Libertex Review

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open a Libertex Account

- Safety and Security

- Trading Platforms and Tools

- Markets available for Trade

- Bonus Offers and Promotions

- Partnership Program

- Customer Support

- Customer Reviews and Trust Scores

- Discussions and Forums

- Employee Overview

- Pros and Cons

- In Conclusion

Libertex is a leading online trading broker offering a user-friendly platform designed to simplify trading for all levels. With a strong 69/99 trust score, it delivers accessibility, reliability, and a seamless trading experience across global markets.

★★ | Minimum Deposit: $10 Regulated by: Not Regulated Crypto: Yes |

Overview

Libertex stands as a trusted online broker backed by over 25 years of industry history. Offering CFDs across Forex, commodities, ETFs, cryptocurrencies, and stocks, it has gained global recognition with more than 40 prestigious awards while serving over 3 million clients in 120+ countries.

Frequently Asked Questions

Is Libertex a reliable broker?

Yes, Libertex has built trust over decades, operating since 1997 as part of the Libertex Group. With multiple global awards, regulation in key jurisdictions, and millions of clients worldwide, the broker demonstrates strong credibility and long-standing reliability in online trading.

What makes the Libertex Affiliate Program attractive?

The Libertex Affiliate Program offers high-earning potential with options like up to $800 CPA per qualified trader or lifetime revenue sharing. Affiliates benefit from a proven brand, established reputation, and marketing support, making it a compelling choice for online entrepreneurs seeking additional income.

Our Insights

Libertex combines history, innovation, and recognition as a global broker. With a wide selection of tradable assets, strong international presence, and award-winning services, it appeals to both new and seasoned traders. However, users should weigh the pros and cons before committing to this platform.

★★ | Minimum Deposit: $10 Regulated by: Not Regulated Crypto: Yes |

Fees, Spreads, and Commissions

Libertex offers traders a competitive fee structure tailored to both active and long-term investors. With commission-free stock investments and zero swap fees on Portfolio accounts, the broker aims to minimize trading costs, while CFD accounts follow a spread-based model with leverage options up to 1:999.

| Account Type | Commissions | Spreads | Other Fees |

| Libertex Portfolio | No commissions | N/A | No swap no inactivity fees |

| Libertex CFD | Spread-based only | Variable by asset | No commission spreads apply |

Frequently Asked Questions

Does Libertex charge a commission on stock trading?

No, Libertex does not charge commission or swap fees on stock investments made through its Portfolio account. This makes it highly attractive for long-term investors looking for cost-efficient access to stocks and ETFs.

How are CFD trading costs calculated on Libertex?

Libertex CFD accounts are spread-based, meaning costs are included in the bid/ask spread rather than flat commissions. Spreads vary depending on the instrument traded, and traders can also apply leverage of up to 1:999 for higher exposure.

Our Insights

Libertex delivers a cost-effective trading experience with zero commissions for investors and spread-based pricing for active traders. The broker keeps fees transparent and accessible, which makes it appealing to both beginners seeking low costs and experienced traders managing larger volumes.

★★ | Minimum Deposit: $10 Regulated by: Not Regulated Crypto: Yes |

Minimum Deposit and Account Types

Libertex provides two distinct account types, each designed for a different style of trading. The Portfolio Account focuses on long-term investing in stocks with no commissions, while the CFD Account caters to active traders, offering access to leveraged instruments across multiple markets.

Frequently Asked Questions

What is the minimum deposit required to open a Libertex account?

The minimum deposit typically starts from $20, making it accessible for new traders. This low entry requirement enables beginners to start trading without committing large sums of capital.

Can I open both a Portfolio and a CFD account on Libertex?

Yes, traders can open both account types, depending on their investment goals. The Portfolio account suits long-term investors, while the CFD account is designed for active traders seeking exposure to multiple instruments with leverage.

Our Insights

Libertex offers flexibility with two account types designed for different trading goals. The low $20 minimum deposit enhances accessibility, while the distinct Portfolio and CFD accounts allow traders to select the structure that best matches their risk appetite and trading strategy.

★★ | Minimum Deposit: $10 Regulated by: Not Regulated Crypto: Yes |

How to Open a Libertex Account

Opening a Libertex account is a simple process that gives you access to CFD trading, stock investments, and a wide range of financial instruments. Whether you are new to trading or an experienced investor, follow these steps to get started.

1. Step 1: Visit the Website or Download the App

Navigate to the Libertex homepage or download the Libertex app from your device’s app store.

2. Step 2: Start the Registration Process

Click on the “Sign Up” button on the homepage or select “Create Account” in the app.

3. Step 3: Provide Your Email and Password

Enter your email address and create a secure password that meets the required criteria.

4. Step 4: Enter Personal Information

Fill in your full name, date of birth, and provide your phone number.

5. Step 5: Select Account Type

Choose between a Libertex Portfolio account (long-term stock investing) or a Libertex CFD account (leveraged trading across multiple instruments).

6. Step 6: Provide Your Address

Enter your residential address by searching for it or adding it manually.

7. Step 7: Complete the Questionnaire

Answer questions about your financial background, trading experience, and source of funds.

8. Step 8: Agree to Terms and Policies

Read through Libertex’s risk disclosures and legal documents, then click “Confirm” to proceed.

9. Step 9: Verify Your Identity

Upload valid identification (passport, driver’s license, or national ID) along with proof of address, such as a utility bill or bank statement.

10. Step 10: Fund Your Account

Once verified, deposit funds using one of the available payment methods in your region.

After your account is set up and funded, you can log in to the Libertex platform or app and begin trading or investing.

★★ | Minimum Deposit: $10 Regulated by: Not Regulated Crypto: Yes |

Safety and Security

A respected third-party observer notes that Libertex has built a solid foundation of trust through consistent regulation across multiple jurisdictions. It combines European compliance with offshore flexibility to meet diverse trader needs in a compliant and transparent way.

| Regulator | Jurisdiction | Coverage Type |

| FSCA | 🇿🇦 South Africa | Onboarding and oversight |

| FSC | 🇲🇺 Mauritius | Licensing for regional operations |

| VFSC | 🇻🇺 Vanuatu | Offshore licensing and supervision |

Frequently Asked Questions

What regulators oversee Libertex operations?

Libertex is licensed and regulated by multiple authorities, including the Financial Sector Conduct Authority (FSCA) in South Africa, the Financial Services Commission (FSC) in Mauritius, and the Vanuatu Financial Services Commission (VFSC). Clients are onboarded under the relevant legal entity depending on their country of residence.

Is Libertex regulation robust and trustworthy?

Libertex follows strict regulatory and compliance standards across all its jurisdictions. The broker prioritizes transparency and client protection while adhering to global norms, giving traders confidence that their investments are secure and compliant with established rules.

Our Insights

Libertex presents a well-rounded regulatory profile, anchored in multiple jurisdictions to suit a wide range of traders. Its approach combines credibility, client protection, and adaptability, making it a solid choice for those seeking both oversight and flexibility.

★★ | Minimum Deposit: $10 Regulated by: Not Regulated Crypto: Yes |

Trading Platforms and Tools

Libertex offers a suite of robust trading platforms and a wide array of markets, catering to both novice and experienced traders. With tools like MetaTrader 4, MetaTrader 5, and Social Trading, coupled with access to over 300 assets, traders are equipped to navigate the financial markets effectively.

| Platform | Asset Coverage | Key Features | Ideal For |

| MetaTrader 4 (MT4) | Forex CFDs on stocks indices commodities cryptocurrencies | Automated trading, expert advisors, copy trading | Forex traders, algorithmic traders |

| MetaTrader 5 (MT5) | Forex stocks indices commodities cryptocurrencies ETFs | More timeframes, economic calendar, improved charting | Advanced traders, multi-asset traders |

| Libertex Proprietary | Over 300 assets including forex stocks, commodities, cryptocurrencies | Real-time data, advanced charting, user-friendly interface | Beginners, mobile traders |

Frequently Asked Questions

What trading platforms does Libertex offer?

Libertex provides access to MetaTrader 4 and MetaTrader 5, two of the most widely used trading platforms globally. These platforms support various trading instruments, including forex, stocks, indices, commodities, and cryptocurrencies. Additionally, Libertex offers a proprietary platform with advanced charting tools and a user-friendly interface.

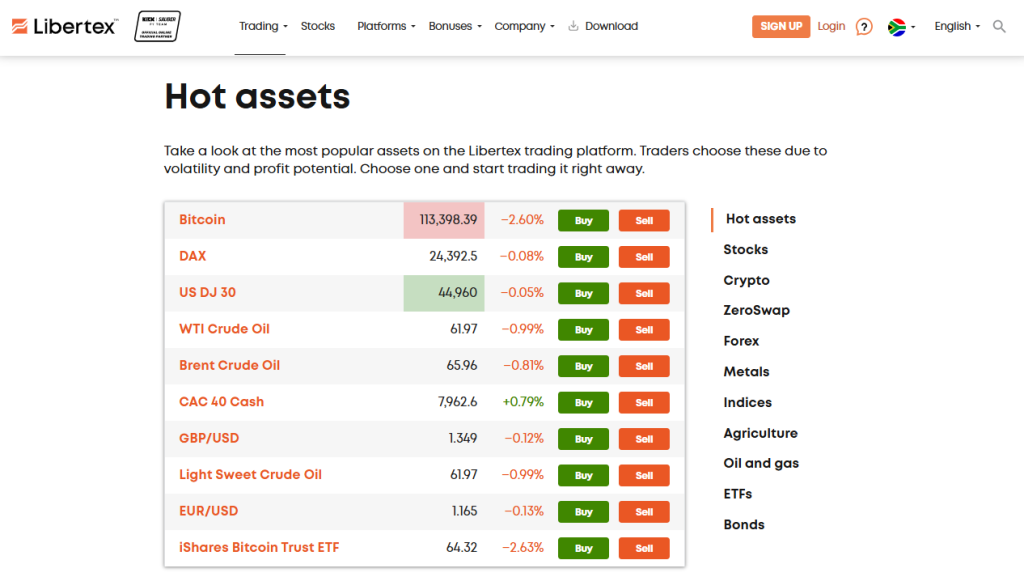

What markets can I trade on Libertex?

Traders on Libertex can access over 300 tradable assets. These include CFDs on stocks, forex pairs, commodities like oil and gold, indices such as the DAX and Dow Jones, as well as cryptocurrencies like Bitcoin and Ethereum. This diverse range allows traders to build a balanced and diversified portfolio.

Our Insights

Libertex stands out as a versatile trading platform, offering a blend of popular third-party tools and its proprietary system. The availability of multiple platforms ensures that traders can choose the one that best fits their trading style and preferences. With access to a broad spectrum of markets, Libertex provides ample opportunities for diversification and growth.

★★ | Minimum Deposit: $10 Regulated by: Not Regulated Crypto: Yes |

Markets available for Trade

Libertex offers a comprehensive selection of over 300 tradable assets, including CFDs on forex, stocks, commodities, cryptocurrencies, and indices. This extensive range allows traders to diversify their portfolios and implement various trading strategies across multiple asset classes.

| Asset Class | Examples | Trading Type | Notes |

| Forex | EUR/USD GBP/USD USD/JPY | CFD | Access to major, minor, and exotic pairs |

| Stocks | Tesla Netflix Apple | CFD | Trade shares of major companies |

| Commodities | Gold Oil Natural Gas | CFD | Speculate on physical goods prices |

| Cryptocurrencies | Bitcoin Ethereum Dogecoin | CFD | Trade digital currencies |

Frequently Asked Questions

What types of assets can I trade on Libertex?

Libertex provides access to a wide array of tradable assets, including CFDs on over 300 instruments. These encompass forex pairs, stocks, commodities like oil and gold, indices such as the DAX and Dow Jones, and cryptocurrencies including Bitcoin and Ethereum.

Can I trade cryptocurrencies on Libertex?

Yes, Libertex offers CFDs on a variety of cryptocurrencies. Traders can engage in contracts for difference on assets like Bitcoin, Ethereum, and other popular digital currencies, allowing for speculation on price movements without owning the underlying assets.

Our Insights

Libertex stands out as a versatile trading platform, offering a wide range of tradable assets across multiple classes. Its user-friendly interface and diverse market options make it suitable for traders looking to diversify their portfolios and explore various investment opportunities.

★★ | Minimum Deposit: $10 Regulated by: Not Regulated Crypto: Yes |

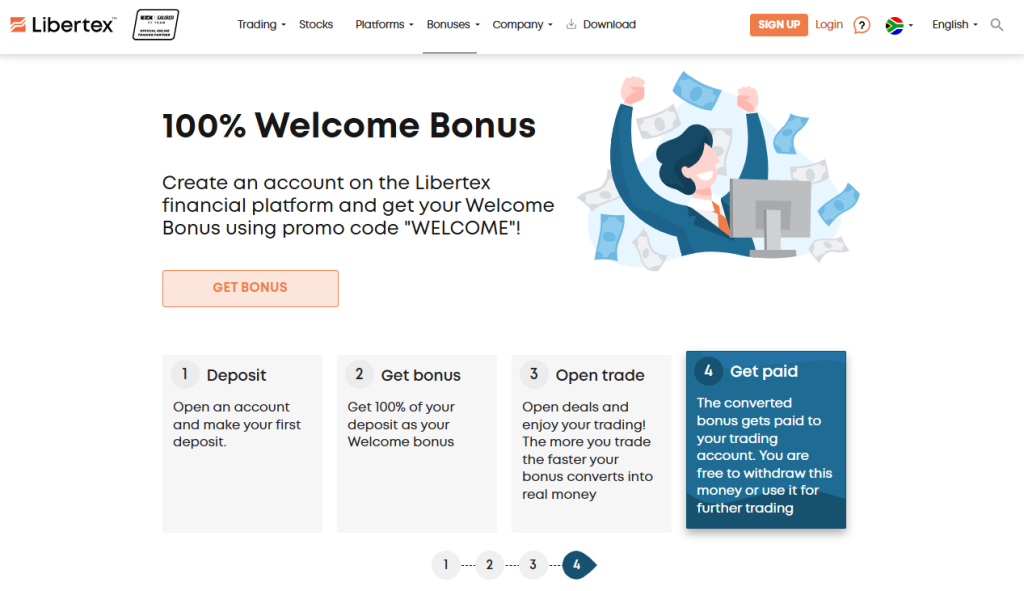

Bonus Offers and Promotions

Libertex offers a 100% Welcome Bonus to new clients, effectively doubling your initial deposit up to $10,000. This bonus is converted into real funds through trading activity, allowing you to use or withdraw the converted amount as you continue to trade.

| Feature | Details | Minimum/Maximum | Notes |

| Bonus Type | Welcome Bonus | $100 minimum deposit | Up to $10,000 maximum |

| Conversion Method | Trading commissions | 10% redeeming speed | Bonus converted daily into real funds |

| Applicable Accounts | CFD MT4 MT5 | First deposit only | Promo code "WELCOME" required |

| Validity Period | Bonus must be fully converted within period | 30 days typical | Unconverted bonus expires |

Frequently Asked Questions

What is the Libertex Welcome Bonus?

The Libertex Welcome Bonus is a promotional offer where new clients receive a 100% bonus on their first deposit, up to $10,000. The bonus is converted into real funds by trading and paying commissions, with a portion credited to your account daily.

How can I claim the Welcome Bonus?

To claim the Welcome Bonus, complete the registration process, fund your trading account with at least $100, and use the promo code “WELCOME” during the deposit. The bonus will be credited to your account upon successful deposit and can be converted into real funds through trading activity.

Our Insights

Libertex’s 100% Welcome Bonus offers an attractive incentive for new traders, effectively doubling your initial deposit. The conversion process, based on trading commissions, encourages active trading and provides a clear path to accessing the bonus funds. It is a valuable opportunity for those looking to enhance their trading experience.

★★ | Minimum Deposit: $10 Regulated by: Not Regulated Crypto: Yes |

Partnership Program

The Libertex Affiliate Programme offers a lucrative opportunity for digital marketers and content creators to monetise their traffic. With competitive commission structures, comprehensive promotional tools, and dedicated support, affiliates can earn substantial income by introducing new traders to the platform. Backed by over 25 years in the industry, Libertex provides a trusted environment for both affiliates and traders.

| Feature | Details | Notes |

| Commission Models | CPA Revenue Share Hybrid | Tailored to affiliate preferences |

| Maximum Earnings | Up to $1,200 per referred client | Competitive rates in the industry |

| Payment Methods | PayPal Skrill Wire Transfer Bitcoin, others | Multiple options for convenience |

| Support | Dedicated affiliate managers | Assistance in multiple languages |

Frequently Asked Questions

How do I join the Libertex Affiliate Programme?

To become an affiliate, create a Libertex account and gain access to exclusive marketing materials and tracking tools. Share your unique affiliate link across various platforms to attract potential traders.

What commission structures are available?

Libertex offers three primary commission models: Cost Per Acquisition (CPA), Revenue Share, and a Hybrid model combining both. Affiliates can earn up to $1,200 per referred client or up to 50% of the broker’s gross revenue.

Our Insights

The Libertex Affiliate Programme stands out for its high earning potential, diverse commission options, and comprehensive support. With a user-friendly interface and a global reach, it presents a compelling opportunity for affiliates seeking to monetise their digital platforms effectively.

★★ | Minimum Deposit: $10 Regulated by: Not Regulated Crypto: Yes |

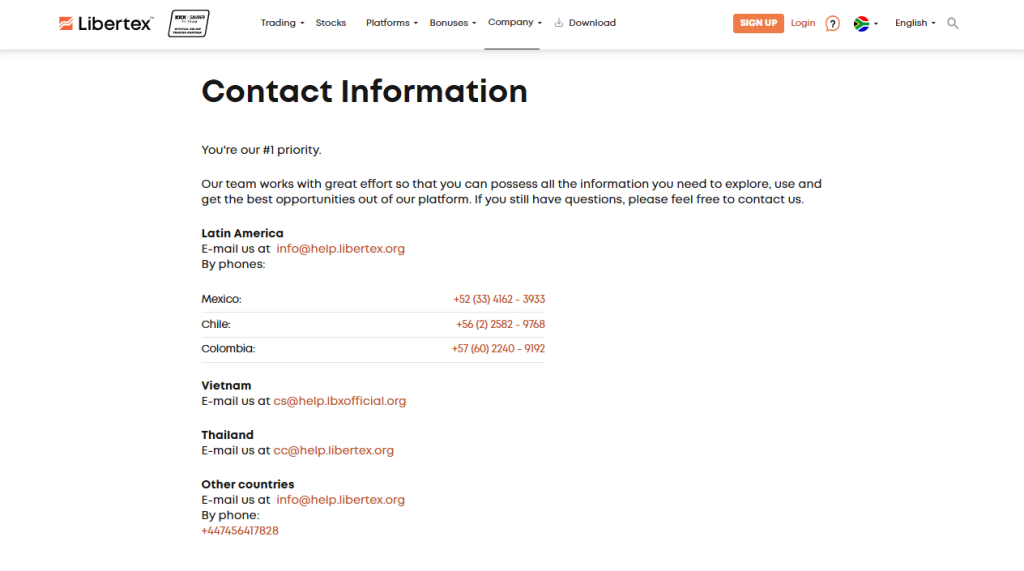

Customer Support

Libertex prioritises client support, providing multiple channels to ensure users can explore the platform and access all necessary information. Whether you are a new or experienced trader, the support team is available to answer queries efficiently and guide you through your trading journey.

Frequently Asked Questions

How can I contact Libertex support in Latin America?

Clients in Latin America can email [email protected] or call regional phone numbers. For example, Mexico: +52 (33) 4162 – 3933, Chile: +56 (2) 2582 – 9768, and Colombia: +57 (60) 2240 – 9192. Support covers general queries, platform guidance, and account assistance.

What if I am located in other countries like Vietnam or Thailand?

For Vietnam, email [email protected]. For Thailand, email [email protected]. Users from other countries can email [email protected] or call +44 7456 417828. The support team provides prompt assistance for trading questions, technical issues, and account-related concerns.

Our Insights

Libertex’s customer support network is comprehensive and region-specific, ensuring users receive timely guidance. With dedicated email addresses and phone numbers for Latin America, Vietnam, Thailand, and other countries, clients can access consistent assistance and reliable information for a seamless trading experience.

★★ | Minimum Deposit: $10 Regulated by: Not Regulated Crypto: Yes |

Customer Reviews and Trust Scores

Libertex has garnered mixed reviews across various platforms, reflecting a diverse customer experience.

| Platform | Rating | Number of Reviews | Notable Insights |

| Trustpilot | 3.8 | 3,560+ | 56% 5-star, 17% 1-star; high response rate to negative reviews |

| Sitejabber | 1.5 | 18 | Predominantly negative feedback |

| Reviews.io | 4.5 | 86 | Positive comments on customer support |

| TradersUnion | 4.5 | N/A | High customer satisfaction and minimal complaints |

These varied ratings suggest that while many users appreciate Libertex’s platform, others have encountered issues, particularly concerning withdrawals.

★★ | Minimum Deposit: $10 Regulated by: Not Regulated Crypto: Yes |

Discussions and Forums

Online forums and discussions offer a platform for traders to share experiences and insights about Libertex.

| Forum | Activity Level | Common Topics |

| Moderate | User experiences, trading strategies |

|

| Trade2Win | Active | Broker comparisons, trade setups |

| Forex Peace Army | High | Broker reviews, scam alerts |

These communities provide valuable peer insights, though it’s essential to approach individual opinions critically.

★★ | Minimum Deposit: $10 Regulated by: Not Regulated Crypto: Yes |

Employee Overview

Insights into working at Libertex reveal a balanced work environment with room for improvement.

| Aspect | Rating (5) | Notes |

| Work-Life Balance | 4 | Generally positive feedback |

| Culture Values | 3.7 | Emphasis on professionalism |

| Career Opportunities | 3.7 | Opportunities for growth available |

| Benefits | 3.7 | Standard benefits package |

While many employees appreciate the work culture, some areas, such as career advancement and benefits, have room for enhancement.

★★ | Minimum Deposit: $10 Regulated by: Not Regulated Crypto: Yes |

Pros and Cons

| ✓ Pros | ✕ Cons |

| User-friendly trading platform | Withdrawal issues reported |

| Regulated in multiple jurisdictions | Mixed customer reviews |

| Offers demo accounts | Limited educational resources |

| Provides mobile trading options | Inconsistent customer support |

| Supports various payment methods | Occasional platform glitches |

References:

In Conclusion

Libertex Group maintains physical offices across several key countries to support its global client base. These regional hubs facilitate customer support, regulatory compliance, and business operations.

- 🇨🇾 Cyprus

- 🇿🇦 South Africa

- 🇻🇨 Saint Vincent and the Grenadines

- 🇲🇺 Mauritius

- 🇷🇺 Russia

- 🇧🇾 Belarus

These offices reflect the company’s geographic footprint and help ensure localized support and regulatory adherence. Let me know if you’d like details about any specific office or how customer support is structured in those regions!

Faq

Yes, Libertex’s user-friendly platforms and instructional tools are ideal for novices.

Withdrawal processing times at Libertex vary based on the method used, with bank wire transfers taking 3-5 business days on average

Libertex maintains a minimal $10 minimum deposit requirement, making it accessible to traders with small amounts of capital looking to enter the market

It might be. However, while Libertex takes precautions to secure client data and funds, its absence of proven regulatory licenses raises worries about its safety as a broker

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open a Libertex Account

- Safety and Security

- Trading Platforms and Tools

- Markets available for Trade

- Bonus Offers and Promotions

- Partnership Program

- Customer Support

- Customer Reviews and Trust Scores

- Discussions and Forums

- Employee Overview

- Pros and Cons

- In Conclusion