KVB Prime Review

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open a KVB Prime Account

- Safety and Security

- Trading Platforms and Tools

- Copy-Trading Program

- Global Markets Access via KVB Prime

- Deposits and Withdrawals

- 100% Deposit Bonus

- IB Program

- Insights from Real Traders

- Customer Reviews and Trust Scores

- Discussions and Forums about KVB Prime

- Employee Overview of Working for KVB Prime

- Pros and Cons

- In Conclusion

KVB Prime is a trustworthy Forex Broker with over two decades of experience in the financial market. It offers access to a proprietary trading app and has a trust score of 65 out of 99.

★★ | Minimum Deposit: $10 Regulated by: Anjouan Offshore Finance Authority Crypto: Yes |

Overview

KVB stands out as a broker that blends technology, financial expertise, and analytics to deliver innovative online trading. Established in 2001, it has expanded across more than 100 countries, offering access to five asset classes, professional-grade platforms, and competitive conditions designed to empower traders worldwide.

Frequently Asked Questions

What makes KVB different from other brokers?

KVB differentiates itself by merging technology with financial expertise. Its advanced platforms, low-cost trading conditions, and global reach across more than 100 countries provide traders with tools and flexibility to grow. Additionally, its strong client support and educational focus empower users to control their financial future effectively.

Does KVB support new traders?

Yes, KVB supports traders of all experience levels. Beginners benefit from intuitive, user-friendly platforms and educational resources, while experienced traders gain access to advanced tools, low spreads, and professional-grade analytics. This combination ensures that every client has an opportunity to learn, improve, and trade with confidence.

Our Insights

KVB delivers a modern, technology-driven trading experience backed by competitive conditions and reliable customer support. With its strong global presence, professional tools, and cost-efficient offerings, the broker positions itself as a forward-thinking choice for traders aiming to balance performance with accessibility.

★★ | Minimum Deposit: $10 Regulated by: Anjouan Offshore Finance Authority Crypto: Yes |

Fees, Spreads, and Commissions

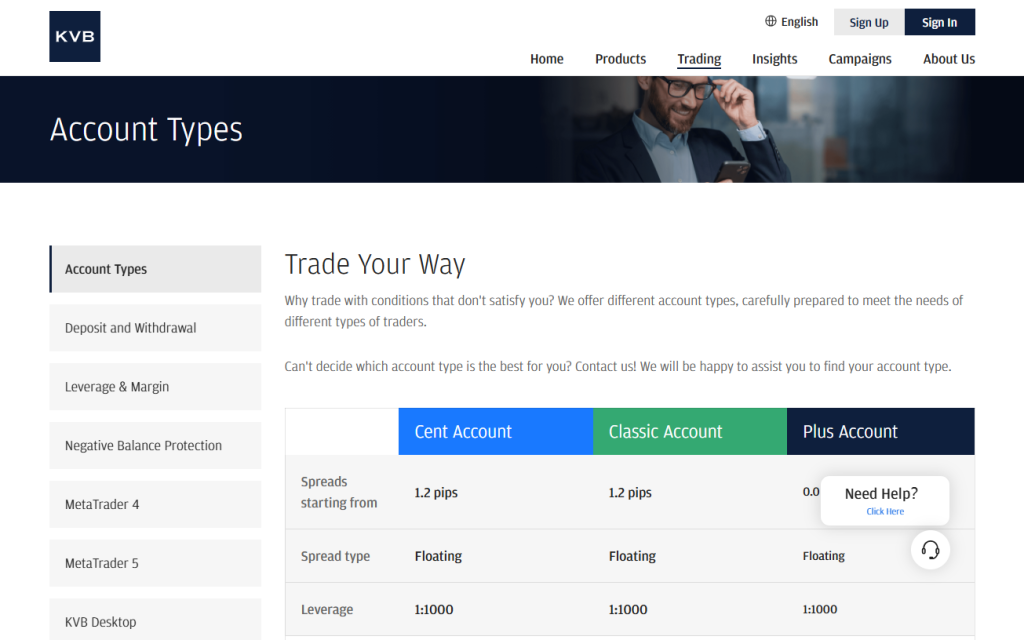

KVB provides competitive trading conditions designed to reduce costs for traders. With spreads starting as low as 0.0 pip and floating spread types across accounts, clients can maximize value. Additionally, the broker offers low commissions and negative balance protection, ensuring an accessible and transparent trading environment.

| Feature | Cent Account | Classic Account | Plus Account |

| Spreads From | 1.2 pips | 1.2 pips | 0.0 pip |

| Spread Type | Floating | Floating | Floating |

| Negative Protection | Yes | Yes | Yes |

Frequently Asked Questions

How low are KVB spreads?

Spreads with KVB vary by account type. Classic and Cent Accounts start from 1.2 pips, while Plus Accounts begin at 0.0 pips. This flexibility allows traders to choose a cost structure that aligns with their strategy while benefiting from floating spreads and competitive execution.

Are commissions high with KVB?

No, commissions at KVB are designed to remain low. Combined with spreads starting at 0.0 pip in the Plus Account, traders can optimize their overall trading costs. This balance of low spreads and minimal fees helps ensure that more value remains in the client’s portfolio.

Our Insights

KVB strikes a balance between affordability and functionality. With low spreads, competitive commissions, and reliable negative balance protection, the broker creates a fair and efficient environment. Traders benefit from cost savings that translate directly into improved performance across different trading strategies.

★★ | Minimum Deposit: $10 Regulated by: Anjouan Offshore Finance Authority Crypto: Yes |

Minimum Deposit and Account Types

KVB offers a range of accounts to suit different trading needs. From entry-level Cent and Classic Accounts with accessible deposits to the advanced Plus Account requiring USD 10,000, each account provides full market insights, professional platforms, and flexible leverage, giving traders the freedom to select their preferred approach.

Frequently Asked Questions

What is the minimum deposit at KVB?

The minimum deposit depends on the account type. Cent Accounts start at USD 10, Classic Accounts require USD 30 and Plus Accounts begin at USD 10,000. This tiered structure ensures that both beginners and professional traders have account options tailored to their capital.

Which account type is best for new traders?

New traders often prefer the Cent or Classic Accounts. With low minimum deposits, floating spreads and full access to market insights, these accounts provide affordable entry points while allowing clients to build experience. However, more advanced traders may benefit from the Plus Account’s tighter spreads.

Our Insights

KVB delivers flexibility with its tiered account structure, making trading accessible to all levels. Affordable minimum deposits for beginners and advanced features for professionals ensure that every trader can find a suitable account. This adaptability makes KVB’s offerings appealing across a broad range of strategies.

★★ | Minimum Deposit: $10 Regulated by: Anjouan Offshore Finance Authority Crypto: Yes |

How to Open a KVB Prime Account

Setting up a KVB Prime account is fast and straightforward. Just follow these steps to begin:

1. Step 1: Visit the KVB Prime Website

Head to the official KVB Prime website and click “Create Account.”

2. Step 2: Select Your Country or Region

Choose your location from the provided dropdown list.

3. Step 3: Enter Email and Verify

Provide a valid email address and input the verification code you receive.

4. Step 4: Submit Registration

Click “Register” to complete the account creation.

5. Step 5: Fund Your Account

Log in to your new account and deposit funds using available payment methods.

The minimum deposit for a Prime account can be as low as USD 10, making it accessible for many traders.

★★ | Minimum Deposit: $10 Regulated by: Anjouan Offshore Finance Authority Crypto: Yes |

Safety and Security

KVB Prime operates under the oversight of 🇰🇲 Anjouan Offshore Finance Authority (AOFA), holding License No. L15626. With strict compliance practices, segregated client funds, and transparent auditing processes, KVB Prime demonstrates a strong commitment to regulatory standards, ensuring a secure and trustworthy environment for traders worldwide.

| Feature | Details |

| Regulator | 🇰🇲 Anjouan Offshore Finance Authority |

| License Number | L15626 / KVB |

| Client Fund Segregation | Yes, with top-tier banks |

| Business Model | True STP and NDD, no conflict of interest |

Frequently Asked Questions

Who regulates KVB Prime?

KVB Prime Limited is regulated by the 🇰🇲 Anjouan Offshore Finance Authority (AOFA) under Government Notice No. 005 of 2005. The AOFA oversees all brokerage activities, including forex, shares, commodities, and securities, ensuring compliance with financial reporting, fund segregation, and corporate governance standards.

How does KVB Prime protect client funds?

KVB Prime fully segregates client deposits from company capital. Funds are ring-fenced in separate bank accounts at top-tier institutions, meaning they cannot be used for operational expenses. This safeguard, combined with external audits and internal controls, helps ensure financial security and client protection.

Our Insights

KVB Prime strengthens trader confidence by adhering to strict regulatory practices set by 🇰🇲 AOFA. With robust compliance measures, transparent auditing, and complete fund segregation, the broker demonstrates reliability and accountability. This commitment to secure operations ensures a safer environment for traders seeking professional oversight.

★★ | Minimum Deposit: $10 Regulated by: Anjouan Offshore Finance Authority Crypto: Yes |

Trading Platforms and Tools

KVB Prime delivers a comprehensive trading experience with MetaTrader 4, MetaTrader 5, its desktop platform, and the KVB mobile app. Traders enjoy fast execution, advanced charting, automated strategies, and full account management. This ensures professionals and beginners can trade global markets efficiently and confidently.

| Platform | Key Features | Supported Assets | Accessibility |

| MetaTrader 4 | Charts indicators Expert Advisors | Forex Commodities Indices | Desktop Web Mobile |

| MetaTrader 5 | Advanced charting backtesting | Forex Commodities Indices Stocks | Desktop Web Mobile |

| KVB Desktop | Real-time market access, account management | All supported instruments | Desktop only |

| KVB App | Mobile trading news alerts fund management | All supported instruments | iOS Android |

Frequently Asked Questions

What makes MetaTrader 4 and 5 ideal at KVB Prime?

MetaTrader 4 and 5 provide fast order execution, multiple chart displays, automated trading with Expert Advisors, customizable tools, and backtesting. Both platforms support alerts, order types, and comprehensive analytics, empowering traders to make informed decisions across Forex, commodities, indices, stocks, and metals.

How does the KVB App enhance mobile trading?

The KVB App enables full trading functionality on mobile devices. Users can open and close trades, set take profits and stop-loss levels, calculate margins, and access economic news. It ensures convenient, flexible account management and execution, making it suitable for traders on the go.

Our Insights

KVB Prime offers a complete trading ecosystem across desktop, web, and mobile platforms. With MT4, MT5, KVB Desktop, and the mobile app, traders benefit from speed, advanced charting, automation, and seamless account management, making trading accessible and efficient for any level of investor.

★★ | Minimum Deposit: $10 Regulated by: Anjouan Offshore Finance Authority Crypto: Yes |

Copy-Trading Program

Investors see the copy-trading program as a highly efficient tool to mirror experienced traders’ moves across MetaTrader servers. By combining flexibility and transparency, it allows participants to choose their preferred Signal Providers, manage risk actively, and engage in a profit-sharing model that rewards performance while protecting their capital.

| Feature | Signal Provider | Copy-trader | Key Benefit |

| Account Eligibility | Any live account | Main account plus copy account | Inclusive access |

| Trading Method | Manual | Manager API only | Simplified replication |

| Profit Sharing | 0%-50% | Pay only if profitable | Performance-based fees |

| Risk Management | N/A | Stop loss, take profit, stop copying | Capital protection |

Frequently Asked Questions

What is the role of a Signal Provider in copy-trading?

A Signal Provider shares their live trading account signals, allowing Copy-traders to replicate their trades. They earn a profit-sharing fee based on successful trades, and they can set account requirements while their performance history remains transparent to ensure credibility and informed decision-making.

How can Copy-traders manage risk in the program?

Copy-traders control risk by adjusting copy ratios, setting stop loss or take profit limits, or stopping trade replication altogether. The High Water Mark ensures fees are only paid on profits exceeding previous peaks, protecting their funds from losses while maximizing potential gains.

Our Insights

The copy-trading program offers a secure and performance-based trading experience. By combining real-time trade replication, flexible risk management, and a transparent profit-sharing model, it ensures investors can follow experienced traders confidently while maintaining control over their funds and investment decisions.

★★ | Minimum Deposit: $10 Regulated by: Anjouan Offshore Finance Authority Crypto: Yes |

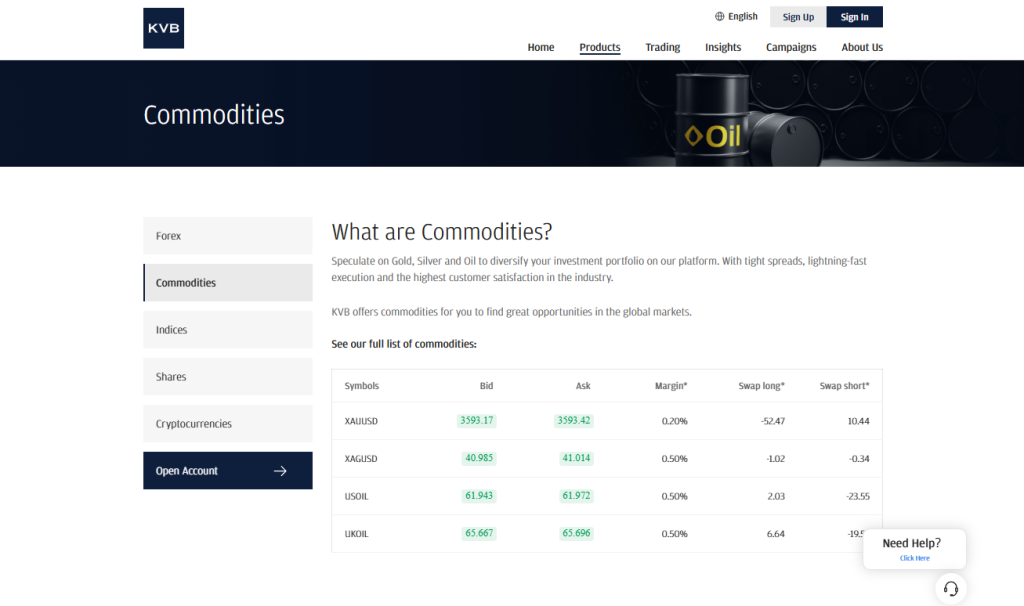

Global Markets Access via KVB Prime

Industry observers recognize that KVB Prime grants traders access to forex, commodities, indices, shares, cryptocurrencies, precious metals, energies, and CFDs. It delivers this on platforms such as MetaTrader 4 plus proprietary mobile and web systems, combining variety with ease of use.

| Market Type | Description | Platform Access | Key Advantage |

| Forex Indices | Currency pairs plus global indices | MT4 and proprietary platforms | Broad global exposure |

| Commodities Energies | Oil gold metals | Same platforms | Diverse asset class coverage |

| Shares CFDs | Equities plus CFD instruments | Same platforms | Flexible investment options |

| Cryptocurrencies | Major digital assets | Same platforms | Access to crypto markets |

Frequently Asked Questions

What asset classes can traders access via KVB Prime?

Traders can access a wide spectrum of markets, including forex, commodities, indices, shares, cryptocurrencies, precious metals and energies, plus general CFDs. Platforms support seamless trading across global markets using both MT4 and KVB’s proprietary systems.

Which platforms does KVB Prime support for market access?

KVB Prime offers flexible platform choices: industry‑standard MetaTrader 4 alongside its own mobile and web platforms, designed for convenience and speed. Therefore, traders enjoy powerful tools, automated strategies, and multi‑device access.

Our Insights

KVB Prime delivers extensive market diversity and flexible platform access. By offering forex, CFDs, shares, commodities, crypto, and precious metals across both MetaTrader 4 and proprietary platforms, it meets the needs of varied trading strategies – while maintaining a user‑focused, tech‑savvy interface.

★★ | Minimum Deposit: $10 Regulated by: Anjouan Offshore Finance Authority Crypto: Yes |

Deposits and Withdrawals

Industry experts recognize KVB Prime for its fast, secure, and simplified deposit and withdrawal processes. Clients benefit from instant deposits, multiple payment methods, and strict adherence to AML regulations, ensuring that funds are safely transferred while maintaining transparency and accessibility for global traders.

| Feature | Options | Execution Time | Cost |

| Local Bank Transfer | Multiple currencies | Instant | Free |

| Cryptocurrency | USDT-ERC20 USDT-TRC20 | Instant | Free |

| Withdrawal Methods | Bank transfer Cryptocurrency | Within 2 hours | Varies by bank |

| Security Measures | AML checks ID verification | Ongoing | N/A |

Frequently Asked Questions

What deposit methods are available at KVB Prime?

KVB Prime offers local bank transfers in multiple currencies and cryptocurrency transfers in USDT‑ERC20 and USDT‑TRC20. Deposits are instant, free, and fully secure, while third-party deposits are not accepted to protect account integrity and comply with AML regulations.

How long does it take to withdraw funds from KVB Prime?

Withdrawals are processed within two hours through bank transfers or cryptocurrencies. Funds are sent only to accounts under your name, and security checks may require verification documents. International bank fees may apply depending on your bank’s policies.

Our Insights

KVB Prime ensures a fast, safe, and user-friendly fund management experience. With instant deposits, multiple withdrawal options, and robust security measures, clients can focus on trading with peace of mind while maintaining full control over their finances.

★★ | Minimum Deposit: $10 Regulated by: Anjouan Offshore Finance Authority Crypto: Yes |

100% Deposit Bonus

Industry analysts highlight KVB Prime’s 100% Deposit Bonus as a powerful way to amplify trading potential. Eligible clients can instantly double their deposited funds up to $10,000, boosting margin and trade capacity. This promotion supports flexible trading while ensuring profits earned on bonus funds are fully withdrawable.

| Feature | Details | Maximum Limit | Key Benefit |

| Bonus Type | 100% Deposit Credit | 10,000 USD | Double trading power |

| Eligible Accounts | Classic, Plus, Cent | N/A | Broad eligibility |

| Minimum Deposit | $100 | N/A | Easy participation |

| Profit Withdrawal | Profits from bonus can be withdrawn | N/A | Realizable gains |

Frequently Asked Questions

What is the KVB 100% Deposit Credit Bonus?

The bonus automatically matches each eligible deposit dollar-for-dollar up to $10,000. It increases available margin, allowing larger trades and higher profit potential. The bonus can be used for trading, while profits generated can be withdrawn at any time. Losses are deducted from the account balance first.

Who is eligible, and are there restrictions for the bonus?

Eligible accounts include Classic, Plus, and Cent accounts with a minimum first deposit of $100. Bonus misuse, forced liquidations, equity falling below 110% of the bonus, or hedging/abnormal trading can lead to cancellation. This bonus cannot be combined with other promotions.

Our Insights

KVB Prime’s 100% Deposit Bonus maximizes trading leverage safely. By doubling deposit funds instantly and allowing full withdrawal of profits, it provides a clear advantage for eligible traders while incorporating strict rules to prevent abuse and maintain a fair trading environment.

★★ | Minimum Deposit: $10 Regulated by: Anjouan Offshore Finance Authority Crypto: Yes |

IB Program

Industry experts note that KVB Prime’s Introducing Broker (IB) program provides an easy way for partners to earn commissions by referring clients. With instant rebate payouts, detailed wallet tracking, and support tools, participants can maximize earnings while helping clients access competitive spreads, CopyTrading, and advanced trading platforms.

| Feature | Details | Access Method | Key Benefit |

| Commission Type | Rebates on referred clients’ trades | Wallet | Immediate and transparent |

| Trading Advantages | Competitive spreads, CopyTrading | Platform | Attract and retain clients |

| Tools Support | Mobile app, promotional materials | Online portal | Efficient account management |

| Onboarding | Verification, account setup | IB account | Quick and easy participation |

Frequently Asked Questions

What are the key benefits of KVB Prime’s IB program?

Partners enjoy competitive spreads, instant deposit and withdrawal access, and the ability to offer CopyTrading to referrals. Innovative technology and the KVB mobile app simplify account management, while multi-level promotional materials and training help partners attract and retain clients efficiently.

How can I get started with the KVB IB program?

To join, contact your referrer or account manager for program details. Complete identity verification, create a trading account, and make an initial deposit. Then share your invitation link with clients and manage commissions directly from your wallet, transferring or withdrawing rebates anytime.

Our Insights

KVB Prime’s IB program is a practical solution for generating passive income. By offering instant rebates, clear wallet tracking, and extensive marketing support, it allows partners to grow their network while providing clients with top-tier trading tools and competitive market access.

★★ | Minimum Deposit: $10 Regulated by: Anjouan Offshore Finance Authority Crypto: Yes |

Insights from Real Traders

⭐⭐⭐⭐

I have been trading with KVB Prime for six months, and the experience has been excellent. The platforms are fast and intuitive, and spreads are very competitive. Their customer support is always responsive, making trading stress-free and reliable. –

Emma

⭐⭐⭐⭐⭐

KVB Prime caters to both beginners and experienced traders. I started with a small deposit and quickly learned the ropes using their educational tools. Advanced traders will appreciate the low spreads and professional execution. Overall, it’s a trustworthy broker that delivers what it promises. –

Michael

⭐⭐⭐

I feel confident trading with KVB Prime because client funds are fully segregated and secure. Whenever I had questions, their multilingual support team responded quickly and clearly. The combination of safety, transparency, and efficient trading makes KVB Prime my top choice. –

Sophie

★★ | Minimum Deposit: $10 Regulated by: Anjouan Offshore Finance Authority Crypto: Yes |

Customer Reviews and Trust Scores

KVB Prime has garnered mixed feedback from its user base. While some traders commend its efficient platform and responsive customer support, others have raised concerns about withdrawal processes and platform execution during volatile market conditions.

| Source | Trust Score (5) | Review Highlights |

| Trustpilot | 4.2 | Positive feedback on KYC process and deposits |

| Forex Peace Army | N/A | Praises fast execution; notes limited withdrawals |

| Traders Union | 3.4 | Generally satisfied; occasional issues reported |

These varied reviews suggest that while KVB Prime offers a functional trading experience, potential clients should be aware of the mixed user experiences.

★★ | Minimum Deposit: $10 Regulated by: Anjouan Offshore Finance Authority Crypto: Yes |

Discussions and Forums about KVB Prime

Online forums present a spectrum of opinions on KVB Prime. Discussions often highlight the broker’s low-cost trading solutions and high leverage options, while also pointing out concerns regarding regulatory oversight and platform reliability during market volatility.

| Forum | Main Discussion Points |

| Forex Wikibit | High spreads and lack of local Malaysian license |

| Forex Peace Army | Platform stability and withdrawal options |

| Traders Union | Trust score and overall satisfaction |

Engaging in these forums can provide prospective traders with a broader perspective on KVB Prime’s offerings and potential drawbacks.

★★ | Minimum Deposit: $10 Regulated by: Anjouan Offshore Finance Authority Crypto: Yes |

Employee Overview of Working for KVB Prime

Employee reviews of KVB Prime indicate a workplace with opportunities for career development, though experiences vary. Some staff appreciate the professional environment and team dynamics, while others cite concerns about compensation and organizational structure.

| Location | Employee Sentiment |

| Kuala Lumpur Malaysia | Positive outlook; supportive colleagues |

| Manchester UK | Mixed feelings; concerns about pay and progression |

| Taipei Taiwan | Generally positive; mentions of low salary |

These insights suggest that KVB Prime offers a diverse work environment with varying experiences across different locations.

★★ | Minimum Deposit: $10 Regulated by: Anjouan Offshore Finance Authority Crypto: Yes |

Pros and Cons

| ✓ Pros | ✕ Cons |

| Regulated by AOFA | Offshore regulation |

| Segregated client funds | No tier-1 oversight |

| True STP and NDD model | No 24/7 support |

| Competitive trading costs | High deposit for some accounts |

| Multilingual support 24/5 | Limited global recognition |

References:

In Conclusion

KVB Prime maintains a growing international presence, offering traders local offices and customer support across several regions. This allows clients to access assistance closer to their markets while benefiting from multilingual service coverage.

- 🇸🇲 Samoa

- 🇦🇺 Australia

- 🇮🇩 Indonesia

Customer service is available 24/5 in multiple languages through email, phone, and live chat. This global setup ensures KVB Prime clients receive timely support and localized assistance wherever they trade.

Faq

Yes, KVB Prime offers the option of opening a demo account for trial trading. However, establishing and converting an actual account may be required before creating a demo account.

KVB Prime provides high-leverage choices of up to 1:800. High leverage may multiply possible rewards, but it also increases risk and should be utilized carefully.

Withdrawals at KVB Prime have varying processing timeframes; certain processes are quick, while others may take up to several business days.

Yes, KVB Prime provides a custom mobile app in addition to the MetaTrader 4 platform. The smartphone app allows for on-the-go trading.

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open a KVB Prime Account

- Safety and Security

- Trading Platforms and Tools

- Copy-Trading Program

- Global Markets Access via KVB Prime

- Deposits and Withdrawals

- 100% Deposit Bonus

- IB Program

- Insights from Real Traders

- Customer Reviews and Trust Scores

- Discussions and Forums about KVB Prime

- Employee Overview of Working for KVB Prime

- Pros and Cons

- In Conclusion