ATC Brokers Review

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open an ATC Brokers Account

- Safety and Security

- Partnership Options

- Trading Platforms and Tools

- Markets Available for Trade

- Deposit and Withdrawal

- Insights from Real Traders

- Employee Overview

- Discussions and Forums

- Customer Reviews and Trust Scores

- Pros and Cons

- In Conclusion

ATC Brokers is a trustworthy and highly regulated Forex Broker that is very competitive in terms of its trading fees. The Broker offers an easy-to-use social copy trading platform with excellent customer support. ATC Brokers has a trust score of 90 out of 99.

★★★★ | Minimum Deposit: $2,000 Regulated by: FCA, CIMA Crypto: Yes |

Overview

ATC Brokers stands out through experience, regulatory strength, and competitive pricing. Since 2005, it has provided a reliable trading environment with multi-asset access, low fees, and client fund protection. Additionally, with a full back-office suite and a practice account, it supports beginners and pros alike.

Frequently Asked Questions

What makes this broker suitable for all types of traders?

The broker offers a user-friendly multi-asset platform, industry-low fees, and access to a free demo account. Moreover, it supports both beginners and experienced traders by ensuring transparency, secure fund protection, and regulatory compliance across multiple jurisdictions.

How are client funds protected by this broker?

Client funds are held in segregated accounts, fully separate from the broker’s operational funds. Furthermore, this setup, combined with regulatory oversight from 🇬🇧FCA and 🇰🇾CIMA, ensures customer assets are safeguarded against company-related financial risks.

Our Insights

With a foundation built on trust, compliance, and transparency, this broker offers a complete trading experience. Consequently, its low fees, secure account structure, and full trading features make it a solid choice for traders who value both performance and protection.

★★★★ | Minimum Deposit: $2,000 Regulated by: FCA, CIMA Crypto: Yes |

Fees, Spreads, and Commissions

ATC Brokers delivers a cost-effective trading experience with low spreads starting at 0.5 pips and zero commissions on standard accounts. Additionally, designed with transparency in mind, the broker ensures traders clearly understand all costs, helping them optimize trade execution and manage expenses efficiently.

| Feature | Details |

| Starting Spreads | From 0.5 pips |

| Commissions | None on standard accounts |

| Withdrawal Fees | Typically around $15 |

| Fee Transparency | Clear and straightforward |

Frequently Asked Questions

What spreads can traders expect at ATC Brokers?

ATC Brokers offers highly competitive spreads starting from just 0.5 pips. As a result, this low-cost structure is especially appealing to active traders who prioritize tight spreads to reduce overall trading costs.

Are commissions applied to standard accounts at ATC Brokers?

No, standard account holders at ATC Brokers benefit from a commission-free trading model. In addition, this further enhances cost savings and simplifies the overall pricing structure for traders of all levels.

Our Insights

ATC Brokers stands out with its commission-free standard accounts and tight spreads, providing an ideal setup for cost-conscious and active traders. Moreover, its transparent and straightforward fee model supports better planning and expense control.

★★★★ | Minimum Deposit: $2,000 Regulated by: FCA, CIMA Crypto: Yes |

Minimum Deposit and Account Types

ATC Brokers delivers a diverse suite of account types tailored for all levels of traders, from beginners to professionals. Furthermore, whether you prefer self-directed trading or professional management, the broker offers options like standard, raw spread, mini, and managed accounts to suit different goals and strategies.

Frequently Asked Questions

What account types does ATC Brokers offer?

ATC Brokers offers standard, raw spread, mini, and managed accounts. Consequently, each caters to different trader needs – whether you’re a beginner looking for simplicity or an advanced trader requiring low spreads and commission-based pricing.

Which ATC Brokers account is best for new traders?

New traders typically benefit most from the standard account. Therefore, it offers higher spreads with no separate commissions, simplifying cost calculations and reducing complexity during the learning phase of trading.

Our Insights

ATC Brokers provides versatile account types that adapt to traders experience and preferences. As a result, with options for low-cost entry, tighter spreads, or professional account management, the broker enables clients to scale their trading approach effectively and confidently.

★★★★ | Minimum Deposit: $2,000 Regulated by: FCA, CIMA Crypto: Yes |

How to Open an ATC Brokers Account

Opening an account with ATC Brokers is a straightforward process that can be done online. Here’s a step-by-step guide to get you started:

1. Step 1: Visit the ATC Brokers’ Website

Go to the official ATC Brokers website and click on the “Create Account” or “Sign Up” button to begin the registration process.

2. Step 2: Choose Your Account Type

ATC Brokers offers various account types, such as standard, raw spread, mini, and managed accounts. Choose the one that best suits your trading preferences and goals.

3. Step 3: Fill Out the Registration Form

You’ll be prompted to enter your personal information.

4. Step 4: Submit Identification Documents

To comply with regulatory requirements, you’ll need to submit proof of identity and proof of address. Acceptable documents typically include a valid passport or driver’s license (for identity verification) and a recent utility bill, bank statement, or government-issued document (for address verification).

5. Step 5: Agree to Terms and Conditions

Carefully read and agree to the terms and conditions of ATC Brokers, including risk warnings and the company’s privacy policy.

6. Step 6: Fund Your Account

Once your account is set up and verified, you can deposit funds. ATC Brokers typically offer various payment methods, including bank transfers, credit/debit cards, and sometimes e-wallets.

7. Step 7: Start Trading or Use the Demo Account

After your deposit is confirmed, you can begin trading on your live account or start with a demo account to practice your trading strategies in a risk-free environment.

★★★★ | Minimum Deposit: $2,000 Regulated by: FCA, CIMA Crypto: Yes |

Safety and Security

ATC Brokers prioritizes client protection through multi-jurisdictional regulation, advanced security technology, and strict fund segregation. Additionally, regulated by 🇬🇧FCA and 🇰🇾CIMA, it provides traders with a safe, transparent platform backed by over a decade of operational credibility and robust risk management protocols.

| Feature | Details |

| Regulation | 🇬🇧FCA 🇰🇾CIMA |

| Client Fund Security | Segregated Accounts |

| Online Protection | Advanced encryption and security measures |

| Risk Controls | Multi-layered risk management procedures |

Frequently Asked Questions

How are my funds protected at ATC Brokers?

Your funds are stored in segregated accounts, fully separate from company capital. Consequently, this safeguard ensures your money is protected from company-related risks and cannot be used for business operations or liabilities in the event of insolvency.

Is ATC Brokers a regulated broker?

Yes, ATC Brokers is regulated by reputable authorities such as 🇬🇧Financial Conduct Authority (FCA) and 🇰🇾Cayman Islands Monetary Authority (CIMA). As a result, these regulators ensure the company follows strict financial standards, offering traders confidence and operational transparency.

Our Insights

ATC Brokers delivers top-tier security through segregated client accounts, regulatory oversight, and strong online protection. Moreover, its compliance with 🇬🇧FCA and 🇰🇾CIMA rules, along with encrypted trading protocols, ensures a safe and trustworthy trading environment for retail and institutional traders.

★★★★ | Minimum Deposit: $2,000 Regulated by: FCA, CIMA Crypto: Yes |

Partnership Options

ATC Brokers offers a comprehensive Introducing Broker (IB) program tailored for growth and efficiency. Furthermore, designed with advanced tools, flexible payouts, and deep integration options, the platform supports individuals and firms seeking to expand their referral networks in a secure, regulated environment.

| Feature | Details |

| IB Compensation Model | 5 structures with multi-tier commissions |

| Sub-IB Support | Up to 7 layers of referral tracking |

| Tech Tools | API reporting IB portal PAMM Pro |

| Regulation | 🇬🇧FCA 🇰🇾CIMA |

Frequently Asked Questions

What is the purpose of the ATC Brokers IB program?

The Introducing Broker program helps individuals and businesses earn commissions by referring traders to ATC Brokers. In addition, with multi-level compensation, customizable tools, and full reporting access, the program supports long-term scalability and operational control.

How can I earn as an IB at ATC Brokers?

IBs can earn from up to seven sub-IB layers using five different commission structures. Consequently, the program’s flexibility allows partners to align compensation with their referral models while optimizing earnings through layered networks and client activity tracking.

Our Insights

ATC Brokers’ IB program provides partners with modern tools, custom payout options, and the support needed to grow a successful referral business. Therefore, whether you’re a solo referrer or a business, this program supports scalable growth within a fully regulated and tech-forward environment.

★★★★ | Minimum Deposit: $2,000 Regulated by: FCA, CIMA Crypto: Yes |

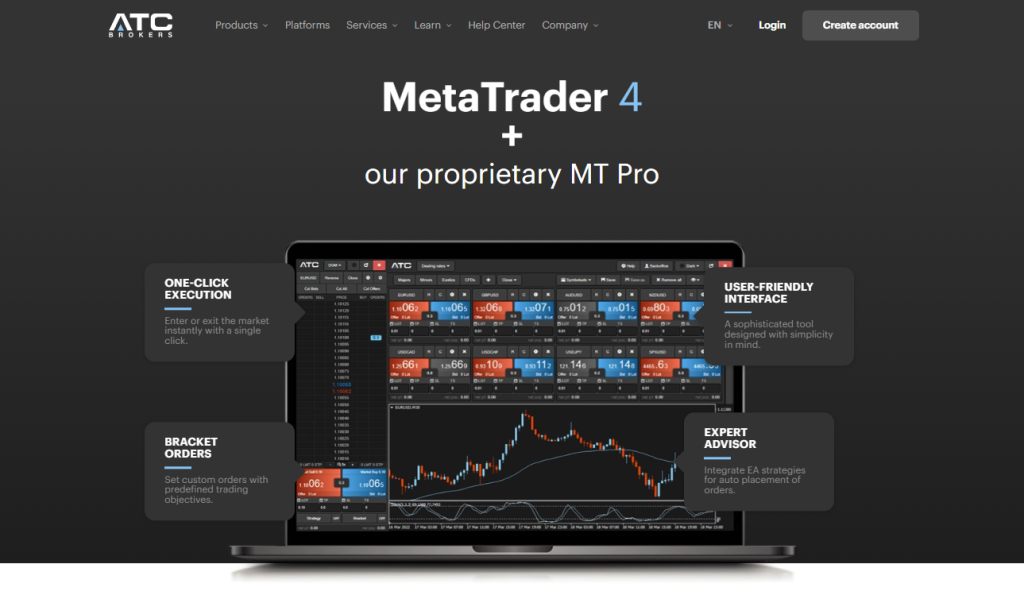

Trading Platforms and Tools

ATC Brokers combines the globally respected MetaTrader 4 platform with its proprietary MT Pro plugin to create a professional-grade trading environment. From one-click execution and customizable charts to bracket and strategy orders, the platform offers a tailored experience for all trader types, on both desktop and mobile.

| Feature | Details |

| Core Platform | MetaTrader 4 (MT4) |

| Added Plugin | MT Pro (exclusive to ATC Brokers) |

| Key Tools | Bracket Orders Strategy Orders EAs |

| Mobile Access | iOS and Android support |

Frequently Asked Questions

What makes the MT4 + MT Pro setup powerful for traders?

MT4 is already a leading forex platform, and ATC Brokers’ MT Pro plugin enhances it further with advanced tools like bracket and strategy orders, OCO functionality, and a streamlined interface. Together, they offer fast, flexible, and automated trading suited for both beginners and pros.

Can I use bracket and strategy orders with ATC Brokers?

Yes, bracket orders allow you to set up to three layers for take profit, stop loss, and conditional execution. Strategy orders enable custom trade setups based on specific conditions, which can be toggled on or off at any time via MT Pro.

Our Insights

ATC Brokers enhances the MT4 experience with its proprietary MT Pro plugin, delivering an optimized platform that supports automation, mobile access, and detailed strategy tools. This setup is ideal for traders seeking a blend of user-friendly execution and professional-grade features.

★★★★ | Minimum Deposit: $2,000 Regulated by: FCA, CIMA Crypto: Yes |

Markets Available for Trade

ATC Brokers delivers a well-rounded trading environment with access to key global markets. From forex majors to cryptocurrencies, traders can diversify across asset classes with competitive spreads and modern trading tools. This versatility helps traders adapt to market shifts and seize new opportunities.

| Market Type | Examples Available |

| Forex | EUR/USD GBP/USD USD/JPY |

| Commodities | Gold Silver Oil Agricultural |

| Indices | S&P 500 Dow Jones FTSE 100 |

| Cryptocurrencies | Bitcoin Ethereum Litecoin |

Frequently Asked Questions

What markets are available for trading at ATC Brokers?

ATC Brokers offers a wide range of instruments across forex, commodities, indices, and cryptocurrencies. This includes major pairs like EUR/USD, metals like gold and silver, indices such as the S&P 500, and digital assets like Bitcoin and Ethereum.

Can I trade cryptocurrencies with ATC Brokers?

Yes, ATC Brokers supports CFD trading on major cryptocurrencies, including Bitcoin, Ethereum, and Litecoin. This allows traders to speculate on crypto price movements without owning the underlying assets, while benefiting from leverage and fast execution.

Our Insights

ATC Brokers provides access to multiple asset classes, making it suitable for traders looking to build a diversified strategy. With forex, commodities, indices, and crypto available under one platform, traders can capitalize on market volatility and broaden their trading potential.

★★★★ | Minimum Deposit: $2,000 Regulated by: FCA, CIMA Crypto: Yes |

Deposit and Withdrawal

ATC Brokers streamlines its funding process by offering a single, secure method: Bank Wire Transfer. With zero deposit fees, clear withdrawal charges, and fast processing within 1–2 business days, traders benefit from a transparent and efficient way to move funds.

| Funding Method | Deposit Fees | Withdrawal Fees | Processing Time |

| Bank Wire Transfer | None | €30.00 (EUR) $40.00 (USD) | 1–2 business days |

Frequently Asked Questions

What deposit options are available at ATC Brokers?

ATC Brokers supports Bank Wire Transfers for account funding. This method ensures security and reliability for both domestic and international traders, although no alternative options like e-wallets or cards are currently supported.

What are the fees and processing times for withdrawals?

International withdrawal fees are €30.00 for EUR and $40.00 for USD. Withdrawals are typically processed within 1 to 2 business days, allowing for quick access to your funds once the request is submitted.

Our Insights

ATC Brokers keeps funding simple with Bank Wire Transfers, no deposit fees, and fast withdrawal handling. Though limited in options, the transparency and efficiency of the process provide a trustworthy solution for managing trading funds.

★★★★ | Minimum Deposit: $2,000 Regulated by: FCA, CIMA Crypto: Yes |

Insights from Real Traders

🥇 Excellent Platform for Beginners.

ATC Brokers has been fantastic for me as a beginner trader. The educational resources they offer have helped me get a better understanding of the market. The platform is easy to use, and I’ve found their customer support to be incredibly helpful. Highly recommend! – Jackie

⭐⭐⭐⭐

🥈 Seamless Trading Experience.

Trading with ATC Brokers has been smooth and efficient. The MetaTrader 4 platform is intuitive, and I love the tight spreads. I also appreciate the quick withdrawal process. It’s a reliable broker that I feel confident trading with. – Alvin

⭐⭐⭐⭐⭐

🥉 Great Customer Support and Tools.

I’ve been trading with ATC Brokers for a few months now, and I’m impressed with their tools and customer service. Their educational section got me started, and the demo account provided the perfect environment for practicing. They offer all the resources I need to succeed! – Michael

⭐⭐⭐⭐

★★★★ | Minimum Deposit: $2,000 Regulated by: FCA, CIMA Crypto: Yes |

Employee Overview

Working at ATC Brokers offers opportunities in a dynamic and client-focused environment within the financial services sector. Employees often highlight a supportive culture emphasizing continuous learning, fintech innovation, and teamwork.

| Category | Details |

| Company Size | Small to medium (11–50 employees) |

| Work Culture | Collaborative, innovation-driven, client-centric |

| Key Departments | Operations, Account Management, Technology |

| Employee Benefits | Professional growth opportunities, fintech exposure |

Employees appreciate the chance to work in a nimble company focused on both technology and client service.

★★★★ | Minimum Deposit: $2,000 Regulated by: FCA, CIMA Crypto: Yes |

Discussions and Forums

Forum commentary shows a range of perspectives. On Forex Factory, users praised the MT4 platform’s usability and tight spreads but noted commission costs and demo account limits. A long-ago BabyPips thread harshly criticized the broker for poor withdrawal support and low staffing. Reddit feedback highlighted US traders concerns over the commission structure.

| Thread Source | Highlights |

| Forex Factory | “Spreads excellent Commission could be lower” |

| BabyPips | “Worst employees withdrawal issues” |

| Reddit /r/Forex | "$10 round trip commission per lot” |

These forums reflect a mixed community view: solid trading conditions offset by concerns over costs and support.

★★★★ | Minimum Deposit: $2,000 Regulated by: FCA, CIMA Crypto: Yes |

Customer Reviews and Trust Scores

On Trustpilot, ATC Brokers holds a moderate score of 3.5 out of 5 from seven reviews. Positive comments highlight fast deposits and withdrawals, responsive support, and transparent service. Negative reviews point to issues with inactivity fees and delayed payouts.

ForexPeaceArmy reports a 4.4 out of 5 rating across 124 reviews. Many users commend swift responses, reliable withdrawals, and tight spreads. Some note account inactivity charges as the only drawback.

| Platform | Trust Score (5) | Positive Feedback | Negative Feedback |

| Trustpilot | 3.5 | Fast withdrawal helpful support | Inactivity fees unresolved issues |

| ForexPeaceArmy | 4.4 | Tight spreads quick withdrawals good execution | Account inactivity charges |

Overall, customer sentiment leans positive, with most praising the broker’s execution, service, and reliability, though some highlight fee transparency issues.

★★★★ | Minimum Deposit: $2,000 Regulated by: FCA, CIMA Crypto: Yes |

Pros and Cons

| ✓ Pros | ✕ Cons |

| Low spreads | Limited deposit options |

| No commissions on standard accounts | Withdrawal fees for international |

| Educational resources available | Only bank wire transfer for deposits |

| Fast withdrawal processing | Limited account types for beginners |

| Reliable customer support | No cryptocurrency withdrawal options |

References:

In Conclusion

ATC Brokers operates physical offices and provides customer support across several countries, ensuring regional presence and accessibility for clients worldwide.

- 🇺🇸 United States

- 🇨🇦 Canada

- 🇦🇪 United Arab Emirates (Dubai)

- 🇮🇳 India (Chennai and Hyderabad)

Customer support is offered in multiple languages, English, Spanish, and Mandarin, and is available via live chat, email, and phone channels during market hours on weekdays.

Faq

No, ATC Brokers does not charge commissions on standard accounts.

ATC Brokers does not specify a minimum deposit on their platform, but it’s best to check when opening an account.

Withdrawals are typically processed within 1 to 2 business days.

ATC Brokers offers MetaTrader 4 (MT4) and their proprietary MT Pro plugin.

ATC Brokers supports cryptocurrency trading alongside forex, commodities, and indices.

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open an ATC Brokers Account

- Safety and Security

- Partnership Options

- Trading Platforms and Tools

- Markets Available for Trade

- Deposit and Withdrawal

- Insights from Real Traders

- Employee Overview

- Discussions and Forums

- Customer Reviews and Trust Scores

- Pros and Cons

- In Conclusion