ICM Capital Review

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open an ICM Capital Account

- Safety and Security

- Advanced Trading Tools

- Trading Products

- Secure and Reliable Fund Withdrawals

- Customer Support

- Insights from Real Traders

- Customer Reviews and Trust Scores

- Discussions and Forums about ICM Capital

- Employee Overview of Working for ICM Capital

- Pros and Cons

- In Conclusion

ICM Capital is a reliable and well-established global online trading broker, trusted by traders worldwide. With a strong international presence, the broker emphasizes exceptional customer service and transparency. Industry analysts rate ICM Capital highly, awarding it a trust score of 90 out of 99, reflecting its credibility and reputation in the trading community.

★★★ | Minimum Deposit: $200 Regulated by: FCA Crypto: Yes |

Overview

ICM Capital stands out as a regulated global Forex and CFD broker, providing traders access to currencies, commodities, indices, and futures. Traders highlight its FCA 🇬🇧 regulation, award-winning support, and use of the MetaTrader 4 platform, combined with strong insurance coverage and a commitment to transparency.

Frequently Asked Questions

Is ICM Capital a regulated broker?

Yes. ICM Capital is authorised and regulated by the Financial Conduct Authority 🇬🇧 (FCA registration number 520965). This ensures strict compliance with financial standards and provides traders with a safe and transparent trading environment that is trusted globally.

What trading products does ICM Capital offer?

ICM Capital offers Forex pairs, commodities such as WTI and Brent Oil, metals like silver and gold, indices, and CFDs. All products can be traded on the MetaTrader 4 platform, which supports advanced charting, technical analysis, and mobile trading features.

Our Insights

ICM Capital combines FCA 🇬🇧 regulation, top-tier insurance coverage, and strong customer support to create a secure and professional trading environment. With access to multiple asset classes and the reliable MetaTrader 4 platform, it appeals to both beginner and professional traders seeking long-term value.

★★★ | Minimum Deposit: $200 Regulated by: FCA Crypto: Yes |

Fees, Spreads, and Commissions

ICM Capital provides traders with a clear and competitive fee structure. Spreads start from zero on specific pairs, while commissions apply only on certain products. The broker’s transparency in spreads, commissions, and execution allows traders to manage costs effectively while accessing diverse instruments and efficient pricing.

| Account Type | Spread | Commission | Execution Style |

| ICM Direct | Variable (view specs) | None | Market Execution |

| ICM Zero | From 0 (on EURUSD) | $7 per round lot | Market Execution |

Frequently Asked Questions

How does ICM Capital structure its spreads and commissions?

ICM Capital offers spreads starting from zero on selected pairs, particularly EURUSD. The ICM Zero account includes a commission of $7 per round lot for Forex and Metals only, while other instruments are commission-free. This pricing approach balances tight spreads with transparent cost structures.

Are spreads fixed or variable at ICM Capital?

Spreads at ICM Capital are variable and may change according to market conditions. Market execution ensures access to the best available prices with the possibility of positive slippage. This allows traders to benefit from real-time pricing efficiency across various instruments, including Forex, Metals, and CFDs.

Our Insights

ICM Capital stands out for its competitive and transparent fee model. With zero-spread opportunities and clearly defined commissions, traders benefit from cost-efficient access to global markets. Its approach balances low trading costs with reliable execution, making it attractive for both retail and professional clients.

★★★ | Minimum Deposit: $200 Regulated by: FCA Crypto: Yes |

Minimum Deposit and Account Types

ICM Capital offers two main account types designed for global accessibility. Both ICM Direct and ICM Zero support multiple base currencies, competitive leverage, and access to a wide range of instruments. Each account type aligns with trader needs, ensuring flexibility, transparency, and supportive trading conditions.

Frequently Asked Questions

What is the minimum deposit for ICM Capital accounts?

ICM Capital does not enforce a high minimum deposit barrier, allowing traders flexibility in starting capital. Both ICM Direct and ICM Zero accounts support USD, EUR, GBP, or SGD as base currencies, making them accessible to traders across different financial backgrounds and regions.

What are the main differences between ICM Direct and ICM Zero?

The primary distinction lies in spreads and commissions. ICM Direct offers commission-free trading with variable spreads, while ICM Zero provides spreads starting from zero with a $7 per round lot commission for Forex and Metals. Both accounts provide the same instruments and execution quality.

Our Insights

ICM Capital ensures traders can choose between cost models that fit their strategy. Whether prioritizing zero spreads with commission or variable spreads with no commission, traders enjoy flexible account conditions, competitive leverage, and robust platform support suitable for diverse global trading needs.

★★★ | Minimum Deposit: $200 Regulated by: FCA Crypto: Yes |

How to Open an ICM Capital Account

Opening an ICM Capital account is fast and mostly online. You can register for a demo or apply for a live account, complete identity checks, and fund your account to start trading with MetaTrader 4. Follow these simple steps to get set up quickly.

1. Step 1: Visit the ICM registration page

Click the Register or Open Account button on the ICM Capital site and start your application.

2. Step 2: Complete the online form

Enter your name, contact details, country of residence, and create a secure password.

3. Step 3: Confirm your email

Open the verification email and click the activation link to access your client area.

4. Step 4: Submit KYC documents

Upload a government-issued ID and proof of address to verify identity. Note that some live accounts require professional client eligibility and extra documentation.

5. Step 5: Fund your account and choose a platform

Deposit funds using an accepted method. The typical minimum for a live account is about $200, after which you can select MetaTrader 4 and begin trading.

This entire process can often be completed in minutes, though verification times may vary.

★★★ | Minimum Deposit: $200 Regulated by: FCA Crypto: Yes |

Safety and Security

ICM Capital operates under the strict supervision of the 🇬🇧 Financial Conduct Authority (FCA). This regulator enforces compliance, ensures market stability, and promotes fair competition in financial services. Traders benefit from enhanced security as FCA oversight demands transparency, accountability, and robust operational standards from all regulated firms.

| Broker | Regulator | Country | License Number |

| ICM Capital | FCA | 🇬🇧 United Kingdom | 520965 |

Frequently Asked Questions

What does it mean that the FCA regulates ICM Capital?

Being regulated by the 🇬🇧 FCA means ICM Capital must follow strict standards to protect clients and maintain fair practices. The FCA monitors conduct, enforces rules, and ensures companies act responsibly, providing traders with a higher level of trust and confidence in their broker.

Why is FCA regulation important for traders?

🇬🇧 FCA regulation is crucial because it safeguards client interests through strict enforcement and oversight. The FCA can investigate breaches, impose fines, or even revoke licenses. This creates a secure trading environment where traders know the firm is accountable to UK Treasury and government standards.

Our Insights

ICM Capital’s regulation by the 🇬🇧 FCA reinforces its credibility and commitment to client protection. With strong oversight, transparent conduct requirements, and legal accountability, traders gain peace of mind knowing their broker adheres to one of the most respected regulatory frameworks in the world.

★★★ | Minimum Deposit: $200 Regulated by: FCA Crypto: Yes |

Advanced Trading Tools

ICM Capital equips traders with powerful tools to enhance decision-making and execution. From pip and pivot calculators to an integrated economic calendar, clients gain real-time support. Additionally, VPS hosting and MT4 trading signals provide professional-grade resources for improved performance, reduced latency, and uninterrupted automated trading strategies.

| Tool | Purpose | Availability | Benefit |

| Pip Calculator | Calculate pip value | All traders | Precision in position sizing |

| Pivot Calculator | Identify pivot points | All traders | Supports technical analysis |

| Economic Calendar | Track key events | All traders | Informed trading decisions |

| VPS Hosting | Run Expert Advisors | Balance ≥ 4,000 USD/EUR/GBP/SGD | Faster, uninterrupted trading |

Frequently Asked Questions

What trading tools does ICM Capital provide to its clients?

ICM Capital offers a range of trading tools, including pip and pivot calculators, an economic calendar, trailing stops, and MT4 trading signals. These features are designed to simplify calculations, track market-moving events, and help traders optimize their strategies through automation and real-time updates.

How does VPS hosting benefit ICM Capital traders?

VPS hosting ensures uninterrupted trading by running Expert Advisors 24/7 with minimal latency. Offered in partnership with Beeks FX, it enhances trade execution speed, reduces slippage, and provides global accessibility. Clients maintaining a balance of 4,000 USD or equivalent can access it for free.

Our Insights

ICM Capital’s suite of trading tools empowers clients with professional-level resources. Whether through automated VPS trading, real-time economic updates, or precision calculators, traders gain practical support for both strategy and execution. These tools add valuable flexibility and reliability for beginners and advanced traders alike.

★★★ | Minimum Deposit: $200 Regulated by: FCA Crypto: Yes |

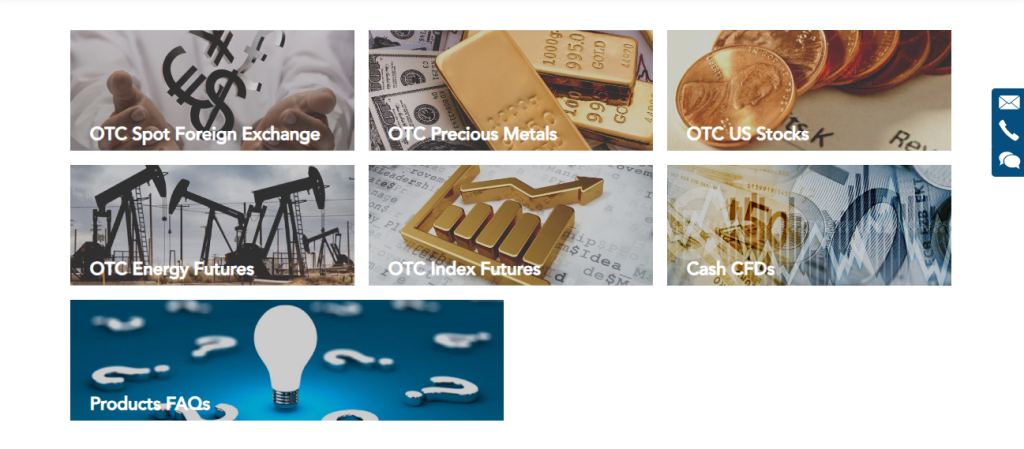

Trading Products

ICM Capital provides traders with access to a broad range of products through MetaTrader 4. From Forex and CFDs on Oil, Gold, and Silver to indices, stocks, and energy futures, clients can trade around the clock. This diversity supports multiple strategies while ensuring global market opportunities.

| Product Type | Examples | Platform | Availability |

| Forex | Major currency pairs | MT4 | 24/5 |

| Precious Metals | Gold Silver | MT4 | 24/5 |

| Energy Futures | WTI Brent | MT4 | 24/5 |

| Index Futures | Global indices | MT4 | 24/5 |

Frequently Asked Questions

What trading products are available at ICM Capital?

ICM Capital offers OTC spot Forex, precious metals, US stocks, energy futures, index futures, and cash CFDs. Traders can access these through MetaTrader 4 with live streaming prices, enabling them to diversify their portfolios and take advantage of global market opportunities efficiently.

Can traders access these products 24 hours a day?

Yes, ICM Capital’s MetaTrader 4 platform allows traders to access Forex, commodities, stocks, and CFDs 24 hours a day. This continuous availability provides flexibility and enables traders to respond quickly to market-moving events across global sessions, enhancing opportunities in volatile conditions.

Our Insights

ICM Capital’s wide product offering empowers traders with flexibility and choice. From currencies to commodities and indices, the broker ensures access to major global markets. This diverse range allows traders to tailor strategies to different asset classes while benefiting from MT4’s robust functionality.

★★★ | Minimum Deposit: $200 Regulated by: FCA Crypto: Yes |

Secure and Reliable Fund Withdrawals

ICM Capital ensures client fund withdrawals are handled promptly and securely. Requests are usually processed the same business day, though banks may take 3–5 working days for transfers. By returning funds through the original payment method, ICM Capital adds an extra layer of fraud prevention and client protection.

| Feature | Details |

| Processing Time | Same business day |

| Bank Transfer | 3–5 working days |

| Withdrawal Method | Same as deposit |

| Security Measure | Proof of ownership required |

Frequently Asked Questions

How long does it take to withdraw funds from ICM Capital?

Withdrawals are typically processed by ICM Capital on the same business day. However, depending on the banking system, it may take 3–5 working days for funds to appear in a client’s account. In rare cases, delays may occur, requiring client service support.

Why must withdrawals be made to the original funding method?

ICM Capital enforces withdrawals to the original deposit method to protect clients from identity fraud and misuse of accounts. For example, if funds were deposited via credit card, withdrawals must go back to the same card. This ensures secure and verifiable fund transfers.

Our Insights

ICM Capital prioritizes client security with a clear and protective withdrawal policy. By processing requests swiftly while enforcing strict return-to-source rules, the broker combines efficiency with safety, giving traders peace of mind when managing their trading funds.

★★★ | Minimum Deposit: $200 Regulated by: FCA Crypto: Yes |

Customer Support

ICM Capital ensures clients can reach support teams quickly and securely. With dedicated client services, technical assistance, and multiple communication channels, traders receive timely help. From its 🇬🇧 London headquarters, ICM Capital provides reliable service, protecting client data and ensuring every query is handled professionally and efficiently.

Frequently Asked Questions

How can clients contact ICM Capital for support?

Clients can reach ICM Capital via phone, email, or the online message form. Client services are available Monday to Friday from 6 am to 6 pm GMT, while technical support operates 24 hours a day during trading days, ensuring continuous assistance when needed.

What measures does ICM Capital take to protect client information during support?

For security, ICM Capital verifies client identity before sharing any information. Telephone calls and online chats may also be recorded and monitored. These measures ensure client data remains safe while providing effective service across technical, trading, or account-related queries.

Our Insights

ICM Capital offers comprehensive support through multiple channels, balancing accessibility with strict data protection. With responsive teams for both client services and technical support, traders benefit from reliable assistance and confidence that their information remains secure at all times.

★★★ | Minimum Deposit: $200 Regulated by: FCA Crypto: Yes |

Insights from Real Traders

⭐⭐⭐⭐

I have been trading with ICM Capital for nearly a year and I am very impressed with their service. The spreads are competitive, withdrawals are quick, and the MetaTrader 4 platform runs smoothly. Their customer support team has been very responsive whenever I had a question, which makes trading stress-free. –

Jake

⭐⭐⭐⭐⭐

ICM Capital has proven to be a reliable broker with fast execution and fair spreads. I like their education center, which is very helpful for improving my trading strategies. However, I would like to see more advanced account types or promotions for regular traders. Overall, still a good experience. –

Mike

⭐⭐⭐

My time with ICM Capital has been a mix of positives and some frustrations. On the positive side, I appreciate their FCA regulation and feel safe trading with them. However, the verification process took longer than expected, and funding options could be more flexible. Still, I trust them as a broker. –

Sammy

★★★ | Minimum Deposit: $200 Regulated by: FCA Crypto: Yes |

Customer Reviews and Trust Scores

ICM Capital garners mixed feedback across review platforms, signaling a varied user experience. While some clients applaud seamless withdrawals and supportive service, others voice frustrations regarding withdrawal delays and unexpected fees. Overall, trust scores reflect this divergence in user satisfaction.

| Platform | Trust Score (5) | Summary |

| Trustpilot | 3.8 | Generally positive, but some complaints |

| Forex Peace Army | 2.7 | Mixed to negative reviews |

| TradersUnion Safety | 4.5 | High safety and transparency rating |

| Myfxbook | 1 | One scathing review about withdrawal issues |

This varied feedback highlights the importance of user caution and personal due diligence.

★★★ | Minimum Deposit: $200 Regulated by: FCA Crypto: Yes |

Discussions and Forums about ICM Capital

Online forums reveal diverse trader experiences with ICM Capital. One user shared frustrations over unexplained account freezes and blocked withdrawals, while others described smooth withdrawals and responsive execution, demonstrating a broad spectrum of perspectives.

| Source | Sentiment | Comments |

| Trustpilot Reviews | Mixed | Issues with withdrawals, account freezes, support |

| Forex Peace Army | Negative | Hidden spreads, profit validity, trading concerns |

Active engagement in these discussions can provide valuable cautionary insights before committing.

★★★ | Minimum Deposit: $200 Regulated by: FCA Crypto: Yes |

Employee Overview of Working for ICM Capital

Employee reviews paint ICM Capital as a firm with a supportive work culture, especially for development roles. Teams are small yet dynamic, offering flexibility and a collaborative environment. However, limited growth opportunities and advancement were also reported.

| Category | Rating (5) |

| Work-Life Balance | 4.5 |

| Management | 4.3 |

| Pay/Benefits | 3.0 |

| Job Security | 3.0 |

| Overall Culture | Positive and flexible |

This environment may suit professionals who value autonomy and collaboration over rapid career progression.

★★★ | Minimum Deposit: $200 Regulated by: FCA Crypto: Yes |

Pros and Cons

| ✓ Pros | ✕ Cons |

| Regulated by FCA | $200 minimum deposit |

| Multiple account types | Limited education tools |

| Competitive spreads | No cent accounts |

| Global offices | Limited bonuses |

| Supports MetaTrader 4 | Inactivity fees apply |

References:

In Conclusion

ICM Capital, a global online trading broker, maintains a strong international presence with local offices and customer support across various regions. These offices cater to clients by providing localized assistance and services, ensuring a seamless trading experience.

- 🇬🇧 United Kingdom

- 🇦🇪 United Arab Emirates

- 🇲🇺 Mauritius

- 🇸🇨 Seychelles

- 🇿🇦 South Africa

- 🇨🇭 Switzerland

- 🇦🇺 Australia

- 🇨🇦 Canada

- 🇮🇪 Ireland

- 🇸🇬 Singapore

- 🇳🇿 New Zealand

- 🇲🇾 Malaysia

- 🇹🇭 Thailand

- 🇸🇦 Saudi Arabia

- 🇪🇸 Spain

- 🇮🇹 Italy

- 🇹🇷 Turkey

- 🇷🇺 Russia

- 🇯🇵 Japan

- 🇭🇰 Hong Kong

- 🇵🇹 Portugal

- 🇰🇷 South Korea

- 🇧🇷 Brazil

These local offices and support centers enable ICM Capital to offer tailored services, addressing the unique needs of traders in each region.

Faq

Withdrawal processing timeframes with ICM Capital vary depending on the withdrawal option used. However, they normally range from a few days to a week.

ICM Capital principally provides the industry-standard MetaTrader 4 (MT4) platform, with additional choices for web-based trading and mobile trading applications.

ICM Capital demands a minimum deposit of $200 to register an account.

Yes. ICM Capital is regulated by the Financial Conduct Authority (FCA) in the United Kingdom.

ICM Capital offers several account types, including Direct and Zero accounts.

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open an ICM Capital Account

- Safety and Security

- Advanced Trading Tools

- Trading Products

- Secure and Reliable Fund Withdrawals

- Customer Support

- Insights from Real Traders

- Customer Reviews and Trust Scores

- Discussions and Forums about ICM Capital

- Employee Overview of Working for ICM Capital

- Pros and Cons

- In Conclusion