10 Best Cashback Forex Rebates

We have listed the 10 Best Cashback Forex Rebates that reward traders for every trade they make. These rebate programs offer excellent cashback rates, trustworthy broker partnerships, and transparent payment systems, ensuring that both beginner and professional traders can maximize their profits while reducing overall trading costs.

10 Best Cashback Forex Rebates (2026)

- MultiBank Group – Overall, The Best Cashback Forex Rebates

- Exness – Variety of account types, and robust regulation

- AvaTrade – Strong regulation across multiple authorities

- HFM – Competitive trading conditions

- Tickmill – Tight spreads, with some accounts starting at 0.0 pips

- RoboForex – CopyFX system for social trading

- IC Markets – Platforms, such as MT 4, MT 5, and cTrader

- OANDA – User-friendly trading platforms with advanced charting

- Pepperstone – Fast and reliable execution with tight spreads

- FP Markets – Competitive pricing with Raw ECN accounts

Top 10 Forex Brokers (Globally)

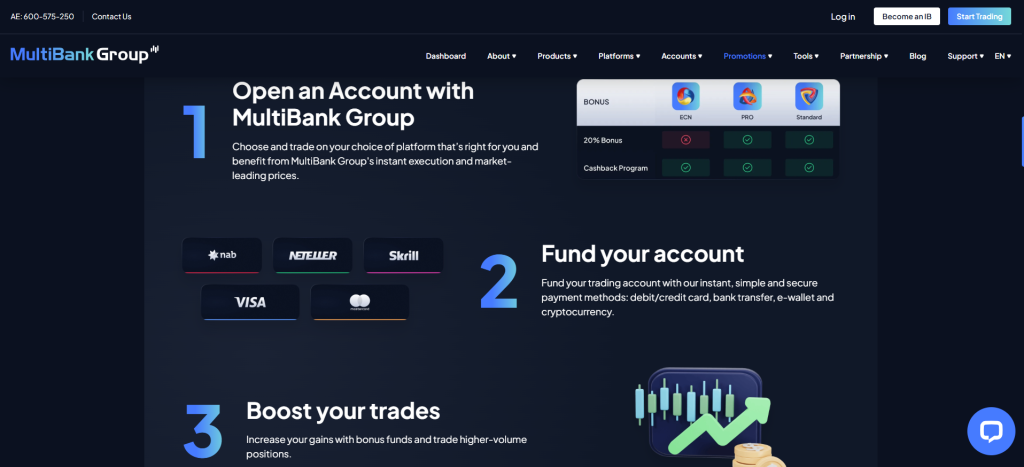

1. MultiBank Group

MultiBank Group offers attractive cashback rebates that allow traders to earn money back on each trade. With competitive rebate rates, tight spreads, and strong regulation, traders can reduce overall trading costs while benefiting from fast execution and secure trading conditions.

Frequently Asked Questions

What are MultiBank Group cashback rebates?

MultiBank Group’s cashback rebates are a reward program for traders. They offer a refund, typically a percentage of the spread or a dollar amount per lot traded in Forex and Metals, based on a tiered trading volume system.

Is MultiBank Group authorized and regulated?

Yes, MultiBank Group is authorized and heavily regulated globally. Its various entities hold licenses from over 17 financial authorities across five continents, including top-tier regulators like ASIC, CySEC, BaFin, and MAS.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Authorized and strongly regulated | Cashback rates vary by account type |

| Competitive cashback rebate structure | Limited availability in some regions |

| Tight spreads and fast trade execution | Minimum trading volume may apply |

| Multiple trading platforms available | Some withdrawal restrictions for small rebates |

| Excellent customer support and transparency | Not all promotions are available to all users |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

MultiBank Group is an authorized and trusted broker offering competitive cashback rebates. With strong regulation, transparent trading conditions, and rebate rewards, traders can effectively lower trading costs while enjoying a secure and efficient trading experience.

2. Exness

Exness offers cashback rebates that reward traders for every completed trade. As an authorized and regulated broker, Exness provides competitive rebate rates, tight spreads, and transparent trading conditions, helping traders reduce costs and increase overall profitability.

Frequently Asked Questions

Is Exness a legit forex broker?

Yes, Exness is considered a legit and well-established broker. It operates through multiple entities regulated by various international bodies, including the FCA (UK), CySEC (Cyprus), and FSCA (South Africa), providing a secure trading environment.

How do traders receive Exness cashback rebates?

Exness rebates, often received through a third-party rebate provider, are typically credited to your trading account and can then be withdrawn using the available payment options in your Personal Area.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legit and highly regulated | Cashback rates differ by account type. |

| Competitive cashback rebate programs | Limited promotional offers for some regions |

| Low spreads and fast trade execution | Minimum trading volume may apply |

| Multiple account types | Rebates may not cover all instruments |

| Transparent pricing and excellent customer support | Withdrawal terms vary by rebate provider |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐☆☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Exness is a legit forex broker offering competitive cashback rebates that help traders save on trading costs. With strong regulation, transparent pricing, and fast execution, Exness remains a trusted choice for global traders.

3. AvaTrade

AvaTrade is a legit and regulated broker offering cashback rebates that return a portion of your trading costs on every trade. They provide competitive rebates coupled with transparent pricing and secure conditions for global traders.

Frequently Asked Questions

Is AvaTrade a legal forex broker?

Yes, AvaTrade is a legal and heavily regulated global forex broker. It holds licenses from multiple top-tier financial authorities across six continents, ensuring compliance and the safety of client funds.

What are AvaTrade cashback rebates?

AvaTrade cashback rebates return a portion of the trading costs, like spreads, to the trader on every completed trade. These competitive rebates effectively lower the cost of trading for global clients.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legal and fully regulated broker | Cashback varies by account type |

| Competitive cashback rebate programs | Limited promotions in some regions |

| Transparent pricing and low spreads | Minimum trade volume required for rebates |

| Wide range of trading platforms | Certain instruments excluded from rebates |

| Reliable customer service and support | Withdrawal conditions may apply |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

AvaTrade is a legal and trusted broker offering competitive cashback rebates that help traders cut costs and enhance profits. With global regulation, fair pricing, and reliable support, AvaTrade delivers a secure trading experience.

Top 3 Cashback Forex Rebates – MultiBank Group vs Exness vs AvaTrade

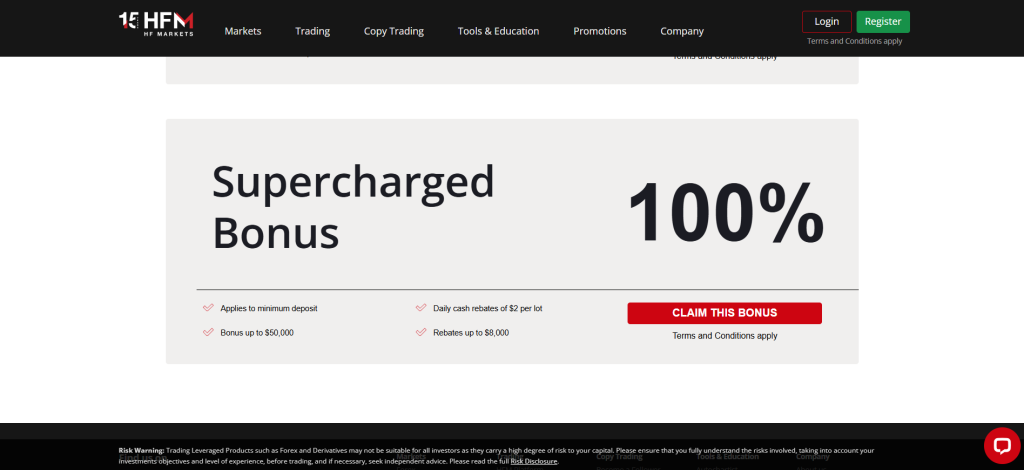

4. HFM

HFM offers cashback rebates that reward traders with money back on every trade. As a legal and fully regulated broker, HFM provides competitive rebate rates, transparent trading conditions, and reliable payout options to help traders reduce overall costs.

Frequently Asked Questions

Is HFM an approved forex broker?

Yes, HFM is a globally regulated forex broker. Its entities hold licenses from multiple authorities, including the FCA (UK), CySEC (Cyprus), DFSA, FSCA (South Africa), and CMA, confirming its approved status across various jurisdictions.

How can traders claim HFM cashback rebates?

HFM’s Loyalty Program automatically awards HFM Bars for trading activity on eligible accounts. You can then redeem these Bars for cash or trading services directly in your myHF area. This video provides a guide on how to claim an HFM bonus.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Approved and strongly regulated | Cashback varies by account type |

| Competitive cashback rebate programs | Minimum trading volume may apply |

| Tight spreads and fast execution | Some regions have limited rebate offers |

| Wide range of trading instruments | Rebates not available on all assets |

| Reliable rebate payout options | Withdrawal conditions may differ by partner |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

HFM is an approved and trusted broker offering competitive cashback rebates. With strong regulation, transparent trading conditions, and reliable payouts, HFM helps traders reduce costs while enjoying a secure and rewarding trading experience.

5. Tickmill

Tickmill provides cashback rebates that return a portion of trading expenses to traders on every completed transaction. As a licensed and regulated broker, Tickmill delivers competitive rebate rates, transparent pricing, and secure trading environments, all designed to help traders enhance their profitability.

Frequently Asked Questions

What are Tickmill cashback rebates?

Tickmill cashback rebates return a portion of the spread or commission on your trades, effectively reducing your trading costs. They are typically paid monthly and the amount often depends on your trading volume and account type, offering cash rewards for loyalty.

How can traders receive Tickmill cashback rebates?

Traders receive them by opening a “Rebate Promotion” account with a minimum deposit and meeting specified monthly trading volume thresholds on eligible instruments like FX and Gold/Silver CFDs. The cash rebates are then credited directly to their account monthly.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Registered and well regulated | Rebate amounts vary by account type |

| Competitive cashback rebate rates | Minimum trade volume may apply |

| Tight spreads and low trading costs | Some regions may have limited rebate offers |

| Multiple account types for flexibility | Rebates not valid for all instruments |

| Transparent rebate tracking and fast payments | Certain withdrawal restrictions may apply |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms, and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Options | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Tickmill is a registered and reputable broker offering competitive cashback rebates. With strong regulation, transparent pricing, and reliable payments, Tickmill helps traders reduce trading costs while maintaining a secure and efficient trading experience.

6. RoboForex

RoboForex offers cashback rebates that return a portion of trading costs to traders for every executed trade. As a registered and regulated broker, RoboForex provides competitive rebate rates, fast payouts, and transparent trading conditions to enhance trader profitability.

Frequently Asked Questions

What are RoboForex cashback rebates?

RoboForex cashback rebates are extra monthly payments for verified clients based on their trading volume in currency pairs and metals. They offer additional profit with no usage restrictions, increasing with a higher monthly trading volume.

Is RoboForex an authorized broker?

Yes, RoboForex Ltd is authorized and regulated by the Financial Services Commission (FSC) of Belize with license 000138/32. It is also a member of The Financial Commission, offering client protection up to €20,000 per case.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Authorized and well regulated | Cashback rates vary by account type |

| Competitive cashback rebate structure | Minimum trade volume may apply |

| Fast and automatic rebate payouts | Limited promotions for some regions |

| Multiple account types and platforms | Rebates not available for all instruments |

| Transparent rebate tracking system | Withdrawal terms may differ by partner |

Final Score

| # | Criteria | Score |

| 1. | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2. | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3. | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4. | Research and Education | ⭐⭐⭐☆☆ |

| 5. | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6. | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7. | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8. | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9. | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10. | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

RoboForex is an authorized, trusted broker that offers appealing cashback rebates. Its strong regulation, fast payouts, and transparent conditions let traders efficiently lower costs and boost overall profitability.

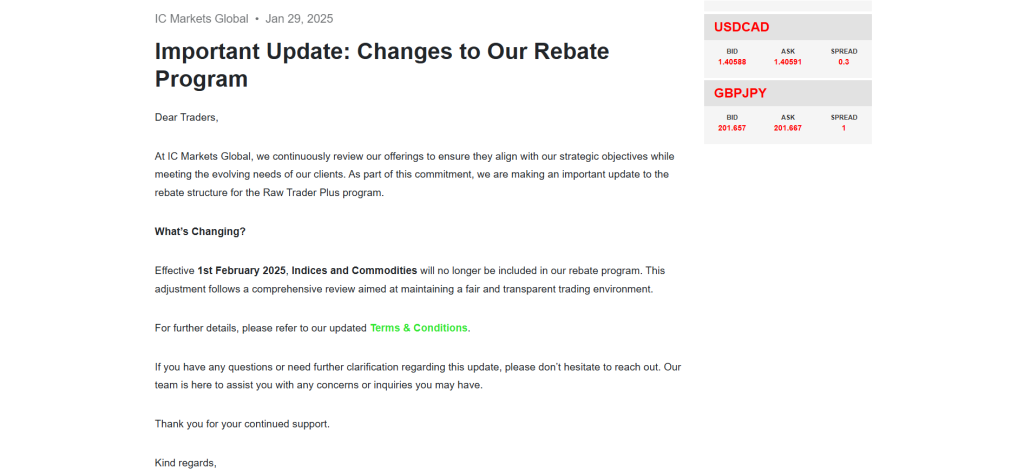

7. IC Markets

IC Markets provides cashback rebates that return a portion of your trading costs on every trade. As an authorized, regulated broker, they offer competitive rebate rates, tight spreads, and transparent conditions to help you maximize profitability.

Frequently Asked Questions

Is IC Markets a legit forex broker?

Yes, IC Markets is widely considered a legitimate forex broker. It is regulated by several financial bodies, including the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC).

How can traders claim IC Markets cashback rebates?

Traders must typically enroll in the Raw Trader Plus program by contacting IC Markets’ client relations team. Once eligible and meeting the minimum trading volume, the cashback rebates are then automatically refunded daily to the trading account.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legit and highly regulated | Cashback varies by account type |

| Competitive cashback rebate programs | Minimum trading volume may apply |

| Low spreads and fast execution speeds | Limited rebate offers in some regions |

| Multiple trading platforms | Rebates not available for all instruments |

| Transparent rebate tracking and payments | Withdrawal conditions depend on the rebate partner |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

IC Markets is a legit and trusted broker offering competitive cashback rebates. With low spreads, fast execution, and reliable payouts, IC Markets helps traders reduce trading costs while enjoying a secure trading experience.

8. OANDA

OANDA offers cashback rebates that reward traders with a portion of their trading costs back on each trade. As a legit and regulated broker, OANDA provides transparent pricing, competitive rebate options, and secure trading conditions for global traders.

Frequently Asked Questions

What are OANDA cashback rebates?

OANDA cashback rebates are a portion of the spread or commission returned to high-volume traders through their Elite Trader program. Traders can earn a cash rebate per million traded, effectively reducing their overall trading costs.

How can traders receive OANDA cashback rebates?

Traders must qualify for the Elite Trader program by meeting a minimum monthly trading volume (e.g., $10M USD). The earned cash rebate is then credited directly to their OANDA trading account, typically within the following month.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legal and well-regulated | Cashback rates differ by account type |

| Competitive cashback rebate programs | Minimum trade volume may apply |

| Transparent pricing with low spreads | Some regions may have limited rebate offers |

| Multiple account types for flexibility | Rebates may not apply to all instruments |

| Reliable rebate payouts and tracking | Withdrawal terms vary depending on rebate partner |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐☆☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

OANDA is a legal and trusted broker offering cashback rebates that help traders reduce costs. With transparent pricing, reliable payouts, and secure trading conditions, OANDA ensures an efficient and profitable trading experience.

9. Pepperstone

Pepperstone offers cashback rebates that return a portion of trading costs to traders on every trade. As a legal and regulated broker, Pepperstone provides competitive rebate rates, tight spreads, and transparent trading conditions to help traders maximize profits.

Frequently Asked Questions

Is Pepperstone an approved forex broker?

Yes, Pepperstone is a highly approved broker. It is multi-regulated by major financial authorities globally, including the ASIC (Australia), FCA (UK), CySEC (Cyprus), and BaFin (Germany), making it a safe and trustworthy option.

How can traders receive Pepperstone cashback rebates?

Traders can join the Active Trader Program by meeting monthly trading volume requirements. The cashback rebates are then refunded daily, directly into the trading account the day after a position is closed.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Approved and well regulated | Cashback rates vary by account type |

| Competitive cashback rebate programs | Minimum trading volume may be required |

| Tight spreads and fast execution | Some regions have limited rebate offers |

| Multiple account types and platforms | Rebates may not apply to all instruments |

| Transparent rebate tracking and reliable payouts | Withdrawal terms depend on rebate partner |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐☆☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆☆ |

Our Insights

Pepperstone is an approved, trusted broker, highly regulated with tight spreads and transparent conditions. It offers competitive cashback rebates through its Active Trader Program, helping clients reduce costs while ensuring a secure and efficient trading experience.

10. FP Markets

FP Markets offers cashback rebates that give traders a portion of their trading costs back on every trade. As a legal and regulated broker, FP Markets provides competitive rebate rates, tight spreads, and transparent trading conditions to help traders boost profitability.

Frequently Asked Questions

What are FP Markets cashback rebates?

FP Markets cashback rebates are a portion of the spread or commission returned to a trader’s account for each trade, typically offered through an Introducing Broker (IB) or similar program, rewarding trading volume to effectively reduce costs.

Is FP Markets a registered forex broker?

Yes, FP Markets is a multi-regulated forex and CFD broker. It is licensed by several authorities globally, including the ASIC (Australia), CySEC (Cyprus), and the FSCA (South Africa).

Pros and Cons

| ✓ Pros | ✕ Cons |

| Registered and well regulated | Cashback rates vary by account type |

| Competitive cashback rebate programs | Minimum trading volume may apply |

| Tight spreads and fast trade execution | Some regions may have limited rebate offers |

| Multiple account types and trading platforms | Rebates may not apply to all instruments |

| Transparent rebate tracking and reliable payouts | Withdrawal terms differ by rebate partner |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms, and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐⭐ |

Our Insights

FP Markets is a registered and trusted broker offering competitive cashback rebates. With strong regulation, transparent pricing, and reliable rebate payouts, FP Markets helps traders reduce costs while enjoying a secure and efficient trading experience.

What are Cashback Forex Rebates?

Cashback Forex Rebates are rewards that return a portion of your trading costs back to you. Every time you open and close a trade, a small percentage of the spread or commission you pay is credited to your account.

Key points:

-

Reduce Trading Costs: They effectively lower the cost of trading, increasing your net profits.

-

Automatic or Manual: Rebates are usually tracked automatically through authorized rebate partners or brokers.

-

Eligibility: Available for most account types, though rates may vary depending on the broker and trading volume.

-

Compatible with Regular Trading: Rebates do not interfere with your trading; they’re added on top of your regular profits.

Cashback forex rebates are a way for traders to earn back money spent on spreads or commissions, making trading more cost-efficient.

Criteria for Choosing Cashback Forex Rebates

| Criteria | Description | Importance |

| Regulation & Authorization | Ensure the broker is regulated and authorized by a reputable financial authority to guarantee safety and transparency of your funds. | ⭐⭐⭐⭐⭐ |

| Rebate Rate | The percentage of the trading cost returned to you per trade. Higher rates mean better cost savings. | ⭐⭐⭐⭐⭐ |

| Rebate Eligibility | Check which account types, instruments, and trading volumes qualify for cashback. Some brokers restrict rebates to certain accounts. | ⭐⭐⭐⭐☆ |

| Payment Frequency | How often rebates are credited (instant, weekly, monthly). Faster payments improve cash flow for active traders. | ⭐⭐⭐⭐☆ |

| Trading Platforms | Ensure the broker supports your preferred platform (MT4, MT5, cTrader) and allows rebates to be tracked automatically. | ⭐⭐⭐⭐☆ |

| Transparency & Tracking | Look for brokers that provide clear, easy-to track rebate reports to ensure accuracy and trustworthiness. | ⭐⭐⭐⭐⭐ |

| Withdrawal Terms | Check whether rebates can be withdrawn freely or have restrictions. Flexible withdrawal terms are essential for liquidity. | ⭐⭐⭐⭐☆ |

| Broker Reputation | Consider user reviews and industry reputation to ensure the broker reliably honors cashback rebates. | ⭐⭐⭐⭐⭐ |

Top 10 Best Cashback Forex Rebates – A Direct Comparison

What Real Traders Want to Know!

Explore the Top Questions asked by real traders across the Globe. From reliability to profitability, we provide straightforward answers to help you understand cashback forex rebates and choose the right broker confidently.

Q: How do cashback rebates work with my existing forex broker? – Michael T.

A: You generally contact a rebate provider and ask them to link your existing broker account to their system. The broker then pays the provider a portion of your spreads/commissions, which is then passed back to you.

Q: Are forex cashback rebates reliable and paid on time? – Sarah K.

A: The reliability and timing depend heavily on the specific rebate provider or broker program. Reputable services are generally reliable and process payments, typically monthly, as per their published terms and conditions.

Q: Can cashback rebates increase my overall profitability? – David L.

A: Yes, absolutely. Cashback rebates effectively reduce your trading costs, like spreads or commissions, on every trade. This lower cost per transaction directly translates to an increase in your net overall profitability.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Reduced Trading Costs | Varying Rebate Rates |

| Guaranteed Benefit | Partner Dependence |

| Automatic Rewards | Minimum Volume Requirements |

| Boosts Profit Margins | Limited Availability |

| Works with Regular Trading | Potentially Smaller Discounts |

You Might also Like:

- MultiBank Group Review

- Exness Review

- AvaTrade Review

- HFM Review

- Tickmill Review

- RoboForex Review

- IC Markets Review

- OANDA Review

- Pepperstone Review

- FP Markets Review

In Conclusion

Cashback Forex Rebates allow traders to earn back a portion of their trading costs, helping reduce expenses and boost profits. They’re an easy, automatic way to improve overall trading efficiency without changing strategies.

Faq

Cashback rebates refund a portion of the spread or commission you pay on each trade. A third-party provider or the broker returns this cash to your account, lowering your effective trading cost.

Often, no. Many brokers or rebate providers offer cashback on standard accounts, but some may have special “Active Trader” or “VIP” accounts with higher rebate tiers or different eligibility criteria. Always check the specific program’s terms.

Yes, typically you can. Rebates are a return of a portion of the trading cost (spread or commission) per lot traded, regardless of whether that trade closes in profit or loss. This helps to reduce your net trading cost.

The legality of Forex cashback rebates varies by jurisdiction. They are permitted and common in many regions, but some regulators (like those in the UK, EU, and Australia) have restrictions or bans on them as a promotional tool.

Earnings depend entirely on your trading volume, the specific rebate rate offered by your broker (e.g., $3 per lot or 0.5 pips), and the instruments you trade. High-volume traders typically earn hundreds or even thousands monthly.

Rebates, particularly in Forex, are paid with varying frequency. Many brokers or Introducing Brokers pay them monthly, typically early in the following calendar month. However, some providers offer rebates daily or credit them to your account after each trade is closed.

Cashback rebates do not directly change the broker’s spreads or commissions. Instead, they are a separate payment that refunds a portion of the spread or commission after your trade, effectively reducing your net trading cost.

Yes, many brokers require a minimum trading volume, often in the millions of dollars (notional value) or a certain number of standard lots per month, to qualify for rebates or ‘Active Trader’ benefits.

No, not all brokers offer cashback rebates. These are typically loyalty programs or “Active Trader” schemes offered by select brokers to reward high-volume traders, often with minimum monthly volume requirements to qualify.

Yes, generally you can withdraw your cashback rebates. Most brokers treat them as real cash credited to your account, allowing you to either withdraw the funds or use them for further trading. Always check the specific broker’s program terms for any withdrawal conditions.