10 Best Forex Brokers by Spreads

We have listed the 10 Best Forex Brokers by Spreads, offering traders the lowest and most competitive pricing across major, minor, and exotic currency pairs. These brokers provide tight spreads, trusted regulation, and advanced trading platforms, ensuring both beginners and professionals can execute cost-effective and precise forex trades with confidence.

10 Best Forex Brokers by Spreads (2026)

- MultiBank Group – Overall, The Best Forex Brokers by Spreads

- IC Markets – Raw spreads from 0.0 pips

- Pepperstone – Fast execution and low-cost trading

- GO Markets – Multiple trading platforms

- Exness – Ultra-low spreads and high leverage

- Axi – Popular proprietary trading program (Axi Select)

- BlackBull Markets – Access to tools like TradingView and ZuluTrade

- fxPro – Wide selection of instruments, competitive spreads

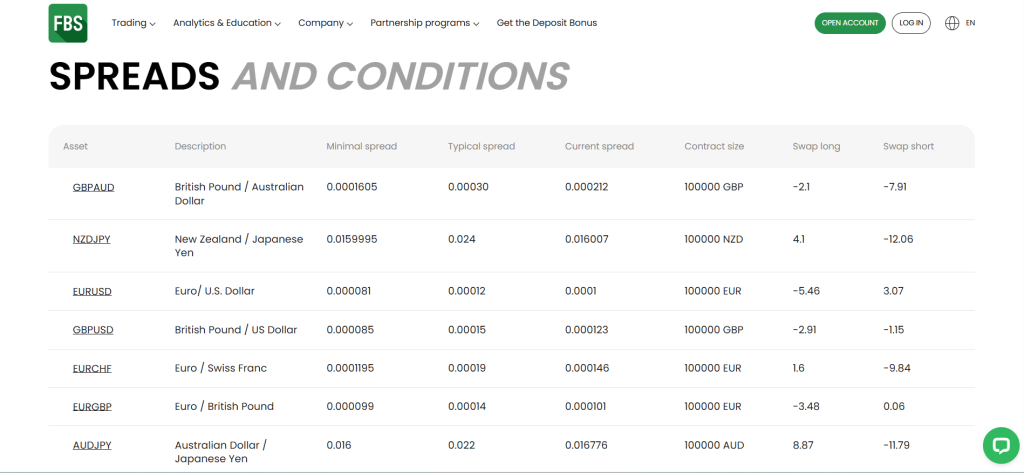

- FBS – Low minimum deposit of just $5

- Tickmill – Competitive trading conditions with spreads from 0.0 pips

Top 10 Forex Brokers (Globally)

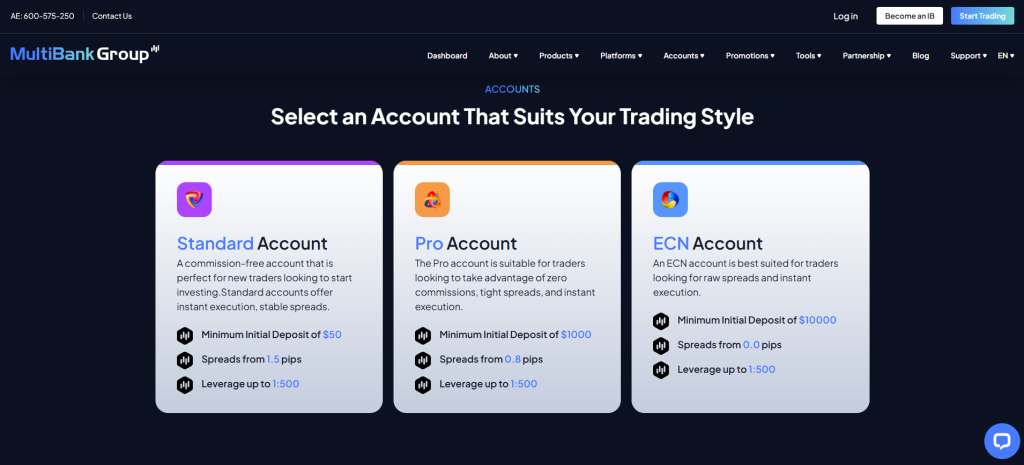

1. MultiBank Group

MultiBank Group is a legit forex broker known for offering some of the lowest spreads in the market, starting from 0.0 pips on major currency pairs. It provides tight pricing, fast execution, and strong regulation, making it ideal for traders seeking cost-efficient forex trading.

Frequently Asked Questions

What are the spreads offered by MultiBank Group?

MultiBank Group’s spreads vary by account type. The ECN account offers raw spreads from 0.0 pips with a commission. Pro accounts have spreads from 0.8 pips, and Standard accounts start from 1.5 pips, both with no commission.

Does MultiBank Group charge commissions in addition to spreads?

Yes, MultiBank Group does charge commissions, but it depends on the account type. The ECN account features raw spreads (from 0.0 pips) plus a commission (e.g., $3.00 per lot, round-turn). However, the Standard and Pro accounts are commission-free, with wider spreads.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Authorized and regulated | Minimum deposit may be high for beginners |

| Spreads from 0.0 pips on major currency pairs | Limited educational materials for new traders |

| Advanced trading platforms | Restricted service in some regions |

| Fast execution and deep liquidity | Inactivity fees may apply |

| 24/7 multilingual customer support | Complex account structure for beginners |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

MultiBank Group is an authorized forex broker offering ultra-tight spreads, strong regulation, and fast execution. Its competitive pricing and advanced platforms make it a solid choice for traders seeking professional and cost-efficient trading conditions.

2. IC Markets

IC Markets is an authorized forex broker known for its ultra-tight spreads starting from 0.0 pips on major currency pairs. It offers fast execution, deep liquidity, and advanced platforms, making it ideal for cost-efficient forex trading.

Frequently Asked Questions

What spreads does IC Markets offer?

IC Markets offers two main types of spreads: Raw Spreads (starting from 0.0 pips plus commission) for their Raw Spread accounts, and Standard Spreads (starting from 0.8 pips with no commission) for their Standard accounts.

Does IC Markets charge commissions on trades?

Yes, IC Markets charges commissions on their Raw Spread and cTrader accounts, typically $7 round turn per standard lot on Raw Spread. However, their Standard account is commission-free, utilizing a spread markup instead.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legit and well regulated global broker | Limited bonuses or promotional offers |

| Spreads from 0.0 pips on major pairs | Educational content could be more extensive |

| Fast order execution and low latency | Some features restricted by region |

| Supports MetaTrader 4, MT5, and cTrader | Withdrawal fees may apply with certain methods |

| Excellent customer service and support | No proprietary trading platform |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

IC Markets is a legit forex broker offering ultra-low spreads, reliable execution, and top-tier regulation. Its competitive pricing and advanced platforms make it a trusted choice for traders seeking precision and value in forex trading.

3. Pepperstone

Pepperstone is a legit, well-regulated forex broker offering ultra-tight spreads from 0.0 pips on their Razor account and competitive spreads on their Standard account.

Frequently Asked Questions

Is Pepperstone a legal forex broker?

Yes, Pepperstone is a legal forex broker, as it is multi-regulated by top-tier financial authorities like ASIC (Australia), FCA (UK), CySEC (Cyprus), and BaFin (Germany) in its different global entities.

What spreads does Pepperstone offer?

Pepperstone offers variable spreads that depend on the account type. The Razor Account provides raw spreads from 0.0 pips plus a commission. The Standard Account is commission-free with spreads starting from around 1.0 pip.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legal and regulated | No proprietary trading platform |

| Spreads from 0.0 pips on major pairs | Limited product range compared to larger brokers |

| Fast execution and low latency | Inactivity fees may apply |

| Supports MetaTrader 4, MT5, and cTrader | No fixed spread account option |

| Excellent customer service and reliability | Educational content could be broader |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐☆☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆☆ |

Our Insights

Pepperstone is a legal forex broker offering tight spreads, fast execution, and strong global regulation. Its advanced platforms and transparent pricing make it a preferred choice for traders seeking professional, low-cost, and reliable trading conditions.

Top 3 Forex Brokers by Spreads – MultiBank Group vs IC Markets vs Pepperstone

4. GO Markets

GO Markets is a regulated forex broker offering spreads starting from 0.0 pips on selected currency pairs (on its Plus+ account) and average spreads around 0.1 pips on EUR/USD, making it a cost-efficient choice for traders focused on tight pricing.

Frequently Asked Questions

What spreads does GO Markets offer?

GO Markets offers variable spreads that vary by account type. The Standard Account offers spreads starting from 0.8 pips with zero commission, while the GO Plus+ account features tighter raw spreads starting from 0.0 pips plus a commission.

Does GO Markets charge commissions on trades?

Yes, GO Markets charges commissions depending on the account type. The Standard Account is commission-free, with costs built into the spread. The GO Plus+ account features tighter raw spreads but charges a commission per lot per side.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Approved and regulated | Limited product range outside forex and CFDs |

| Spreads from 0.0 pips on major pairs | Educational resources could be more advanced |

| Fast order execution with deep liquidity | No proprietary trading platform |

| Supports MT4, MT5, and mobile trading | Some regional restrictions apply |

| Excellent customer support and reliability | Occasional inactivity fees |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

GO Markets is an approved forex broker offering low spreads, fast execution, and strong regulation. With competitive pricing and reliable platforms, it’s a solid choice for traders seeking efficient and transparent forex trading conditions.

5. Exness

Exness is a regulated forex broker offering spreads from 0.0 pips on its Raw/Zero account types and around 0.1–0.3 pips on pro/standard accounts for major currency pairs.

Frequently Asked Questions

What spreads does Exness offer?

Exness offers spreads from 0.0 pips on its Raw Spread and Zero accounts (with commission). The commission-free Standard and Pro accounts offer spreads from 0.2 pips and 0.1 pips, respectively. Spreads are dynamic and can fluctuate.

Does Exness charge commissions on low-spread accounts?

Yes, Exness charges a commission on its lowest-spread accounts. The Raw Spread and Zero accounts offer spreads from 0.0 pips, but incur a trading commission per lot. The Pro account, however, is commission-free but has spreads from 0.1 pips.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Registered and regulated | Commission applies on Raw and Zero accounts |

| Spreads from 0.0 pips on Raw accounts | Limited educational resources for beginners |

| Instant withdrawals and fast execution | Regional restrictions in some countries |

| Supports MT4 and MT5 platforms | No proprietary trading platform |

| Wide range of trading instruments | Customer support not available 24/7 in all languages |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐☆☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Exness is a registered forex broker offering tight spreads, fast execution, and strong regulatory oversight. With reliable platforms and competitive pricing, it’s a preferred choice for traders seeking low-cost and transparent forex trading conditions.

6. Axi

Axi is a regulated forex broker that offers ultra-competitive spreads. Some account types feature spreads starting from 0.0 pips on major pairs, while standard accounts have more typical spreads around 0.7 pips on EUR/USD.

Frequently Asked Questions

Is Axi an authorized forex broker?

Yes, Axi is an authorized forex broker. It is regulated by several top-tier financial bodies globally, including the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), and the Cyprus Securities and Exchange Commission (CySEC).

What spreads does Axi offer?

Axi’s spreads vary by account type. The Standard Account offers spreads from around 0.7 pips with zero commission, while the Pro Account and Elite Account offer raw spreads from 0.0 pips plus a commission.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Authorized and regulated | No proprietary trading platform |

| Spreads from 0.0 pips on Pro accounts | Limited non-forex asset selection |

| Fast trade execution and strong liquidity | Commission applies on Pro accounts |

| Supports MT4 and advanced trading tools | Inactivity fees may apply |

| Excellent customer support and reliability | Educational content could be more detailed |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Offering tight spreads and rapid trade execution, Axi is a fully authorized broker. Its use of the reliable MT4 platform, backed by strong regulation, ensures traders get competitive, secure, and efficient forex trading conditions.

7. BlackBull Markets

BlackBull Markets is a regulated ESG-broker offering spreads from 0.8 pips on its Standard ECN account, and starting at 0.0 pips on its Prime and Institutional accounts, making it a competitive choice for tight-spread forex trading.

Frequently Asked Questions

What spreads does BlackBull Markets offer?

BlackBull Markets offers competitive spreads that vary by account type. The ECN Prime and ECN Institutional accounts provide the tightest spreads, starting from 0.0 pips, but charge a commission. The commission-free ECN Standard account has spreads starting from 0.8 pips.

Are commissions charged in addition to the spreads?

Yes, BlackBull Markets charges commissions in addition to spreads for two of its account types. The ECN Prime and ECN Institutional accounts feature tighter, raw spreads (from 0.0 pips) plus a fixed commission per lot. The ECN Standard account is commission-free, with costs built into a wider spread.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legit and regulated | Standard account spreads are wider |

| Competitive spreads | Prime/Institutional account minimum deposits are high |

| ECN-style execution | Commission structure is more complex for the raw-spread accounts |

| Supports popular platforms | Limited educational resources |

| Strong customer support | Some regional restrictions apply |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

BlackBull Markets is a legit ECN broker offering ultra-tight spreads on higher-tier accounts and strong execution. While the cost-structure is advanced and minimums higher, it suits serious traders seeking low-cost, direct-access forex trading conditions.

8. FxPro

FxPro is a globally regulated broker offering variable spreads that depend on account type and platform. On its Standard MT4/MT5 accounts, spreads start around 1.2 pips, while its Raw/Elite accounts can begin from 0.0 pips (with commission).

Frequently Asked Questions

Is FxPro a legal forex broker?

Yes, FxPro is a legal and heavily regulated forex broker. It operates under multiple entities with licenses from top-tier global financial authorities, including the UK’s FCA and Cyprus’s CySEC, demonstrating strong regulatory compliance and a commitment to client fund safety.

Does FxPro charge commissions in addition to spreads?

Yes, FxPro’s commission structure depends on the account type. Standard MT4/MT5 accounts are commission-free, but have wider spreads. cTrader and Raw+ accounts offer much tighter spreads but charge a commission on Forex and Metals trades.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legal and regulated | Standard account spreads are relatively higher compared to some ultra-low spread brokers |

| Offers account types with ultra-tight spreads | Minimum deposits for some account types may be higher |

| Supports multiple trading platforms | Some regions are restricted |

| No dealer desk intervention | Inactivity fees may apply |

| No fees for deposits/withdrawals in many cases | Educational resources less extensive |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

FxPro is a legal broker with strong regulation, multiple platforms, and very low-spread account options. While higher costs apply on standard accounts and some regions are restricted, it remains a solid choice for traders seeking quality execution and variety.

9. FBS

FBS offers floating spreads starting from 0.7 pips on major forex pairs such as EUR/USD. It also features zero-commission trading on many accounts, making it a cost-efficient option for traders.

Frequently Asked Questions

What spreads does FBS offer?

FBS offers both floating and fixed spreads, depending on the account type. Floating spreads on major Forex pairs can start as low as 0.7 pips on their Standard accounts. They also have a Zero Spread account, where you pay a commission instead of a spread.

Is FBS an approved forex broker?

Yes, FBS is a regulated forex broker. They operate with multiple licenses, including top-tier oversight from the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities and Investments Commission (ASIC), and the Financial Services Commission (FSC) of Belize.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Approved and regulated | Commission applies on certain account types |

| Spreads from as low as 0.7 pips | Educational resources are limited for beginners |

| Multiple account types to suit all traders | Higher spreads on standard accounts |

| Supports MT4, MT5, and mobile trading apps | Regional restrictions in some countries |

| Offers bonuses and promotions for active traders | Withdrawal fees may apply with some methods |

Final Score

| # | Criteria | Score |

| 1. | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2. | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3. | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4. | Research and Education | ⭐⭐⭐⭐☆ |

| 5. | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6. | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7. | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8. | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9. | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10. | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

FBS is an approved forex broker offering competitive spreads, flexible account options, and strong regulation. Its low-cost trading environment and user-friendly platforms make it a solid choice for traders of all experience levels.

10. Tickmill

Tickmill is a globally regulated forex broker offering floating spreads. Their Raw/Pro account types feature spreads starting from 0.0 pips, while the Classic account begins from around 1.6 pips on major currency pairs.

Frequently Asked Questions

Is Tickmill a registered broker?

Yes, Tickmill is a registered and multi-regulated broker. It is overseen by several authorities, including the FCA (UK), CySEC (Cyprus), and the FSCA (South Africa), providing a high degree of regulatory oversight.

Does Tickmill charge commission in addition to the spread?

It depends on the account type. The Classic Account is commission-free but has wider spreads. The Raw Account charges a commission (e.g., $3 per side per lot for FX) in addition to very tight spreads.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Registered and regulated | Classic account’s spread may be less competitive |

| Raw/Pro account offers very low spreads | Higher minimum deposit |

| Easy account options | Variable spreads (floating) only |

| Strong execution infrastructure | Limited non-forex instrument variety |

| Suitable for different trading strategies | Regional restrictions apply |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms, and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Options | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Tickmill is a registered forex broker offering ultra-low spreads on its Raw account and solid regulation support. While the Classic account’s costs may be higher and spread widening can occur, it remains a strong choice for traders seeking efficient, low-cost execution.

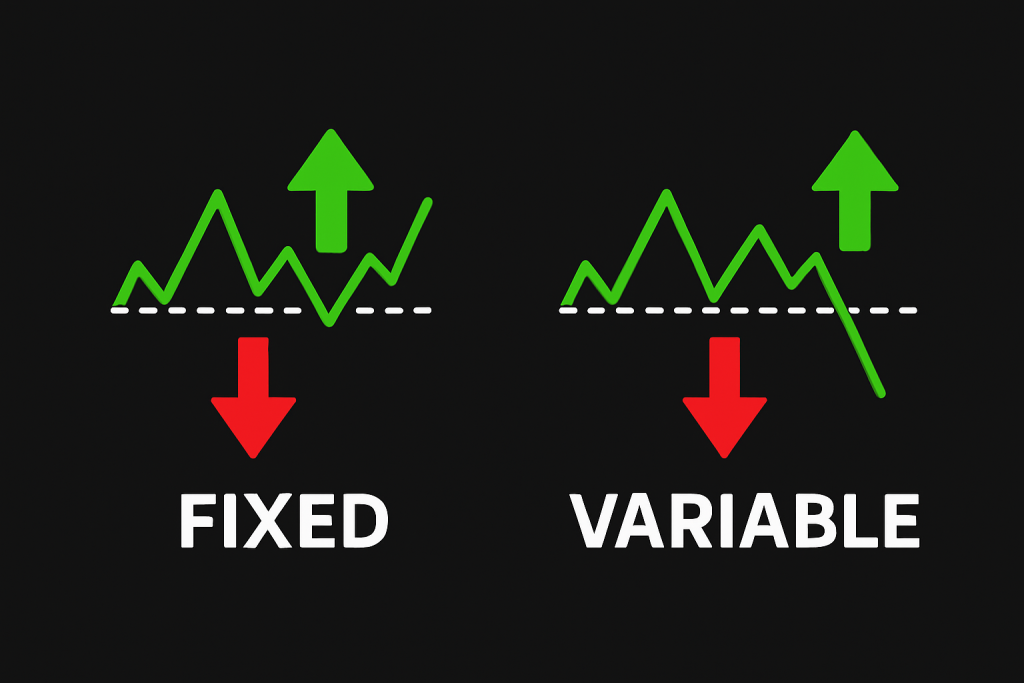

What are Spreads in Forex Trading?

In forex trading, a spread is the difference between the buy (ask) price and the sell (bid) price of a currency pair. It represents the broker’s fee or trading cost for executing a trade.

For example, if EUR/USD has a bid price of 1.1000 and an ask price of 1.1002, the spread is 2 pips.

Spreads can be:

-

Fixed – staying constant regardless of market conditions.

-

Variable (floating) – changing depending on liquidity and volatility.

Tighter spreads usually mean lower trading costs, which is why many traders prefer brokers offering low or zero-pip spreads for high-volume or scalping strategies.

Criteria for Choosing Forex Brokers by Spreads

| Criteria | Description | Importance |

| Spread Type (Fixed or Variable) | Determines if spreads remain constant or fluctuate with market conditions. Variable spreads are usually lower during high liquidity. | ⭐⭐⭐⭐☆ |

| Average Spread Size | Reflects the typical cost of trading. Lower average spreads reduce trading expenses and improve profit margins. | ⭐⭐⭐⭐⭐ |

| Account Type Options | Some brokers offer accounts with zero spreads but charge commissions, while others include costs in wider spreads. | ⭐⭐⭐⭐☆ |

| Regulation and Licensing | Choosing a regulated and authorized broker ensures transparent pricing and fair spread practices. | ⭐⭐⭐⭐⭐ |

| Trading Volume Liquidity | High liquidity ensures tighter spreads and minimal slippage, especially during peak trading hours. | ⭐⭐⭐⭐☆ |

| Market Conditions Impact | Spreads may widen during volatility or news events, brokers with stable spreads are more reliable. | ⭐⭐⭐⭐☆ |

| Broker Transparency | Brokers should clearly disclose average and minimum spreads to help traders calculate true costs. | ⭐⭐⭐⭐⭐ |

| Execution Speed | Fast order execution prevents spread related slippage, improving trade accuracy and outcomes. | ⭐⭐⭐⭐☆ |

| Commissions and Fees | Low commissions complement tight spreads, resulting in overall lower trading costs. | ⭐⭐⭐⭐⭐ |

| Currency Pair Availability | More pairs mean more trading opportunities, but spread competitiveness varies across pairs. | ⭐⭐⭐☆☆ |

Top 10 Best Forex Brokers by Spreads – A Direct Comparison

What Real Traders Want to Know!

Explore the Top Questions asked by real traders across the Globe. From fixed and variable spreads to why some brokers spreads are lower than others, we provide straightforward answers to help you understand spreads and choose the right broker confidently.

Q: What does a “0.0 pip spread” really mean, is it truly free to trade? – Sarah M.

A: A “0.0 pip spread” means the buy and sell prices are virtually identical. However, trading is not free; the broker usually charges a separate, fixed commission per trade/lot as their fee instead of building it into the spread.

Q: Which is better, fixed or variable spreads? – Lisa K.

A: There is no single “better” spread; it depends on your trading style. Fixed spreads offer predictable costs, best for scalpers or news traders. Variable spreads are often lower during high liquidity but widen during volatility, generally preferred by swing traders.

Q: Why do some brokers have lower spreads than others? – Juan P.

A: Broker spreads differ based on their business model. Brokers offering raw spreads earn via commissions and are often lower. Market Makers generate revenue by setting the spread wider as their cost.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Lower Trading Costs | Commissions May Apply |

| Faster Break-Even Point | Variable Spread Fluctuations |

| Ideal for Scalping Strategies | Higher Deposit Requirements |

| Transparent Pricing | Hidden Fees Possible |

| Access to ECN/STP Accounts | Complex for Beginners |

You Might also Like:

- MultiBank Group Review

- IC Markets Review

- Pepperstone Review

- GO Markets Review

- Exness Review

- Axi Review

- BlackBull Markets Review

- FxPro Review

- FBS Review

- Tickmill Review

In Conclusion

Forex brokers by spreads offer traders transparent and cost-efficient trading conditions. Choosing brokers with tight, stable spreads helps reduce overall costs, improve trade precision, and support effective strategies for both beginners and experienced forex traders.

Faq

Spreads are the direct transaction cost for every trade. A smaller spread means lower overall trading expenses, which significantly impacts your profitability, especially for high-frequency strategies like scalping.

A low-spread forex broker offers minimal differences between the buy and sell prices of currency pairs. This significantly reduces your transaction costs per trade, often using a commission-based ECN/Raw spread model to generate revenue.

No, zero-spread brokers are not truly free. They typically generate revenue by charging a fixed commission per trade. Other costs, such as overnight swap fees or withdrawal charges, may also apply.

Spreads widen during news events because market volatility increases and liquidity decreases. Brokers widen the gap between bid/ask prices to protect themselves against the higher risk of rapid, unpredictable price moves and difficulties filling orders.

Regulation primarily ensures transparency and fairness, not necessarily the lowest spreads. However, highly-regarded, regulated brokers often offer competitive spreads because their high trading volume allows them to access better pricing from liquidity providers.

Spreads are critical for scalping, as they are a large percentage of the small profit targets. Tight spreads are essential to minimize transaction costs and ensure profitability on the many quick trades.

No, low spreads aren’t always better. Brokers may compensate with higher commissions or hidden fees like excessive slippage. Also, extremely low spreads can widen unpredictably during volatile news events.

Theoretically, a bid-ask spread cannot be negative because the Ask price (seller’s minimum) must be equal to or higher than the Bid price (buyer’s maximum). However, “negative spreads” can occur in certain financial products like interest rate swap spreads or in credit default swap (CDS) basis trades due to specific market or regulatory conditions.

Brokers derive spreads from their liquidity providers’ raw pricing and then add a markup as their main source of profit. The final spread size also constantly adjusts based on market volatility and liquidity.