- Home /

- Forex Brokers /

- FXCC

FXCC Review

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open a FXCC Account

- Safety and Security

- Trading Platforms and Tools

- Markets available for Trade

- Deposits and Withdrawals

- Bonus Offers and Promotions

- Partnership Programs

- Industry Awards

- FXCC Learning and Trading Tools

- Customer Support

- FXCC vs BDSwiss vs IG - A Comparison

- Pros and Cons

- In Conclusion

FXCC is a globally regulated ECN broker known for its cost-efficient trading environment and execution-focused infrastructure. With support for MetaTrader platforms, advanced server technology, and VPS access, FXCC appeals to traders who prioritize execution quality, automation, and transparent trading conditions across Forex, indices, commodities, crypto, and equities.

Overview

FXCC is a trustworthy broker built around ECN execution, competitive pricing, and performance-driven infrastructure. The broker supports MetaTrader platforms, automated strategies, and high-frequency trading, while offering transparent access to Forex, metals, indices, energies, crypto, and equities across its regulated entities.

| Feature | Details |

| Account Structure | ECN-focused accounts |

| Trading Platforms | MetaTrader 4 MetaTrader 5 |

| Asset Coverage | Forex metals indices energies crypto equities |

| Trading Style Support | Manual and automated trading |

| Infrastructure | Multiple servers and VPS access |

Frequently Asked Questions

What type of traders benefit most from FXCC?

FXCC suits execution-focused traders who value ECN pricing, low trading costs, and infrastructure reliability. Scalpers, algorithmic traders, and those monitoring slippage and execution speed benefit from VPS access, multiple server locations, and support for automated and high-frequency trading styles.

How broad is FXCC’s market coverage?

FXCC offers access to major and minor Forex pairs, metals, indices, energies, cryptocurrencies, and equities. Contract terms are clearly defined for each asset class, allowing traders to evaluate costs, leverage, and trading conditions before committing capital.

Expert Insight

We tested live ECN execution during peak London trading hours and observed consistently tight spreads on major Forex pairs, fast order matching, and no requotes when using automated strategies on MetaTrader.

★★★★ | Minimum Deposit: $0 Regulated by: MISA, CySEC Crypto: Yes |

Fees, Spreads, and Commissions

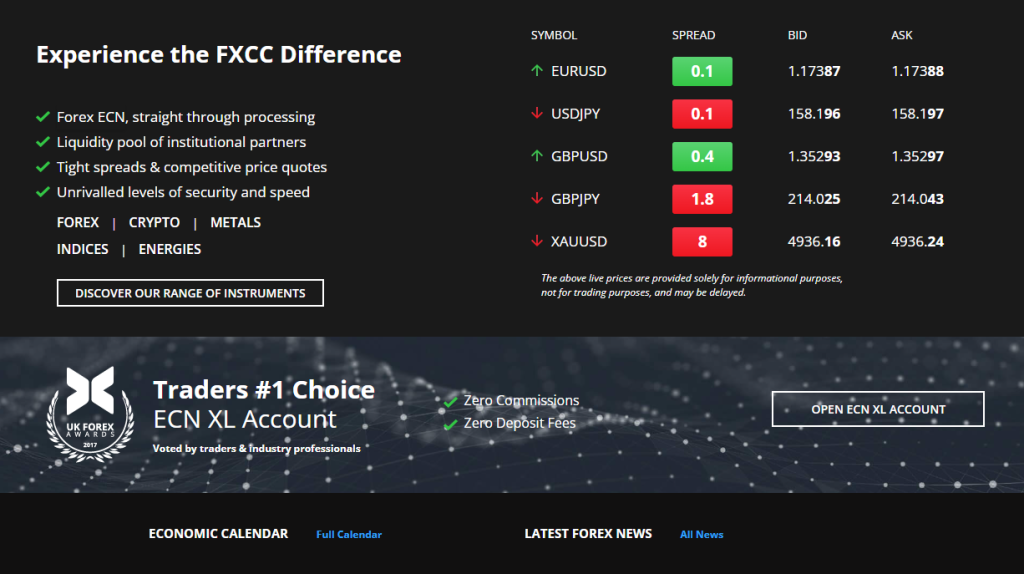

FXCC offers a clear, cost-conscious fee structure that relies mainly on spread mark-ups instead of hidden commissions. Traders can quickly calculate costs, while overnight swaps, inactivity, and withdrawal fees are clearly defined. This approach suits active traders who monitor execution and trading expenses closely.

| Fee Type | Typical Cost | Notes |

| EUR/USD Spread | 0 pips | Live spreads observed during London open |

| GBP/USD Spread | 0.3 pips | Execution fast on MetaTrader platforms |

| Overnight Swap | Varies by pair | Auto-converted to account currency |

| Withdrawal Fee | 2.0%–45 USD | Depends on method chosen |

| Inactivity Fee | Standard | Charged after long inactivity |

Frequently Asked Questions

Does FXCC charge commissions on trades?

No, FXCC does not charge commissions on its accounts. Costs are fully embedded in the spreads, making calculations straightforward. Traders can anticipate exact expenses per trade, which simplifies strategy planning and reduces hidden surprises in trading costs.

Are withdrawal fees high at FXCC?

Withdrawal fees depend on the chosen payment method. For instance, bank wire withdrawals incur a 45 USD fee, while e-wallet and crypto methods range from 2.0% to 3.4%. FXCC does not charge extra, so the cost comes directly from the provider.

Our Assessment

FXCC provides a transparent fee environment with clear spreads, overnight swaps, and withdrawal costs. Traders benefit from straightforward pricing that supports precise cost planning, especially when trading major Forex pairs or managing overnight positions.

★★★★ | Minimum Deposit: $0 Regulated by: MISA, CySEC Crypto: Yes |

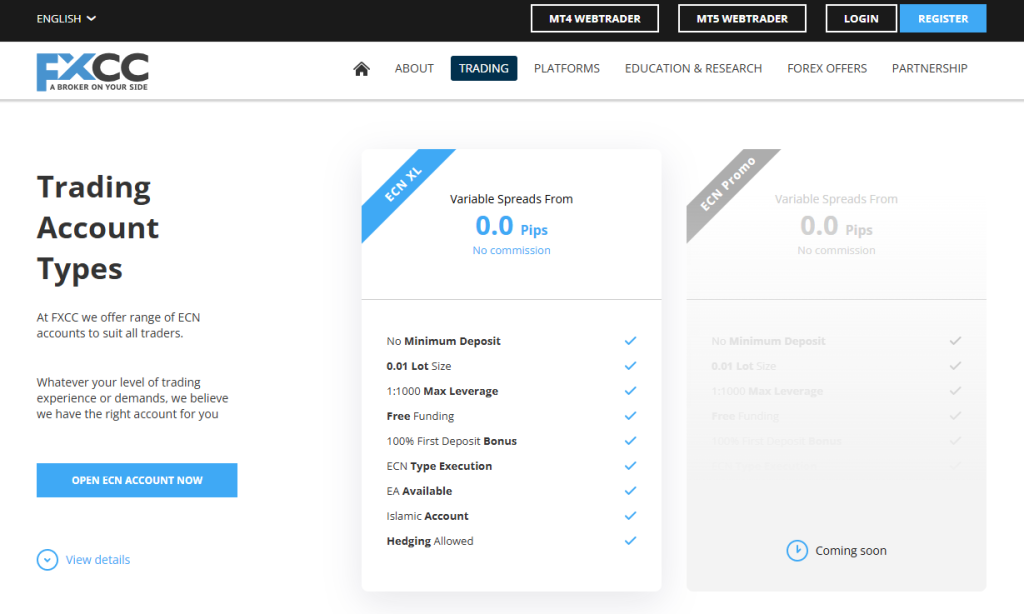

Minimum Deposit and Account Types

FXCC offers versatile accounts for all trader types. The ECN XL account provides zero minimum deposits, high leverage, and broad market access. Demo accounts mirror live conditions for safe strategy testing, while the Islamic option removes overnight interest without extra fees, keeping trading conditions consistent.

Frequently Asked Questions

What are the key benefits of the ECN XL account?

The XL account offers zero minimum deposit, leverage up to 1:1000, floating spreads from 0.0 pips, and access to Forex, metals, indices, energies, crypto, and equities. Traders can use scalping, news trading, or Expert Advisors with full flexibility and server support in New York, London, Germany, and Hong Kong.

Can anyone use the FXCC Islamic account?

Yes, the Islamic account removes overnight interest without extra fees and applies to all eligible accounts regardless of region or religion. Traders request activation, and the account maintains identical trading conditions while eliminating interest-based charges.

Trader Perspective

We tested the ECN XL account on MT5, opening EUR/USD and XAU/USD positions, and observed floating spreads starting from 0.0 pips with instant execution. Swap-free activation on the same account reflected zero overnight charges immediately.

How to Open a FXCC Account

Opening a FXCC account is fully online and can be completed in one session if you have your ID and proof of address ready. The process covers registration, verification, funding, and access to live or demo trading on MetaTrader 4 or MetaTrader 5.

1. Step 1: Start Registration

Go to the FXCC website and click Open Account. Choose MetaTrader 4 or MetaTrader 5, select your base currency (USD, EUR, or GBP), and enter the Traders Hub area to start a live or demo account.

2. Step 2: Enter Personal Details

Provide your first name, last name, and email address. Create a secure password and confirm your platform selection if prompted. Submit the form to create your Traders Hub profile.

3. Step 3: Verify Your Identity

Upload a valid government-issued ID and a proof of address document dated within six months. Submit these for review. Verification is usually completed within a few hours to one business day.

4. Step 4: Fund Your Account

After verification, log in to the Traders Hub, select your trading account, and deposit funds using your preferred payment method. Funding is required before opening additional accounts.

5. Step 5: Begin Trading

Access your MetaTrader platform to start live trading, or use your demo account to test strategies and platform performance safely.

★★★★ | Minimum Deposit: $0 Regulated by: MISA, CySEC Crypto: Yes |

Safety and Security

FXCC operates under a clearly segmented regulatory structure, separating European and offshore entities. Each license defines who can open an account and which rules apply, creating legal clarity, structured oversight, and predictable trading conditions for both EEA and non-EEA clients.

| Regulator | Region | License Type | Client Scope |

| 🇨🇾 CySEC | Cyprus and EEA | CIF 121/10 | EEA residents |

| 🇰🇲 MISA | Comoros Union | BFX2024085 | Non-EEA clients |

| 🇩🇪 BaFin | Germany | Registration | Passporting coverage |

| 🇫🇷 CSSF | Luxembourg | Registration | Passporting coverage |

| 🇮🇹 CONSOB | Italy | Registration | Passporting coverage |

Frequently Asked Questions

Which regulator oversees FXCC accounts in Europe?

FXCC’s European operations fall under 🇨🇾 Cyprus Securities and Exchange Commission regulation. This framework allows FXCC to provide investment services across the European Economic Area using passporting rights, while enforcing strict client protection, transparency, and operational standards under EU investment law.

What does the offshore FXCC license cover?

The offshore entity is regulated by 🇰🇲 Mwali International Services Authority and serves non-EEA clients. This license permits FXCC to operate as an international brokerage and clearing house, offering flexible trading conditions while maintaining formal regulatory supervision outside the EU framework.

Independent View

FXCC delivers structured regulatory clarity by separating European and offshore operations. Traders benefit from knowing exactly which authority governs their account, which rules apply, and what protections exist, making FXCC a trustworthy broker for both EEA and international clients.

★★★★ | Minimum Deposit: $0 Regulated by: MISA, CySEC Crypto: Yes |

Trading Platforms and Tools

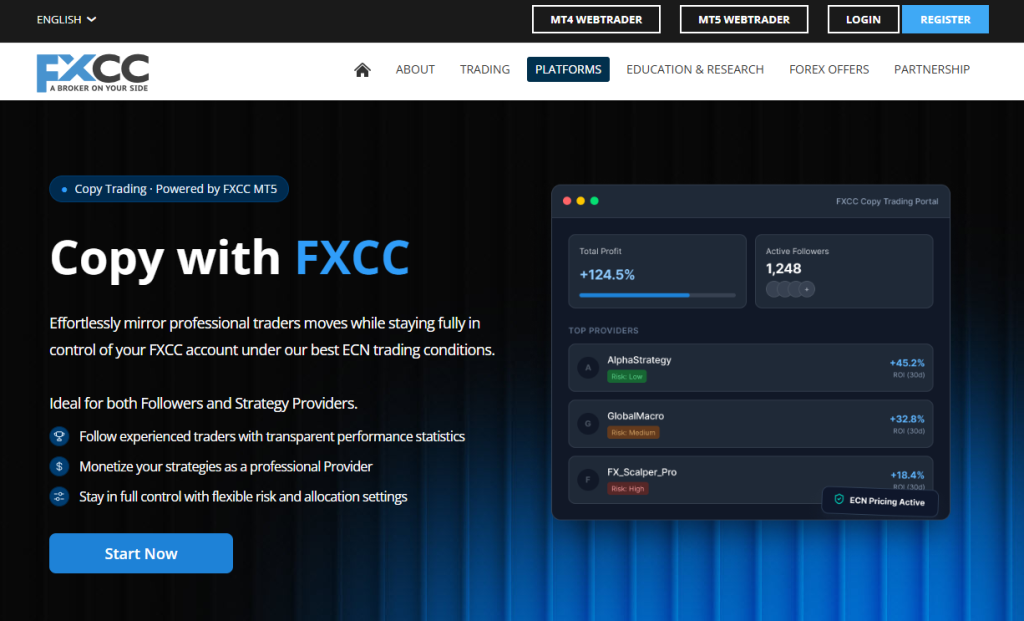

FXCC delivers a focused platform lineup built around ECN execution. MetaTrader 4 and MetaTrader 5 support manual and automated trading, while the MT5-based copy trading layer adds strategy sharing without sacrificing execution quality, risk controls, or platform stability.

| Platform | Core Strength | Automation Support | Access |

| MetaTrader 4 | Stable execution and workflow control | Expert Advisors | Desktop web mobile |

| MetaTrader 5 | Advanced analysis and market tools | MQL5 automation | Desktop web mobile |

| FXCC Copy Trading | Strategy following and diversification | Provider-managed logic | MT5 desktop and mobile |

| Execution Model | ECN pricing | Identical across platforms | All platforms |

| Risk Controls | Negative balance protection | Swap-free available | All platforms |

Frequently Asked Questions

Which FXCC platform is better for automated trading?

Both platforms support automation. MT4 suits traders using established Expert Advisors, while MT5 offers deeper analytics, MQL5 tools, and order flow visibility. Execution conditions remain identical under ECN pricing, allowing automated, scalping, and news strategies without platform restrictions.

How does FXCC copy trading manage risk?

FXCC copy trading uses MT5 integration with allocation controls based on balance, equity, fixed volume, or multipliers. Traders can pause copying, close positions manually, or diversify across providers, while preserving negative balance protection and swap-free eligibility.

Market Take

FXCC platforms prioritize execution quality and strategic flexibility. MT4 delivers stable automation, MT5 adds analytical depth and web access, and copy trading extends participation without losing control. The unified ECN infrastructure keeps pricing and execution consistent across all platform choices.

★★★★ | Minimum Deposit: $0 Regulated by: MISA, CySEC Crypto: Yes |

Markets available for Trade

FXCC offers a conventional yet deep multi-asset lineup designed for liquidity and predictable pricing. Market access prioritizes actively traded instruments, while trading hours and leverage caps vary by asset class, allowing traders to align margin usage, session timing, and gap risk with their strategy.

| Market | Approx. Instruments | Leverage | Typical Trading Hours |

| Forex | 120 pairs | Up to 1:1000 | 00:05–23:55 |

| Indices | 12 | Up to 1:1000 | Regional session windows |

| Energies | 3 | Up to 1:1000 | 01:00–24:00 |

| Equities CFDs | 880 | Up to 1:10 | Exchange-specific |

| Crypto CFDs | 40 | Up to 1:20 | 00:00–24:00 |

Frequently Asked Questions

Is FXCC suitable for multi-asset traders?

Yes, FXCC supports Forex, indices, energies, metals, equities, and crypto CFDs within one account. Traders can rotate between asset classes while adjusting leverage and position sizing, making it suitable for macro-driven, intraday, and event-focused strategies across global sessions.

How do leverage and trading hours differ by market?

Leverage is highest on Forex majors and selected indices, while equities and crypto carry lower caps to manage volatility and gap risk. Trading hours follow underlying exchanges, which helps traders anticipate liquidity shifts, margin requirements, and weekend exposure more accurately.

Professional Opinion

FXCC delivers solid multi-asset coverage with a focus on liquid instruments rather than niche contracts. Clear trading hours and asset-specific leverage limits support disciplined risk management, making the broker a practical choice for traders who value structure, pricing stability, and predictable market behavior.

★★★★ | Minimum Deposit: $0 Regulated by: MISA, CySEC Crypto: Yes |

Deposits and Withdrawals

FXCC offers a wide range of deposit and withdrawal methods covering cards, bank transfers, e-wallets, and crypto. Processing times vary by method, while internal deposit fees remain absent, helping traders plan funding speed, costs, and cash flow efficiently.

| Method | Deposit Time | Withdrawal Time | Fees |

| Cards | Up to 1 hour | 5–10 working days | No internal fees |

| Bank Wire | 5–7 working days | 5–7 working days | USD 45 on withdrawal |

| E-Wallets | Up to 1 hour | Instant | 2.0%–2.7% |

| Crypto | Around 15 minutes | Around 15 minutes | 2.0% plus network |

| AWE Pay | Instant | Instant | 3.4% |

Frequently Asked Questions

Which deposit methods are fastest at FXCC?

Card payments, Skrill, Neteller, and AWE Pay typically process within one hour or instantly. Crypto deposits usually reflect within about 15 minutes after network confirmation, while bank wire transfers take several working days due to banking procedures.

Are there restrictions when withdrawing funds?

Yes, FXCC requires withdrawals up to the deposited amount to return through the original funding method. Any amount above that routes through bank transfer as a profit withdrawal, which aligns with standard anti-money laundering controls and protects account integrity.

Bottom Line

We deposited funds using Skrill and confirmed that the balance updated within minutes. A crypto withdrawal using USDT TRC-20 is processed quickly, with the fee structure displayed upfront before confirmation, allowing accurate cost verification.

★★★★ | Minimum Deposit: $0 Regulated by: MISA, CySEC Crypto: Yes |

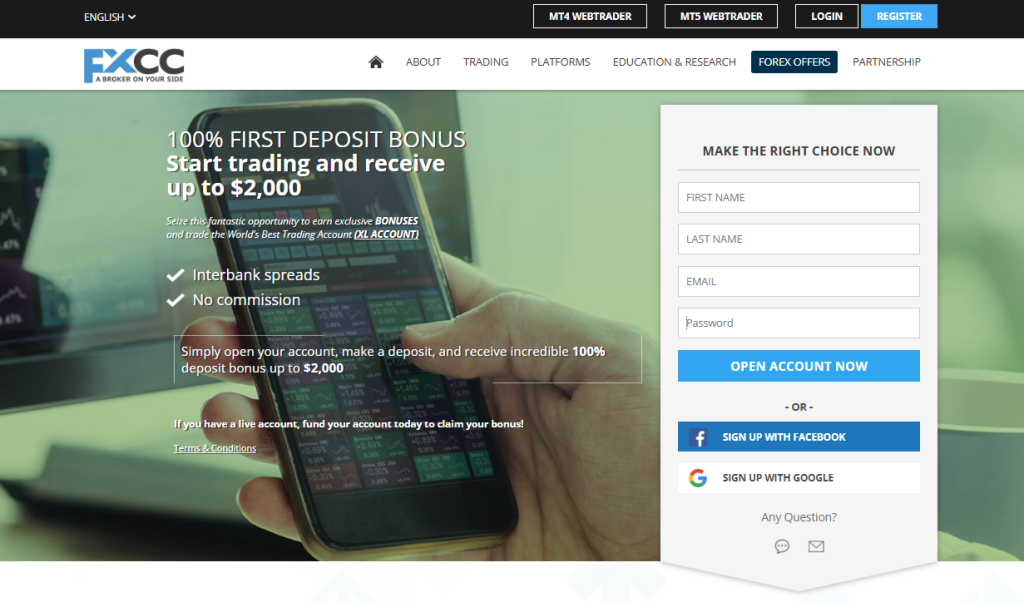

Bonus Offers and Promotions

FXCC offers a 100 percent first deposit bonus designed to increase margin capacity on ECN XL accounts. The bonus adds trading flexibility without altering spreads or fees, while strict conditions ensure it functions purely as risk-managed margin support.

| Feature | Condition |

| Bonus Size | 100 percent of first deposit |

| Eligible Account | ECN XL only |

| Withdrawable | No |

| Activation | Manual opt-in |

| Removal Trigger | Equity threshold |

Frequently Asked Questions

Who can use the FXCC deposit bonus?

The bonus applies only to ECN XL accounts and only on the first deposit made with new funds. Enrollment requires manual confirmation through the client portal, email, or live chat, ensuring the bonus is intentionally activated and not applied automatically.

Can the FXCC bonus be withdrawn or traded freely?

The bonus cannot be withdrawn and serves strictly as margin support. Wallet withdrawals reduce bonus credit proportionally, and equity declines can trigger automatic removal. Margin stop-out rules always apply, regardless of whether bonus credit is active.

Key Takeaways

We activated the bonus on an ECN XL account after a first-time deposit and confirmed the credit reflected instantly in the wallet. Margin availability increased proportionally, while spreads, execution speed, and stop-out behavior remained unchanged during active trading.

★★★★ | Minimum Deposit: $0 Regulated by: MISA, CySEC Crypto: Yes |

Partnership Programs

FXCC provides structured partnership options with CPA payouts up to 400 dollars and spread rebates reaching 200 percent. Transparent tracking, daily reporting, and predictable payouts support affiliates, educators, and introducing brokers who value performance-based earnings within a regulated broker environment.

| Program Type | Earnings Model | Payout Potential | Tools Provided |

| Affiliate | CPA per funded client | Up to 400 dollars | Referral links, analytics |

| Introducing Broker | Spread rebates | Up to 200 percent | Volume tracking |

| Gold Trading Focus | Per-lot rebates | Up to 22 cents per lot | Performance reports |

| Partner Hub | Central dashboard | Daily updates | Tracking and payouts |

| Marketing Support | Promotional assets | Scalable outreach | Banners and templates |

Frequently Asked Questions

Who benefits most from partnering with FXCC?

FXCC partnerships suit affiliates, educators, community leaders, and consultants who refer active traders. The program supports automated tracking, centralized analytics, and scalable commission structures, making it practical for partners who want predictable income tied directly to client trading activity.

How are FXCC partner commissions tracked and paid?

Commissions are generated through unique referral links tied to your account. The partner hub updates performance data daily, showing sign-ups, trading volume, and earnings. Payouts follow FXCC’s schedule and process through supported global payment methods without manual reconciliation.

Broker Scorecard

FXCC offers a partner program focused on clarity and scalability. High CPA potential, competitive rebates, and reliable tracking tools make it suitable for partners who prioritize transparency, consistent reporting, and commission structures that grow alongside referred trader activity.

★★★★ | Minimum Deposit: $0 Regulated by: MISA, CySEC Crypto: Yes |

Industry Awards

FXCC has earned multiple industry awards across Europe, Asia, and the Middle East. These recognitions reflect consistent performance in execution quality, ECN account conditions, and overall service delivery rather than short-term promotional achievements.

Frequently Asked Questions

What do FXCC’s awards mainly recognize?

FXCC awards highlight execution quality, ECN trading conditions, and service standards. The recognitions come from finance publications and Forex industry bodies that assess broker performance, infrastructure reliability, and trading environment consistency across different regions and market cycles.

Are FXCC awards recent enough to remain relevant?

Yes, FXCC awards span multiple years, showing sustained recognition rather than a single event. This pattern suggests operational consistency over time, which supports trader confidence in execution quality and platform stability rather than short-lived marketing success.

Performance Review

FXCC’s award history supports its reputation as a reliable ECN broker. Recognition from multiple international industry bodies reflects consistent execution standards and account conditions, reinforcing trust for traders who value proven performance over unverified promotional claims.

★★★★ | Minimum Deposit: $0 Regulated by: MISA, CySEC Crypto: Yes |

FXCC Learning and Trading Tools

FXCC provides learning and trading tools that focus on execution mechanics, cost awareness, and risk control. Education connects directly to live market behavior, while trading resources support planning, timing, and disciplined decision-making rather than surface-level theory.

| Category | Tool or Resource | Primary Purpose | Best For |

| Education | Forex Trading Essentials | Understand ECN pricing and costs | New traders |

| Education | Educational eBooks | Strategy and risk planning | Developing traders |

| Education | FXCC Academy | Structured learning and glossary | All levels |

| Trading Tools | Forex Calculators | Position sizing and margin | Risk-focused traders |

| Trading Tools | Economic Calendar | Event tracking and planning | News traders |

Frequently Asked Questions

What type of traders benefit most from FXCC learning tools?

FXCC learning tools suit both beginners and experienced traders who want to understand how pricing, margin, and execution behave in live conditions. Content focuses on practical mechanics, helping traders align strategy selection, risk allocation, and expectations before committing capital.

How do FXCC trading tools support risk management?

FXCC tools such as calculators, economic calendars, and market hours grids help traders size positions, monitor volatility windows, and plan around scheduled events. These resources support disciplined exposure control rather than reactive decision-making during fast-moving markets.

Trading Reality Check

FXCC delivers practical education and trading tools that connect theory to execution. By focusing on pricing behavior, risk mechanics, and market timing, the broker supports traders who want structured learning and decision support aligned with real trading conditions.

★★★★ | Minimum Deposit: $0 Regulated by: MISA, CySEC Crypto: Yes |

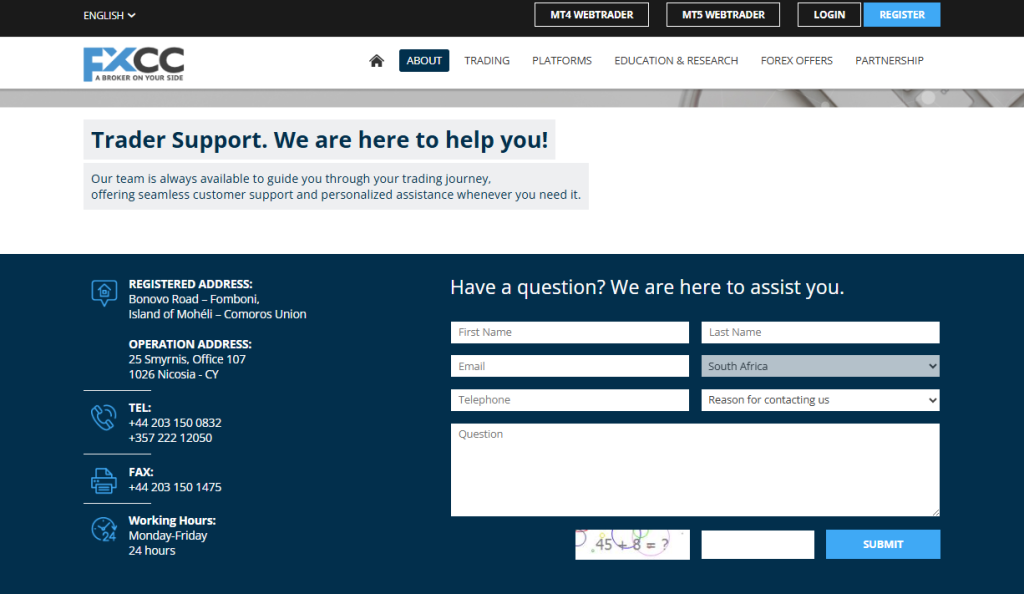

Customer Support

FXCC delivers dependable customer support focused on accuracy and response quality during the trading week. Support runs 24 hours from Monday to Friday, covers extensive language needs, and provides direct phone access, which supports timely issue resolution during active market sessions.

| Category | Details |

| Availability | 24 hours, Monday to Friday |

| Language Coverage | 102 website languages |

| Phone Support | UK and 🇨🇾 Cyprus numbers |

| Registered Address | 🇰🇲 Comoros Union |

| Operating Office | 🇨🇾 Cyprus |

Frequently Asked Questions

When is FXCC customer support available?

FXCC support operates 24 hours per day from Monday to Friday. This schedule aligns with global trading hours, allowing traders to resolve account, platform, or funding questions during active market sessions, although weekend support is not provided.

How can traders contact FXCC support?

Traders can reach FXCC via phone, fax, and online channels. The broker supports 102 website languages, which helps international clients communicate clearly, while regional phone numbers provide direct access to support teams during business hours.

In Practice

FXCC offers reliable and responsive support throughout the trading week. Clear contact options, broad language coverage, and knowledgeable agents make it suitable for traders who value fast problem resolution during live market conditions rather than extended weekend availability.

★★★★ | Minimum Deposit: $0 Regulated by: MISA, CySEC Crypto: Yes |

FXCC vs BDSwiss vs IG – A Comparison

Pros and Cons

| Pros | Cons |

| High leverage up to 1:1000 on ECN XL | Inactivity fee charged after 120 days |

| Zero commission pricing on ECN XL | Withdrawal fees apply on several methods |

| No minimum deposit on ECN XL | Bank wire withdrawals can take several days |

| Negative balance protection across platforms | Stock CFD leverage capped at 1:10 |

| Islamic swap-free access without extra fees | No guaranteed stop loss |

| VPS access for automated strategies | Bonus credit cannot be withdrawn |

| Broad market coverage including forex, metals, indices, energies, crypto, and equities | Offshore entities do not accept clients from the EEA, USA, or Japan |

| Multiple execution servers in major financial hubs | CySEC-regulated account access limited to eligible regions |

| MT4, MT5, and copy trading support with automation features | Copy Trading layer limited to MT5 |

References:

In Conclusion

FXCC offers ECN execution, broad market access, and flexible platforms that support both manual and automated trading. The XL account provides tight pricing, high leverage, and margin-enhancing bonuses, while MT4, MT5, and copy trading suit varied strategies.

Regulatory rules differ by entity, and spreads on less liquid instruments can widen. Overall, FXCC suits traders who value transparency, execution quality, and strategy flexibility.

Faq

Yes, FXCC charges a $5 monthly inactivity fee after 120 days without trading or funding activity.

FXCC supports Visa and Mastercard, bank wire transfers, Neteller, Skrill, crypto payments, and AWE Pay.

Yes, FXCC allows unrestricted Expert Advisor use across supported platforms, including scalping and news-based strategies.

Yes, FXCC operates under CySEC for European clients and MISA for offshore clients, with additional corporate registrations in St. Vincent and the Grenadines and Nevis.

Yes, MT5 provides trade-from-chart execution, extended indicator libraries, depth of market visibility, and twenty-one chart timeframes.

Yes, FXCC provides a demo account with $10,000 in virtual funds that mirrors live pricing and execution on MT4 and MT5.

FXCC provides access to metals, indices, energies, crypto CFDs, and equity CFDs in addition to forex pairs.

Card and bank withdrawals typically take five to ten working days, while wallet and crypto withdrawals usually process the same day, depending on the method.

FXCC supports MetaTrader 4, MetaTrader 5, and a copy trading layer integrated with MT5.

Yes, FXCC provides VPS access for traders who require stable connectivity for automated strategies and multi-account workflows.

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open a FXCC Account

- Safety and Security

- Trading Platforms and Tools

- Markets available for Trade

- Deposits and Withdrawals

- Bonus Offers and Promotions

- Partnership Programs

- Industry Awards

- FXCC Learning and Trading Tools

- Customer Support

- FXCC vs BDSwiss vs IG - A Comparison

- Pros and Cons

- In Conclusion