Firstrade Securities Review

- Overview

- Firstrade Securities Pricing

- Brokerage Accounts

- How to Open a Firstrade Securities Account

- Data Protection

- Investment Portfolio

- Education Center

- Customer Support

- Insights from Real Traders

- Discussions and Forums about Firstrade

- Employee Overview of Working for Firstrade

- Customer Reviews and Trust Scores

- Pros and Cons

- In Conclusion

Firstrade Securities is a low-risk broker with a strong Trust Score of 95/100. Regulated by two Tier-1 authorities, it ensures maximum safety and reliability. With no Tier-2, Tier-3, or Tier-4 regulators, Firstrade stands out as a highly trusted and secure trading platform.

★★★ | Minimum Deposit: $0 Regulated by: FINRA, SEC Crypto: No |

| Broker | Firstrade |

| Minimum Deposit | Varies |

| Fees/Commissions | Commissions from $0 |

| Base Currencies | USD |

| Leverage | 1:2 |

| Regulation and Licenses | FINRA SEC |

| Open an Account |

Overview

Firstrade Securities delivers a client-first experience, empowering investors with commission-free trading, intuitive platforms, and innovative financial tools. Since 1985, the firm has combined advanced technology with dedicated support to ensure investors can manage their financial future efficiently and confidently.

Frequently Asked Questions

What investment products does Firstrade offer?

Firstrade provides a full range of investment products, including Stocks, ETFs, Options, Mutual Funds, and fixed-income products. Both new investors and active traders can access extended trading hours and advanced tools, making it easy to manage portfolios and execute trades efficiently.

Is Firstrade a secure and regulated broker?

Yes, Firstrade is regulated by 🇺🇸 FINRA and protected under SIPC insurance. The firm prioritizes privacy and security while providing reliable order execution and high-quality customer support, giving investors confidence that their assets and personal information are safeguarded.

Our Insights

Firstrade Securities combines robust technology, low-cost trading, and a customer-first approach to deliver a reliable investment platform. Investors seeking a secure, intuitive, and efficient brokerage will benefit from its extensive tools, commission-free trades, and commitment to long-term client success.

★★★ | Minimum Deposit: $0 Regulated by: FINRA, SEC Crypto: No |

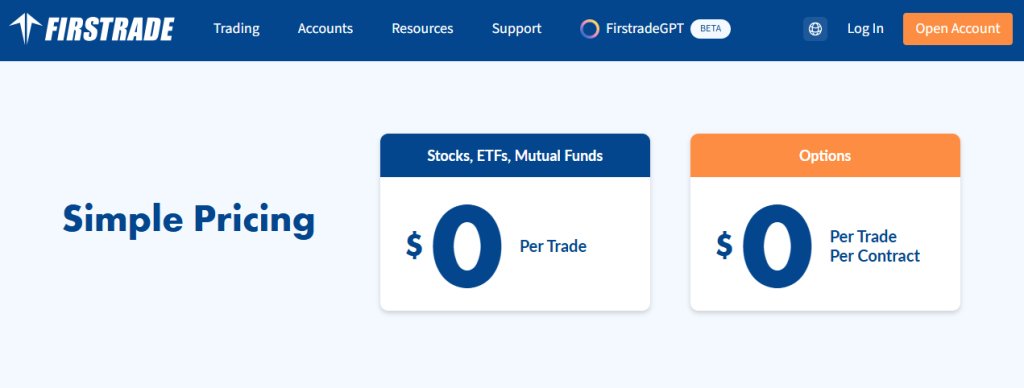

Firstrade Securities Pricing

Firstrade Securities provides clear and simple pricing designed to keep investing affordable. Investors benefit from commission-free trades on stocks, ETFs, options, and mutual funds, while fixed income products and broker-assisted orders maintain competitive rates. Transparent fees ensure clients understand costs and can trade confidently.

| Product | Commission/Fee | Additional Notes | Broker-Assisted Fee |

| Stocks | $0 per trade | Commission-free | $19.95 |

| ETFs | $0 per trade | Commission-free | $19.95 |

| Options | $0 per trade | $0 per contract | $19.95 + $0.50/contract |

| Mutual Funds | $0 | Load, No-Load, NTF funds free | $19.95 for No-Load |

Frequently Asked Questions

Are all Firstrade trades commission-free?

Yes, Firstrade offers commission-free trading for stocks, ETFs, options, and mutual funds. Some broker-assisted orders and specific mutual fund redemptions carry small fees, but the overall pricing is highly transparent and designed to minimize trading costs for investors.

How are fixed-income products priced at Firstrade?

Fixed income investments, including Treasury Bills, Bonds, Municipal Bonds, and Agency Bonds, are priced on a net yield basis. This means Firstrade acts as principal, applying a markup or markdown, while keeping fee structures clear and consistent for investors.

Our Insights

Firstrade Securities stands out for its straightforward and cost-effective pricing model. Investors can trade a wide range of products commission-free while understanding all applicable fees. The transparent structure ensures clarity, affordability, and confidence in managing investments efficiently.

★★★ | Minimum Deposit: $0 Regulated by: FINRA, SEC Crypto: No |

Brokerage Accounts

Firstrade Securities offers versatile brokerage accounts designed to help investors reach their financial goals. With zero commission trading, extensive product access, and powerful mobile and desktop apps, investors can manage portfolios efficiently while leveraging research tools, educational resources, and extended trading hours.

Frequently Asked Questions

What makes a Firstrade brokerage account advantageous?

Firstrade brokerage accounts provide zero commission trades, no deposit minimums, and no inactivity fees. Clients gain access to stocks, ETFs, options, fixed income, and thousands of mutual funds while using intuitive apps and premium research for smarter investing.

Can I trade outside regular market hours with Firstrade?

Yes, Firstrade offers extended trading hours from 8 am – 8 pm ET, Monday through Friday, and overnight sessions from 8 pm – 4 am ET, Sunday through Friday. This flexibility allows investors to react to market developments and news efficiently.

Our Insights

Firstrade brokerage accounts provide a flexible, cost-efficient, and secure solution for investors at every experience level. With commission-free trades, extensive product offerings, and powerful trading tools, the accounts empower clients to pursue financial goals confidently and efficiently.

★★★ | Minimum Deposit: $0 Regulated by: FINRA, SEC Crypto: No |

How to Open a Firstrade Securities Account

Opening a Firstrade Securities account is a straightforward process designed to get you trading quickly. With a few simple steps, you can set up an account, fund it, and start investing in stocks, ETFs, and forex.

1. Step 1: Visit the Firstrade Website

Go to the official Firstrade homepage.

2. Step 2: Select Account Type

Choose between Individual, Joint, Retirement, or International account options.

3. Step 3: Fill in Personal Information

Provide your full name, date of birth, address, and contact details.

4. Step 4: Verify Your Identity

Submit identification documents, such as a passport or national ID, as required.

5. Step 5: Set Up Security Features

Create a username, password, and security questions for account protection.

6. Step 6: Agree to Terms and Conditions

Review and accept the brokerage’s legal agreements.

7. Step 7: Fund Your Account

Deposit money via bank transfer, wire, or other supported methods.

8. Step 8: Start Trading

Once your account is funded and verified, you can begin trading on the Firstrade platform.

Following these steps ensures a smooth account setup, giving you access to Firstrade’s trading tools and resources quickly.

★★★ | Minimum Deposit: $0 Regulated by: FINRA, SEC Crypto: No |

Data Protection

Firstrade Securities prioritizes the safety of your data and account information. By combining advanced technology, secured servers, and strict access controls, the firm ensures that clients can trade confidently online while minimizing the risk of unauthorized activity or data breaches.

| Protection Measure | Details | Client Responsibility | Benefits |

| Secured Servers | Advanced technology protects data | Keep passwords strong | Safe online trading |

| Restricted Access | Limited internal access to sensitive info | Review accounts regularly | Prevent unauthorized activity |

| Encryption | Protects communication and transactions | Maintain up-to-date contact info | Enhanced confidentiality |

| Online Protection Guarantee | Investigations security protocols | Promptly report suspicious activity | Minimized risk of fraud |

Frequently Asked Questions

How does Firstrade safeguard client accounts?

Firstrade safeguards accounts through secured servers, encrypted connections, restricted internal access, and advanced technology. Clients are encouraged to review statements regularly, update contact information, and report any suspicious activity immediately to maintain the highest level of security.

What is the Online Protection Guarantee?

The Online Protection Guarantee ensures that if an account is compromised, Firstrade will investigate promptly. Measures may include identity verification, system updates, anti-virus installations, and collaboration with authorities to resolve issues while minimizing losses for the client.

Our Insights

Firstrade Securities provides a comprehensive and proactive approach to online security. By combining advanced technology, strict access controls, and client-focused guidelines, the firm ensures a safe trading environment, allowing investors to manage their accounts with confidence and peace of mind.

★★★ | Minimum Deposit: $0 Regulated by: FINRA, SEC Crypto: No |

Investment Portfolio

Firstrade Securities empowers investors to build diversified portfolios with stocks, ETFs, options, mutual funds, and fixed income products. With zero commission trades, no minimums, and user-friendly apps, clients can manage investments efficiently while maximizing potential returns and exploring income opportunities through dividend reinvestment and securities lending programs.

| Investment Product | Features | Trading Costs | Additional Benefits |

| Stocks | NYSE AMEX Nasdaq OTC | 0 USD per trade | Full market access |

| ETFs | 2,200+ options | 0 USD per trade | Commission-free opportunities |

| Options | Hedging Strategies | 0 USD per trade 0 USD contract fees | Flexible risk management |

| Mutual Funds | 11,000+ funds | 0 USD | Professionally managed portfolios |

| Fixed Income | Bonds Treasuries | Net yield basis | Long-term stability |

| Margin Loans | Leverage | Competitive rates | Amplify investment potential |

| Dividend Reinvestment | Automatic reinvestment | 0 USD | Grow portfolio efficiently |

| Securities Lending | Earn income | Varies | Extra income from fully paid shares |

| Cash Management | Banking Brokerage | 0 USD | Consolidated account control |

Frequently Asked Questions

Can I trade multiple investment types in one account at Firstrade?

Yes, Firstrade allows clients to trade stocks, ETFs, options, mutual funds, and fixed income products within a single account. Commission-free trades, no minimums, and integrated tools provide flexibility to diversify and manage a full portfolio efficiently.

How does Firstrade help investors earn additional income?

Investors can earn extra income through dividend reinvestment, securities lending on fully paid shares, and leveraging margin loans. These programs allow clients to enhance portfolio growth while maintaining full control over their investments.

Our Insights

Firstrade Securities offers a versatile, commission-free platform for building and managing diversified portfolios. With extensive investment options, income-enhancing features, and intuitive tools, investors can confidently grow their portfolios while controlling costs and optimizing returns.

★★★ | Minimum Deposit: $0 Regulated by: FINRA, SEC Crypto: No |

Education Center

Firstrade’s Education Center is designed to help investors of all experience levels expand their knowledge, understand investment products, and develop stronger trading strategies. With resources ranging from beginner-friendly guides to advanced strategies, plus a full library of videos, investors can access everything they need to make informed decisions.

Frequently Asked Questions

What type of investor can benefit from Firstrade’s Education Center?

The Education Center is designed for all levels – from beginners learning stock basics to experienced traders refining options or margin strategies.

Does Firstrade provide practical learning tools?

Yes, alongside guides and glossaries, Firstrade offers step-by-step video tutorials that cover real trading examples, strategies, and account tools.

Our Insights

Firstrade’s Education Center equips investors with the knowledge and practical tools to trade with confidence. With guides, glossaries, and video tutorials, it balances foundational learning with actionable strategies, making it an excellent resource for self-directed investors.

★★★ | Minimum Deposit: $0 Regulated by: FINRA, SEC Crypto: No |

Customer Support

Firstrade’s Support Center is designed to give investors quick and reliable assistance for all account and trading-related needs. Whether you have a question about funding, trading, or account management, Firstrade provides multiple support channels, ensuring help is always within reach.

| Support Channel | Details | Availability |

| Help Center | FAQ library with common answers | 24/7 online |

| Customer service assistance | Response within business hours |

|

| Phone (U.S.) | 1-800-869-8800 | Mon–Fri, 8:00am 6:00pm ET |

| Phone (Outside U.S.) | 1-718-961-6600 | Mon–Fri, 8:00am 6:00pm ET |

| Fax | Send forms agreements: 1-718-961-3919 | During office hours |

| Office Visit | NY Headquarters: 30-50 Whitestone Expwy, Ste. A301, Flushing, NY | Mon–Fri, 10:00am 4:00pm ET |

Frequently Asked Questions

When is Firstrade’s phone support available?

Phone support is available Monday through Friday, from 8:00 am to 6:00 pm ET.

Can I visit Firstrade’s office in person?

Yes, Firstrade’s New York headquarters is open for visits from Monday to Friday, between 10:00 am and 4:00 pm ET.

Our Insights

Firstrade offers a solid support structure with multiple ways to get in touch, ensuring investors have the help they need for both basic and complex inquiries. While weekend and live chat support are missing, the combination of phone, email, and in-person service makes Firstrade’s customer support reliable and trustworthy.

★★★ | Minimum Deposit: $0 Regulated by: FINRA, SEC Crypto: No |

Insights from Real Traders

⭐⭐⭐⭐

I’ve been using Firstrade Securities for over a year, and it’s been a fantastic experience. The low trading costs make it easy to invest regularly, and the platform is intuitive and fast. Customer support is responsive and helpful whenever I have questions. Highly recommended!

James

⭐⭐⭐⭐⭐

Firstrade made my first steps into forex trading simple and stress-free. The educational resources are excellent, and the account setup was quick. I feel confident managing my investments, and the interface is clean and easy to navigate. I would recommend Firstrade to new traders.

Michael

⭐⭐⭐⭐

I trust Firstrade Securities for my trading needs because of its strong regulation and reliability. Transactions are smooth, and I feel secure knowing my funds are well-protected. The mobile app is convenient and keeps me updated on my portfolio at all times. Excellent broker overall.

Sophie

★★★ | Minimum Deposit: $0 Regulated by: FINRA, SEC Crypto: No |

Discussions and Forums about Firstrade

Online forums and discussions reveal a community of traders sharing experiences with Firstrade. While some commend its user-friendly interface and educational resources, others caution about occasional technical issues and the need for improved customer support.

| Platform | User Sentiment |

| Mixed | |

| StockTwits | Cautious |

| Trade2Win | Neutral |

Engaging with these communities can provide valuable insights into Firstrade’s performance and user experiences.

★★★ | Minimum Deposit: $0 Regulated by: FINRA, SEC Crypto: No |

Employee Overview of Working for Firstrade

Employee reviews of Firstrade Securities present a varied picture. Some employees highlight a collaborative work environment and growth opportunities, while others point out challenges such as micromanagement and limited career advancement.

| Aspect | Rating (5) | Notes |

| Work-Life Balance | 2.9 | Average satisfaction |

| Culture Values | 2.9 | Mixed perceptions |

| Career Opportunities | 2.7 | Limited advancement noted |

| Compensation Benefits | 3.0 | Standard offerings |

| Senior Management | 3.0 | Generally positive feedback |

These insights suggest that while Firstrade offers a stable work environment, there may be areas for improvement in employee satisfaction and career development.

★★★ | Minimum Deposit: $0 Regulated by: FINRA, SEC Crypto: No |

Customer Reviews and Trust Scores

Firstrade Securities has garnered mixed feedback from its customers. While some users appreciate its low-cost trading options, others express dissatisfaction with customer service and platform reliability. The company holds a Trustpilot rating of 1.8 out of 5, based on 48 reviews.

| Rating | Percentage | Number of Reviews |

| 5 stars | 13% | 6 |

| 4 stars | 2% | 1 |

| 3 stars | 2% | 1 |

| 2 stars | 9% | 4 |

| 1 star | 74% | 36 |

The high percentage of 1-star reviews indicates significant customer dissatisfaction.

★★★ | Minimum Deposit: $0 Regulated by: FINRA, SEC Crypto: No |

Pros and Cons

| ✓ Pros | ✕ Cons |

| Low-cost trading options | Mixed customer service feedback |

| User-friendly platform | Occasional technical issues |

| No inactivity fees | Limited international support |

| Educational resources available | Micromanagement reported by staff |

| Access to various investment tools | Limited career advancement opportunities |

References:

In Conclusion

Firstrade Securities Inc. is a U.S.-based brokerage firm headquartered in Flushing, New York. While it offers international accounts and multilingual customer support, it does not maintain physical offices outside the United States. All customer service operations, including call centers, are centralized at its New York headquarters. The firm provides support in English, Simplified Chinese, and Traditional Chinese. Countries with Firstrade Customer Support:

-

US United States

Firstrade does not have local offices or customer support teams in other countries. International clients can access support through the U.S. headquarters via phone or email.

Faq

No, the broker does not provide conventional paper trading (demo) accounts.

Yes, the broker provides a variety of retirement accounts, including regular, Roth, and rollover IRAs. You may benefit from tax-advantaged retirement investing via Firstrade.

The broker normally processes withdrawals within a few business days. However, the time can vary based on the withdrawal type and any extra verification procedures.

The broker does not need a minimum deposit, enabling traders to begin trading without prior financial commitment.

Yes, Firstrade is a renowned broker regulated in the United States that uses modern encryption technologies to secure client data and assets.

- Overview

- Firstrade Securities Pricing

- Brokerage Accounts

- How to Open a Firstrade Securities Account

- Data Protection

- Investment Portfolio

- Education Center

- Customer Support

- Insights from Real Traders

- Discussions and Forums about Firstrade

- Employee Overview of Working for Firstrade

- Customer Reviews and Trust Scores

- Pros and Cons

- In Conclusion