments. Learners can practice with a demo account funded with $50,000 in virtual money, making it an ideal hub for skill development.

Frequently Asked Questions

What courses does the FOREX.com Trading Academy offer?

The academy provides structured courses for beginners, intermediates, and advanced traders. These lessons include topics like financial markets, creating trading plans, technical analysis, and Fibonacci theory, enabling traders to build knowledge progressively and apply strategies confidently in real market conditions.

Does FOREX.com offer practical trading tools for learners?

Yes, the academy pairs theoretical learning with practical tools. Traders can open a demo account with $50,000 in virtual funds to experience live market conditions without financial risk. Additionally, platform tutorials and short guides help learners navigate trading software with ease.

Our Insights

FOREX.com Trading Academy delivers a balanced blend of education and hands-on practice, making it an excellent resource for traders at every stage. With structured courses, interactive tools, and real-time simulation, it ensures learners gain both knowledge and practical confidence in the trading world.

★★★ | Minimum Deposit: $100 Regulated by: CIRO, CySEC, NFA, CFTC, CIMA, FCA, FSA, MAS, ASIC Crypto: Yes |

Customer Support

FOREX.com actively ensures customer satisfaction with multiple support channels, including live chat, global phone lines, and email. Traders can get assistance with account setup, platform queries, and trading issues. Additionally, an extensive FAQ section helps users find quick answers without waiting for direct support.

Frequently Asked Questions

What is the quickest way to contact FOREX.com support?

The fastest way to reach FOREX.com support is through live chat. A Client Services specialist will assist you in real time, answering queries about account opening, trading tools, or platform issues, making it the most convenient and immediate option for traders.

Are there phone and email options for support?

Yes, FOREX.com offers phone support for international and regional clients, including UAE and Middle East contacts. You can also email the global support team at [email protected]. These alternatives ensure users have flexible ways to reach assistance anytime they need help.

Our Insights

FOREX.com provides strong customer support through live chat, phone, and email, ensuring traders receive quick and professional assistance. Combined with a detailed FAQ section, it delivers a seamless experience for resolving issues and answering queries effectively.

★★★ | Minimum Deposit: $100 Regulated by: CIRO, CySEC, NFA, CFTC, CIMA, FCA, FSA, MAS, ASIC Crypto: Yes |

Insights from Real Traders

🥇 Seamless Trading Experience!

I have been using FOREX.com for over a year, and the experience has been exceptional. The platform is intuitive, trade execution is lightning-fast, and I love the access to detailed charts and analytics. Customer support is quick and professional whenever I have a question. – Emily

⭐⭐⭐⭐

🥈 Reliable and Transparent Broker!

FOREX.com stands out for its transparency and reliability. Deposits and withdrawals have always been smooth, and I feel secure knowing my funds are held with a regulated broker. The web platform is easy to navigate, and the mobile app makes trading on the go effortless. – Larry

⭐⭐⭐⭐⭐

🥉 Excellent Tools and Education.

What I appreciate most about FOREX.com is the range of educational resources and advanced tools like TradingView charts. It’s perfect for both beginners and experienced traders. I’ve seen a big improvement in my trading strategy since joining. – James

⭐⭐⭐

★★★ | Minimum Deposit: $100 Regulated by: CIRO, CySEC, NFA, CFTC, CIMA, FCA, FSA, MAS, ASIC Crypto: Yes |

Customer Reviews and Trust Scores

Client feedback and independent evaluations consistently portray FOREX.com as a trustworthy broker. High trust scores and positive community reviews underscore its reputation for reliability and security.

| Source | Trust Score | Review Summary |

| Trustpilot | 4.7/5 | Excellent customer service |

| ForexBrokers.com | 99 /99 | Highly trusted globally |

| TopBrokers.com | 4 /5 | Mostly positive user reviews |

High scores across independent platforms reflect consistently strong user satisfaction and credibility.

★★★ | Minimum Deposit: $100 Regulated by: CIRO, CySEC, NFA, CFTC, CIMA, FCA, FSA, MAS, ASIC Crypto: Yes |

Discussions and Forums about FOREX.com

Traders actively discuss FOREX.com across online communities, sharing diverse experiences. While many praise its platform and execution, some highlight customer service and withdrawal concerns.

| Forum | Community Sentiment | Common Themes |

| Reddit (r/Forex) | Mixed to Positive | Good education, mixed support complaints |

| BabyPips forum | Largely Positive | Platform quality and service praised |

| ForexPeaceArmy | Mixed to Negative | Complaints about withdrawal delays and fees |

Forum insights reveal a generally positive platform experience, balanced by occasional reports of service and withdrawal frustrations.

★★★ | Minimum Deposit: $100 Regulated by: CIRO, CySEC, NFA, CFTC, CIMA, FCA, FSA, MAS, ASIC Crypto: Yes |

Employee Overview of Working for FOREX.com

Insights from professionals and career platforms suggest that working at FOREX.com and its parent, StoneX, offers a strong culture, job security, and skill development opportunities.

| Source | Rating/Feedback Score | Employee Insights |

| AmbitionBox | Good overall rating | Supportive culture, solid development |

| LinkedIn Insights | High-level retention | Stability and institutional growth |

| Industry reputation | Positive | Backed by publicly traded parent StoneX |

Employee feedback and firm legacy suggest FOREX.com offers a stable, growth‑oriented workplace supported by a strong corporate structure.

★★★ | Minimum Deposit: $100 Regulated by: CIRO, CySEC, NFA, CFTC, CIMA, FCA, FSA, MAS, ASIC Crypto: Yes |

Pros and Cons

| ✓ Pros | ✕ Cons |

| Strong regulatory oversight | No fixed spread accounts |

| Fast trade execution | Limited product range in some regions |

| Advanced trading platforms | Inactivity fees apply |

| Competitive pricing | No social trading features |

| Solid financial backing | Limited crypto options |

References:

In Conclusion

FOREX.com maintains regional offices and support services across major financial markets worldwide. This network ensures clients can access localized assistance tailored to their region’s regulatory framework and market practices. Customer support operates 24/5, covering all trading hours.

• 🇺🇸 United States

• 🇨🇦 Canada

• 🇬🇧 United Kingdom

• 🇦🇺 Australia

• 🇯🇵 Japan

• 🇭🇰 Hong Kong

• 🇸🇬 Singapore

FOREX.com supports traders through both direct regional entities and affiliates, ensuring compliance with local regulations and delivering customer service in native time zones. This setup fosters responsive, reliable support wherever you trade.

Faq

Yes, FOREX.com is a fully regulated broker authorized by multiple financial authorities, including 🇰🇾 CIMA (Cayman Islands Monetary Authority).

FOREX.com provides access to over 80 forex pairs, stock CFDs, indices, commodities, and cryptocurrencies. Traders can diversify their portfolios with thousands of global instruments on one platform.

Yes, FOREX.com offers a free demo account where traders can practice strategies and explore the platform without risking real funds. It is ideal for beginners and experienced traders testing new methods.

You can fund your account using credit or debit cards, wire transfers, and e-wallets like Neteller and Skrill. Deposits are processed quickly, and there are no internal funding fees, though your bank might apply charges.

FOREX.com offers its proprietary web and mobile platforms, as well as TradingView and MetaTrader 5 (MT5). These platforms include advanced charting, analytics, and customizable trading tools for both beginners and professionals.

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open a Forex.com Account

- Safety and Security

- Trading Platforms and Tools

- Markets Available for Trade

- Deposit and Withdrawal

- Education and Resources

- Customer Support

- Insights from Real Traders

- Customer Reviews and Trust Scores

- Discussions and Forums about FOREX.com

- Employee Overview of Working for FOREX.com

- Pros and Cons

- In Conclusion