10 Best Ripple Trading Brokers

We have listed the 10 Best Ripple Trading Brokers for buying, selling, and investing in XRP with ease. These brokers offer tight spreads, strong regulatory protection, and advanced trading platforms, allowing both beginners and experienced traders to trade Ripple securely and efficiently.

10 Best Ripple Trading Brokers (2026)

- MultiBank Group – -Overall, The Best Ripple Trading Broker

- XTB – highly-Rated proprietary platform, xStation 5

- AvaTrade – Insurance-like coverage to volatile trades

- Octa – Cost-effective trading conditions

- eToro – Zero Commission Stock and ETF Trading

- HFM – Strong multi-regulatory compliance

- XM – Exceptionally fast trade execution

- FxPro – Robust regulatory oversight

- Pepperstone – Wide selection of popular third-party trading platforms

- FP Markets – Competitive and low spreads

Top 10 Forex Brokers (Globally)

1. MultiBank Group

MultiBank Group allows traders to buy, sell, and trade Ripple (XRP) through its advanced trading platforms such as MetaTrader 4 and MetaTrader 5. The broker offers tight spreads, high liquidity, and strong regulatory oversight, making it a reliable choice for Ripple traders seeking secure and efficient crypto trading conditions.

Frequently Asked Questions

Is MultiBank Group authorized to offer Ripple trading?

Yes, MultiBank Group offers Ripple (XRP) trading, primarily through Contracts for Difference (CFDs). Their subsidiary, MultiBank.io, also holds a Virtual Assets Service Provider (VASP) license from Dubai’s VARA, authorizing certain virtual asset activities.

What platforms does MultiBank Group offer for Ripple trading?

MultiBank Group offers Ripple (XRP) trading, primarily as CFDs, on the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, and its proprietary MultiBank-Plus platform. They also have their dedicated crypto exchange, MultiBank.io.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Authorized and regulated | Limited crypto selection beyond major coins |

| Competitive spreads for Ripple (XRP) trading | Inactivity fees may apply |

| Advanced trading platforms | Higher minimum deposits for some accounts |

| High liquidity and fast execution | Restricted access in certain countries |

| Strong customer support and educational tools | No direct crypto wallet services |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

MultiBank Group is an authorized and trusted broker for Ripple trading, offering competitive spreads, advanced platforms, and strong regulation. It provides secure, efficient, and beginner-friendly conditions for traders looking to trade XRP confidently.

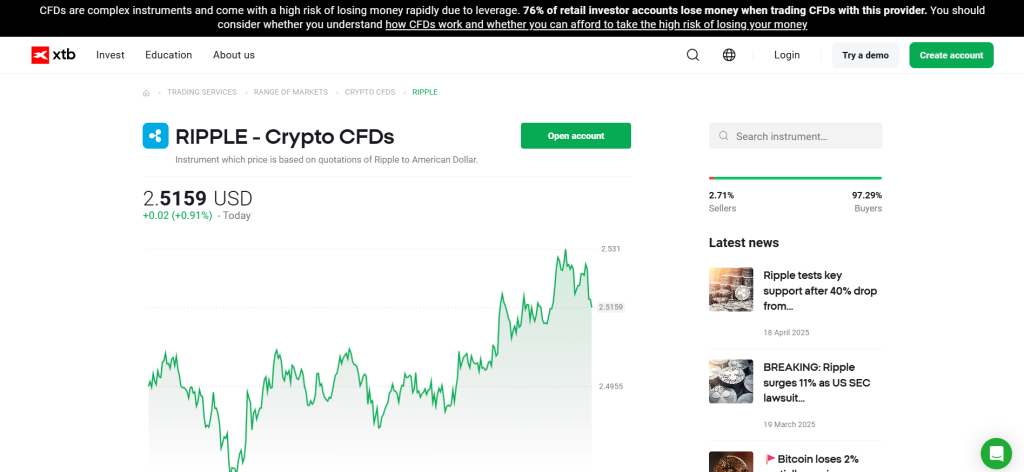

2. XTB

XTB is an authorized and regulated broker offering Ripple (XRP) trading through its powerful xStation platform. Traders can access competitive spreads, fast execution, and advanced analysis tools, making XTB a secure and efficient choice for Ripple trading.

Frequently Asked Questions

What platform does XTB use for Ripple trading?

XTB utilizes its proprietary, award-winning trading platform, xStation 5, for trading Ripple (XRP) in the form of Crypto CFDs. It is accessible via web and as a dedicated mobile application.

Can beginners trade Ripple on XTB?

Yes, beginners can trade Ripple CFDs on XTB. XTB is considered beginner-friendly, offering an intuitive platform, a free demo account, and educational resources, but remember that CFD trading, especially with volatile cryptocurrencies like Ripple, carries high risk.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legit and strongly regulated broker | Limited range of crypto assets |

| Competitive spreads for Ripple (XRP) | No MT4 or MT5 support |

| Intuitive and powerful xStation platform | Withdrawal fees may apply |

| Excellent educational and analytical tools | Crypto trading unavailable in some regions |

| Fast and reliable trade execution | No crypto wallet storage option |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐⭐ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

XTB is a legit and reliable broker for Ripple trading, offering competitive spreads, advanced tools, and a trusted platform. It’s ideal for traders seeking secure, efficient, and regulated access to XRP markets.

3. AvaTrade

AvaTrade is an authorized and regulated broker that offers Ripple (XRP) trading on multiple platforms, including AvaTradeGO and MetaTrader 4/5. Traders benefit from tight spreads, strong security, and reliable execution for safe and efficient Ripple trading.

Frequently Asked Questions

Is AvaTrade legal for Ripple trading?

Yes, AvaTrade is a regulated broker that offers Ripple (XRP) as a CFD for trading. Its legality depends on your specific jurisdiction and local crypto/CFD regulations. AvaTrade operates under several global regulatory licenses.

Which platforms does AvaTrade support for Ripple trading?

AvaTrade supports Ripple CFD trading on MetaTrader 4 (MT4), MetaTrader 5 (MT5), their proprietary WebTrader platform, and the dedicated AvaTrade Mobile App. Copy trading is also available through platforms like DupliTrade.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legal and regulated broker | Limited range of cryptocurrencies |

| Competitive spreads for Ripple | Withdrawal fees may apply |

| Multiple trading platforms | Inactivity fees on dormant accounts |

| Strong security and reliable execution | Restricted in certain countries |

| Beginner-friendly tools and educational resources | No direct crypto wallet services |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

AvaTrade is a legal and trustworthy broker for Ripple trading, offering competitive spreads, secure platforms, and reliable execution. It provides both beginners and experienced traders with safe and efficient access to XRP markets.

Top 3 Zero Spread Forex Brokers – MultiBank Group vs XTB vs AvaTrade

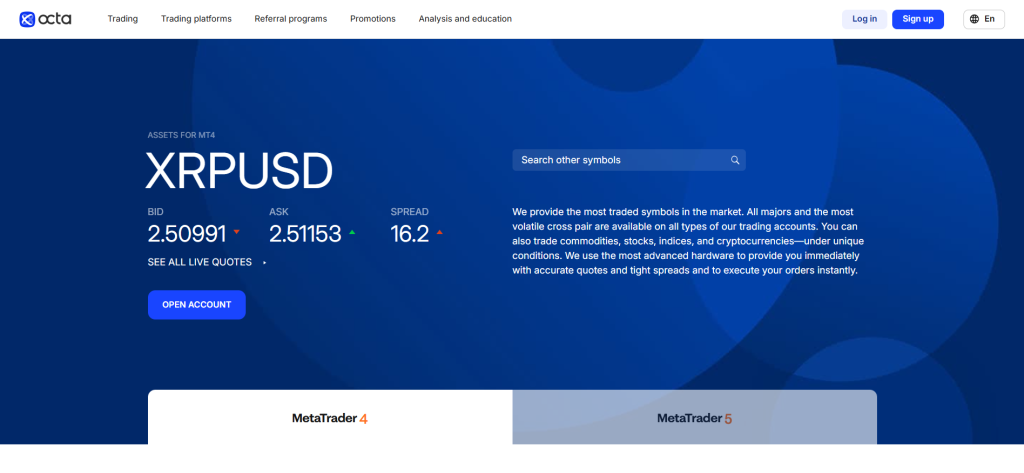

4. Octa

Octa is a regulated broker offering Ripple (XRP) trading on leading platforms like MetaTrader 4 and 5. Traders on Octa benefit from tight spreads, fast execution, and secure conditions for efficient cryptocurrency trading.

Frequently Asked Questions

Is Octa an approved broker for Ripple trading?

Octa, operating under multiple entities with varying regulation, does offer Ripple (XRP) CFD trading. However, regulatory approval can vary widely based on your specific country of residence and the Octa entity serving you.

Which platforms are available for Ripple trading on Octa?

Octa offers Ripple (XRP) trading on its proprietary OctaTrader platform, as well as the popular third-party platforms, MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

Pros and Cons

| ✓ Pros | ✕ Cons |

| Approved and regulated broker | Limited cryptocurrency options beyond Ripple |

| Competitive spreads for Ripple | Withdrawal fees may apply |

| MT4 and MT5 platform support | Inactivity fees on dormant accounts |

| Fast trade execution and high liquidity | Restricted access in some countries |

| Educational tools and demo accounts for beginners | No built-in crypto wallet services |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆☆ |

Our Insights

Octa is an approved broker for Ripple trading, offering secure platforms, competitive spreads, and reliable execution. It provides both beginners and experienced traders with safe and efficient access to XRP markets worldwide.

5. eToro

eToro is an approved and regulated broker that allows traders to buy, sell, and trade Ripple (XRP) on its user-friendly platform. It offers competitive spreads, secure trading, and social trading features for efficient XRP trading.

Frequently Asked Questions

Which platforms does eToro use for Ripple trading?

eToro utilizes its proprietary eToro investment platform (web and mobile app) for buying and selling Ripple (XRP). Additionally, users can transfer their purchased XRP to the eToro Money crypto wallet for secure storage and transfer.

Can beginners trade Ripple on eToro?

Yes, beginners can trade Ripple (XRP) on eToro. The platform is often cited as beginner-friendly, offering a simple interface and educational resources, like the eToro Academy, to help new crypto traders get started.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Registered and regulated broker | Limited selection of cryptocurrencies beyond major coins |

| Competitive spreads for Ripple | Withdrawal and conversion fees may apply |

| User-friendly web and mobile platforms | Inactivity fees on dormant accounts |

| Social and copy trading features | Restricted in some countries |

| Demo accounts and educational resources | No direct crypto wallet support |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐☆☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐☆☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆☆ |

Our Insights

eToro is a registered and reliable broker for Ripple trading, offering secure platforms, competitive spreads, and social trading features. It’s ideal for beginners and experienced traders seeking efficient and regulated XRP trading access.

6. HFM

HFM allows you to trade Ripple (XRP) using cryptocurrency CFDs, featuring leverage and competitive spreads. You can use advanced platforms like MetaTrader 4/5 for efficient and regulated XRP trading.

Frequently Asked Questions

Is HFM an authorized broker for Ripple trading?

HFM, as part of the HF Markets Group, is a regulated broker under multiple authorities (like CySEC and FSCA). They are authorized to offer Ripple (XRP) trading via Cryptocurrency CFDs.

Can beginners trade Ripple on HFM?

Yes, beginners can trade Ripple CFDs on HFM. The broker offers a free Demo Account and educational resources. They also provide Cent Accounts for starting with minimal risk, making it beginner-friendly.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Authorized and regulated broker | Limited cryptocurrency options beyond Ripple |

| Competitive spreads for Ripple | Withdrawal fees may apply |

| MT4 and MT5 platform support | Inactivity fees on dormant accounts |

| Fast execution and high liquidity | Restricted access in some countries |

| Educational resources and demo accounts available | No direct crypto wallet service |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

HFM is an authorized and regulated broker for Ripple (XRP) trading. They provide secure platforms, competitive spreads, and reliable execution, ensuring safe and efficient access to XRP markets for all traders, from beginners to experts.

7. XM

XM provides Ripple (XRP) trading through cryptocurrency CFDs on MetaTrader 4/5. Traders get access to the XRPUSD pair with up to 1:250 leverage and do not need a crypto wallet.

Frequently Asked Questions

Is XM a legit broker for Ripple trading?

Yes, XM is considered a legit, multi-regulated broker offering Ripple (XRP) via CFDs. They are globally recognized, regulated by multiple authorities, and provide client fund protection.

Which platforms does XM support for Ripple trading?

XM supports Ripple (XRP) CFD trading across its suite of platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and the proprietary XM App. This gives traders desktop, web, and mobile access.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legit and regulated broker | Limited cryptocurrency options beyond Ripple |

| Competitive spreads for Ripple (XRP) | Withdrawal fees may apply |

| Supports MT4 and MT5 platforms | Inactivity fees on dormant accounts |

| High execution speed and liquidity | Restricted in some countries |

| Demo accounts and educational tools for beginners | No direct crypto wallet services |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐⭐ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

XM is a legit broker for Ripple trading, offering secure platforms, competitive spreads, and reliable execution. It provides both beginners and experienced traders safe, efficient, and regulated access to XRP markets worldwide.

8. FxPro

FxPro is a regulated broker that offers Ripple (XRP) trading as a CFD, alongside other cryptocurrencies. Traders can buy or sell XRP on their choice of platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), or cTrader.

Frequently Asked Questions

Is FxPro a legal broker for Ripple trading?

Yes, FxPro is a legal and highly regulated broker offering Ripple (XRP) as a CFD. It is overseen by multiple top-tier financial authorities globally, including the FCA, CySEC, and SCB, ensuring client protection.

Which platforms does FxPro support for Ripple trading?

FxPro supports Ripple (XRP) CFD trading across its platform range, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. These are available on desktop, web, and mobile devices.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legal and regulated broker | Limited cryptocurrency options beyond Ripple |

| Competitive spreads for Ripple (XRP) | Withdrawal fees may apply |

| Multiple platform support (MT4, MT5, cTrader) | Inactivity fees on dormant accounts |

| Fast execution and high liquidity | Restricted in some countries |

| Educational tools and demo accounts available | No direct crypto wallet service |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

FxPro is a trusted, regulated broker that offers efficient and secure access to Ripple (XRP) trading. It features competitive spreads and reliable execution on its platforms, serving both beginner and experienced traders in the XRP CFD market.

9. Pepperstone

Pepperstone facilitates trading of the Ripple (XRP)/USD pair as a CFD. Traders benefit from the broker’s top-tier regulation, competitive spreads, and advanced tools available across its MT4, MT5, and cTrader platforms.

Frequently Asked Questions

Which platforms does Pepperstone support for Ripple trading?

Pepperstone supports Ripple (XRP) CFD trading on several platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, TradingView, and their proprietary Pepperstone platform and mobile app.

Can beginners trade Ripple on Pepperstone?

Yes, beginners can trade Ripple (XRP) CFDs on Pepperstone. The broker offers a demo account for risk-free practice and a variety of educational resources and guides specifically focused on cryptocurrency CFD trading.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Approved and regulated broker | Limited cryptocurrency options beyond Ripple |

| Competitive spreads for Ripple | Withdrawal fees may apply |

| Supports MT4, MT5, and cTrader platforms | Inactivity fees on dormant accounts |

| Fast execution and high liquidity | Restricted in certain countries |

| Educational resources and demo accounts available | No built-in crypto wallet services |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐☆☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆☆ |

Our Insights

Pepperstone is a trusted, regulated broker providing secure and efficient access to Ripple (XRP) CFD trading worldwide. It offers competitive spreads and reliable execution across its platforms, catering to the needs of both beginner and experienced traders.

10. FP Markets

FP Markets enables Ripple (XRP) trading through crypto CFDs on the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. The broker offers XRP traders tight spreads, fast execution, and a broad asset portfolio.

Frequently Asked Questions

Is FP Markets a registered broker for Ripple trading?

Yes, FP Markets is a globally regulated broker that offers Ripple (XRP) via CFDs. The group is regulated by entities like ASIC (Australia), CySEC (Europe), and the FSCA (South Africa).

Can beginners trade Ripple on FP Markets?

Yes, beginners can trade Ripple (XRP) CFDs on FP Markets. They offer a demo account for practice and provide educational resources like trading guides to help new traders understand the volatile cryptocurrency market and the use of leverage.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Registered and regulated broker | Limited cryptocurrency options beyond Ripple |

| Competitive spreads for Ripple (XRP) | Withdrawal fees may apply |

| Supports MT4 and MT5 platforms | Inactivity fees on dormant accounts |

| Fast execution and high liquidity | Restricted in some countries |

| Educational resources and demo accounts available | No direct crypto wallet service |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms, and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐⭐ |

Our Insights

FP Markets, a regulated broker, offers safe and efficient access to global Ripple (XRP) CFD trading. With secure platforms, competitive spreads, and reliable execution, it is an ideal choice for both novice and seasoned traders.

What is a Ripple Trading Forex Broker?

A Ripple Trading Forex Broker is a financial services company that allows traders to buy, sell, or speculate on Ripple (XRP), usually through Contracts for Difference (CFDs) or other derivative products. Unlike cryptocurrency exchanges, these brokers typically do not require you to hold the actual XRP coins.

Key features of a Ripple Trading Forex Broker include:

-

Trading Platforms – Access to platforms like MetaTrader 4, MetaTrader 5, or proprietary platforms for charting, analysis, and execution.

-

Leverage and Margin – Some brokers offer leverage, allowing traders to control larger positions with smaller capital, though this increases risk.

-

Regulation & Safety – Authorized and regulated brokers operate under financial authorities to ensure secure and fair trading conditions.

-

Spreads and Fees – Brokers charge a spread or commission for each trade; tight spreads are ideal for cost-efficient trading.

-

Educational Tools & Support – Many brokers provide demo accounts, tutorials, and customer support, which are helpful for beginners.

Essentially, a Ripple Trading Forex Broker enables traders, both beginners and experienced, to speculate on XRP price movements without directly owning the cryptocurrency, providing a safer and regulated environment compared to unregulated crypto exchanges.

Criteria for Choosing a Ripple Trading Broker

| Criteria | Description | Importance |

| Regulation & Authorization | Ensure the broker is authorized and regulated by recognized financial authorities to protect your funds and trading activity. | ⭐⭐⭐⭐⭐ |

| Trading Platforms | Check if the broker offers reliable platforms like MT4, MT5, or proprietary platforms for smooth execution and analysis. | ⭐⭐⭐⭐☆ |

| Spreads & Fees | Look for competitive spreads and low commissions to reduce trading costs, especially for frequent trades. | ⭐⭐⭐⭐⭐ |

| Leverage & Margin | Assess the leverage options; higher leverage can increase profits but also risks. | ⭐⭐⭐⭐☆ |

| Liquidity & Execution | Fast order execution and high liquidity are crucial for avoiding slippage during volatile Ripple price movements. | ⭐⭐⭐⭐☆ |

| Crypto Asset Selection | Availability of Ripple (XRP) and other cryptocurrencies for portfolio diversification. | ⭐⭐⭐☆☆ |

| Customer Support | Responsive support can help resolve issues quickly and provide guidance, especially for beginners. | ⭐⭐⭐⭐☆ |

| Educational Resources | Access to tutorials, webinars, and demo accounts helps beginners learn trading strategies and risk management. | ⭐⭐⭐⭐☆ |

| Deposit & Withdrawal Options | Convenient and secure methods for funding and withdrawing accounts, including fiat and crypto options. | ⭐⭐⭐⭐☆ |

| Security Measures | Strong encryption, two-factor authentication, and fund protection ensure safe trading conditions. | ⭐⭐⭐⭐⭐ |

Top 10 Best Ripple Trading Brokers – A Direct Comparison

What Real Traders Want to Know!

Explore the Top Questions asked by real traders across the Globe. From leverage to fees and spreads, we provide straightforward answers to help you understand ripple trading and choose the right broker confidently.

Q: Can I trade Ripple (XRP) with leverage on most forex brokers? – David T.

A: Yes, you can trade Ripple (XRP) with leverage on many forex brokers through CFDs (Contracts for Difference). However, the maximum leverage for retail crypto traders is often low, typically around 2:1, due to regulatory restrictions.

Q: Are Ripple trading brokers well regulated? – Ana B.

A: The best Ripple (XRP) brokers are typically well-regulated by major financial bodies (like the FCA, ASIC, or CySEC) because they often offer XRP as a Contract for Difference (CFD), which is a regulated financial product.

Q: What are the typical spreads and fees when trading Ripple? – Mohan A.

A: Ripple’s costs vary. Spreads on XRP/USD CFDs can be $0.002 to $0.008 on raw accounts, or 1% over-market price on others. Additional fees often include overnight/swap charges for holding positions.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Good liquidity | High volatility & risk of large losses |

| Opportunity for speculation | Regulatory / legal uncertainty |

| Access via CFDs or derivatives | Custody / ownership issues |

| Global access, 24/7 market | Costs and spreads can vary widely |

| Potential cost efficiency | Market‑specific risks for XRP |

You Might also Like:

- MultiBank Group Review

- XTB Review

- AvaTrade Review

- Octa Review

- eToro Review

- HFM Review

- XM Review

- FxPro Review

- Pepperstone Review

- FP Markets Review

In Conclusion

Ripple (XRP) trading brokers offer good liquidity, 24/7 market access, and speculative opportunities, but come with high volatility, regulatory uncertainty, and counterparty risks. Careful broker selection and risk management are essential for safe trading.

Faq

Yes, many crypto exchanges and brokers offering XRP as a Contract for Difference (CFD) allow 24/7 trading. Since the underlying crypto market never truly closes, a good number of platforms facilitate continuous trading, even on weekends.

No, you do not need to own the actual XRP coin to trade it with most brokers. You can trade it using Contracts for Difference (CFDs), which allow you to speculate on the price movement without taking ownership of the underlying cryptocurrency.

Ripple brokers typically charge spreads (the difference between the buy and sell price) or a commission on the trade. Additionally, some charge overnight funding fees for holding leveraged CFD positions.

Safety varies. Regulated brokers with proper security and transparent policies are safer, but unregulated brokers carry higher counterparty risks.

CFD trading lets you speculate on XRP price changes without owning the asset, using leverage and allowing short selling. Owning XRP means direct possession, with benefits like holding, transferring, or using it, but without leverage or shorting.

Yes, many brokers provide educational resources for XRP trading. These include tutorials, webinars, online courses, and practical workshops designed to help traders understand Ripple markets, trading strategies, and risk management techniques.

Risks of trading XRP with brokers include high price volatility causing sudden losses, regulatory uncertainty affecting price and trading conditions, leverage amplifying both profits and losses, and potential broker-related risks like unfair pricing if not properly regulated. Proper risk management is essential.

The best Ripple (XRP) brokers in 2025 are often chosen based on regulation, trading conditions, spreads, and user reviews. Top brokers include MultiBank Group, XTB and Avatrade offering competitive spreads, regulated environments, and various trading platforms tailored for Ripple trading.

Yes, you can trade XRP on mobile devices. Many brokers and apps offer fully functional mobile trading platforms and wallets, like Best Wallet and XRP Wallet, supporting buying, selling, real-time tracking, and secure transactions on iOS and Android.