- Home /

- Forex Brokers /

- Axi

Axi Review

- Overview

- Minimum Deposit and Account Types

- How To Open an Account

- Fees, Spreads, and Commissions

- Safety and Security

- Axi Cybersecurity

- Lightning-Fast Execution and Low-Cost Trading

- Award-Winning Service

- Axi Select

- Trading Platforms and Software

- Which Markets Can You Trade?

- Deposit and Withdrawal

- Educational Resources

- Customer Support

- Insights from Real Traders

- Customer Reviews and Trust Scores

- Employee Insights on Working for Axi

- What Real Traders Want to Know about Axi

- Pros and Cons

- In Conclusion

Axi is a trustworthy Forex Broker with a robust regulatory framework and a highly competitive starting spread. Moreover, Axi offers access to premium trading facilities catering to a diverse clientele base and has a 92 out of 99 trust score.

★★★★ | Minimum Deposit: $5 Regulated by: ASIC, FCA, DFSA, VFSC Crypto: Yes |

Overview

Founded in 2007 in Sydney, Axi has grown from a two-person startup into a multi-award-winning global broker. Today, it serves tens of thousands of traders across more than 100 countries, offering competitive spreads, seamless execution, and a strong trader-first approach.

Frequently Asked Questions

What makes Axi stand out among other brokers?

Axi’s biggest strength is that it’s built by traders, for traders. Moreover, the brand focuses on offering super competitive spreads, advanced tools, and reliable execution. Additionally, with a strong global presence and multiple regulatory licenses, Axi backs its promises with proven performance and award-winning service.

Is Axi a trusted and regulated broker?

Yes. Since its launch in 2007, Axi has expanded its regulatory footprint across major financial hubs, including Australia, the UK, Dubai, and Cyprus. Additionally, it has won more than 35 industry awards and partners with top sports clubs, further demonstrating credibility and a commitment to transparency.

Our Insights

Axi has evolved into a trusted global broker with a trader-focused approach, competitive pricing, and reliable execution. Supported by multiple regulatory licenses and numerous industry awards, Axi continues to deliver transparent, high-quality service to tens of thousands of traders worldwide.

★★★★ | Minimum Deposit: $5 Regulated by: ASIC, FCA, DFSA, VFSC Crypto: Yes |

Minimum Deposit and Account Types

Axi offers flexible CFD trading accounts designed for different strategies and trader levels. From the accessible Standard to the high-volume Elite, each account type provides competitive spreads, advanced tools, and tailored features, thereby helping traders maximise their trading potential.

| Account Type | Open an Account | Minimum Deposit | EUR/USD Spread | Commission |

| Standard | 5 USD | From 0.7 pips | None | |

| Pro | 5 USD | From 0.0 pips | $7 round trip | |

| Elite | 25,000 USD | From 0.0 pips | $3.50 round trip |

Frequently Asked Questions

What’s the difference between Axi’s Standard, Pro, and Elite accounts?

Axi’s Standard account is great for beginners, offering no commission and tight spreads from 0.7 pips. Meanwhile, the Pro account provides spreads from 0.0 pips plus low commission. Additionally, the Elite account is designed for high-volume traders seeking extra benefits.

Does Axi charge setup costs or high deposits for its accounts?

No setup cost is required for the Standard or Pro accounts, and deposits start from as low as $5. However, the Elite account is for VIP traders, with a higher minimum deposit of $25,000, yet it offers lower commissions and premium perks.

Our Insights

Axi’s CFD accounts provide traders with choice and flexibility. Whether you’re just starting out or, alternatively, an experienced high-volume trader, Axi’s accounts deliver competitive spreads, powerful tools, and tailored features that help you trade confidently with an edge.

★★★★ | Minimum Deposit: $5 Regulated by: ASIC, FCA, DFSA, VFSC Crypto: Yes |

How To Open an Account

Visit the Axi website and the “Open Live Account” or “Getting Started” page.

- Complete the first application form.

- Determine your desired account type.

- Before submitting your application, carefully read and accept the Terms and Conditions.

- After completing the first form, you will be asked to provide papers to prove your identification.

- Ensure that the documents are readable, valid, and correspond to the information you gave in the application.

Once your account has been validated, you may deposit money to begin trading.

★★★★ | Minimum Deposit: $5 Regulated by: ASIC, FCA, DFSA, VFSC Crypto: Yes |

Fees, Spreads, and Commissions

Axi’s fee structure keeps trading costs clear and competitive. Whether you choose Standard, Pro, or Elite, you’ll consistently benefit from tight spreads, flexible commission options, and transparent pricing. Simply pick the best setup that matches your trading goals and volume.

| Account | EUR/USD Spread | Gold Spread | Commission |

| Standard | From 0.7 pips | From 15 cents | None |

| Pro | From 0.0 pips | From 5 cents | $7 round trip |

| Elite | From 0.0 pips | From 5 cents | $3.50 round trip |

Frequently Asked Questions

What are the typical spreads and commissions for Axi accounts?

Axi’s Standard account offers EURUSD spreads from 0.7 pips with no commission. Meanwhile, the Pro and Elite accounts start from 0.0 pips but charge a low round-trip commission of $7 or $3.50, respectively, for tighter pricing.

Are there any hidden setup costs or extra trading fees with Axi?

No. Axi does not charge a setup fee for any account type. Traders benefit from free tools like Autochartist, mobile access, and 5-digit pricing. Although Pro and Elite traders may pay a small commission, they enjoy lower spreads and additional perks.

Our Insights

Axi keeps its fees, spreads, and commissions clear and competitive. Moreover, with no setup costs and tight pricing across all account types, traders can easily find the ideal balance between low spreads and minimal commission to match their trading style.

★★★★ | Minimum Deposit: $5 Regulated by: ASIC, FCA, DFSA, VFSC Crypto: Yes |

Safety and Security

Axi, founded by traders for traders in 2007, has steadily grown into a trusted global broker supporting tens of thousands of clients in over 100 countries. Renowned for transparency, award-winning customer service, and robust regulation, Axi therefore ensures traders can confidently trade their edge.

| Feature | Details | Benefit | Availability |

| Regulation | Multiple licenses globally | Regulated safe trading | 100+ countries |

| Trading Support | 24/5 multilingual award-winning service | Reliable accessible help | 14 languages |

| Technology | Connects to 20+ liquidity providers | Fast stable trade execution | Desktop/mobile platforms |

| Risk Management Tools | Stop Loss Trailing Stop Take Profit | Helps protect trader capital | Free for all clients |

Frequently Asked Questions

What makes Axi a trusted broker for global traders?

Axi holds multiple financial licenses worldwide and delivers reliable, fast execution by connecting to over 20 top liquidity providers. Additionally, with 24/5 multilingual, award-winning support and transparent pricing, Axi builds strong trader confidence and trust.

How does Axi support traders in managing risk?

Axi offers free protective tools such as stop loss, trailing stops, and take profit orders, along with extensive educational resources. These features help traders manage risk effectively and maintain greater control when trading in volatile markets.

Our Insights

Axi’s trader-focused approach combines robust regulation, transparent practices, and cutting-edge technology. Additionally, its comprehensive educational resources and risk management tools empower traders worldwide to trade securely with confidence and clarity.

★★★★ | Minimum Deposit: $5 Regulated by: ASIC, FCA, DFSA, VFSC Crypto: Yes |

Axi Cybersecurity

Axi places the highest priority on online safety. By using advanced cybersecurity measures, encryption, and strict data privacy protocols, Axi protects traders’ funds and information around the clock. Therefore, you can stay alert, trade smartly, and trust Axi’s proactive approach to fraud prevention.

| Feature | Details | Benefit | Priority |

| Data Encryption | Best practice encryption | Secures private data | 24/7 |

| Safe Transactions | Verified secure payments | Protects client funds | Always |

| Cyber Compliance | Internal audits top partners | Meets global standards | Ongoing |

| Fraud Prevention | Spot report protect | Proactive scam defense | Immediate action encouraged |

Frequently Asked Questions

How does Axi protect traders from online fraud and scams?

Axi uses leading cybersecurity providers and follows best practices for data encryption and secure transactions. Additionally, internal audits ensure compliance with international standards. Importantly, Axi never asks for passwords or guarantees returns, keeping your information safe and secure.

What can traders do to stay secure online with Axi?

Traders should verify secure websites, watch for fake domains, use strong internet security, and check privacy settings. If suspicious activity occurs, Axi’s team encourages prompt reporting to help prevent fraud and protect your account.

Our Insights

Axi sets a high benchmark for online safety with industry-leading cybersecurity, clear fraud prevention guidelines, and customer awareness tips. Consequently, traders gain peace of mind knowing their accounts, transactions, and personal data are safeguarded 24/7.

★★★★ | Minimum Deposit: $5 Regulated by: ASIC, FCA, DFSA, VFSC Crypto: Yes |

Lightning-Fast Execution and Low-Cost Trading

Serious traders value speed, reliability, and raw pricing – Axi delivers all three. With co-located servers, direct connections to top-tier liquidity, and minimal latency, Axi ensures better pricing, faster execution, and fewer outages to help traders maximise every opportunity.

| Month | Price Filled at Request or Better | Median Latency | Fill Rates |

| June 25 | 94% | 31ms | >99.99% |

| May 25 | 93% | 31ms | >99.99% |

| Apr 25 | 93% | 28ms | >99.99% |

| Mar 25 | 95% | 29ms | >99.99% |

Frequently Asked Questions

How does Axi’s trade execution technology give traders an advantage?

Axi’s network routes trades through the shortest, fastest connections to 20+ liquidity providers. This reduces latency, lowers slippage, and refreshes pricing faster, keeping traders ahead, especially during volatile market events.

What do Axi’s execution stats show about real performance?

Recent monthly data shows over 90% of trades filled at requested prices or better, median execution times under 33ms, and fill rates consistently above 99.99%. This highlights Axi’s commitment to reliable, high-speed trade execution.

Our Insights

Axi combines ultra-low spreads, flexible leverage, and powerful trade execution technology. For traders who demand better pricing and lightning-fast fills without typical ECN delays, Axi’s setup makes it easier to trade your edge with confidence.

★★★★ | Minimum Deposit: $5 Regulated by: ASIC, FCA, DFSA, VFSC Crypto: Yes |

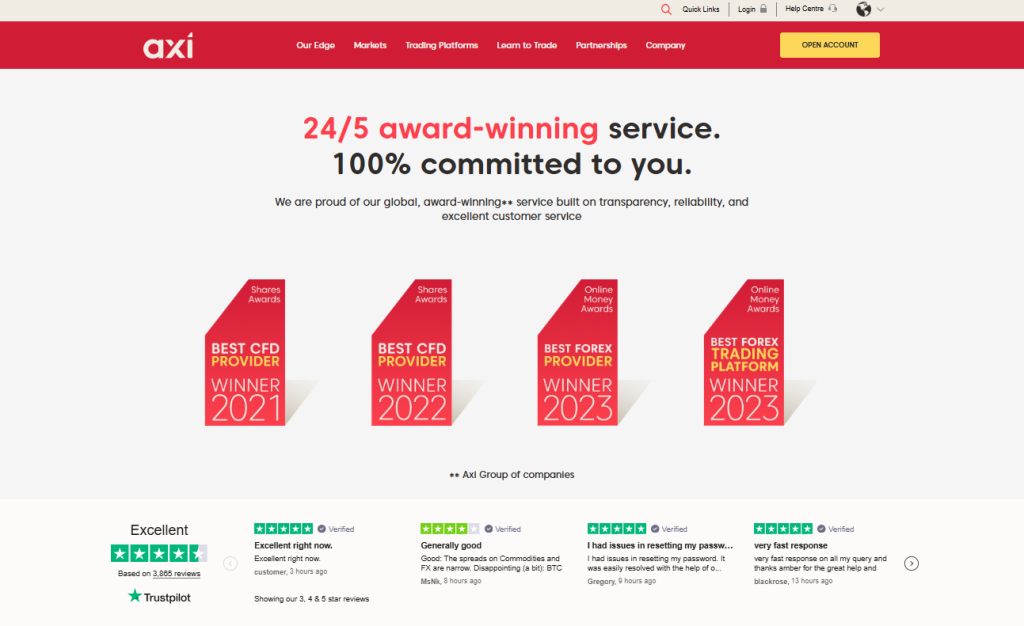

Award-Winning Service

When reliability and personal service matter, traders turn to Axi. With a global team speaking your language, dedicated account managers, and award-winning 24/5 support, Axi makes sure every trader, anywhere, has the edge to succeed.

| Feature | Details | Benefit | Availability |

| Personalised Service | Dedicated Relationship Manager | Tailored trading support | All clients |

| Multilingual Support | 24/5 award-winning help | Local language assistance | 14 languages |

| Global Presence | Offices in 8 regions | Local expertise worldwide | 100+ countries |

| Low Trading Costs | No setup or transaction fees | More to trade with | All account types |

Frequently Asked Questions

What makes Axi’s customer support award-winning?

Axi offers 24-hour multilingual support whenever markets are open. From dedicated Relationship Managers to live chat and local offices in eight regions, Axi combines personal service with global reach for responsive, trusted help.

How does Axi personalise the trading experience?

Every trader is different – that’s why Axi connects clients with a Relationship Manager from day one. They ensure traders have the right tools, resources, and account type to match their experience and goals, at a low cost.

Our Insights

Axi backs its global reputation with personalised service, low trading costs, and multilingual support available 24/5. For traders who want reliability, local expertise, and a broker that truly cares, Axi consistently delivers award-winning service.

★★★★ | Minimum Deposit: $5 Regulated by: ASIC, FCA, DFSA, VFSC Crypto: Yes |

Axi Select

Axi Select is Axi’s unique capital allocation program, giving traders the chance to access funding up to USD 1 million. It’s designed to help serious traders scale their skills and profit potential through a structured, transparent pathway with no signup costs.

| Feature | Details | Requirement | Benefit |

| Maximum Funding | Up to $1 million USD | Six-stage progression | Higher capital access |

| Edge Score | Min. 50 to qualify | Measures skill/risk | Unlock more funding |

| Minimum Deposit | $500 USD | 20 closed trades needed | Easy to get started |

| Profit Sharing | Up to 90% | Depends on stage level | Higher take-home profits |

Frequently Asked Questions

What is the Edge score in Axi Select?

The Edge score is a unique measure that tracks your trading skill, risk control, and consistency. The higher your score, the more funding you can unlock through Axi Select’s six stages, with profit shares reaching up to 90%.

How can traders join Axi Select?

Joining Axi Select is free and simple. Traders place at least 20 trades, reach an Edge score of 50 or more, and deposit a minimum of USD 500 to qualify for funding starting at USD 5,000, with a clear path to $1 million USD.

Our Insights

Axi Select offers a compelling, cost-free way for ambitious traders to prove their skill and trade with serious capital. With profit sharing up to 90% and advanced analytics to grow your Edge score, Axi Select supports real traders chasing real growth.

★★★★ | Minimum Deposit: $5 Regulated by: ASIC, FCA, DFSA, VFSC Crypto: Yes |

Trading Platforms and Software

Axi provides versatile trading software designed for every trading style. Whether you prefer to copy top traders with Axi Copy Trading or chart your path with MetaTrader 4, you’ll benefit from trusted platforms, powerful tools, and flexible access.

Axi Copy Trading

Axi Copy Trading lets you discover top traders worldwide and automatically copy their trades via an easy-to-use mobile app. This modern approach allows you to learn from experienced traders while managing risk and exploring new markets effectively.

| Feature | Details | Requirement | Benefit |

| Copy Top Traders | Access proven trader strategies | MT4 account linked | Learn by copying experts |

| Flexible Risk Control | Adjust lot size and risk level | Personal risk settings | Stay in control of your trades |

| Supported Markets | Forex, Shares, Indices, Crypto | Minimum funding needed | Broad trading opportunities |

| Powered by Pelican | FCA-regulated partnership | Axi Copy Trading app | Trusted social trading setup |

What is Axi Copy Trading?

Axi Copy Trading connects you with successful traders around the world. By linking your MT4 account, you can select traders to follow and automatically copy their positions in real time. This makes social trading straightforward and accessible.

Is there a minimum deposit for Axi Copy Trading?

To start using Axi Copy Trading, you must fund your MT4 account with an amount aligned to the strategies and lot sizes of the traders you wish to copy. This helps your account copy trades accurately and manage positions effectively.

★★★★ | Minimum Deposit: $5 Regulated by: ASIC, FCA, DFSA, VFSC Crypto: Yes |

MetaTrader 4 (MT4)

MetaTrader 4 (MT4) remains the go-to platform for traders worldwide, offering powerful tools, real-time charts, and flexible access across devices. With Axi, you can trade over 150 products easily, enjoying top-tier spreads and no brokerage fees.

| Feature | Details | Devices Supported | Benefit |

| Market Coverage | 150+ assets Forex Indices Crypto | PC Mac iOS Android Browser | Trade anytime, anywhere |

| Tools & Indicators | Charts alerts EAs NOP calculator | Mobile Desktop versions | Stay ahead with advanced tools |

| Cost to Use | No brokerage fees on standard | Available for all Axi clients | Cost-effective trading solution |

| Execution Speed | Fast order execution with low spreads | MT4 platform with Autochartist | Greater confidence in your trades |

What makes MetaTrader 4 popular for traders?

MetaTrader 4 is known for its simple yet robust interface, real-time market data, custom indicators, and automated trading options. It suits both beginners and seasoned traders, offering flexibility and powerful tools for a wide range of trading strategies.

Can I use MT4 on my mobile and desktop?

Yes – MT4 works seamlessly on Windows, Mac, iOS, Android, and even directly in your web browser with WebTrader. This means you can monitor, modify, and execute trades on the go or from your desk, anytime.

★★★★ | Minimum Deposit: $5 Regulated by: ASIC, FCA, DFSA, VFSC Crypto: Yes |

Frequently Asked Questions

What is Axi Copy Trading and how does it work?

Axi Copy Trading helps you automatically mirror the trades of proven top traders worldwide. Simply link your MT4 account, choose the traders to follow, set your risk, and let the app replicate trades in real-time.

Why do traders choose MetaTrader 4 with Axi?

MetaTrader 4 is globally trusted for its live pricing, robust charting tools, and custom indicators. With Axi, traders enjoy competitive spreads, no brokerage fees on standard accounts, and flexible access on desktop and mobile devices.

Our Insights

Axi’s combination of MetaTrader 4 and Axi Copy Trading provides something for every trader. From independent strategies to social trading, you get advanced tools, clear pricing, and trusted performance – all from an award-winning global broker.

★★★★ | Minimum Deposit: $5 Regulated by: ASIC, FCA, DFSA, VFSC Crypto: Yes |

Which Markets Can You Trade?

Axi opens the door to a wide selection of global markets, offering traders access to Forex, Shares, Indices, Commodities, and Cryptocurrencies. Whether you’re going long or short, Axi’s flexible environment confidently helps you trade your edge.

| Asset Class | Example Instruments | Profit on Rise or Fall | Leverage Available |

| Forex | Major/minor pairs | Yes | Yes |

| Shares (CFDs) | US UK EU stocks | Yes | Yes |

| Indices | Global market indices | Yes | Yes |

| Commodities | Oil Gold Silver | Yes | Yes |

| Cryptocurrencies | Popular crypto CFDs | Yes | Yes |

Frequently Asked Questions

What assets can I trade with Axi?

Traders at Axi can access a wide range of global markets, including major Forex pairs, popular shares, global indices, commodities, and cryptocurrencies – all designed to help you diversify your portfolio effectively.

Can I trade with leverage and low fees?

Yes, Axi offers leveraged trading across all instruments to help boost your potential returns. Additionally, there are no commission fees on deposits or withdrawals, although payment providers may apply their own charges.

Our Insights

From major currencies to top US, UK, and EU shares, Axi’s diverse markets and leveraged trading create a flexible environment for traders at every level, all backed by competitive pricing and no hidden commission fees on deposits and withdrawals.

★★★★ | Minimum Deposit: $5 Regulated by: ASIC, FCA, DFSA, VFSC Crypto: Yes |

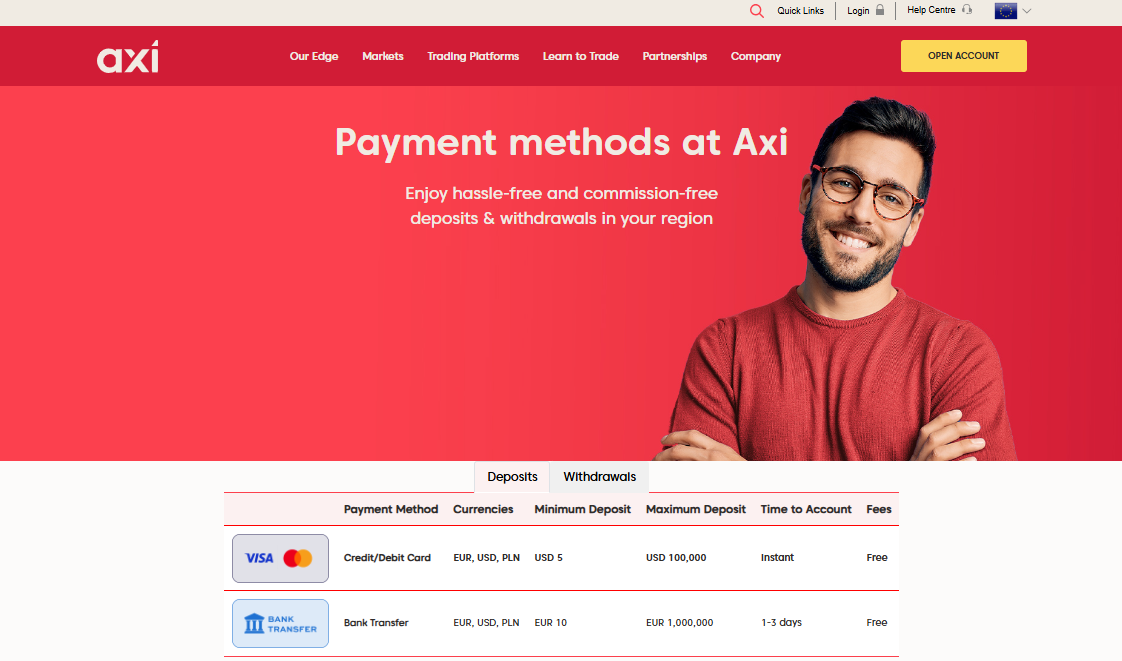

Deposit and Withdrawal

Axi supports a variety of local and global payment methods, enabling traders to fund and withdraw their accounts easily, often without commission fees. With flexible options and broad regional accessibility, managing your funds becomes straightforward and convenient.

| Method | Supported for Deposits | Supported for Withdrawals | Notes |

| Credit/Debit Card | Yes | Yes | Widely accepted globally |

| Neteller | Yes | Yes | Fast and secure |

| PayPal | Yes | Yes | Popular e-wallet option |

| Skrill | Yes | Yes | Convenient for digital payments |

| Bank Transfer | Yes | Yes | May take longer processing |

| Cryptocurrency | Yes | Yes | Not available to some retail clients |

Frequently Asked Questions

What payment methods does Axi support for deposits and withdrawals?

Axi accepts a broad range of payment options, including credit/debit cards, Neteller, PayPal, Skrill, bank transfers, and cryptocurrencies, thus ensuring convenient access for traders worldwide.

Are there any fees for deposits or withdrawals?

Most deposits and withdrawals with Axi are commission-free, though certain payment providers may charge fees. Cryptocurrency CFDs are restricted in some regions for retail investors.

Our Insights

Axi’s flexible and extensive payment methods cater to traders globally, providing mostly commission-free deposits and withdrawals. This ease of fund management complements its competitive trading environment.

★★★★ | Minimum Deposit: $5 Regulated by: ASIC, FCA, DFSA, VFSC Crypto: Yes |

★★★★ | Minimum Deposit: $5 Regulated by: ASIC, FCA, DFSA, VFSC Crypto: Yes |

Educational Resources

Axi offers an extensive range of free online trading resources designed to boost skills for traders of all levels. From expert-led courses and webinars to demo accounts and market analysis, traders gain the knowledge and tools needed to trade smarter and with confidence.

| Resource Type | Description | Access | Benefits |

| Trading Courses | Online modules covering basics to advanced | Free via Axi Academy | Structured learning |

| Demo Account | $50,000 virtual funds for practice | Free, unlimited with live account | Risk-free real-market simulation |

| Webinars Workshops | Live sessions with market experts | Scheduled regularly | Real-time tips and analysis |

| eBooks Guides | Downloadable expert written materials | Free downloads | Learn at your own pace |

| Market Insights | Daily news analysis and expert commentary | Online blog and insights page | Stay updated with market trends |

| Personalised Support | Dedicated account managers and 24/5 multilingual support | Available on request | Tailored help whenever needed |

Frequently Asked Questions

What educational resources does Axi provide for traders?

Axi offers free trading courses, tutorial videos, expert market insights, downloadable eBooks, and live webinars to help traders enhance their skills and market understanding.

Can I practice trading without risking real money?

Yes, Axi provides a free demo account loaded with $50,000 in virtual funds, enabling traders to practice strategies in a risk-free environment that mirrors live market conditions.

Our Insights

Axi’s comprehensive education suite, combined with a risk-free demo account and multilingual support, equips traders with essential knowledge and practical tools to develop effective trading strategies confidently.

★★★★ | Minimum Deposit: $5 Regulated by: ASIC, FCA, DFSA, VFSC Crypto: Yes |

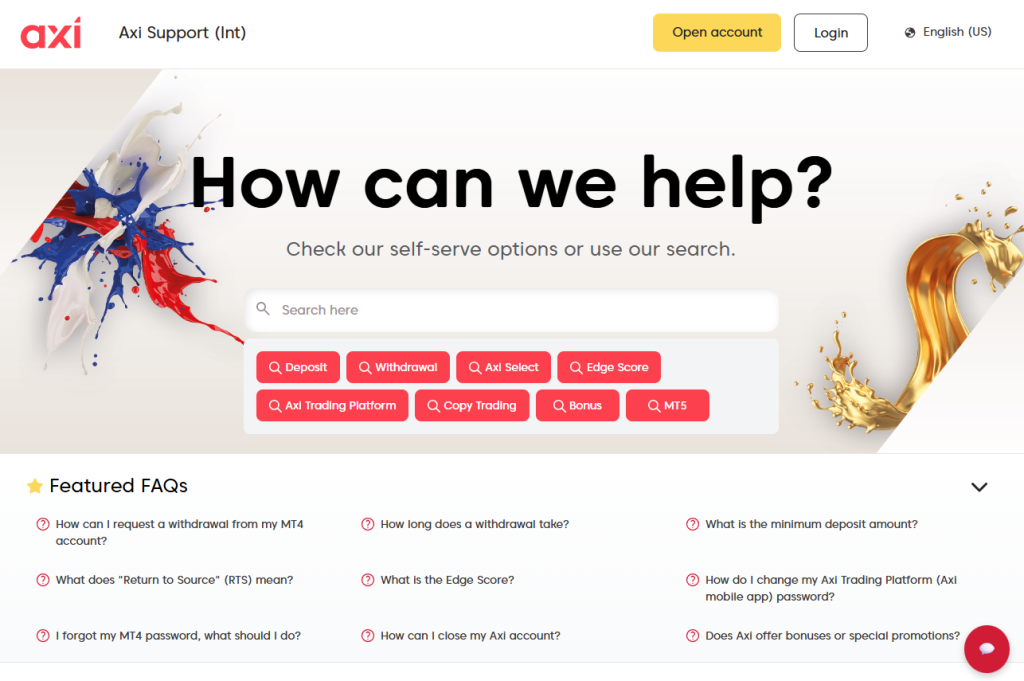

Customer Support

Axi offers a well-organized support system combining self-service tools and detailed FAQs that cover essential trading topics such as deposits, withdrawals, account management, trading platforms, and unique features like Edge Score and Axi Select. This structure enhances trader confidence and ease of access to vital information.

Frequently Asked Questions

How can I request a withdrawal from my MT4 account?

To request a withdrawal, log into your MT4 account via Axi’s platform, navigate to the withdrawal section, complete the necessary forms, and submit your request. Processing times may vary depending on your payment method and region.

What is the Edge Score, and how does it impact my trading?

The Edge Score is a personalized metric used by Axi Select to evaluate trading performance based on skill, consistency, risk, and experience. A higher Edge Score improves eligibility for increased funding and access to advanced trading stages.

Our Insights

Axi’s support system stands out for its clarity and depth, providing traders with comprehensive resources, responsive customer service, and useful educational content that simplifies complex trading concepts and promotes informed decision-making.

★★★★ | Minimum Deposit: $5 Regulated by: ASIC, FCA, DFSA, VFSC Crypto: Yes |

Insights from Real Traders

⭐⭐⭐⭐

I’ve been trading with Axi for over a year now, and I’m impressed by their fast execution speeds and competitive spreads. Additionally, the support team is always responsive and helpful whenever I have questions. Their educational resources have truly helped me grow as a trader.

Sarah

⭐⭐⭐⭐⭐

Axi offers an easy-to-use platform with plenty of advanced features. As someone new to trading, the demo account and tutorial videos were invaluable. Moreover, their multilingual support made everything much smoother. Highly recommend for traders at any level.

David

⭐⭐⭐⭐⭐

What sets Axi apart for me is the Axi Select funding program. Indeed, it’s a fantastic opportunity for traders to access capital and grow without big upfront risks. Additionally, the Edge Score system is a smart way to track performance and improve. Overall, Axi is a trustworthy broker with great technology.

Kate

★★★★ | Minimum Deposit: $5 Regulated by: ASIC, FCA, DFSA, VFSC Crypto: Yes |

Customer Reviews and Trust Scores

Axi has garnered a solid reputation among traders, reflected in its ratings across various review platforms. While the majority of feedback is positive, some concerns have been raised regarding withdrawal processes; however, these issues are generally addressed promptly by customer support.

Customer Ratings Overview

| Platform | Rating (5) | Reviews Count | Notes |

| Trustpilot | 4.4 | 3,865 | High praise for support and reliability |

| ForexPeaceArmy | Mixed | N/A | Some complaints about withdrawal issues |

| Reviews.io | 4.5 | N/A | Positive feedback on customer service |

Axi’s Trustpilot rating of 4.4 out of 5 stars, based on over 3,800 reviews, reflects strong customer satisfaction. Users particularly praise the efficient customer support and reliable services. Although some have experienced withdrawal delays, Axi’s support team responds promptly to resolve these concerns.

★★★★ | Minimum Deposit: $5 Regulated by: ASIC, FCA, DFSA, VFSC Crypto: Yes |

Employee Insights on Working for Axi

Axi is recognized as a favorable employer within the forex industry, offering competitive salaries and flexible working arrangements. Moreover, employee reviews generally highlight a positive work environment; however, some note areas where improvements could further enhance the overall experience.

| Category | Rating (5) | Highlights |

| Overall Satisfaction | 3.8 | Good work-life balance and flexibility |

| Compensation | 4.0 | Above industry standards |

| Career Growth | 3.6 | Opportunities for advancement |

| Management | 3.5 | Mixed feedback on leadership |

★★★★ | Minimum Deposit: $5 Regulated by: ASIC, FCA, DFSA, VFSC Crypto: Yes |

What Real Traders Want to Know about Axi

Q: What is the minimum deposit required to open an Axi account? – John M, South Africa

A: Axi does not require a minimum deposit to open an account, allowing traders to start with any amount they choose.

Q: How long does it take to verify my account and receive login details? – Sarah L, United Kingdom

A: Account verification typically takes 1–3 business days after submitting all required documents.

Q: What trading platforms can I use with Axi? – Ahmed K, United Arab Emirates

A: Axi offers MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary Axi Trading Platform.

Q: Can I trade micro lots with Axi? – Maria G, Spain

A: Yes, Axi allows trading in micro (1,000 units), mini (10,000 units), and standard lots.

Q: Does Axi offer bonuses or promotions? – David W, Australia

Seamless Trading Experience with Great Tools.

A: Axi occasionally offers promotions; details can be found on their official website.

★★★★ | Minimum Deposit: $5 Regulated by: ASIC, FCA, DFSA, VFSC Crypto: Yes |

Pros and Cons

| ✓ Pros | ✕ Cons |

| Axi is regulated by top-tier agencies | Only MetaTrader 4 is available |

| Axi provides standard, professional, and advanced accounts | Axi does not have a proprietary trading platform |

| Axi supports the use of MetaTrader 4 across devices | Crypto withdrawals are not available |

| Users can trade forex and CFDs on equities, indices, commodities, and Crypto | Axi restricts customers from the United States and other regions |

You might also like:

In Conclusion

Axi is a well-regulated trading broker, offering a range of services suitable for both beginner and professional traders. Additionally, Axi offers both local offices in six locations and extensive multilingual customer support, including dedicated phone lines. Local Offices are available in:

- 🇦🇺 Australia

- 🇬🇧 United Kingdom

- 🇨🇾 Cyprus (EU)

- 🇦🇪 United Arab Emirates

- 🇻🇺 Vanuatu

- 🇻🇨 St Vincent and the Grenadines

Together, these offices and local teams show how Axi delivers truly comprehensive, multilingual support for traders worldwide.

Faq

To withdraw funds, log in to your MT4 account, go to the ‘Funds’ section, and choose ‘Withdraw’. Then, follow the on-screen prompts to complete your withdrawal request smoothly.

The Edge Score evaluates your trading performance, offering valuable insights to help you refine and enhance your trading strategies effectively.

In the Axi Trading Platform, open the ‘Settings’ menu, select ‘Account,’ then choose ‘Change Password’ and follow the given instructions to update your password.

Use the ‘Forgot Password’ option on the MT4 login screen to reset your password through your registered email address.

To close your Axi account, contact their customer support. Make sure you have closed all open positions and withdrawn any remaining funds before starting the closure process.

Yes, Axi offers MetaTrader 5 (MT5) accounts to traders in select regions. If MT5 is available in your country, you can open an MT5 account during the onboarding process or by logging into the Axi Client Portal and selecting “Create New Account” to choose MT5.

Slippage occurs when a trade is executed at a different price than expected, often due to market volatility. Consequently, traders may experience price differences during fast-moving markets.

- Overview

- Minimum Deposit and Account Types

- How To Open an Account

- Fees, Spreads, and Commissions

- Safety and Security

- Axi Cybersecurity

- Lightning-Fast Execution and Low-Cost Trading

- Award-Winning Service

- Axi Select

- Trading Platforms and Software

- Which Markets Can You Trade?

- Deposit and Withdrawal

- Educational Resources

- Customer Support

- Insights from Real Traders

- Customer Reviews and Trust Scores

- Employee Insights on Working for Axi

- What Real Traders Want to Know about Axi

- Pros and Cons

- In Conclusion