FXPro Minimum Deposit Review

FxPro Minimum Deposit amount required to open an FxPro Account is 100 USD. FxPro offers access to 3 Live Trading Accounts, including Standard, Raw+, and Elite.

★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, ASIC Crypto: Yes |

Minimum Deposit and Account Types

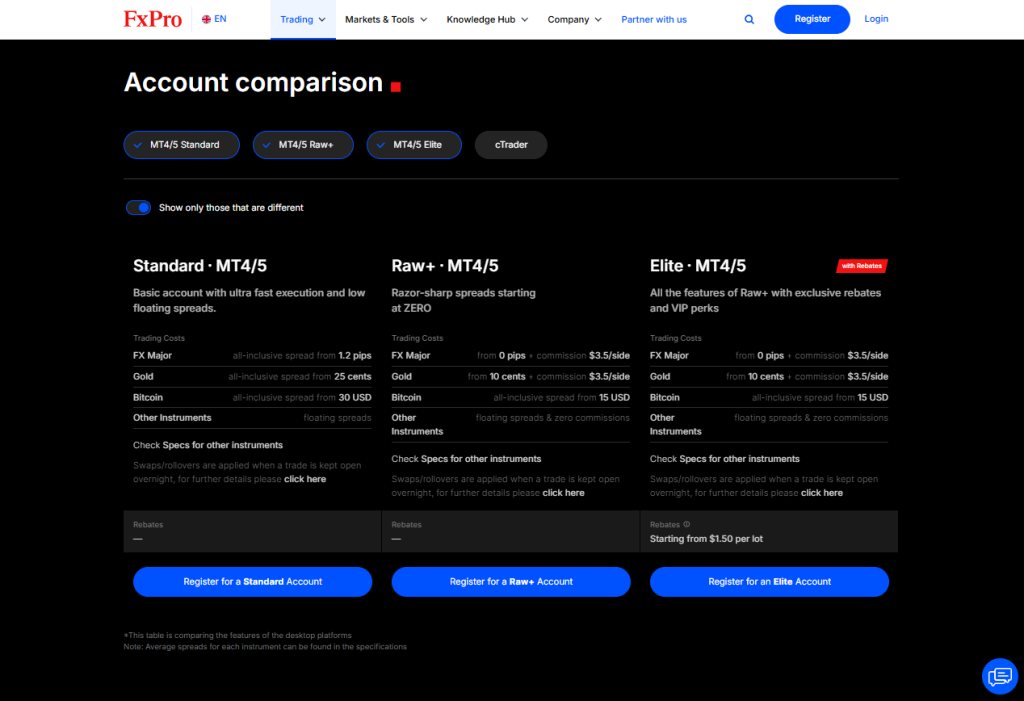

FxPro offers three main account types, Standard, Raw+, and Elite, each designed with different pricing structures and commission models. Traders can select based on preferred spread type, commission style, and trading volume.

| Account Type | Spread Type | Commission | Rebates |

| Standard | All-inclusive (from 1.2 pips) | None | n/a |

| Raw+ | Raw (from 0.0 pips) | $3.5 per side | n/a |

| Elite | Raw (from 0.0 pips) | $3.5 per side | From $1.50/lot |

Frequently Asked Questions

What’s the difference between FxPro’s Standard and Raw+ accounts?

The Standard account features all-inclusive spreads starting from 1.2 pips, making it ideal for simplicity. Raw+ offers ultra-low spreads starting from 0.0 pips with a $3.5 commission per side, better suited for active or algorithmic traders.

Who qualifies for the FxPro Elite account?

The Elite account is tailored for high-volume traders. It offers all the benefits of Raw+ along with rebates starting at $1.50 per lot, plus additional VIP features. It requires a higher trading volume to qualify.

Our Insights

FxPro’s tiered account structure gives traders real control over their cost preferences. From zero-spread models to rebate-rich VIP setups, it offers accounts that align with every trading budget and goal.

★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, ASIC Crypto: Yes |

How To Open an Account

To register an account with FxPro, follow these steps:

1. Step 1: Start the Registration Process.

Begin the process by going to the FxPro website and browsing the registration page. After submitting the initial form, check your email for a confirmation PIN.

2. Step 2: Complete The Questionnaire.

You will next be prompted to complete a questionnaire about your financial knowledge and trading experience. Choose your favorite trading platform from the alternatives available.

3. Step 3: Meet regulatory requirements

To meet regulatory requirements, submit a clear copy of your government-issued ID or passport. You will get confirmation from FxPro after your papers have been successfully verified and your account approved.

Finally, after your account has been funded, you may begin trading by accessing FxPro’s wide variety of financial products via your preferred platform.

★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, ASIC Crypto: Yes |

Deposit and Withdrawal

FxPro supports a wide range of deposit and withdrawal methods, including bank wire transfers, credit/debit cards, and popular e-wallets. Designed for simplicity and speed, the platform ensures secure and timely transactions, with most deposits processed within one business day.

| Method | Type | Deposit Time | Withdrawal Time |

| Bank Transfer | Traditional | Within 1 business day | 1–3 business days |

| Credit/Debit Card | Instant | Instant or near-instant | 1–2 business days |

| E-Wallets | Digital | Instant or near-instant | Varies by provider |

| FxPro Direct | Account Portal | Centralized access | Manages all transactions |

Frequently Asked Questions

What deposit and withdrawal methods does FxPro support?

FxPro accepts bank wire transfers, credit/debit cards, and various e-wallets. All transactions are managed through the FxPro Direct portal, where users can follow step-by-step instructions for fast and secure fund transfers.

How long does it take to process deposits and withdrawals?

FxPro typically processes deposits within one working day. Withdrawals depend on the chosen payment method, but the platform ensures flexibility and efficiency, returning funds to your original payment channel whenever possible.

Our Insights

FxPro offers a seamless deposit and withdrawal experience. With fast processing times, global payment options, and easy-to-follow procedures, managing your funds is simple and secure, whether you’re using a bank, card, or e-wallet.

★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, ASIC Crypto: Yes |

Getting Started Essentials – A Quick Q&A

5 Frequently Asked Questions about the FxPro minimum deposit, withdrawal process, and sign-up perks.

Q: What’s the minimum deposit to open an FxPro account? – Sophia, Australia

A: FxPro requires a minimum deposit of 100 USD (or equivalent in other currencies), providing an affordable entry for new traders while allowing access to a wide range of financial instruments across multiple platforms.

Q: How quickly can I withdraw funds from FxPro? – Amina, Kenya

A: Withdrawal requests are typically processed within one business day. E-wallets and card transfers may reflect within minutes to hours, while bank wire transfers can take 1–3 business days, depending on your bank and location.

Q: Does FxPro charge fees for deposits or withdrawals? – Oliver, Germany

A: FxPro does not charge fees on deposits or withdrawals. Third-party providers, such as banks or e-wallets, may apply transaction or conversion fees depending on the payment method chosen.

Q: Can I withdraw profits to a different method than my deposit method? – Fatima, UAE

A: Anti-money laundering rules require withdrawals up to your deposit amount to return to the original funding method. Profits exceeding the deposit can be withdrawn using another registered payment method in your name.

Q: What perks come with signing up at FxPro? – Liam, UK

A: FxPro offers tight spreads, flexible leverage, commission-free Standard accounts, zero-spread Raw+ options, advanced platforms including MT4, MT5, and cTrader, and a free demo account for practice, providing value for both beginners and professional traders.

★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, ASIC Crypto: Yes |

Pros and Cons

| ✓ Pros | ✕ Cons |

| MetaTrader 4 and 5 | Basic FXPro App |

| cTrader accounts | Commissions on cTrader accounts |

| Wide Range of Trading Instruments | Withdrawal Processing Times |

| Diverse Educational Resources | Limited Advanced Content |

| Multiple Platform Options | Spread Variability |

| Flexible Leverage | Potential for Higher Risk with Leverage |

| No Deposit or Withdrawal Fees | Complexity for New Traders |

You might also like:

In Conclusion

Traders can access FxPro with a minimum deposit of USD 100 and choose from Standard, Raw+, or Elite accounts. The broker’s tiered account structure, fast funding options, and secure platforms serve both beginners and high-volume professionals, delivering flexible trading conditions and cost-efficient solutions for a variety of strategies.

Faq

Yes, FxPro allows several currency sub-accounts under your main account. You can transfer funds between these sub-accounts, but be mindful of possible conversion costs.

No. While FxPro does not expressly reward greater deposits, higher account balances can qualify you for better account types or more services.

Yes, you can use several deposit methods to fund your account, which are then pooled for trading. However, each deposit is handled independently and may have a varied processing time.

Cryptocurrency deposits are converted to your account’s base currency using the current market rate.