CMC Markets Review

- Overview

- CMC Markets Visual, Video Overview

- Ways to Trade with CMC Markets

- How to Open an Account with CMC Markets

- Trading and Non-Trading Fees, Spreads, and Commissions

- Markets available for Trade

- Trading Platforms and Tools

- Education and Resources

- Customer Support

- Insights from Real Traders

- Customer Support and Trust Scores

- Employee Impressions of Working for CMC Markets

- Discussions and Forums - What People Are Saying

- Pros and Cons

- In Conclusion

CMC Markets can be summarised as a trustworthy and well-regarded entity within the online financial trading arena. It has a global presence in crucial financial hubs like Australia and a trust score of 99 out of 100.

★★★★★ | Minimum Deposit: $0 Regulated by: BaFin, FCA, ASIC, MAS, FMA, IIROC, DFSA Crypto: Yes |

Overview

CMC Markets stands out with over 35 years of experience, robust technology, tight spreads, and advanced tools for CFD traders. Backed by award-winning platforms and a client-first approach, it attracts traders globally seeking quality execution and insight.

Frequently Asked Questions

Why do traders choose CMC Markets for CFDs?

Many traders prefer CMC Markets because of its competitive spreads starting from 0.0 pips on major FX pairs, micro lot trading options, and an extensive range of over 12,000 instruments. Moreover, its focus on technology and client support adds extra value.

How does CMC Markets support its clients?

CMC Markets prioritises clients by providing 24/5 dedicated support, best-in-class analysis, and an award-winning trading environment. The broker sets high standards in transparency and, furthermore, in service quality to ensure traders feel supported at every stage.

Our Insights

With decades of expertise, advanced platforms like MetaTrader 4, and a clear commitment to quality and client care, CMC Markets remains a compelling option for traders who, moreover, want reliability, tight spreads, and responsive support.

★★★★★ | Minimum Deposit: $0 Regulated by: BaFin, FCA, ASIC, MAS, FMA, IIROC, DFSA Crypto: Yes |

CMC Markets Visual, Video Overview

Get a clear look at what sets CMC Markets apart through this engaging video overview. Discover how over 35 years of experience, advanced trading technology, competitive spreads, and client-focused service come together to support traders in achieving their financial goals.

★★★★★ | Minimum Deposit: $0 Regulated by: BaFin, FCA, ASIC, MAS, FMA, IIROC, DFSA Crypto: Yes |

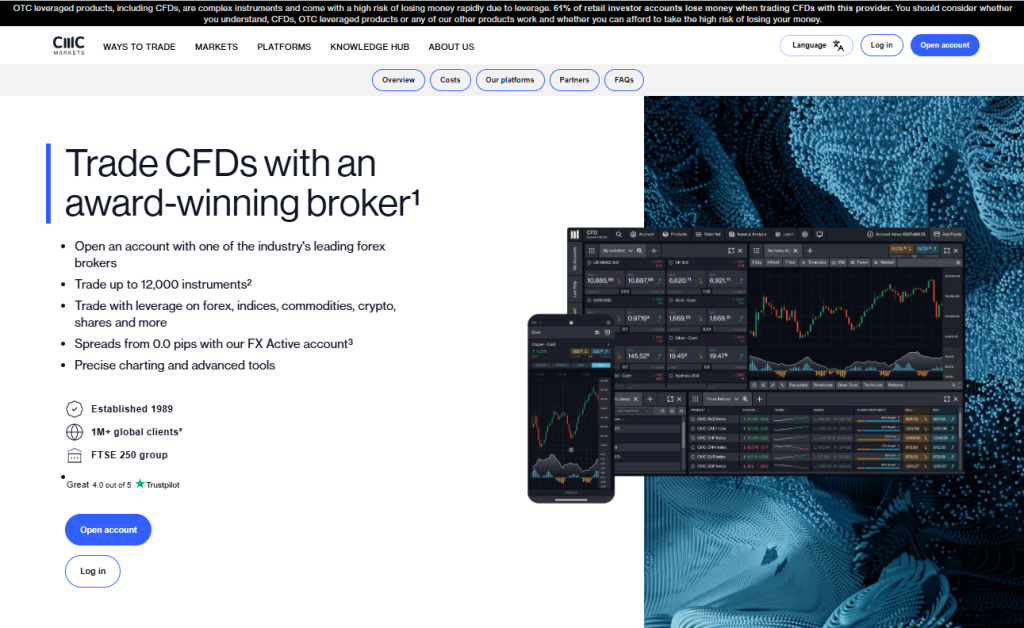

Ways to Trade with CMC Markets

CMC Markets offers traders access to over 12,000 instruments, tight spreads from 0.0 pips, and powerful platforms like MT4, MT5, TradingView, and its proprietary web platform. With 35+ years of experience, traders benefit from trusted execution, advanced tools, and robust support.

| Feature | Details |

| Founded | 1989 |

| Instruments Offered | 12,000+ |

| Minimum FX Spread | 0.0 pips (FX Active account) |

| Supported Platforms | MT4 MT5 TradingView Web Platform |

Frequently Asked Questions

What makes trading CFDs with CMC Markets appealing?

CMC Markets combines award-winning technology, competitive pricing, and exceptional reliability. Traders can go long or short on forex, indices, shares, and more, with tight spreads, high-speed execution, and trusted platforms to manage trades confidently.

How does CMC Markets ensure platform reliability and trade execution?

CMC Markets maintains London-based servers, automated execution, and an impressive 99.95% platform stability rate. Combined with tier-one liquidity and zero dealer intervention, traders experience near-instant fills and consistent pricing across all major asset classes.

Our Insights

With decades of industry experience, CMC Markets delivers a secure CFD trading environment, ultra-tight spreads, and flexible platforms for traders at every level. Their strong tech, fast execution, and broad market access make them a standout choice for active traders.

★★★★★ | Minimum Deposit: $0 Regulated by: BaFin, FCA, ASIC, MAS, FMA, IIROC, DFSA Crypto: Yes |

How to Open an Account with CMC Markets

1. Step 1: Visit the official CMC Markets website.

Navigate to the “Create Account” section and select your country of residence from the list provided.

2. Step 2: Enter a valid email address and create a secure password.

Check your email for a verification code and confirm your email address.

3. Step 3: Choose your account type and preferred base currency.

Fill in your personal information as requested (identity documents may be required).

4. Step 4: Wait for account approval from CMC Markets.

Once approved, make your first deposit into your trading account. After the deposit is processed, you’re ready to start trading on CMC Markets’ platforms.

★★★★★ | Minimum Deposit: $0 Regulated by: BaFin, FCA, ASIC, MAS, FMA, IIROC, DFSA Crypto: Yes |

Trading and Non-Trading Fees, Spreads, and Commissions

CMC Markets offers competitive trading fees with spreads starting from 0.0 pips on major forex pairs and access to over 12,000 instruments. Traders benefit from transparent commissions, overnight holding costs, and additional fees tailored by asset class and trade type.

| Fee Type | Details | Example Rates | Notes |

| Minimum FX Spread | From 0.0 pips on major forex pairs | 0.0 pips (FX Active account) | Includes 25% spread discount on others |

| Share CFD Commission | Varies by country % + fixed fee | UK: 0.10% + GBP 9.00 | Applies on entry and exit |

| Overnight Holding Cost | Daily charge on held positions | UK 100: 0.0198% charged | Depends on instrument and trade side |

| Maximum Leverage | Up to 1:200 for retail clients | 1:200 | Regulatory limits apply |

Frequently Asked Questions

How are CMC Markets’ spreads and commissions structured?

Spreads vary by instrument, with forex spreads as low as 0.0 pips on six major pairs. Share CFDs incur commissions based on country, typically 0.10% plus a fixed fee, ensuring traders pay fair costs relative to their trading volume.

What additional costs should traders expect beyond spreads?

Traders may face overnight holding costs charged daily at 5 pm New York time, plus potential fees for rollover, guaranteed stop-loss orders, market data, and inactivity, all depending on the instrument and trading behavior.

Our Insights

CMC Markets maintains transparent and competitive fee structures across various asset classes. With low spreads, tiered commissions, and clear disclosure of overnight and additional costs, it supports both active and casual traders with fair pricing.

★★★★★ | Minimum Deposit: $0 Regulated by: BaFin, FCA, ASIC, MAS, FMA, IIROC, DFSA Crypto: Yes |

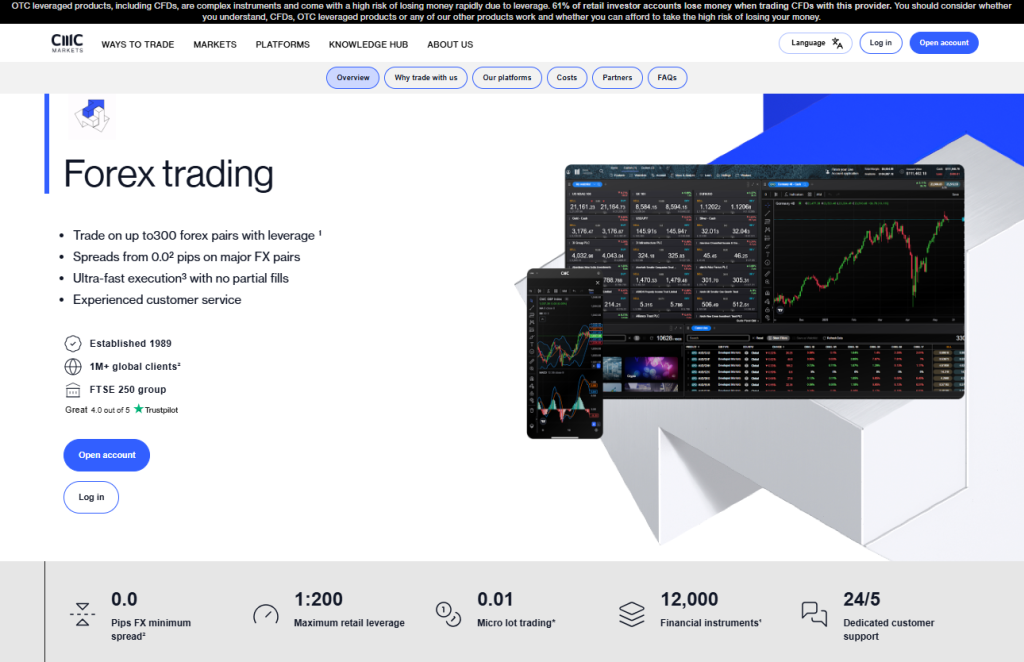

Markets available for Trade

CMC Markets empowers traders with access to thousands of global markets, including forex, indices, commodities, cryptocurrencies, shares, ETFs, and treasuries. With tight spreads, leading platforms, and exceptional support, it caters to diverse strategies and styles.

| Market Type | Instruments Available | Example Count | Notes |

| Forex | Major minor exotic pairs | 330+ | Spreads from 0.0 pips |

| Indices | Global index CFDs | 80+ | Covers US Europe, Asia |

| Commodities | Metals energy softs | 100+ | Trade metals, oil, gas |

| Shares,ETFs | CFD exposure to global stocks | Shares 9,000+ ETFs 1,000+ | Commission applies to shares |

| Treasuries | Government bond CFDs | ~50 | Includes gilts and bonds |

| Cryptocurrencies | Coins and crypto indices | ~19 cryptos index CFDs | All Crypto, Major/Emerging |

Frequently Asked Questions

Which markets can I trade through CMC Markets?

Traders can access over 12,000 instruments across major asset classes: forex with over 330 pairs, global indices, commodities, shares, ETFs, treasuries, and crypto CFDs. This wide range supports both traditional and modern trading opportunities.

Can I trade cryptocurrencies on CMC Markets?

Yes. CMC Markets offers CFDs on major cryptocurrencies like Bitcoin, Ethereum, and Litecoin, along with unique crypto indices such as All Crypto, Major Crypto, and Emerging Crypto, giving traders diversified exposure to the digital asset market.

Our Insights

AvaTrade is a top-tier broker that combines global regulation, user-friendly platforms, and trader protection tools. It’s well-suited for beginners and experienced traders alike, thanks to its strong educational resources and innovative features like AvaProtect.

★★★★★ | Minimum Deposit: $0 Regulated by: BaFin, FCA, ASIC, MAS, FMA, IIROC, DFSA Crypto: Yes |

Trading Platforms and Tools

CMC Markets delivers traders a choice of leading platforms: MetaTrader 4, MetaTrader 5, TradingView, and its proprietary Next Generation platform. Each one offers fast execution, powerful analysis tools, and trusted reliability for traders at every level.

Frequently Asked Questions

Which trading platforms can I choose with CMC Markets?

CMC Markets supports MetaTrader 4 and 5, TradingView, and its own award-winning web and mobile platform. Each platform includes advanced charting, real-time insights, automated trading capabilities, and mobile access to suit any trading style or strategy.

What makes CMC’s proprietary platform stand out?

CMC Markets’ proprietary platform combines integrated TradingView charts, advanced execution, client sentiment tracking, Morningstar research, and Reuters news. It’s designed for serious traders seeking precision, speed, and a user-friendly experience across desktop and mobile.

Our Insights

CMC Markets empowers traders to execute trades their way, offering multiple leading platforms with cutting-edge tools and features. Whether you prefer MT4, MT5, TradingView, or CMC’s platform, you get ultra-fast, secure, and flexible trading.

★★★★★ | Minimum Deposit: $0 Regulated by: BaFin, FCA, ASIC, MAS, FMA, IIROC, DFSA Crypto: Yes |

Education and Resources

The CMC Markets Knowledge Hub offers traders a practical library of guides and tutorials. From day trading strategies to risk management tools like GSLOs, it helps traders strengthen skills, understand markets, and make informed decisions.

Frequently Asked Questions

What topics can I learn about in the Knowledge Hub?

CMC Markets’ Knowledge Hub covers day trading, equity trading, indices, options, stop-loss orders, and platform features like one-click trading. Whether you’re new or experienced, it’s designed to sharpen your knowledge and trading edge.

Is the Knowledge Hub suitable for beginners?

Yes, beginners benefit from clear, structured content explaining trading basics, strategies, and tools step-by-step. From how equities and indices work to using stop-losses effectively, it’s a practical resource to build trading confidence.

★★★★★ | Minimum Deposit: $0 Regulated by: BaFin, FCA, ASIC, MAS, FMA, IIROC, DFSA Crypto: Yes |

Customer Support

CMC Markets operates a strong global presence with offices in major financial hubs such as London, Sydney, Toronto, Singapore, and more. The company’s experienced support teams are available Monday to Friday, helping clients with trading needs across various time zones.

| Location | Office Address | Phone Number | Contact Email |

| 🇬🇧 UK HQ | 133 Houndsditch, London | +44 (0)20 7170 8200 | [email protected] |

| 🇦🇺 Australia | Sydney, Barangaroo Ave | +61 1300 303 888 | [email protected] |

| 🇨🇦 Canada | Toronto, Bay Street | +1 866 884 2608 | [email protected] |

| 🇸🇬 Singapore | Central Boulevard Towers | +65 6559 6000 | [email protected] |

Frequently Asked Questions

Where are CMC Markets’ international offices located?

CMC Markets has offices in the UK, Bermuda, Australia, Canada, China (Shanghai and Beijing), New Zealand, Norway, Austria, Poland, Singapore, Spain, and the UAE. This global reach provides traders with local expertise and multilingual customer support.

How can I reach CMC Markets for help?

You can contact CMC Markets by phone or email. Their main support line is open Monday to Friday, with dedicated teams ready to assist. For country-specific help, you can also reach out to local offices during business hours.

Our Insights

CMC Markets’ worldwide network of offices and professional support teams highlights its commitment to serving traders wherever they are. From London to Singapore, clients benefit from reliable, regionally aware assistance and industry expertise.

★★★★★ | Minimum Deposit: $0 Regulated by: BaFin, FCA, ASIC, MAS, FMA, IIROC, DFSA Crypto: Yes |

Insights from Real Traders

⭐⭐⭐⭐

I’ve been trading with CMC Markets for over two years, and I’m impressed with their Next Generation platform. Execution is fast, charting tools are top-notch, and I appreciate how transparent their pricing is. Highly recommended!

James

⭐⭐⭐⭐⭐

CMC Markets offers an impressive range of instruments, which lets me diversify my strategies easily. Spreads are tight, and I enjoy the flexibility of using both MT4 and TradingView. Overall, a reliable broker I trust.

Michael

⭐⭐⭐⭐

As a relatively new trader, I’ve found CMC’s educational resources and webinars extremely helpful. Their customer service team has always answered my questions quickly and professionally. I feel more confident trading because of them.

Priya

★★★★★ | Minimum Deposit: $0 Regulated by: BaFin, FCA, ASIC, MAS, FMA, IIROC, DFSA Crypto: Yes |

Customer Support and Trust Scores

Third-party reviews highlight CMC Markets’ responsive customer service and reliable platforms, though some clients raise concerns about delays in transfers and occasional high fees. Overall, traders appreciate transparency and support, with mixed feedback on efficiency.

| Source | Trust Score (5) | Common Praise | Common Criticism |

| Trustpilot | 4.5 | Helpful support, smooth transfers | High fees for share trades |

| Reddit (r/ausstocks) | 4.3 | Zero-fee trades under $1k | App outages & login delays |

| Trustpilot (IE) | 4.7 | Reliable platform, demo access | Transfer delays flagged |

Our Insights

CMC Markets earns trust from many clients for responsive service and transparent trading. Yet, occasional ticket resolution delays and transfer issues highlight areas for improvement. Most traders recommend CMC, balancing competitive features with service limitations.

★★★★★ | Minimum Deposit: $0 Regulated by: BaFin, FCA, ASIC, MAS, FMA, IIROC, DFSA Crypto: Yes |

Employee Impressions of Working for CMC Markets

Glassdoor reviews paint a mixed picture: employees value supportive colleagues and work-life balance, but senior leadership and career progression receive lower marks. Cultural and compensation issues are frequently cited.

| Category | Rating (5) | Positive Aspects | Challenges Highlighted |

| Overall Rating | 2.2 | Friendly teams, culture | Senior leadership criticised |

| Culture Values | 2.1 | Work-life balance, camaraderie | Office mandates, senior disconnect |

| Compensation Benefits | 2.4 | Decent entry-level pay | Low salaries, limited raises |

| Opportunities | 2.4 | Some internal mobility | Few promotions, unclear paths |

Our Insights

Employees consistently praise supportive colleagues and a balanced environment, yet express frustration with senior management, limited remote work, and slow career advancement. While entry-level roles may be appealing, those seeking growth or flexible policies may face challenges.

★★★★★ | Minimum Deposit: $0 Regulated by: BaFin, FCA, ASIC, MAS, FMA, IIROC, DFSA Crypto: Yes |

Discussions and Forums – What People Are Saying

Forum discussions on platforms like Reddit underscore CMC Markets’ low-cost trades under $1k and strong ETF access. However, users also report occasional app reliability problems, login outages, fund transfers, and chart discrepancies.

| Platform | Common Praise | Frequent Complaints |

| Free trades under $1k, ETF access | Login/app instability and transfer delays |

|

| Good charting, basic tools | Chart data discrepancies noted |

|

| Mixed threads | Helpful support responses | Slow fund withdrawals, missing shares |

Our Insights

Online community feedback reveals CMC Markets appeals to cost-conscious traders, especially for ETFs and small trades. Yet negative chatter on tech issues and transfer inefficiencies suggests room for improvement. The overall sentiment, nevertheless, skews positive if you value pricing over service friction.

★★★★★ | Minimum Deposit: $0 Regulated by: BaFin, FCA, ASIC, MAS, FMA, IIROC, DFSA Crypto: Yes |

Pros and Cons

| ✓ Pros | ✕ Cons |

| Regulated in multiple regions | No US client acceptance |

| Wide range of markets | Inactivity fees may apply |

| Award-winning trading platforms | Share CFD commissions can add up |

| Competitive spreads and tools | Limited crypto range compared to some brokers |

| Strong research and education | No fixed spread accounts |

References:

In Conclusion

CMC Markets stands out as a trusted, global broker with decades of industry experience, competitive trading costs, and award-winning platforms. Its broad market access, advanced tools, and strong client support make it a reliable choice for traders seeking flexibility and professional-grade execution. CMC Markets has offices in the:

- 🇬🇧 UK

- 🇧🇲 Bermuda

- 🇦🇺 Australia

- 🇨🇦 Canada

- 🇨🇳 China (Shanghai and Beijing)

- 🇳🇿 New Zealand

- 🇳🇴 Norway

- 🇦🇹 Austria

- 🇵🇱 Poland

- 🇸🇬 Singapore

- 🇪🇸 Spain

- 🇦🇪 The UAE

This global reach provides traders with local expertise and multilingual customer support.

Faq

No, CMC Markets does not have a set minimum deposit requirement, allowing you to invest in what you are comfortable with.

Withdrawal timeframes at CMC Markets vary based on the method utilized, with bank wire transfers normally taking 1 to 2 working days and credit/debit card withdrawals processing in the same period.

They provide competitive prices for forex and CFDs regarding spreads and commissions. Furthermore, CMC Markets charges a 10 GBP inactivity fee, currency conversion fees of 0.5%, and withdrawal fees of 15 GBP on international bank wire.

CMC Markets does not need a minimum deposit to start a trading account; nevertheless, traders must ensure they have enough funds to satisfy the margin requirements of their intended transactions.

Yes, CMC Markets is regarded as a safe broker, as it is licensed by top-tier regulators such as the FCA in the United Kingdom. To secure the information and assets of traders, the business implements strong security measures like as segregated client money and SSL encryption.

- Overview

- CMC Markets Visual, Video Overview

- Ways to Trade with CMC Markets

- How to Open an Account with CMC Markets

- Trading and Non-Trading Fees, Spreads, and Commissions

- Markets available for Trade

- Trading Platforms and Tools

- Education and Resources

- Customer Support

- Insights from Real Traders

- Customer Support and Trust Scores

- Employee Impressions of Working for CMC Markets

- Discussions and Forums - What People Are Saying

- Pros and Cons

- In Conclusion