LiteFinance Review

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open a LiteFinance Account

- Trading Platforms and Tools

- Safety and Security

- Markets Available for Trade

- Deposits and Withdrawals

- Bonus Offers and Promotions

- Affiliate Programs

- Customer Support

- Insights from Real Traders

- Customer Reviews and Trust Scores

- Discussions and Forum Mentions

- Employee and Insider Perspective

- Pros and Cons

- In Conclusion

LiteFinance holds an average-risk rating with a Trust Score of 76 out of 100. Regulated by one Tier-2 authority, the broker lacks Tier-1 and Tier-3 licenses. It offers traders two account types – ECN and Classic – providing flexible options for various trading strategies, though regulatory protection may vary by region.

★★★ | Minimum Deposit: $50 Regulated by: CySEC Crypto: Yes |

Overview

Since its rebranding from LiteForex in 2021, LiteFinance has expanded its global presence, offering advanced ECN trading technology, multi-asset access, and social trading features. With over 20 years in the market, it provides a secure, high-performance environment suited for both beginners and professionals.

Frequently Asked Questions

Is LiteFinance regulated in multiple jurisdictions?

Yes. LiteFinance operates through different entities. 🇨🇾 Cyprus regulation is held under CySEC, 🇲🇺 Mauritius licenses are issued by the FSC, and 🇻🇨 Saint Vincent and the Grenadines serves as its global offshore base. This allows broad service coverage but mixed regulatory strength.

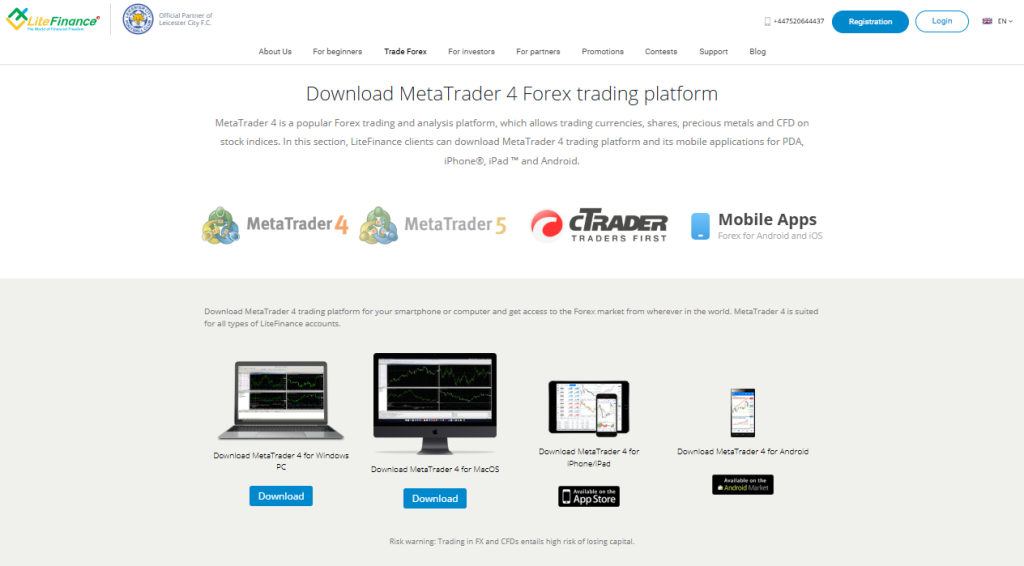

What trading platforms and tools does LiteFinance support?

LiteFinance supports MetaTrader 4 and MetaTrader 5, as well as its user-friendly web platform. It includes built-in chart analysis tools, copy trading options, and multilingual access, making it an efficient and flexible choice for various trading strategies.

Our Verdict

LiteFinance is a compelling choice for traders seeking advanced ECN execution, multilingual support, and copy-trading features. Although not available in some major jurisdictions, it remains a respected broker with solid execution, automation tools, and strong affiliate rewards. It suits both new and experienced users.

★★★ | Minimum Deposit: $50 Regulated by: CySEC Crypto: Yes |

Fees, Spreads, and Commissions

LiteFinance offers competitive pricing across all its account types. Traders benefit from low floating spreads, commission-free options, and predictable cost structures. The ECN account stands out with raw spreads from 0.0 pips and direct liquidity access, making it ideal for high-frequency and professional strategies.

| Account Type | Open an Account | Spread (From) | Commission | Execution Type |

| ECN | 0.0 pips | From $0.25 per lot | Market execution | |

| Classic | 1.8 pips | None | Market execution | |

| Cent | 3.0 pips | None | Market execution |

Frequently Asked Questions

What are the main trading fees on LiteFinance accounts?

The ECN account charges floating spreads from 0.0 pips with commissions starting from $0.25 per lot. Classic and Cent accounts have wider spreads, 1.8 and 3 pips respectively, but no commissions. Asset-based fees apply to shares, indices, and commodities.

Are there any hidden fees on LiteFinance?

LiteFinance does not impose deposit or withdrawal fees. However, asset-specific commissions apply (e.g., $5 per lot for major forex pairs, 0.1% on share CFDs). Additionally, account inactivity fees may apply after extended periods without trading.

Our Insights

LiteFinance offers a cost-effective trading environment for both casual and professional traders. Whether you prefer raw spreads with commission or wider spreads with zero commission, the platform provides a structure that is easy to understand and competitively priced.

★★★ | Minimum Deposit: $50 Regulated by: CySEC Crypto: Yes |

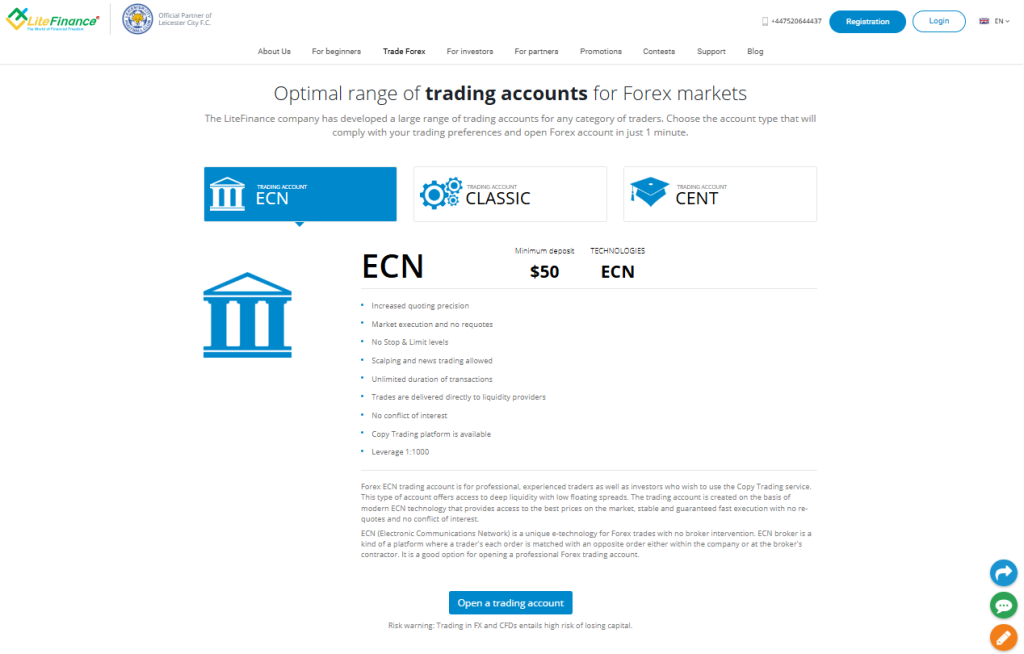

Minimum Deposit and Account Types

LiteFinance caters to all experience levels through its tiered account structure. With a minimum deposit starting at just $10, even beginners can participate. The ECN account, built on advanced technology, provides direct market access for skilled traders seeking deep liquidity and low-latency execution.

Frequently Asked Questions

What is the minimum deposit required to open an account?

The minimum deposit is $10 for Cent accounts and $50 for both ECN and Classic accounts. This low entry point allows traders of all financial backgrounds to access the forex market quickly and easily.

What are the differences between ECN, Classic, and Cent accounts?

ECN accounts offer raw spreads, direct liquidity, and are best suited for experienced traders. Classic accounts provide commission-free trading with wider spreads. Cent accounts allow micro trading with smaller contract sizes and are ideal for beginners or low-risk strategies.

Our Insights

LiteFinance delivers a well-structured range of accounts that suit different trading styles and risk levels. From the Cent account’s affordability to the ECN account’s advanced execution model, traders can easily find a match that aligns with their goals and experience.

★★★ | Minimum Deposit: $50 Regulated by: CySEC Crypto: Yes |

How to Open a LiteFinance Account

Opening a LiteFinance live account is a straightforward process that takes only a few minutes. You simply register, verify, select an account type, and fund your account before you can begin trading confidently.

1. Step 1: Visit the LiteFinance website and click on the Registration button.

Enter your email address or phone number, a secure password, and a unique nickname for Social Trading.

2. Step 2: Verify Your Email.

Verify your email using the one‑time code sent to you, then verify your phone number via SMS code to fully confirm your profile.

3. Step 3: Complete identity verification

Complete identity verification by uploading a government‑issued photo ID and a utility bill or bank statement to confirm your address. This unlocks full trading access.

4. Step 4: In the Metatrader section of your Profile, click Open account.

Choose your preferred platform (MT4, MT5, or cTrader), account type (ECN, Classic, or Cent), base currency, and leverage.

5. Step 5: Deposit the required minimum.

USD 50 for ECN or Classic accounts or USD 10 for Cent accounts in eligible countries. Use the Finance section to fund your chosen account.

Switch from demo mode to real trading mode via your Profile menu. Your first account will be labelled main, and you can open additional accounts as needed, up to your account limit.

★★★ | Minimum Deposit: $50 Regulated by: CySEC Crypto: Yes |

Trading Platforms and Tools

LiteFinance delivers robust trading experiences through the industry’s most trusted platforms—MetaTrader 4, MetaTrader 5, and cTrader. These platforms are designed for speed, flexibility, and deep market analysis. Combined with mobile compatibility, they ensure that traders can stay connected and in control from anywhere.

| Platform | Device Compatibility | Account Types | Notable Features |

| MT4 | PC, Mac iOS Android | ECN Classic Cent | Simple UI Reliable Tools |

| MT5 | PC Mac iOS, Android | ECN Classic | Advanced Tools More Assets |

| cTrader | Web PC Mac iOS Android | ECN | Level II Depth Fast Execution |

| Mobile Apps | Android iOS | All | Alerts Signals Multi-language |

Frequently Asked Questions

Which trading platform is best for beginners using LiteFinance?

MetaTrader 4 is a popular choice for beginners. It offers a user-friendly interface, essential analytical tools, and supports all LiteFinance account types. Moreover, the platform is compatible with both desktop and mobile, which makes it perfect for those starting.

Does LiteFinance support trading on mobile devices?

Yes, LiteFinance offers full support for mobile trading across Android and iOS devices. Whether using MT4, MT5, or cTrader, traders can access real-time data, market signals, and analytics via LiteFinance’s free apps in more than eight languages.

Our Insights

LiteFinance excels in platform diversity and accessibility. Whether you’re a seasoned trader or a newcomer, you can benefit from fast execution, modern interfaces, and full mobile functionality. With MT4, MT5, and cTrader available, LiteFinance meets the needs of every trading style and skill level.

★★★ | Minimum Deposit: $50 Regulated by: CySEC Crypto: Yes |

Safety and Security

Reviewers highlight that LiteFinance operates under 🇨🇾 CySEC, 🇲🇺 FSC Mauritius, and 🇻🇨 SVG FSA jurisdictions. It secures client funds in segregated accounts and enforces two‑factor authentication and encryption. However, critics caution that the lack of top‑tier regulators limits legal protections.

| Regulator | Jurisdiction | Key Protection Features | Regulatory Limitations |

| 🇨🇾 CySEC | Cyprus EU | Negative balance protection | Leverage capped at 30:1 |

| 🇲🇺 FSC | Mauritius | Segregated accounts | Tier‑2 oversight limited recourse |

| 🇻🇨 SVG FSA | St. Vincent and the Grenadines | Flexible trading terms | Minimal oversight and client remedies |

Frequently Asked Questions

What regulators oversee LiteFinance, and what protections exist?

LiteFinance holds licenses from 🇨🇾 CySEC, 🇲🇺 FSC Mauritius, and 🇻🇨 SVG FSA. Under CySEC, it offers negative balance protection and deposit insurance via an investor fund. Offshore entities in SVG and Mauritius follow lighter oversight and limit client safeguard options.

How does LiteFinance secure client funds and data?

It maintains segregated client accounts that separate customer funds from operational capital. The platform uses two‑factor authentication, SSL encryption, and isolated servers or VPS for added security. Users also benefit from fraud detection and strict KYC protocols.

Our Insights

LiteFinance delivers solid regulatory coverage under 🇨🇾 CySEC and basic compliance via 🇲🇺 and 🇻🇨 regulators. Its fund segregation, encryption, and authentication tools support client safety. Yet without top‑tier regulators, the platform holds moderate risk for traders seeking maximum protection.

★★★ | Minimum Deposit: $50 Regulated by: CySEC Crypto: Yes |

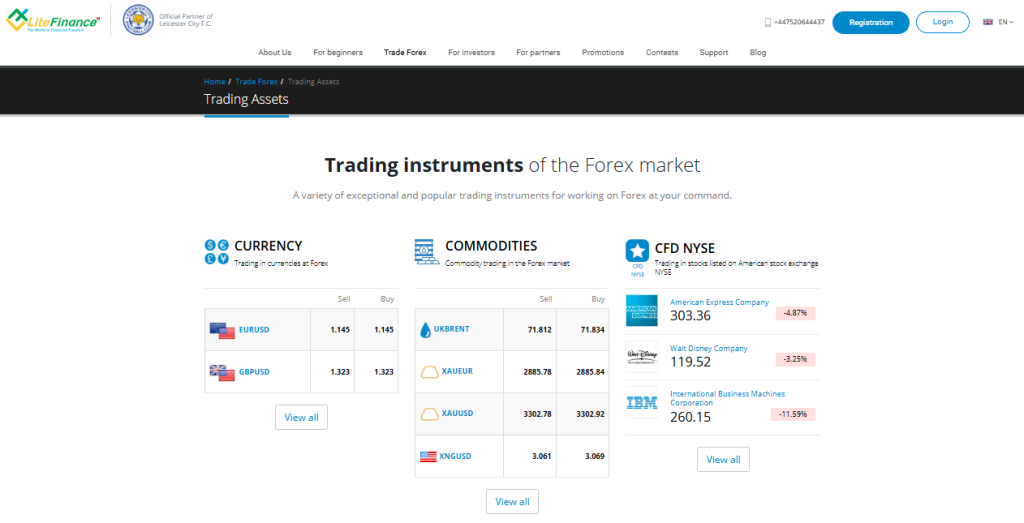

Markets Available for Trade

The Forex market offers traders a robust selection of instruments, from major currency pairs to global stock CFDs, commodities, indices, and cryptocurrencies. With access to leading assets across 🇺🇸 NYSE, 🇩🇪 XETRA, 🇬🇧 LSE, and more, traders can diversify strategies, hedge risks, and explore market opportunities in real time.

| Instrument Type | Examples | Trading Venue | Key Assets |

| Currencies | EURUSD GBPUSD | Forex | Major Forex Pairs |

| Commodities | XAUUSD UKBRENT | Spot/CFD | Metals Oil Gas |

| Stock CFDs | Apple Airbus Adidas | 🇺🇸 NYSE 🇪🇺 EURONEXT 🇩🇪 XETRA | Global Equities |

| Indices Crypto | SPX BTCUSD | Indices Crypto CFD | Stock Indices Cryptos |

Frequently Asked Questions

What types of assets can I trade in the Forex market?

Forex traders can access a broad range of instruments, including currencies like EURUSD and GBPUSD, commodities such as 🇬🇧 UK Brent and XAUUSD, CFDs on global stocks from 🇺🇸 NYSE and 🇪🇺 EURONEXT, major indices like SPX and FDAX, and cryptocurrencies such as BTCUSD and ETHUSD.

Are cryptocurrencies available for trading on Forex platforms?

Yes, most Forex brokers now offer crypto trading. You can trade popular pairs like BTCUSD, ETHUSD, and LTCUSD. Although crypto markets are volatile, they provide unique short-term opportunities when integrated into a diversified trading portfolio.

Our Insights

The variety of trading instruments in Forex empowers traders to diversify and adapt to market movements. From traditional assets like currencies and commodities to modern instruments such as crypto and global stock CFDs, the choices available serve both conservative and aggressive trading styles efficiently.

★★★ | Minimum Deposit: $50 Regulated by: CySEC Crypto: Yes |

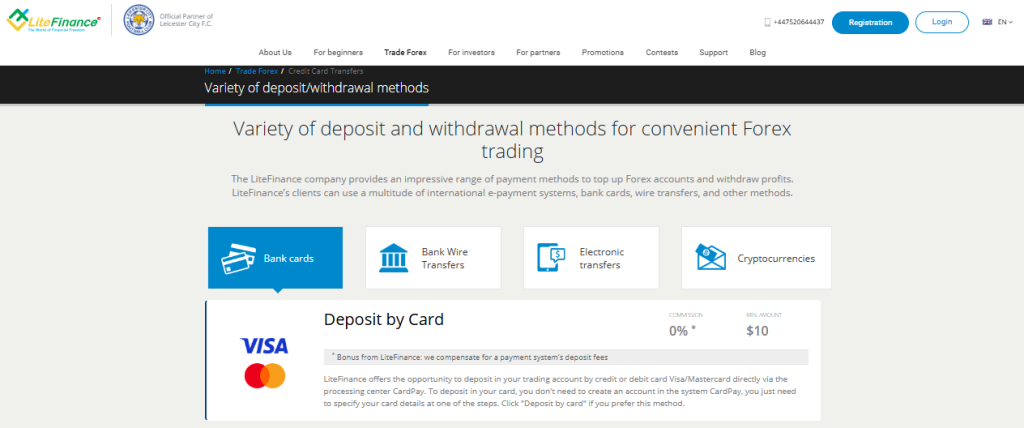

Deposits and Withdrawals

LiteFinance ensures hassle-free Forex transactions by offering a wide array of deposit and withdrawal options. Clients can fund accounts or withdraw profits using international bank cards, wire transfers, e-wallets, and even cryptocurrencies – all while benefiting from 0% deposit commissions thanks to LiteFinance’s bonus compensation.

| Method Type | Example Providers | Minimum Deposit | Deposit Fee |

| Bank Cards | Visa Mastercard | 10 USD | 0% (Compensated) |

| Bank Transfers | Wire Transfer | Varies | Varies |

| E-Payments | Various e-wallets | Varies | Depends on provider |

| Cryptocurrencies | Bitcoin Others | Varies | Usually 0% |

Frequently Asked Questions

What payment methods does LiteFinance support for deposits and withdrawals?

LiteFinance supports various methods, including bank cards like Visa and Mastercard, wire transfers, electronic payment systems, and crypto options. These choices give traders flexibility and convenience, making it easy to manage funds from anywhere in the world.

Is there a fee for depositing funds into a LiteFinance trading account?

LiteFinance does not charge deposit fees. They compensate for any commission charged by the payment system itself. For example, deposits made via CardPay using Visa or Mastercard are processed with 0% commission, helping traders maximize their account balance from the start.

Our Insights

LiteFinance’s diverse payment system accommodates traders globally with speed and security. Whether using a bank card, cryptocurrency, or e-wallet, clients benefit from flexible funding and no deposit fees – making it an excellent choice for seamless Forex account management.

★★★ | Minimum Deposit: $50 Regulated by: CySEC Crypto: Yes |

Bonus Offers and Promotions

LiteFinance rewards its clients with powerful Forex deposit bonuses of up to 100%, along with flexible promotional offers. Traders benefit from withdrawable bonus funds, spread rebates up to $7 per lot, and compensation for deposit commissions – enhancing both profit potential and overall trading experience.

| Bonus Type | Offer Amount | Withdrawable | Extra Perks |

| Deposit Bonus | Up to 100% | Yes | Additional margin, volume boost |

| Individual Bonus | On request | Varies | Personalized offers |

| Spread Rebates | Up to $7/lot | Yes | All instruments included |

| Fee Compensation | 100% of deposit fee | Yes | Instant refund |

Frequently Asked Questions

What kind of Forex bonuses does LiteFinance offer?

LiteFinance offers multiple bonus options, including up to 100% deposit bonuses, individual promotions upon request, and spread rebates of up to $7 per lot. These bonuses can be withdrawn under certain conditions, giving traders more capital and flexibility to enhance their strategies.

Are LiteFinance’s Forex bonuses withdrawable?

Yes, LiteFinance provides withdrawable Forex bonuses. Profits earned from bonus funds can be withdrawn, and in many cases, the bonus itself is also eligible for withdrawal after meeting specific trading conditions. This ensures that bonuses add real value to your trading account.

Our Insights

LiteFinance stands out with its robust bonus programs, offering up to 100% on deposits and ongoing promotional flexibility. With profit withdrawals allowed, margin support provided, and zero deposit commissions, these bonuses empower traders to explore bigger opportunities with lower financial pressure.

★★★ | Minimum Deposit: $50 Regulated by: CySEC Crypto: Yes |

Affiliate Programs

LiteFinance offers one of the most rewarding Forex affiliate programs in the industry. With up to 70% commission payouts, multi-level referral structures, and fast daily payments, partners can scale their income rapidly. Backed by robust tools and a trusted broker brand, success becomes a partnership.

| Key Metric | Value | Description | Notes |

| Max Affiliate Payout | 70% | Of LiteFinance’s profit | Plus 10% from sub partners |

| Top Partner Annual Earnings | $1.2 million | Estimated by company data | Based on high-volume referrals |

| Total Payouts (Last Year) | $78.36 million | To all active partners | Growing annually |

| Referral Tools Provided | Yes | Includes platform access and support | For both beginners and experts |

Frequently Asked Questions

How much can I earn with LiteFinance’s Forex affiliate program?

LiteFinance partners can earn up to 70% of the broker’s profit, plus 10% from sub-partners. Top affiliates have earned over $1.2 million annually, and total commissions last year exceeded $78 million. Earnings grow based on referral activity, volume traded, and program tier.

What makes LiteFinance’s affiliate program stand out?

LiteFinance’s program features daily payouts, unlimited withdrawals, a hybrid model, and spread rebates. With over 20 years in the market, access to marketing tools, and a user-friendly copy trading system, it’s designed for both beginners and experienced IBs to grow sustainably.

Our Insights

LiteFinance’s affiliate program is ideal for those seeking long-term, high-reward partnerships in the Forex space. With strong payouts, transparent reporting, and promotional tools, partners can confidently refer traders, grow their network, and earn serious passive income with a globally trusted broker.

★★★ | Minimum Deposit: $50 Regulated by: CySEC Crypto: Yes |

Customer Support

LiteFinance offers expert-level client support through live chat, email, FAQs, and community engagement. Their skilled team assists clients in multiple languages and is available seven days a week. Whether you need trading help, financial guidance, or partnership support, LiteFinance is always ready to respond.

Frequently Asked Questions

How can I contact LiteFinance’s support team?

You can reach LiteFinance’s assistance team via live chat, email, FAQ section, and the online community. They are equipped to handle general inquiries, financial matters, and affiliate-related questions with professionalism and in your native language whenever needed.

What are the working hours of LiteFinance’s departments?

All major departments, including General Inquiries, Financial, and Partnership Support, operate daily, based on GMT+3. This includes weekends, ensuring traders and partners get timely help regardless of time zone or trading day.

Our Insights

LiteFinance’s multilingual, always-available support team ensures traders and partners feel informed and confident. With dedicated departments operating all week, LiteFinance proves its commitment to fast, friendly, and professional client service across all aspects of Forex trading.

★★★ | Minimum Deposit: $50 Regulated by: CySEC Crypto: Yes |

Insights from Real Traders

🥇 Perfect for Copy Trading and Learning!

As someone new to forex, I found LiteFinance’s SocialTrading platform extremely helpful. I can learn from top-performing traders while I work at my own pace. The tools and analytics are user-friendly, and the support team always responds quickly. Highly recommended for beginners! – Daniel

⭐⭐⭐⭐

🥈 Lightning-Fast Execution and Smooth Withdrawals!

I’ve been trading with LiteFinance for over a year, and I’m honestly impressed by their platform speed and order execution. Withdrawals are processed faster than most brokers I’ve used. The automated system is a game-changer; my last payout hit my wallet within 2 hours! – Aisha

⭐⭐⭐⭐⭐

🥉 Reliable Platform with Low Spreads.

LiteFinance offers consistently low spreads and no annoying requotes, even during volatile market hours. I mostly trade gold and crypto, and the execution is always fast. I also love that I can use MetaTrader 5 in Portuguese; it makes a difference! – Lucia

⭐⭐⭐⭐

★★★ | Minimum Deposit: $50 Regulated by: CySEC Crypto: Yes |

Customer Reviews and Trust Scores

A snapshot of how traders rate LiteFinance and themes around reliability and support:

| Metric | Summary |

| Trustpilot TrustScore | 4.1 out of 5 based on 352 reviews; most praise user-friendly platform, fast execution and responsive support; some complaints about withdrawals and regional service differences |

| Review sentiment mix | Many positive experiences, but notable issues reported: withdrawal delays or rejections, account closures, support inconsistency |

| Expert review rating | Brokersway gives an 8.2/10 score: positive on spreads, leverage, account types; downside in transparency and licensing in some entities |

LiteFinance garners generally good ratings but faces mixed feedback on trust and customer experience.

★★★ | Minimum Deposit: $50 Regulated by: CySEC Crypto: Yes |

Discussions and Forum Mentions

Community forums share real-world experiences and cautionary tales:

| Platform | Key Comments |

| Reddit threads | Users report experiencing slippage, system glitches, cancelled trades or “inactive” account fees wiping balances |

| Crypto/Forex forums | Some warn that older names like "LiteForex" may be impersonations of the current LiteFinance; caution advised on scams seeking upfront fees |

| PHinvest subreddit | Several traders from the Philippines report smooth deposits and withdrawals via GCash, though others prefer bigger platforms like XM |

Forum feedback highlights both practical positives and serious risk signals – especially around withdrawal complications and technical reliability.

★★★ | Minimum Deposit: $50 Regulated by: CySEC Crypto: Yes |

Employee and Insider Perspective

Internal reviews and partner feedback offer insight into working dynamics and partnership models:

| Role | Feedback |

| IB/affiliate partners | Many reviews highlight reliable affiliate commissions, transparent IB programs, and positive long-term cooperation |

| Employee-like testimonials | Some users working with or through LiteFinance for years praise trustworthiness, speed of service, and partner support |

| Lack of published internal data | There is minimal public info about management, corporate structure, or employee satisfaction outside partner reviews. Most “insider” content comes from affiliates rather than typical staff reviews. |

Those involved with the broker in affiliate or partner roles generally report favorable conditions, though direct employee reviews are sparse.

★★★ | Minimum Deposit: $50 Regulated by: CySEC Crypto: Yes |

Pros and Cons

| ✓ Pros | ✕ Cons |

| Competitive spreads | Reports of withdrawal delays or denials |

| High leverage options (up to 1:1000) | Platform glitched or freezing |

| Variety of account types | Regulatory transparency is limited |

| Responsive support for some users | Allegations of stop‑loss manipulation |

| Affiliate/IB program reportedly fair | Mixed experiences across regions |

References:

In Conclusion

LiteFinance operates a network of regional representative offices providing localized customer support across Asia and Africa, in addition to its registered entities in Mauritius, Saint Vincent & the Grenadines, and Cyprus.

Below is a list of the countries where LiteFinance has physical offices or formal support operations:

- 🇰🇭 Cambodia

- 🇪🇬 Egypt

- 🇬🇭 Ghana

- 🇮🇩 Indonesia

- 🇰🇬 Kyrgyzstan

- 🇲🇳 Mongolia

- 🇲🇦 Morocco

- 🇲🇲 Myanmar

- 🇳🇬 Nigeria

- 🇸🇬 Singapore

- 🇹🇯 Tajikistan

- 🇹🇿 Tanzania

- 🇹🇭 Thailand

- 🇺🇿 Uzbekistan

- 🇻🇳 Vietnam

Additionally, LiteFinance operates via registered entities in these jurisdictions:

- 🇲🇺 Mauritius

- 🇻🇨 Saint Vincent and the Grenadines

- 🇨🇾 Cyprus

In summary, LiteFinance provides direct in‑country operations and client support across a wide range of nations in Africa and Asia and maintains formal registered company offices in Mauritius, Saint Vincent & the Grenadines, and Cyprus.

Faq

LiteFinance is regulated by one Tier-2 regulator (CySEC in Cyprus) but lacks Tier-1 oversight

LiteFinance offers three account types: ECN, Classic, and Cent.

LiteFinance secures funds in segregated client accounts, separate from company capital. The platform also uses SSL encryption, two-factor authentication, and VPS servers for safer data transmission.

LiteFinance supports MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. Each platform offers real-time analytics, copy trading, customizable charts, and multilingual access.

Clients under CySEC (Cyprus) benefit from investor protection and negative balance insurance. However, those registered under Mauritius or Saint Vincent entities operate under lighter regulation.

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open a LiteFinance Account

- Trading Platforms and Tools

- Safety and Security

- Markets Available for Trade

- Deposits and Withdrawals

- Bonus Offers and Promotions

- Affiliate Programs

- Customer Support

- Insights from Real Traders

- Customer Reviews and Trust Scores

- Discussions and Forum Mentions

- Employee and Insider Perspective

- Pros and Cons

- In Conclusion