Interactive Brokers Review

- Overview

- Fees, Spreads, and Commissions

- Safety and Security

- Minimum Deposit and Account Types

- How to Open an IBKR Account

- Trading Platforms and Tools

- Markets Available for Trade

- Deposits and Withdrawals

- Education and Research

- Insights from Real Traders

- Customer Reviews and Trust Scores

- Discussions and Forums about Interactive Brokers

- Employee Overview of Working for Interactive Brokers

- Pros and Cons

- In Conclusion

Interactive Brokers stands out as a reliable broker offering access to global markets in over 200 countries and territories. Commissions begin at 0 USD, and all client funds are held in segregated accounts for added security. The platform holds an impressive trust score of 98 out of 99.

★★★★ | Minimum Deposit: $0 Regulated by: SEC, FINRA, FCA, ASIC Crypto: No |

Overview

Interactive Brokers stands out as a top-tier brokerage, enabling clients across 200+ countries to access over 150 global markets. Its low commissions, powerful tools, and educational resources make it ideal for professionals and seasoned traders seeking efficiency, security, and transparency in global investing.

Frequently Asked Questions

What markets can clients access through Interactive Brokers?

Interactive Brokers gives users access to over 150 global markets, including stocks, options, futures, currencies, bonds, and funds. Clients in more than 200 countries can trade seamlessly from a unified platform designed for serious, global-minded investors.

What are the trading costs and commission rates?

IBKR’s commission structure is built for professionals. Trades on US-listed stocks and ETFs start at USD 0. Importantly, there are no hidden charges like spreads or ticket fees, and no account minimums, helping traders keep their costs low.

Our Insights

Interactive Brokers offers one of the most comprehensive and cost-effective trading experiences in the industry. With global reach, institutional-grade tools, and transparent pricing, it remains a highly trusted choice for experienced investors looking to maximize efficiency and control in their trading strategies.

★★★★ | Minimum Deposit: $0 Regulated by: SEC, FINRA, FCA, ASIC Crypto: No |

Fees, Spreads, and Commissions

Interactive Brokers is widely respected for offering a cost-effective trading environment. With its transparent fee structure, tight spreads, and low to zero commissions on many instruments, IBKR empowers traders of all levels to minimize costs and maximize trading efficiency.

| Fee Type | Details |

| Commissions | Low or zero depending on asset and volume |

| Spreads | Tight, market-based spreads |

| Maintenance Fees | Generally none |

| Minimum Deposit | Often none; varies by account type |

Frequently Asked Questions

What are the typical commissions on trades?

Commissions at IBKR depend on the asset class and trading volume. However, many instruments are available with low or even zero commission, giving traders significant savings compared to traditional brokerage models.

Are there any account maintenance fees?

IBKR typically does not charge account maintenance fees, making it accessible and cost-efficient. Still, it’s wise to confirm based on your specific account type to ensure no exceptions apply.

Our Insights

IBKR offers a competitive edge through its transparent and low-cost fee structure. The absence of account maintenance fees and the availability of commission-free trades make it a smart choice for traders aiming to optimize returns without being weighed down by overhead costs.

★★★★ | Minimum Deposit: $0 Regulated by: SEC, FINRA, FCA, ASIC Crypto: No |

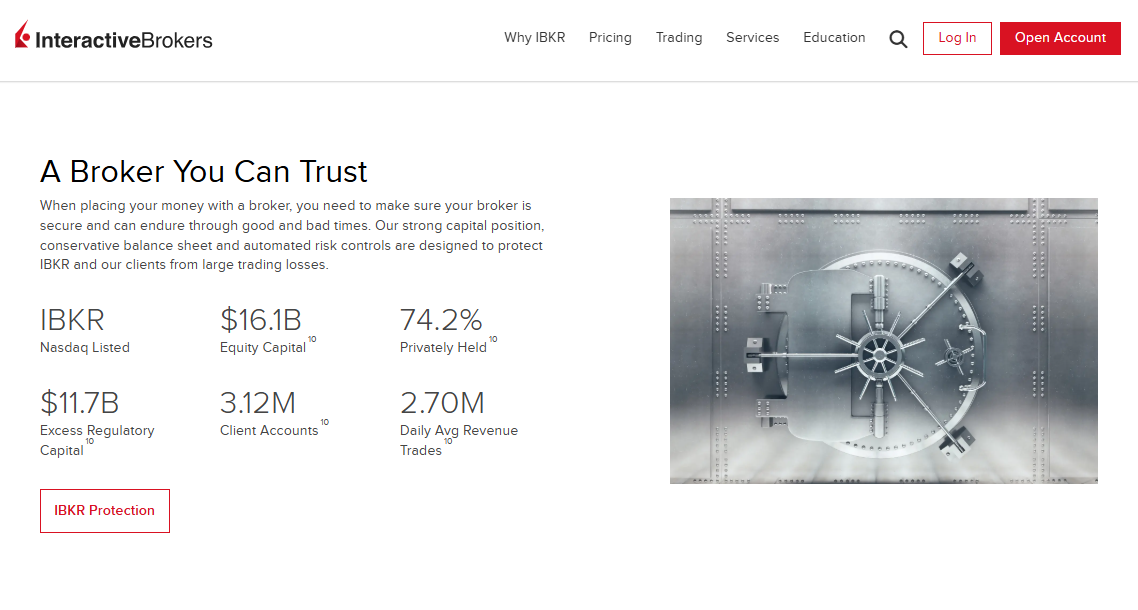

Safety and Security

Interactive Brokers emphasizes safety and security, delivering a fortified trading environment through strong financial backing and advanced technology. The broker’s robust capital base, automated risk controls, and compliance with global regulatory standards make it a reliable platform for investors seeking peace of mind while trading.

| Feature | Description |

| Capital Strength | $16.1B equity $11.7B excess regulatory capital |

| Risk Management | Automated controls to prevent major losses |

| Data Security | Advanced encryption and compliance protocols |

| Regulatory Compliance | Top-tier global oversight |

Frequently Asked Questions

How does IBKR ensure the security of my funds?

IBKR combines a conservative balance sheet with automated risk management tools to secure client funds. The firm’s strong capital position helps it withstand market volatility while maintaining the integrity of client accounts.

What measures does IBKR have in place to protect my data?

IBKR employs advanced security protocols, encryption technologies, and follows global compliance standards. These measures protect sensitive client data from cyber threats and unauthorized access.

Our Insights

IBKR offers a secure and professionally managed trading environment. Its strong financial backing, commitment to regulatory compliance, and cutting-edge risk controls make it one of the safest online brokers for traders and investors alike.

★★★★ | Minimum Deposit: $0 Regulated by: SEC, FINRA, FCA, ASIC Crypto: No |

Minimum Deposit and Account Types

Interactive Brokers accommodates a wide spectrum of investors by offering a diverse range of account types and flexible minimum deposit requirements. Whether you are a retail trader or a financial institution, IBKR ensures you have access to the tools, account features, and margin capabilities required for global trading success.

*May vary by region or account subtype

Frequently Asked Questions

What is the minimum deposit required to open an account with IBKR?

IBKR’s minimum deposit starts at $10,000 for individual accounts, although this may vary based on region and account type. Specialized accounts could have different requirements depending on the client profile and trading features selected.

What account types does IBKR offer?

IBKR supports multiple account types, including individual, joint, trust, IRA, UGMA/UTMA, advisor, family office, and institutional accounts. These are designed to suit both personal investment needs and large-scale professional portfolio management.

Our Insights

Interactive Brokers offers unmatched flexibility in account selection and margin access, paired with transparent deposit requirements. This approach makes IBKR a strong choice for both individual investors and professional institutions aiming to scale efficiently in global markets.

★★★★ | Minimum Deposit: $0 Regulated by: SEC, FINRA, FCA, ASIC Crypto: No |

How to Open an IBKR Account

To open an Interactive Brokers (IBKR) account, follow these steps:

1. Step 1: Visit the IBKR Website

Go to the official Interactive Brokers website at www.ibkr.com.

2. Step 2: Select ‘Open an Account’

On the homepage, click the “Open an Account” button to start the registration process.

3. Step 3: Choose Account Type

IBKR offers a variety of account types (individual, joint, trust, advisor, business, etc.). Choose the one that suits your needs. Each account type has different features and requirements.

4. Step 4: Complete the Online Application

Fill out the online application form with your details. Depending on your location, you may need to provide additional documents such as proof of identity and address (e.g., a government-issued ID and a utility bill).

5. Step 5: Fund Your Account

Once your application is approved, you’ll be asked to fund your account. IBKR supports various funding methods, including bank transfers and wire transfers.

You can fund your account in multiple currencies, depending on your location and the account type.

6. Step 6: Agree to Terms and Conditions

Review and accept the terms, conditions, and any applicable agreements, such as the margin agreement if you plan to trade on margin.

7. Step 7: Submit and Verify

After submitting your application, IBKR may verify your identity and other information. This process may take some time, especially for accounts that require additional documentation.

8. Step 8: Access Your Account

Once your account is approved and funded, you will receive access to IBKR’s trading platforms, such as the IBKR WebTrader, IBKR Mobile, or IBKR Trader Workstation (TWS).

You can then start trading, managing your portfolio, and exploring the platform’s various tools and features. If you need assistance during the application process, IBKR provides customer support to help you through the steps.

★★★★ | Minimum Deposit: $0 Regulated by: SEC, FINRA, FCA, ASIC Crypto: No |

Trading Platforms and Tools

Interactive Brokers delivers a comprehensive suite of trading platforms that cater to beginners, active traders, and institutional professionals. With no platform fees and access to advanced features, IBKR empowers users to trade stocks, options, forex, futures, bonds, and ETFs with confidence, speed, and flexibility.

| Platform Name | Best For | Key Features | Platform Fees |

| IBKR GlobalTrader | Beginners | Simple UI stock ETF trading | None |

| Trader Workstation | Advanced Traders | Algo tools technical analysis | None |

| IBKR Mobile | All Traders | On-the-go portfolio access | None |

Frequently Asked Questions

Which IBKR trading platform is best for beginners?

IBKR GlobalTrader is an ideal choice for beginners. Available via mobile and web, it offers a simplified interface and supports stock and ETF trading with intuitive navigation and essential features.

What features are available on IBKR’s advanced platforms?

Trader Workstation (TWS) and IBKR APIs are geared toward advanced users. They offer professional-grade tools such as algorithmic trading, custom order types, technical analysis, and real-time data integration.

Our Insights

Interactive Brokers stands out with its versatile platform offerings, built to suit the diverse needs of traders globally. From intuitive mobile apps for beginners to fully customizable workstations for professionals, IBKR delivers top-tier technology without the cost burden of platform fees.

★★★★ | Minimum Deposit: $0 Regulated by: SEC, FINRA, FCA, ASIC Crypto: No |

Markets Available for Trade

Interactive Brokers offers a wide range of tradable assets, including stocks, options, futures, currencies, bonds, ETFs, and more. With access to over 150 global markets, IBKR accommodates a variety of investment strategies and preferences, ensuring traders can find opportunities across multiple asset classes.

| Asset Type | Availability | Global Access | Fractional Trading |

| Stocks | Yes | Yes | Yes |

| ETFs | Yes | Yes | Yes |

| Options | Yes | Yes | None |

| Currencies | Yes | Yes | None |

| Futures | Yes | Yes | None |

| Bonds | Yes | Yes | None |

Frequently Asked Questions

What types of assets can I trade on IBKR?

IBKR allows access to a wide array of assets, including stocks, options, futures, forex, bonds, ETFs, and mutual funds. This enables traders to diversify their portfolios and adapt their strategies across more than 150 global markets.

Can I trade fractional shares?

Yes. IBKR enables fractional share trading starting from just $1. This makes investing in high-priced stocks more accessible and supports easier portfolio diversification for both new and experienced traders.

Our Insights

Interactive Brokers offers a comprehensive range of tradable assets and access to over 150 international markets, providing traders with the flexibility to explore diverse investment opportunities.

★★★★ | Minimum Deposit: $0 Regulated by: SEC, FINRA, FCA, ASIC Crypto: No |

Deposits and Withdrawals

Interactive Brokers supports multiple deposit and withdrawal methods, offering convenience to global clients. While bank transfers are universally accepted, other options may vary by country. The platform ensures secure processing, though withdrawal times depend on the method selected.

| Feature | Availability | Notes | Processing Time |

| Bank Transfers | Global | Widely accepted worldwide | 1–5 business days |

| Wire Transfers | Select Regions | Depends on local banks | 1–3 business days |

| Local Payment Methods | Regional | Varies by country | Instant–3 days |

| Withdrawal to Bank | Global | Delays possible with international banks | 2–5 business days |

| Minimum Deposit Required | Yes | Based on account type | N/A |

Frequently Asked Questions

What deposit options are available with Interactive Brokers?

IBKR provides various funding methods such as bank transfers, wire transfers, and localized payment systems. However, the specific availability of each method depends on your country of residence.

Are all deposit methods available in every country?

No. While 🇺🇸 bank transfers are widely supported, other methods such as local payment gateways or online wallets may not be available in all regions. It’s best to confirm the country-specific options within your IBKR account.

Our Insights

Interactive Brokers offers a reliable and secure funding process, accommodating global clients with multiple deposit options. While bank transfers are universally supported, regional restrictions and varying withdrawal speeds mean users should review local availability before funding.

★★★★ | Minimum Deposit: $0 Regulated by: SEC, FINRA, FCA, ASIC Crypto: No |

Education and Research

Interactive Brokers offers an extensive range of educational resources through the IBKR Online Campus. These resources are ideal for traders at all levels, particularly beginners looking to enhance their skills and knowledge. The IBKR Campus includes:

- Traders Academy

- IBKR Webinars

- Traders Insights

- IBKR Podcasts

- IBKR Quant

- Student Trading Lab

Additionally, Interactive Brokers provides access to short educational videos and a comprehensive Traders Glossary.

Frequently Asked Questions

What resources are available through the IBKR Online Campus?

The IBKR Online Campus provides a variety of resources, including the Traders Academy, webinars, Traders Insights, podcasts, IBKR Quant, and the Student Trading Lab.

Are there any short video tutorials available?

Yes, IBKR offers short video tutorials covering various trading topics, allowing for quick and easy learning.

Our Insights

Interactive Brokers offers a comprehensive suite of educational resources through the IBKR Online Campus, making it an invaluable platform for traders at all skill levels. With accessible tools like webinars, podcasts, and a glossary, beginners can easily enhance their trading knowledge and expertise.

★★★★ | Minimum Deposit: $0 Regulated by: SEC, FINRA, FCA, ASIC Crypto: No |

Insights from Real Traders

🥇 Exceptional Trading Platform!

I’ve been using Interactive Brokers for over a year now, and I couldn’t be more impressed with the platform. The variety of assets available to trade, coupled with their competitive fees, makes it a top choice for me. The educational resources on the IBKR Campus have been invaluable in improving my trading skills. – John

⭐⭐⭐⭐

🥈 Great Experience and Low Fees!

Interactive Brokers has truly exceeded my expectations. The platform is user-friendly, and I appreciate how low the commissions are, especially when compared to those of other brokers. I was able to start trading with a small deposit, and their educational resources helped me get up to speed quickly. – Sarah

⭐⭐⭐⭐⭐

🥉 Best Broker for Active Traders!

As an active trader, I need a platform that offers powerful tools and low fees, and Interactive Brokers delivers on both fronts. The Trader Workstation (TWS) is packed with advanced features that make complex trades easier to manage. Plus, the customer support team is always available to assist when needed. – Michael

⭐⭐⭐⭐

★★★★ | Minimum Deposit: $0 Regulated by: SEC, FINRA, FCA, ASIC Crypto: No |

Customer Reviews and Trust Scores

User ratings for Interactive Brokers vary widely. Independent platforms often show low satisfaction, particularly highlighting customer service and user interface issues.

| Platform | Common Rating/ Comment |

| Trustpilot/ Sitejabber | Often under 2 stars; complaints about service and bugs |

| User sentiment on Reddit | Service described as slow or unresponsive; platform powerful yet complex |

| Professional reviews | Low fees and execution praised; service rated B- to poor |

However, IBKR also receives praise for its low trading costs and broad market access, especially among sophisticated traders. Nothing consistently balances the polarized perspectives on its trustworthiness.

★★★★ | Minimum Deposit: $0 Regulated by: SEC, FINRA, FCA, ASIC Crypto: No |

★★★★ | Minimum Deposit: $0 Regulated by: SEC, FINRA, FCA, ASIC Crypto: No |

Discussions and Forums about Interactive Brokers

Market forums often spotlight IBKR’s technical robustness but also criticize its customer support. Reddit users repeatedly describe a complex and unintuitive interface paired with long wait times for service. While advanced traders appreciate the system, others find it user-hostile.

| Discussion Theme | Key Observations |

| Platform Usability | Described as outdated, unintuitive and fragmented across platforms |

| Customer Support | Frequent complaints about delays, lack of help, and poor communication |

| Value Proposition | Praised for low fees and wide market access by experienced users |

Forums reflect a clear divide: power users love IBKR’s capabilities; frequent users fault its support and usability.

★★★★ | Minimum Deposit: $0 Regulated by: SEC, FINRA, FCA, ASIC Crypto: No |

★★★★ | Minimum Deposit: $0 Regulated by: SEC, FINRA, FCA, ASIC Crypto: No |

Employee Overview of Working for Interactive Brokers

Insider reviews paint a picture of a company focused on technical excellence but harsh as a workplace. Employees report good pay and benefits like free lunch, but cite rigid management, limited career progression, and dated technology stacks.

| Workplace Aspect | Employee Feedback Highlights |

| Compensation Benefits | Competitive salary, free meals, lab coding incentives |

| Culture Flexibility | Generally rigid, micromanaged; limited remote flexibility |

| Career Advancement | Very limited growth opportunities; internal moves discouraged |

| Technology Stack | Old tech (Java, legacy systems) makes development mundane |

The firm is often described as high-pressure and low flexibility.

It seems appealing for disciplined professionals, but less so for work-life balance or open culture.

★★★★ | Minimum Deposit: $0 Regulated by: SEC, FINRA, FCA, ASIC Crypto: No |

★★★★ | Minimum Deposit: $0 Regulated by: SEC, FINRA, FCA, ASIC Crypto: No |

Pros and Cons

| ✓ Pros | ✕ Cons |

| Interactive Brokers offers a wide range of marketable assets and markets | A challenging platform with a steep learning curve |

| The Advanced Trader Workstation (TWS) platform is available to traders | During peak periods of activity, customer service may be less accessible |

| Competitive commission and margin rates | Low-balance accounts incur monthly inactivity penalties |

References:

In Conclusion

Interactive Brokers operates physical offices and dedicated support teams across multiple continents. Clients in these countries can access local support services, including regional sales and client service centers.

- 🇺🇸 United States

- 🇨🇦 Canada

- 🇬🇧 United Kingdom

- 🇨🇭 Switzerland

- 🇭🇺 Hungary

- 🇯🇵 Japan

- 🇮🇳 India

- 🇨🇳 China

- 🇸🇬 Singapore

- 🇮🇪 Ireland

- 🇪🇪 Estonia

- 🇦🇺 Australia

This list reflects the countries where Interactive Brokers maintains physical office facilities and client support operations.

Interactive Brokers offers localized support through regional offices across major global financial hubs. These offices support customer inquiries, sales contacts, and regulatory compliance, ensuring service is tailored to regional client needs.

Faq

IBKR gives you access to over 150 global markets, including stocks, options, futures, currencies, bonds, and funds in over 200 countries.

Commissions for US-listed stocks and ETFs start at USD 0, with no added ticket charges, spreads, or account minimums. Rates for other products are also low.

You can fund your account in 28 different currencies, making it easy to deposit and trade across multiple global markets.

Yes, IBKR provides margin trading with margin rates up to 53% lower than the industry average, allowing for more leverage and potentially higher returns.

IBKR offers interest rates up to USD 3.83% on instantly available cash in your account, providing additional earning potential.

- Overview

- Fees, Spreads, and Commissions

- Safety and Security

- Minimum Deposit and Account Types

- How to Open an IBKR Account

- Trading Platforms and Tools

- Markets Available for Trade

- Deposits and Withdrawals

- Education and Research

- Insights from Real Traders

- Customer Reviews and Trust Scores

- Discussions and Forums about Interactive Brokers

- Employee Overview of Working for Interactive Brokers

- Pros and Cons

- In Conclusion