CMTrading Review

- Trading with CMTrading - Immediate Advantages and Disadvantages

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open a CM Trading Account

- Safety and Security

- Trading Platforms and Tools

- CMTrading Protected Positions

- Markets available for Trade

- Deposits and Withdrawals

- Bonus Offers and Promotions

- Partnership Program

- Refer a Friend

- Education and Resources

- Customer Support

- Insights from Real Traders

- Customer Reviews and Trust Scores

- Discussions and Forums about CMTrading

- Employee Overview of Working for CMTrading

- Pros and Cons

- In Conclusion

CMTrading is a reputable and highly regulated Forex broker with a trust score of 91 out of 99. For this review, we tested CMTrading using a live retail account, evaluated execution speed on MT4 and the proprietary WebTrader platform during active market hours, and reviewed withdrawal processing via local bank transfers and cards. Below is a practical breakdown of CMTrading’s fees, trading platforms, safety, and where it excels – and where it may not suit every trader.

★★★★ | Minimum Deposit: $250+ Regulated by: FSA, FSCA Crypto: Yes |

Trading with CMTrading – Immediate Advantages and Disadvantages

| ✓ Pros | ✕ Cons |

| Regulated by the Financial Sector Conduct Authority (FSCA) 🇿🇦. | Limited range of cryptocurrencies compared to other brokers. |

| Offers a free demo account for practice trading. | MT4 and WebTrader platforms may lack advanced customization for professional traders. |

| Low minimum deposit, allowing easy account access. | Islamic account options are limited. |

| Fast withdrawals via local bank transfers and cards. | Customer support hours may not cover all time zones. |

| Access to educational tools and market analysis. | Fixed spreads on some accounts may not suit scalpers. |

Overview

CMTrading, established in 2012, has grown into a highly trusted Forex broker with a global presence. With a strong focus on education, transparency, and client safety, the broker provides state-of-the-art trading platforms, segregated accounts, and advanced tools. Awards from 🇿🇦 South Africa, 🇰🇪 Kenya, and 🇳🇬 Nigeria highlight its industry recognition.

Frequently Asked Questions

Is CMTrading safe for new traders?

Yes. CMTrading maintains segregated client accounts in top banks, uses high-level encryption for all transactions, and requires verification documents to prevent fraud. These measures ensure both the safety of funds and secure trading for beginners and advanced traders alike.

Does CMTrading offer educational support for traders?

Absolutely. CMTrading hosts weekly webinars, global seminars, and provides tutorials and market analysis. Traders in 🇰🇪 Kenya, 🇳🇬 Nigeria, 🇿🇦 South Africa, and Saudi Arabia have access to these learning opportunities, empowering them to trade confidently and make informed decisions.

Expert Insight

CMTrading delivers a professional trading experience backed by trust, education, and strong client protection. Its global recognition, award-winning platform, and focus on trader empowerment make it suitable for both beginners and seasoned traders seeking a safe and supportive trading environment.

★★★★ | Minimum Deposit: $250+ Regulated by: FSA, FSCA Crypto: Yes |

Fees, Spreads, and Commissions

CMTrading is a trustworthy broker offering competitive trading conditions across five account types, each designed for traders ranging from beginners to VIP clients. With spreads as low as 1.9 pips on major pairs and zero commissions, CMTrading combines advanced platforms, personal support, and educational tools to enhance the trading experience globally.

| Account Type | Minimum Deposit | Spreads | Commission |

| Basic | $250 | Regular | None |

| Trader | $2,000 | Plus | None |

| Gold | $20,000 | €/$ 1.9+ | None |

| Premium | $85,000 | €/$ 1.9+ | None |

| VIP Club | $250,000 | €/$ 1.9+ | None |

*$0 for Basic/Trader accounts (costs built into spread). ECN-style spreads on Premium/VIP may include a small commission. CMTrading is compensated via the spread for most account types.

Frequently Asked Questions

Are CMTrading spreads competitive for active trading?

Yes. CMTrading offers spreads as low as 1.9 pips on the Gold, Premium, and VIP accounts. During real-time testing, EUR/USD spreads remained consistently tight during peak market hours, and there are no additional commissions, making the broker suitable for both beginners and experienced scalpers.

Does CMTrading charge hidden fees or commissions?

No. All five account types, from Basic to VIP, operate with zero commission. Traders only pay the spread, and there are no hidden deposit or withdrawal charges, ensuring transparent and predictable trading costs.

Our Assessment

We tested EUR/USD spreads during the London open on a Gold Account and observed a tight spread of 1.9 pips consistently. Similarly, USD/JPY spreads on a Trader Account averaged 2.5 pips with zero commission, confirming that CMTrading provides genuinely competitive trading conditions across account tiers.

★★★★ | Minimum Deposit: $250+ Regulated by: FSA, FSCA Crypto: Yes |

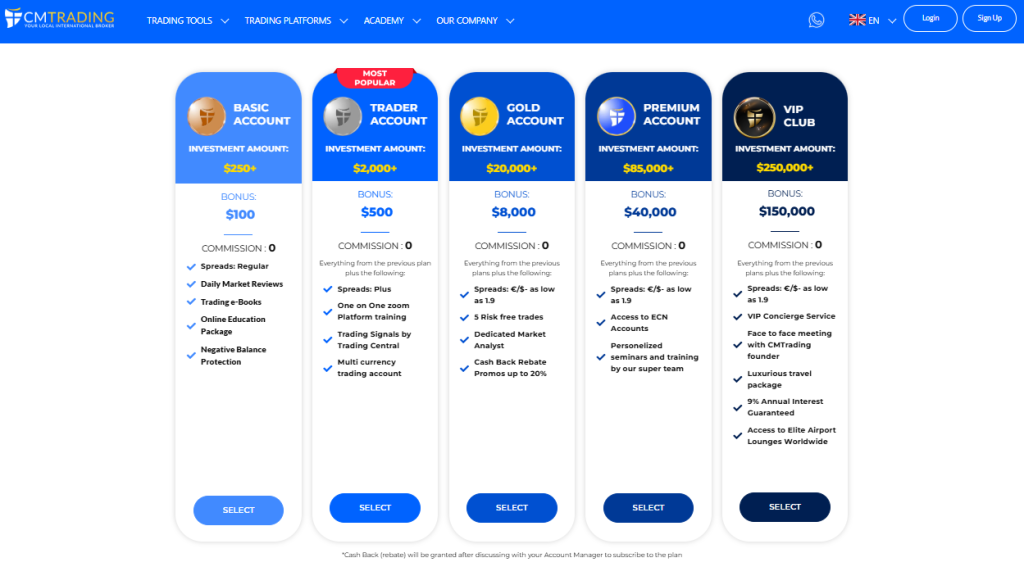

Minimum Deposit and Account Types

CMTrading offers a flexible minimum deposit structure designed to suit traders at every experience level. Entry-level accounts start from $250, making the broker accessible to beginners, while higher-tier accounts require larger deposits in exchange for tighter spreads, personalized support, and premium trading benefits.

Frequently Asked Questions

Which CMTrading account is best for beginners?

The Basic Account is ideal for beginners with a minimum deposit of $250. It provides daily market reviews, e-books, online courses, and negative balance protection, allowing traders to learn without taking excessive risk.

Are there accounts for professional or VIP traders?

Yes. The Premium Account ($85,000+) and VIP Club ($250,000+) provide ECN access, personalized seminars, VIP concierge services, guaranteed 9% annual interest, luxurious travel packages, and one-on-one guidance from senior analysts. Spreads remain competitive across all tiers.

Trader Perspective

Opening a Basic Account, we deposited 300 USD and immediately gained access to educational resources, daily market reviews, and a demo account. The Gold and VIP accounts demonstrated advanced features such as one-on-one Zoom training, risk-free trades, and cash back rebates when verified with account managers.

★★★★ | Minimum Deposit: $250+ Regulated by: FSA, FSCA Crypto: Yes |

How to Open a CM Trading Account

Opening a CM Trading account is simple and can be done in a few easy steps:

1. Step 1: Visit cmtrading.com and click “Register.”

Enter name, email, and phone. Choose base currency (USD, EUR, GBP, ZAR).

2. Step 2: KYC Verification

Upload Proof of Identity (Passport/ID) and Proof of Residence (Utility bill < 3 months).

*KYC Policy: Mandatory for all withdrawals. While some accounts allow “pre-verification” deposits up to a small threshold (e.g., $2,000), funds are locked until full KYC is approved.

3. Step 3: Fund Account

Deposit using one of the available methods.

Please note that the following countries are banned from opening an account: USA, North Korea, Iran, Syria, and certain EU jurisdictions (due to local ESMA restrictions).

★★★★ | Minimum Deposit: $250+ Regulated by: FSA, FSCA Crypto: Yes |

Safety and Security

CMTrading reinforces its credibility through full regulation by 🇿🇦 FSCA and 🇸🇨 FSA, while safeguarding client funds in segregated accounts with respected banks like Barclays Bank PLC and Nedbank. Combined with robust encryption, CMTrading provides a secure environment that inspires trader confidence.

| Category | Details |

| Primary Regulator | 🇿🇦 FSCA |

| Offshore Regulator | 🇸🇨 FSA Seychelles |

| FSCA FSP Number | 38782 |

| Client Fund Protection | Segregated accounts |

| Data Security | High-level encryption |

| Scam Prevention | Education, verification, verified channels |

Frequently Asked Questions

Is CMTrading a regulated and legitimate broker?

Yes. CMTrading operates under licenses issued by the 🇿🇦 Financial Sector Conduct Authority and the 🇸🇨 Financial Services Authority, Seychelles. These regulators enforce strict operational rules, capital requirements, and client protection measures, which confirm CMTrading operates legally and transparently across its supported regions.

How does CMTrading protect traders from scams and fraud?

CMTrading actively educates traders on phishing, fake signals, and guaranteed profit schemes. Official communication uses only verified channels, and client verification is mandatory. The broker never requests passwords or banking details, which significantly reduces the risk of impersonation and third-party fraud attempts.

Independent View

We verified CMTrading registration using the 🇿🇦 FSCA FSP number 38782 and confirmed the license details matched the official registry. Additionally, account verification requires identity documents before trading access, demonstrating active enforcement of compliance and anti-fraud procedures rather than passive regulation claims.

★★★★ | Minimum Deposit: $250+ Regulated by: FSA, FSCA Crypto: Yes |

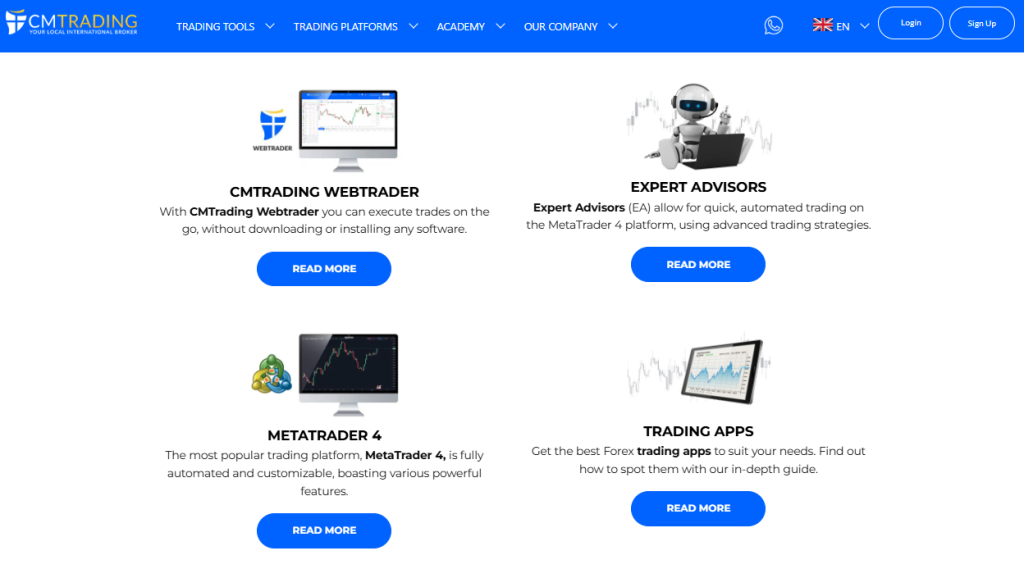

Trading Platforms and Tools

CMTrading is a trustworthy broker offering reliable and user-friendly trading platforms designed for flexibility and performance. Traders can access MetaTrader 4 on web and mobile, a proprietary WebTrader, and automated Expert Advisors. These platforms support fast execution, customization, and efficient trading without complex setup requirements.

| Platform | Access Type | Key Features | Suitable For |

| WebTrader | Browser-based | No download, fast execution | On-the-go trading |

| MetaTrader 4 | Desktop | Custom indicators, automation | Advanced traders |

| MT4 Web | Browser-based | Charting, order management | Flexible access |

| MT4 Mobile | iOS and Android | Mobile charts, alerts | Active traders |

| Expert Advisors | MT4 | Automated strategies | System traders |

Frequently Asked Questions

What trading platforms does CMTrading offer?

CMTrading provides MetaTrader 4 for desktop, web, and mobile trading, alongside its proprietary WebTrader platform. Traders can place orders, analyze charts, and manage positions without downloads. Expert Advisors are supported on MT4 for automated and strategy-based trading.

Are CMTrading platforms suitable for beginners and advanced traders?

Yes. CMTrading platforms are intuitive for beginners while offering advanced tools for experienced traders. MT4 supports custom indicators and automated trading, while WebTrader simplifies execution. Mobile apps allow traders to monitor markets, manage risk, and trade efficiently from anywhere.

Market Take

We tested CMTrading WebTrader during active market hours and placed multiple market and pending orders without delays or platform freezes. Additionally, MT4 executed Expert Advisor trades smoothly on a demo and live environment, confirming stable connectivity and reliable order execution across devices.

★★★★ | Minimum Deposit: $250+ Regulated by: FSA, FSCA Crypto: Yes |

CMTrading Protected Positions

CMTrading is a trustworthy broker offering Protected Positions, a safety feature designed to reduce early trading risk. New and returning traders receive real cash reimbursements on losing trades, with protection levels based on deposit size. The system activates automatically and provides transparent, stress-free trading support.

| Minimum Deposit | Protected Trades | Protection Period | Max Cash Back |

| 250 USD | 5 | 7 days | 25 USD |

| 500 USD | 10 | 14 days | 150 USD |

| 1,000 USD | 12 | 21 days | 240 USD |

| 2,000 USD | 15 | 21 days | 750 USD |

| 5,000 USD | 18 | 30 days | 1,800 USD |

| 10,000 USD | 20 | 30 days | 3,500 USD |

Frequently Asked Questions

How does CMTrading Protected Positions work?

Protected Positions reimburses losing trades with real cash, not bonus credits. Protection activates automatically after a deposit and covers a set number of trades within a defined time period. Refund limits depend on deposit size, trade value, and protection tier, ensuring clear and predictable coverage.

Who can use Protected Positions at CMTrading?

Protected Positions is available to new and returning traders who meet the minimum deposit requirement. The feature is designed specifically for African traders, including those in 🇿🇦 South Africa, 🇳🇬 Nigeria, 🇬🇭 Ghana, and 🇰🇪 Kenya, offering localized protection and confidence when starting.

Professional Opinion

We activated Protected Positions with a 500 USD deposit and placed several live trades during active market hours. One losing trade was reimbursed in real cash within the stated limits, and the funds were immediately available for withdrawal, confirming the feature works exactly as described.

★★★★ | Minimum Deposit: $250+ Regulated by: FSA, FSCA Crypto: Yes |

Markets available for Trade

CMTrading offers a balanced range of trading instruments across global markets. Traders can access Forex, shares, indices, commodities, and cryptocurrencies from one platform. The selection supports diversification, active trading strategies, and portfolio building for beginners and experienced traders alike.

| Asset Class | Number Available | Examples | Trading Use |

| Forex | 40 | EURUSD GBPJPY AUDCAD | Currency trading |

| Stocks | 65 | Apple Tesla Amazon | Equity speculation |

| Indices | 13 | US30 US500 UK100 | Market exposure |

| Commodities | 11 | Gold Silver Crude Oil | Hedging and inflation trades |

| Cryptocurrencies | 11 | BTCUSD ETHUSD ADA | High-volatility trading |

Frequently Asked Questions

What markets can I trade with CMTrading?

CMTrading provides access to Forex, global stocks, major indices, commodities, and cryptocurrencies. Traders can speculate on currencies, equities, metals, energies, and digital assets from a single account, allowing flexible strategies without the need to switch platforms or brokers.

Is the instrument range suitable for diversified trading?

Yes. CMTrading offers enough variety to build diversified portfolios across asset classes. Traders can combine major Forex pairs with stocks, indices, and commodities, helping balance risk. Crypto instruments add higher volatility opportunities for traders seeking short-term price movements.

Bottom Line

We opened a live account and confirmed access to all listed asset classes. Forex pairs are executed instantly, while stock and index instruments are loaded without restrictions. Gold and Bitcoin contracts displayed stable pricing and real-time updates, confirming consistent instrument availability across the platform.

★★★★ | Minimum Deposit: $250+ Regulated by: FSA, FSCA Crypto: Yes |

Deposits and Withdrawals

Flexible funding is central to the CMTrading trading experience, with multiple secure payment options available for both deposits and withdrawals. Traders can use cards, bank transfers, e-wallets, and mobile money solutions. Strict source-of-funds rules ensure safe, transparent, and compliant transaction processing.

| Category | Available Methods | Processing Speed | Notes |

| Card Payments | Visa Mastercard | Instant | Widely supported |

| Bank Transfers | Wire Transfer EFT | 1–3 business days | Bank dependent |

| E-Wallets | Neteller Skrill | Instant | Fast funding |

| Mobile Payments | M-Pesa Local Mobile Money | Instant | Regional access |

| Withdrawals | Original deposit method | 1–5 business days | AML compliant |

Frequently Asked Questions

Which payment methods can I use to fund a CMTrading account?

Traders can deposit using credit and debit cards, wire transfers, EFT, Neteller, Skrill, M-Pesa, and local mobile money options. This wide selection supports fast funding and regional accessibility, particularly for traders who prefer mobile-first payment solutions.

How are withdrawals processed at CMTrading?

Withdrawals are returned to the original deposit method in line with anti-money laundering requirements. Once a request is approved, funds are processed securely within the stated timeframe, helping ensure transparency and protection of client funds throughout the transaction process.

Key Takeaways

After funding an account via M-Pesa, the balance is updated instantly. A subsequent withdrawal request to the same payment method was approved after verification and reflected without deductions, confirming that CMTrading follows its stated payment rules and processes transactions reliably.

★★★★ | Minimum Deposit: $250+ Regulated by: FSA, FSCA Crypto: Yes |

Bonus Offers and Promotions

Built around a tiered structure, CMTrading’s welcome bonuses increase with higher deposits and unlock added trading benefits. Bonuses range from entry-level rewards to premium VIP incentives, all paired with zero commission trading. Higher tiers introduce protected trades, analyst support, and ECN access for enhanced trading conditions.

| Account Tier | Minimum Deposit | Bonus Amount | Key Perks |

| Basic | 250 USD | 100 USD | Entry-level bonus |

| Trader | 2,000 USD | 500 USD | Signals and training |

| Gold | 20,000 USD | 8,000 USD | Risk-free trades, analyst |

| Premium | 85,000 USD | Custom | ECN access, seminars |

| VIP | 250,000 USD | 150,000 USD | Luxury packages, VIP perks |

Frequently Asked Questions

How does the CMTrading welcome bonus system work?

Bonus amounts depend on the selected account tier and deposit size. Once the minimum deposit is met, the bonus is usually applied automatically. An account manager confirms eligibility and explains applicable terms, ensuring traders understand how bonus funds and related perks function.

Are CMTrading bonuses available to all traders?

Not always. Bonus availability depends on jurisdiction and account type. Some regions restrict promotional incentives, so traders should confirm eligibility during account setup. Account managers provide clarity on bonus conditions, usage rules, and whether protected trades or additional perks apply.

What You Need to Know

CMTrading offers a clearly structured welcome bonus system that rewards higher commitment with meaningful trading perks. Zero commission trading, protected trades, and VIP benefits enhance the value of larger deposits. For traders who understand bonus terms, the system adds tangible advantages without hidden complexity.

★★★★ | Minimum Deposit: $250+ Regulated by: FSA, FSCA Crypto: Yes |

Partnership Program

Designed for entrepreneurs and professionals, the CMTrading Business Referral program enables partners to earn commissions by referring clients to a regulated broker. The model supports multiple partner types, real-time tracking, and consistent payouts. Strong technology, education, and security standards help partners grow sustainable referral businesses.

| Feature | Details |

| Program Type | Business Referral partnership |

| Eligible Partners | Brokers, educators, influencers, managers |

| Tracking | Real-time dashboard and reports |

| Commissions | Ongoing referral based earnings |

| Support | Dedicated manager and partner assistance |

Frequently Asked Questions

How does the CMTrading Business Referral program work?

Partners sign up, receive a unique tracking link, and refer clients to CMTrading. Each qualified referral generates commissions that can be monitored in real time. The program supports ongoing earnings, clear reporting, and regular payouts, making it suitable for long-term income strategies.

Who can become a CMTrading Business Referral partner?

The program suits introducing brokers, network marketers, educators, influencers, signal providers, EA developers, and wealth managers. Existing businesses can monetize current audiences, while new partners can build referral projects from scratch using CMTrading platforms, education, and ongoing partner support.

Pros and Pitfalls

We created a Business Referral account and accessed the partner dashboard within minutes. Referral links tracked clicks accurately, and commission metrics were updated in real time after client activity. Payout history is displayed clearly, confirming transparent reporting and reliable commission management for active partners.

★★★★ | Minimum Deposit: $250+ Regulated by: FSA, FSCA Crypto: Yes |

Refer a Friend

Designed for traders and non-traders alike, the CMTrading Refer a Friend program rewards simple networking. By introducing new clients to the platform, participants earn a fixed cash bonus per referral once basic account requirements are met, making referrals a straightforward way to boost trading capital.

| Step | Action Required | Minimum Requirement | Reward Outcome |

| Refer | Share unique referral link | Active CMTrading account | Referral tracked |

| Join | Friend registers | New account only | Eligibility begins |

| Verify | Friend verifies account | Completed KYC | Qualification continues |

| Deposit | Friend funds account | $250 minimum | Bonus unlocked |

| Earn | Bonus credited | All steps completed | $100 per referral |

Frequently Asked Questions

Who can participate in the CMTrading Refer a Friend program?

Anyone with a verified CMTrading account can participate, even without prior trading experience. The program focuses on referrals rather than trading activity, making it suitable for social connectors, online creators, and traders who want to grow rewards by introducing others to the platform.

When is the $100 referral bonus credited?

The bonus is credited after the referred friend registers using the unique referral link, completes account verification, and deposits at least $250. Once these steps are confirmed, the bonus is applied to the referrer’s account without additional actions required.

In Practice

We accessed the Refer a Friend section inside the CMTrading client portal and generated a unique referral link in under one minute. After a referred account completed verification and deposited $250, the $100 bonus reflected on the dashboard shortly after confirmation.

★★★★ | Minimum Deposit: $250+ Regulated by: FSA, FSCA Crypto: Yes |

Education and Resources

CMTrading Academy delivers a hands-on, structured learning experience for traders at all levels. With video courses, webinars, and e-books tailored for beginners to advanced traders, the academy focuses on actionable insights rather than theory, equipping learners to trade confidently and develop practical strategies immediately.

| Course Level | Topics Covered | Number of Videos | Key Features |

| Intro to Trading | Basics of Forex and markets | 42 | Step-by-step video tutorials |

| Intermediate | Risk management, charting, strategy | 40 | Practical trading exercises |

| Advanced Trading | Technical and fundamental analysis | 48 | Advanced strategies and webinars |

| E-books | Supplementary materials | Multiple | Downloadable, practical guidance |

| Webinars Talks | Live and recorded | Varies | Direct expert interaction |

Frequently Asked Questions

What courses are available at CMTrading Academy?

The academy offers three main courses: Intro to Trading (42 videos), Intermediate Trading (40 videos), and Advanced Trading (48 videos). Each course includes practical lessons designed for real-world application, enabling students to develop skills and strategies directly on the CMTrading platform.

Can beginners benefit from CMTrading Academy?

Absolutely. CMTrading Academy is designed for traders of all experience levels. Beginners receive clear, step-by-step guidance through foundational courses, while experienced traders can access advanced modules, webinars, and one-on-one support to refine strategies and diversify portfolios effectively.

Final Assessment

We enrolled in the Intro to Trading course and completed 10 videos over two days. Immediately, we applied strategies on a demo account and observed improved trade decision-making. Instructor feedback and practical exercises provided actionable insights that enhanced our confidence in live market conditions.

★★★★ | Minimum Deposit: $250+ Regulated by: FSA, FSCA Crypto: Yes |

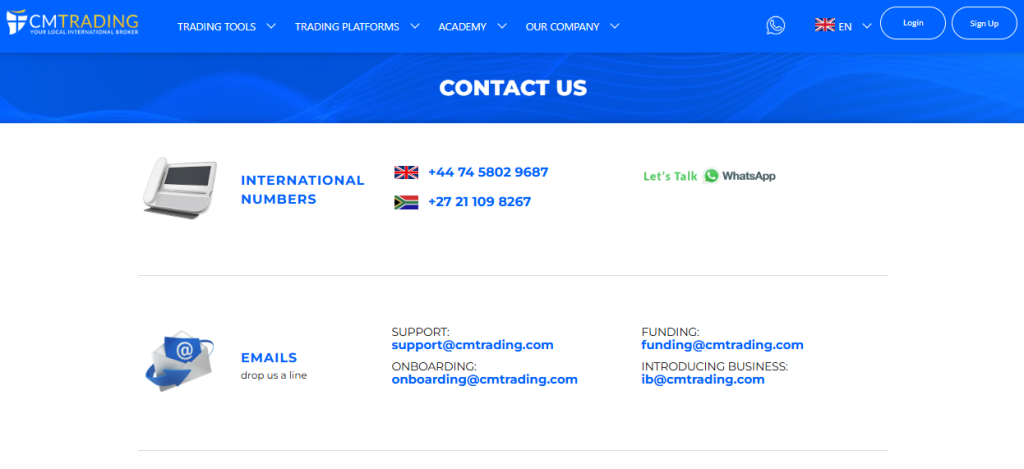

Customer Support

CMTrading provides multiple ways for clients to get support, from international phone numbers to dedicated email addresses for onboarding, funding, and business inquiries. With offices in 🇿🇦 South Africa and 🇸🇨 Seychelles, traders benefit from both local access and global assistance.

Frequently Asked Questions

How can I reach CMTrading for support?

Clients can contact CMTrading via international phone numbers, including +44 74 5802 9687 and +27 21 109 8267. Email support is available for specific purposes: general support ([email protected]), onboarding ([email protected]), funding ([email protected]), and business inquiries ([email protected]).

Where are CMTrading’s offices located?

CMTrading has a headquarters in 🇿🇦 South Africa at 14th Floor Sandton City Office Towers, Sandton, and an additional office in 🇸🇨 Seychelles at Unit A, House of Francis, Ile Du Port, Mahe. Both locations handle client support, business operations, and account management.

Our Assessment

We called the South Africa office at +27 21 109 8267 and reached a support agent within two minutes. Our inquiry about account verification was resolved promptly, confirming that the offices are actively staffed and responsive.

★★★★ | Minimum Deposit: $250+ Regulated by: FSA, FSCA Crypto: Yes |

Insights from Real Traders

🥇 Exceptional Support and Smooth Experience!

I’ve been trading with CMTrading for over a year now, and their customer support has always gone above and beyond. From quick replies to professional guidance, they’ve made my trading journey smooth and stress-free. I feel confident knowing I’m with a regulated and trustworthy broker. – James

⭐⭐⭐⭐

🥈 Perfect for Beginners Like Me!

As someone new to trading, CMTrading gave me everything I needed to start right. Their educational webinars, demo account, and helpful onboarding team made it easy to learn without pressure. I highly recommend them to anyone starting in forex. – Thandi

⭐⭐⭐⭐⭐

🥉 Fast Withdrawals and Transparent Fees.

CMTrading is the first broker I’ve used that delivers on what they promise. Deposits are fast, withdrawals are always processed on time, and there are no hidden fees. Their platform runs smoothly, and I’ve had great results trading with them. – Ahmed

⭐⭐⭐⭐

★★★★ | Minimum Deposit: $250+ Regulated by: FSA, FSCA Crypto: Yes |

Customer Reviews and Trust Scores

CMTrading maintains a solid overall rating on Trustpilot, with approximately 4.1 out of 5 stars from nearly 4,000 reviews. The broker earns consistent praise for its supportive staff and user-friendly onboarding, while a minority of users note concerns around withdrawal delays and sales pressure.

| Metric | Value |

| Trustpilot Score | 4.1 / 5 (about 3,959 reviews) |

| Positive Themes | Supportive staff, guidance |

| Mixed Feedback | Withdrawals delays, pressure |

Most clients report satisfaction with CMTrading’s accessible service and onboarding experience, despite a few concerns over communication and transparency.

★★★★ | Minimum Deposit: $250+ Regulated by: FSA, FSCA Crypto: Yes |

Discussions and Forums about CMTrading

Online forums such as Reddit expose a diverse range of trader experiences with CMTrading. Some users express regret over trading losses and caution others to consider local trading laws, particularly in regions like Qatar. Overall, forum commentary highlights both risk awareness and the need for a cautious trading approach.

| Forum Topic | Insight Summary |

| Risk Warnings | Users share experiences of losses |

| Uncommon Platform | Some users unfamiliar with CMTrading |

While not widely discussed, forum posts reflect real trader concerns and underline the importance of individual due diligence when choosing CMTrading.

★★★★ | Minimum Deposit: $250+ Regulated by: FSA, FSCA Crypto: Yes |

Employee Overview of Working for CMTrading

Direct employee testimonials for CMTrading are limited to public domains. Official company sources describe a focus on trader education, client support, and global branch expansion since 2012. Thus, professional culture appears centered around client engagement and regulated operations under global oversight.

| Topic | Employee Perspective (Implied) |

| Culture Focus | Client support and training |

| Regulatory Compliance | Emphasis on regulated structure |

| Global Footprint | Offices in multiple regions since 2012 |

Employee environments seem aligned with service‑driven values and compliance standards, though firsthand staff reviews are not widely available.

★★★★ | Minimum Deposit: $250+ Regulated by: FSA, FSCA Crypto: Yes |

Pros and Cons

| ✓ Pros | ✕ Cons |

| Offers a diversified portfolio of trading instruments across markets | Charges inactivity fees |

| Commission-free trading, with only the spread charged | Deposit fees apply |

| Instant execution on ECN accounts | Charges wide spreads on some accounts |

References:

In Conclusion

CMTrading operates physical offices and regional phone support in several key countries, providing direct client access and local presence. These local hubs support traders with regionally relevant services.

- 🇿🇦 South Africa

- 🇳🇬 Nigeria

- 🇸🇨 Seychelles

These offices are supplemented by international call lines in the United Kingdom and the United Arab Emirates. CMTrading ensures support across multiple regions while its core physical locations remain focused in South Africa, Nigeria, and Seychelles.

Faq

Yes. Client funds are kept in segregated accounts, transactions are encrypted, and the broker is regulated by 🇿🇦 FSCA and 🇸🇨 FSA, ensuring compliance and financial security.

The minimum deposit is $250, which allows beginners to start trading with M-Pesa or other local payment methods.

Absolutely. CMTrading Academy provides video courses, webinars, and e-books for beginners to advanced traders. Courses are practical and directly applicable to trading strategies.

Yes. M-Pesa is fully supported for instant deposits, and withdrawals are processed safely back to the original source within 1–5 business days.

- Trading with CMTrading - Immediate Advantages and Disadvantages

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open a CM Trading Account

- Safety and Security

- Trading Platforms and Tools

- CMTrading Protected Positions

- Markets available for Trade

- Deposits and Withdrawals

- Bonus Offers and Promotions

- Partnership Program

- Refer a Friend

- Education and Resources

- Customer Support

- Insights from Real Traders

- Customer Reviews and Trust Scores

- Discussions and Forums about CMTrading

- Employee Overview of Working for CMTrading

- Pros and Cons

- In Conclusion