MultiBank Group Review

- Trading with MultiBank Group - Immediate Advantages and Disadvantages

- Overview

- MultiBank Group Visual, Video Overview

- MultiBank Group’s Competitive Edge

- Fees, Spreads, and Commissions

- Which MultiBank Group Account Is Right for You?

- Islamic Account

- How to Open an Account with MultiBank Group

- Safety and Security

- Trading Platforms and Software

- Mobile Trading Experience

- Leverage and Margin

- Trading Instruments and Products

- Streamlined Deposits and Withdrawals

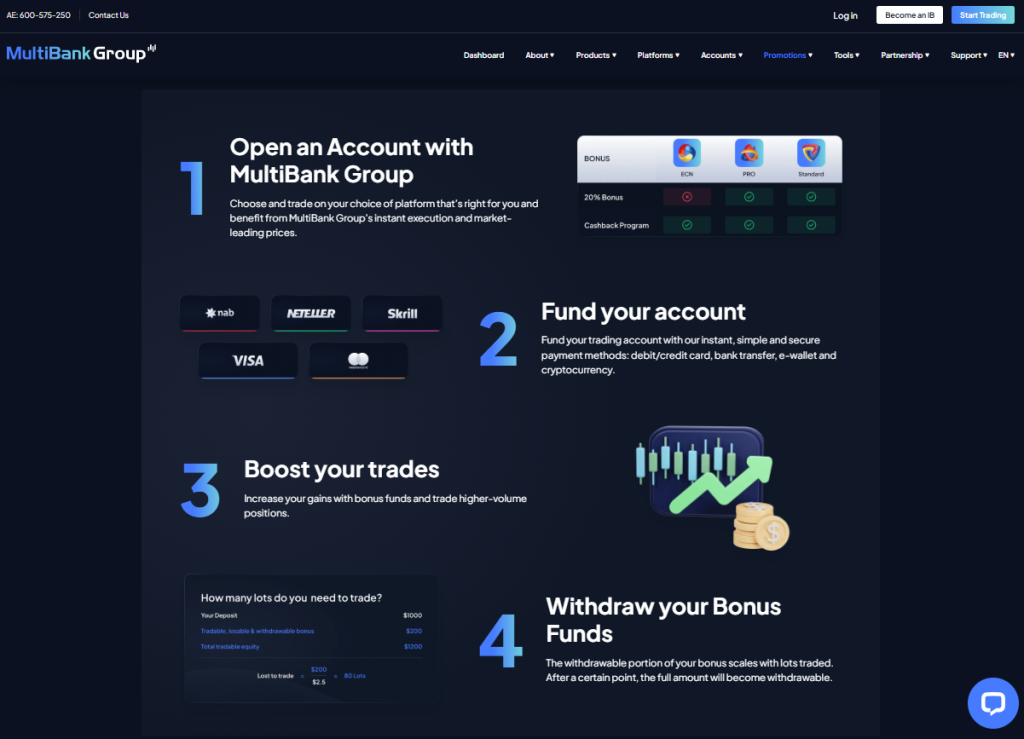

- 20% Deposit Bonus

- Introducing Broker (IB) Program

- Free Educational Resources

- Customer Support

- Insights from Real Traders

- Employee Insights

- Pros and Cons

- Conclusion

MultiBank Group is a trustworthy and highly regulated global financial derivatives provider with several industry awards. It offers commission-free options with narrower spreads and ECN accounts for direct market access. The Broker has a trust score of 99 out of 99.

★★★★ | Minimum Deposit: $50 Regulated by: AUSTRAC, BAFIN, CIMA, ESCA, CySEC, FSC, FMA, MAS, TFG, VFSC Crypto: Yes |

Trading with MultiBank Group – Immediate Advantages and Disadvantages

| ✓ Pros | ✕ Cons |

| Highly regulated across multiple jurisdictions. | High minimum deposits for Pro and ECN accounts. |

| Trust score of 99/99. | Inactivity fee applies after 3 months. |

| Spreads from 0.0 pips with ECN pricing. | ECN account commissions may add cost for small traders. |

| Deep liquidity and nano-second execution. | Standard account lacks advanced features. |

| 20,000+ instruments available. | Some instruments have lower leverage limits. |

| Strong fund protection with insurance up to $1M. | Islamic account restricted to eligible users only. |

Overview

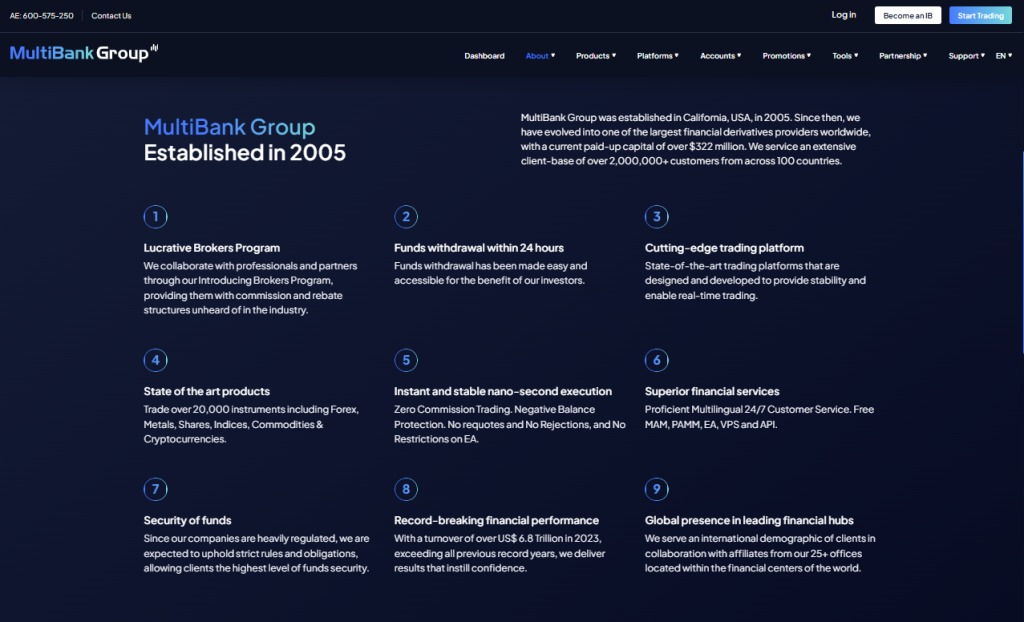

Founded in 2005 in California, MultiBank Group has grown into one of the world’s largest financial derivatives institutions. In addition, serving over 2 million clients across more than 100 countries, the Group boasts a paid-up capital exceeding $322 million and maintains a strong regulatory presence across five continents.

Frequently Asked Questions

How secure is trading with MultiBank Group?

MultiBank Group is one of the most heavily regulated brokers globally, complying with stringent financial standards across five continents. Moreover, client funds are held in segregated accounts, and negative balance protection provides added security for traders of all levels.

What trading instruments does MultiBank offer?

Traders with MultiBank can access over 20,000 instruments, including Forex, Metals, Shares, Indices, Commodities, and Cryptocurrencies. Additionally, the broker provides real-time execution and nanosecond processing.

Our Insights

MultiBank Group stands as a reputable, capital-strong, and globally regulated broker, offering deep liquidity, high leverage of up to 500:1, and fast execution. In addition, with a client-first approach and advanced technology, it remains a top-tier choice for both retail and institutional traders.

★★★★ | Minimum Deposit: $50 Regulated by: AUSTRAC, BAFIN, CIMA, ESCA, CySEC, FSC, FMA, MAS, TFG, VFSC Crypto: Yes |

MultiBank Group Visual, Video Overview

Explore the MultiBank Group through a dynamic visual and video overview that highlights its key features, services, and market presence. At the same time, this section offers a clear and engaging snapshot of what sets MultiBank apart in the trading industry.

★★★★ | Minimum Deposit: $50 Regulated by: AUSTRAC, BAFIN, CIMA, ESCA, CySEC, FSC, FMA, MAS, TFG, VFSC Crypto: Yes |

MultiBank Group’s Competitive Edge

MultiBank Group sets itself apart through superior financial performance, cutting-edge platforms, lightning-fast execution, and multilingual customer service. In addition, with over $6.8 trillion in trading volume in 2023, the broker delivers elite tools and services designed for today’s global traders.

| Advantage | Description |

| Leverage | Up to 500:1 |

| Products | 20,000+ including Forex/Crypto |

| Execution | Instant nano-second no requotes |

| IB Program | High-paying scalable commissions |

Frequently Asked Questions

What makes MultiBank’s execution speed exceptional?

MultiBank uses high-frequency infrastructure, enabling nano-second execution. As a result, there are zero requotes, no rejections, and seamless trading – even during periods of high market volatility. Consequently, traders benefit from reliable order fills and real-time pricing accuracy.

How does MultiBank support its partners and clients?

Through its robust Introducing Brokers (IB) Program, MultiBank offers industry-leading commission and rebate structures. In addition, clients enjoy 24/7 multilingual support, free VPS, MAM/PAMM solutions, and access to exclusive educational and analytical content.

Expert Insight

MultiBank Group excels by integrating regulatory strength with real-time trading technology and world-class support. Additionally, whether you’re a beginner or a professional partner, its global infrastructure and superior offerings make it a standout broker in today’s competitive trading environment.

★★★★ | Minimum Deposit: $50 Regulated by: AUSTRAC, BAFIN, CIMA, ESCA, CySEC, FSC, FMA, MAS, TFG, VFSC Crypto: Yes |

Fees, Spreads, and Commissions

MultiBank Group offers transparent and competitive pricing across its account types. At the same time, while the Standard and Pro accounts are commission-free, the ECN account provides ultra-low spreads starting from 0.0 pips, featuring raw pricing and a commission structure tailored for high-volume traders.

| Account Type | Spreads From | Commission | Execution Type |

| Standard | 0.0 pips | None | Instant |

| Pro | 0.8 pips | None | Instant |

| ECN | 0.0 pips | Yes | Instant |

Frequently Asked Questions

Does MultiBank charge a commission on trades?

Commissions vary depending on the account type. In particular, the Standard and Pro accounts offer zero commissions, whereas the ECN account charges a commission in exchange for raw spreads starting from 0.0 pips, making it ideal for professional traders seeking tighter pricing.

What are the spreads like at MultiBank Group?

Spreads vary by account. However, all accounts benefit from instant execution and deep liquidity, ensuring consistent pricing.

Broker Assessment

MultiBank Group keeps costs low and flexible, catering both to traders who prefer tight spreads without commissions (Pro) and those seeking raw pricing with institutional-grade execution (ECN). In addition, their transparent pricing structure makes it easy for traders to plan and manage costs effectively.

★★★★ | Minimum Deposit: $50 Regulated by: AUSTRAC, BAFIN, CIMA, ESCA, CySEC, FSC, FMA, MAS, TFG, VFSC Crypto: Yes |

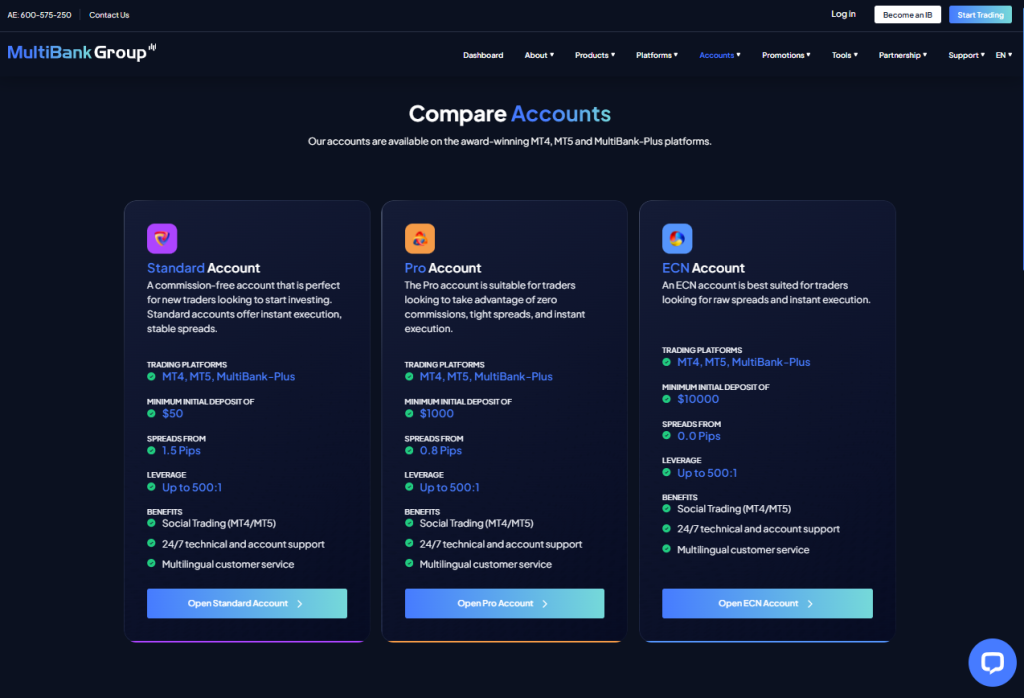

Which MultiBank Group Account Is Right for You?

MultiBank Group offers three distinct account types – Standard, Pro, and ECN – tailored for everyone from beginners to seasoned professionals. In addition, each account is compatible with MT4, MT5, and MultiBank-Plus platforms, and comes with 24/7 multilingual support, high leverage of up to 500:1, and integrated social trading features.

| Account Type | Open an Account | Min. Deposit | Spreads From |

| Standard | 50 USD | 0.0 pips | |

| Pro | 1000 USD | 0.8 pips | |

| ECN | 10'000 USD | 0.0 pips |

Frequently Asked Questions

What is the minimum deposit required for MultiBank accounts?

The minimum deposit varies by account type. In particular, the Standard account starts at 50 USD, the Pro account requires 1,000 USD, and the ECN account begins at 10,000 USD. Each account is designed to suit different trading styles and experience levels.

Are all accounts available on MT4 and MT5?

Yes, MultiBank Group supports all account types on MT4, MT5, and its proprietary MultiBank-Plus platform. As a result, traders have access to robust tools and reliable execution, regardless of their trading preferences or skill level.

Trader Perspective

MultiBank Group offers a scalable account structure, making it easy for both beginners and experienced traders to choose a platform that fits their goals. Furthermore, with flexible deposits and reliable execution across all accounts, it provides a solid foundation for every trading journey.

★★★★ | Minimum Deposit: $50 Regulated by: AUSTRAC, BAFIN, CIMA, ESCA, CySEC, FSC, FMA, MAS, TFG, VFSC Crypto: Yes |

Islamic Account

MultiBank Group offers a dedicated Islamic Account designed to align with Shariah principles by removing all swap or interest fees on overnight positions. This swap-free solution allows Muslim traders to access global financial markets while remaining compliant with religious values.

| Feature | Details |

| Interest Charges | None |

| Platforms Supported | MT4 MT5 MultiBank-Plus |

| Available To | Muslim Traders Only |

| Limitations | One account type per user |

Frequently Asked Questions

What is a swap-free Islamic Account?

An Islamic or swap-free account excludes any interest charges on overnight positions. This is in line with Islamic finance rules that prohibit earning or paying interest, allowing Muslim traders to participate ethically in global forex markets.

Are there any limitations on Islamic Account usage?

Yes. Traders may only hold either a swap-free or a standard account at any one time. MultiBank Group also reserves the right to revoke swap-free status in cases of misuse or abuse, ensuring the account is used appropriately.

Independent View

MultiBank Group’s Islamic Account is ideal for traders seeking to comply with Islamic principles. With zero swap fees, strong platform support, and strict eligibility controls, it offers both ethical flexibility and robust functionality for faith-conscious investors.

★★★★ | Minimum Deposit: $50 Regulated by: AUSTRAC, BAFIN, CIMA, ESCA, CySEC, FSC, FMA, MAS, TFG, VFSC Crypto: Yes |

How to Open an Account with MultiBank Group

1. Step 1: Visit the Official Website

Go to the official MultiBank Group website to start your online registration process.

2. Step 2: Choose Your Account Type

Select the trading account that best suits your goals – Standard, Pro, ECN, or Islamic.

3. Step 3: Complete the Application Form

Fill in your personal information, trading experience, and financial background as requested.

4. Step 4: Submit Required Documents

Upload identification and proof of residence to verify your identity and activate the account.

5. Step 5: Fund Your Account

Select your preferred deposit method and transfer your initial trading capital.

6. Step 6: Choose a Trading Platform

Decide between MT4, MT5, or the proprietary MultiBank-Plus platform to start trading.

7. Step 7: Start Learning

Before trading live, take advantage of MultiBank Group’s educational tools, tutorials, and market resources.

★★★★ | Minimum Deposit: $50 Regulated by: AUSTRAC, BAFIN, CIMA, ESCA, CySEC, FSC, FMA, MAS, TFG, VFSC Crypto: Yes |

Safety and Security

MultiBank Group stands out for its extraordinary global footprint, regulated by 17+ financial authorities across five continents. This regulatory structure ensures that clients receive full transparency, operational oversight, and secure fund handling, making it one of the most trusted names in online trading today.

Global Regulation

MultiBank Group is regulated by over 17 financial authorities across five continents, providing clients with a transparent, compliant, and secure trading environment. Its structure spans multiple licensed entities, each monitored by a recognized regulator, ensuring fund protection and global operational credibility.

| Regulator Code | Jurisdiction | Entity Name / License |

| 🇩🇪 BAFIN | Germany | Licensed Entity |

| 🇦🇪 ESCA | UAE | Licensed Entity |

| 🇨🇾 CySEC | Cyprus | Licensed Entity |

| 🇲🇺 FSC | Mauritius | Licensed Entity |

| 🇸🇬 MAS | Singapore | Licensed Entity |

| 🇻🇺 VFSC | Vanuatu | Licensed Entity |

| 🇰🇾 CIMA | Cayman Islands | Licensed Entity |

| 🇦🇹 FMA | Austria | Licensed Entity |

| 🇭🇰 TFG | Hong Kong | Licensed Entity |

| 🇸🇨 FSAS | Seychelles | Licensed Entity |

| 🇲🇳 FSCM | Mongolia | Licensed Entity |

| 🇦🇺 AUSTRAC | Australia (AML/CTF) | Reporting Authority |

| 🇦🇪 VARA | UAE (Dubai) | Virtual Asset Regulator |

| 🇪🇪 FIU | Estonia | Financial Intelligence Unit |

★★★★ | Minimum Deposit: $50 Regulated by: AUSTRAC, BAFIN, CIMA, ESCA, CySEC, FSC, FMA, MAS, TFG, VFSC Crypto: Yes |

Security of Funds

MultiBank Group, through its MEX Atlantic entity, provides one of the most robust fund protection systems in the trading industry. With a Lloyd’s of London insurance policy offering coverage up to $1,000,000 per account, plus segregated funds and Tier 1 banking, clients enjoy true financial peace of mind.

| Security Measure | Description |

| Insurance Coverage | Up to $1,000,000 per account (Lloyd’s) |

| Client Fund Segregation | Funds held in separate accounts |

| Capital Strength | $322 Million Paid-Up Capital |

| Banking Infrastructure | Tier 1 Global Banks |

| Credit Rating | B Rating by Standard/Poor’s |

Frequently Asked Questions

Why is MultiBank Group’s regulatory structure important?

Being regulated by multiple global authorities reduces the risk of malpractice and increases transparency. It ensures that client funds are managed responsibly and that all trading practices align with international financial standards.

Which top-tier regulators license MultiBank Group?

MultiBank Group operates under BaFin (Germany), CySEC (Cyprus), MAS (Singapore), and more. These top-tier regulatory bodies enforce strict capital, audit, and operational requirements, offering traders peace of mind.

Market Take

MultiBank Group’s global licensing portfolio positions it among the most transparent and compliant brokers. For traders who prioritize regulation and trust, the broker’s worldwide oversight offers unmatched protection and legitimacy.

★★★★ | Minimum Deposit: $50 Regulated by: AUSTRAC, BAFIN, CIMA, ESCA, CySEC, FSC, FMA, MAS, TFG, VFSC Crypto: Yes |

Trading Platforms and Software

MultiBank Group provides a diverse suite of trading platforms designed to meet the needs of every trader. From the classic power and automation of MetaTrader 4 to the advanced versatility of MetaTrader 5, the innovative Social Trading platform, and the ultra-fast, transparent MultiBank-Plus, traders gain access to cutting-edge tools, deep market liquidity, and seamless execution.

| Platform | Key Features | Target Users | Asset Coverage |

| MetaTrader 4 | Automated trading deep technical analysis | Beginners Advanced Traders | Forex CFDs |

| MetaTrader 5 | Enhanced analytics multi-asset algo trading | Experienced Traders | Forex CFDs Stocks Commodities |

| Social Trading | Copy top traders automated replication | Beginners Passive Traders | Forex Metals Indices Cryptos |

| MultiBank-Plus | ECN pricing nano-second execution web/mobile | All Levels | Forex Metals Commodities Shares |

MetaTrader 4

MultiBank Group’s MetaTrader 4 platform provides traders with a refined blend of simplicity and sophistication. Whether you are a beginner or an advanced trader, MT4’s automation tools, deep market access, and analytical capabilities deliver the speed, flexibility, and precision needed to succeed in today’s global financial markets.

★★★★ | Minimum Deposit: $50 Regulated by: AUSTRAC, BAFIN, CIMA, ESCA, CySEC, FSC, FMA, MAS, TFG, VFSC Crypto: Yes |

MetaTrader 5

MultiBank Group’s MetaTrader 5 (MT5) platform combines speed, versatility, and precision. Building on the legacy of MT4, MT5 introduces deeper analytical tools, enhanced algorithmic capabilities, and access to a broader range of markets, making it a top choice for modern traders of all experience levels.

★★★★ | Minimum Deposit: $50 Regulated by: AUSTRAC, BAFIN, CIMA, ESCA, CySEC, FSC, FMA, MAS, TFG, VFSC Crypto: Yes |

Social Trading

MultiBank Group’s social trading platform empowers both beginners and experts to maximize profits by copying top traders worldwide. By combining transparency, automation, and a diverse selection of assets, it simplifies investing, allowing users to learn, diversify, and trade seamlessly without requiring extensive market knowledge.

★★★★ | Minimum Deposit: $50 Regulated by: AUSTRAC, BAFIN, CIMA, ESCA, CySEC, FSC, FMA, MAS, TFG, VFSC Crypto: Yes |

MultiBank-Plus

MultiBank-Plus provides a cutting-edge trading environment designed for stability and real-time execution on both web and mobile platforms. With tight spreads, deep market liquidity, and a pure ECN model, it delivers transparent pricing and powerful tools suitable for traders of all experience levels.

Frequently Asked Questions

What are the main differences between MetaTrader 4 and MetaTrader 5 on MultiBank Group?

MT4 focuses on simplicity with robust automation and technical analysis for forex and CFD trading, ideal for beginners and seasoned traders. MT5 builds on MT4 by offering enhanced analytical tools, additional asset classes, and advanced algorithmic trading capabilities for a more versatile experience.

How does MultiBank Group’s Social Trading platform benefit new traders?

Social Trading lets beginners copy expert traders’ strategies in real-time, reducing the learning curve and enabling profit potential without deep market knowledge. It offers transparency, automated trade replication, and access to a broad range of financial products, fostering community and diversification.

Real Trader Experience

MultiBank Group’s platform portfolio caters to all trading styles and experience levels. Whether you prefer the trusted familiarity of MT4, the cutting-edge features of MT5, the community-driven Social Trading, or the high-speed MultiBank-Plus platform, MultiBank ensures secure, efficient, and flexible trading in global markets.

★★★★ | Minimum Deposit: $50 Regulated by: AUSTRAC, BAFIN, CIMA, ESCA, CySEC, FSC, FMA, MAS, TFG, VFSC Crypto: Yes |

Mobile Trading Experience

MultiBank Group provides powerful mobile trading apps for both beginners and professionals. Traders can access all account types and manage trades on the go.

| Feature | MultiBank Plus App | MT4 Mobile | MT5 Mobile |

| Platforms Supported | iOS Android | iOS Android | iOS Android |

| Key Features | ECN pricing fast execution alerts charts | Classic MT4 tools, indicators automated trading | Advanced charts multi-asset trading algo tools |

| Execution Speed | Nano-second | Instant | Instant |

| Account Access | Standard Pro ECN Islamic | Standard Pro ECN | Standard Pro ECN |

App Highlights

- Usability/Design: Clean, intuitive, and easy to navigate. Real-time alerts and charts included.

- Platform Compatibility: Available on iOS and Android.

- Execution Speed: Nano-second execution on MultiBank Plus; instant on MT4/MT5.

- Account Access: Standard, Pro, ECN, Islamic.

- Ratings: High user ratings on App Store and Google Play.

Traders enjoy fast, flexible, and fully-featured mobile trading across all platforms, making it easy to trade anytime, anywhere.

★★★★ | Minimum Deposit: $50 Regulated by: AUSTRAC, BAFIN, CIMA, ESCA, CySEC, FSC, FMA, MAS, TFG, VFSC Crypto: Yes |

Leverage and Margin

MultiBank Group employs margin trading to amplify traders’ buying power by leveraging deposited funds. This strategy allows traders to control larger positions with less capital, thereby enhancing profit potential. However, it also carries increased risk, and MultiBank enforces strict risk management measures – such as stop-out levels and maximum leverage limits – to protect clients.

| Feature | Description | Purpose | Notes |

| Leverage | Amplifies trading capacity using deposited funds | Increase profit potential | Adjustable by asset and regulation |

| Margin | Collateral required to open and maintain trades | Ensures sufficient funds | Varies by leverage and market rates |

| Stop-Out Level | Automatic position closure at 50% equity threshold | Limits trader losses | Protects trader and broker |

| Leverage Limits | Caps maximum leverage allowed | Risk management | Complies with regulatory standards |

Frequently Asked Questions

What is the stop-out level used by MultiBank Group to control risk?

MultiBank Group implements a stop-out level that activates when a trader’s equity falls below 50% of the required margin. This mechanism helps limit losses by automatically closing positions, thereby protecting both the trader and the broker from excessive risk.

Are there any limitations on the use of leverage with MultiBank Group?

Yes, MultiBank Group enforces maximum leverage limits based on the asset class and regulatory requirements. These limits help traders manage risk effectively and prevent overexposure to the market from excessive leverage.

Bottom Line

MultiBank Group provides a balanced leverage and margin framework that maximizes trading potential while prioritizing risk control. Through transparent risk warnings, a strict stop-out policy, and clearly defined leverage limits, the broker ensures that traders operate within a secure and responsible trading environment.

★★★★ | Minimum Deposit: $50 Regulated by: AUSTRAC, BAFIN, CIMA, ESCA, CySEC, FSC, FMA, MAS, TFG, VFSC Crypto: Yes |

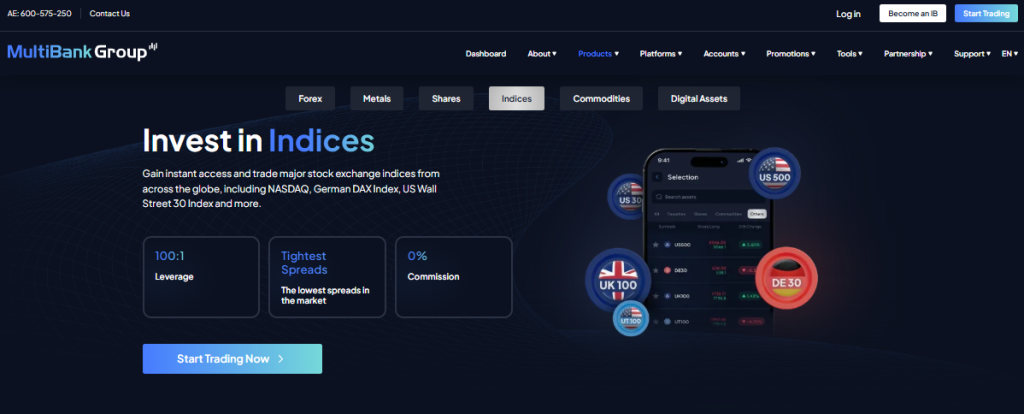

Trading Instruments and Products

MultiBank Group offers access to over 20,000 instruments, including Forex, Metals, Shares, Indices, Commodities, and Cryptocurrencies. Supported by deep liquidity and a tightly regulated infrastructure, the platform ensures that traders benefit from competitive pricing, a wide variety of assets, and reliable execution worldwide.

| Market | Instruments Included | Typical Spread* | Leverage |

| Forex | Majors minors exotics (55+ pairs) | From 0.0 pips | Up to 500:1 |

| Metals | Gold Silver (+others) | From 0.0 pips | Up to 500:1 |

| Shares/Indices | Global CFDs including US, European stocks/indices | Varies by asset | Up to 100:1* |

| Commodities/Crypto | Energy agriculture and 200+ crypto instruments | Commodity spreads from X cents; crypto feeds vary | Up to 20:1 (crypto)* |

* Spreads and leverage may vary based on account type, platform, and jurisdiction.

Frequently Asked Questions

Which asset classes can I trade at MultiBank Group?

MultiBank Group enables traders to engage in Forex, Metals, Shares, Indices, Commodities, and Cryptocurrencies. With access to over 20,000 instruments, clients can explore diverse markets through a single trading account while enjoying competitive trading conditions.

Are all markets available across all platforms and account types?

Yes, traders can access all supported markets across MetaTrader 4, MetaTrader 5, and MultiBank-Plus platforms. All account types – including Standard, Pro, ECN, and Islamic – provide full market access, although specific instruments may have varying leverage or margin requirements.

Key Takeaways

With one of the industry’s broadest selections of tradable markets, MultiBank Group allows traders to operate with both flexibility and depth. By combining diverse assets, cutting-edge platforms, and a regulated infrastructure, the broker provides a robust solution for accessing global markets.

★★★★ | Minimum Deposit: $50 Regulated by: AUSTRAC, BAFIN, CIMA, ESCA, CySEC, FSC, FMA, MAS, TFG, VFSC Crypto: Yes |

Streamlined Deposits and Withdrawals

MultiBank Group offers a wide range of deposit and withdrawal methods, including bank wire, credit/debit cards, e-wallets, and cryptocurrencies, catering to global traders. Processing times and limits vary by method, ensuring flexibility, convenience, and secure fund movement across platforms.

| Method | Deposit Timing | Fees |

| Credit/Debit Cards | Instant | Broker-free; issuer/3rd-party may apply |

| Bank Wire | 1–3 business days | Broker-free bank fees may apply |

| E-Wallets | Instant | Broker-free possible provider fees |

| Cryptocurrencies | Instant (confirmation dependent) | Broker-free network fees may apply |

Frequently Asked Questions

Are there limits on withdrawals with MultiBank Group?

Yes. Withdrawal limits depend on both your account type and the method used. Larger withdrawals may trigger additional verification steps to comply with security protocols and regulatory requirements.

How long do withdrawals take?

Withdrawal times vary: credit/debit cards take 2–5 business days, bank wires 3–7 days, e-wallets 1–2 days, and crypto transfers typically process within 24 hours. All requests are processed within 24 working hours.

Broker Scorecard

MultiBank Group delivers smooth, secure, and fee-free deposit and withdrawal processes across multiple methods. With transparent timelines and verification protocols, it provides a reliable and flexible approach to managing trader funds worldwide.

★★★★ | Minimum Deposit: $50 Regulated by: AUSTRAC, BAFIN, CIMA, ESCA, CySEC, FSC, FMA, MAS, TFG, VFSC Crypto: Yes |

20% Deposit Bonus

MultiBank Group enhances trading potential with a generous 20% deposit bonus, rewarding users with up to $40,000.

Frequently Asked Questions

Why should I care about a trading bonus?

A trading bonus increases your trading capital, allowing you to enter larger positions and potentially amplify your profit margins. It provides more flexibility in executing strategies and helps cushion market volatility during periods of high-risk trading.

What is the maximum deposit bonus I can earn?

The maximum 20% deposit bonus a trader can earn with MultiBank Group is $40,000.

Our Insights

MultiBank Group’s 20% deposit bonus is ideal for active traders seeking added capital and higher exposure. With clear terms, transparent conversion rules, and a substantial maximum cap, it’s a strategic incentive that blends risk with opportunity.

★★★★ | Minimum Deposit: $50 Regulated by: AUSTRAC, BAFIN, CIMA, ESCA, CySEC, FSC, FMA, MAS, TFG, VFSC Crypto: Yes |

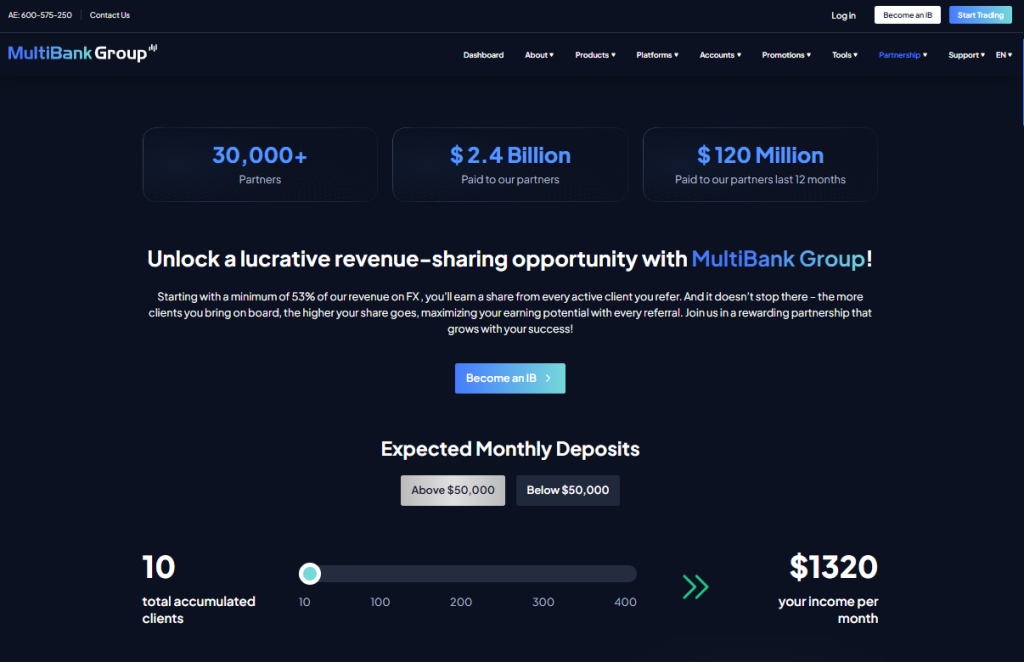

Introducing Broker (IB) Program

MultiBank Group’s IB Program offers one of the highest revenue shares in the trading industry, starting at a minimum of 53% on FX trades. With over 30,000 global partners and billions paid out, it’s a scalable opportunity for anyone looking to grow a client network and earn consistently.

| Feature | Details |

| Revenue Share (FX) | Starts from 53% |

| Total Paid to Partners | $2.4 Billion+ |

| Monthly Income | $1,320+ |

| Dedicated IB Portal/ Tools | Available for real-time tracking |

Frequently Asked Questions

How much can I earn as a MultiBank Group IB partner?

IB partners can earn a minimum of 53% of MultiBank’s revenue on FX trades. The more clients referred, the higher the payout. Earnings are performance-based and scale with trading volume and client activity.

What tools are provided to support IBs in growing their network?

MultiBank Group provides IBs with a personalized portal to track client activity and earnings, a Media Centre with marketing assets, and support for both MT4 and MT5 platforms, making it easier to manage and expand their business.

Our Insights

The MultiBank Group IB Program is ideal for partners seeking high returns and long-term scalability. With its unmatched revenue share, global regulatory framework, and top-tier tools, it’s a standout partnership for anyone ready to grow a profitable trading network.

★★★★ | Minimum Deposit: $50 Regulated by: AUSTRAC, BAFIN, CIMA, ESCA, CySEC, FSC, FMA, MAS, TFG, VFSC Crypto: Yes |

Free Educational Resources

MultiBank Group empowers new and experienced traders with free educational materials, platform tutorials, and live seminars. From strategy tips to real-time market analysis, their comprehensive training helps users trade confidently while learning from industry professionals in a structured, risk-aware environment.

Frequently Asked Questions

Are there any costs associated with accessing MultiBank Group’s educational resources?

No. MultiBank Group provides its entire suite of educational tools, including tutorials, seminars, and strategy guides, completely free to all traders, helping them build foundational skills without financial barriers.

Does MultiBank Group offer mentorship programs for aspiring traders?

Yes. MultiBank Group facilitates mentorship opportunities where experienced professionals guide newcomers through live training sessions, personalized strategy feedback, and insights into professional trading practices.

Our Insights

MultiBank Group’s educational support is ideal for beginners and evolving traders. With no-cost access to tutorials, training seminars, and mentorships, it reflects the broker’s dedication to skill development, confidence building, and long-term trading success.

★★★★ | Minimum Deposit: $50 Regulated by: AUSTRAC, BAFIN, CIMA, ESCA, CySEC, FSC, FMA, MAS, TFG, VFSC Crypto: Yes |

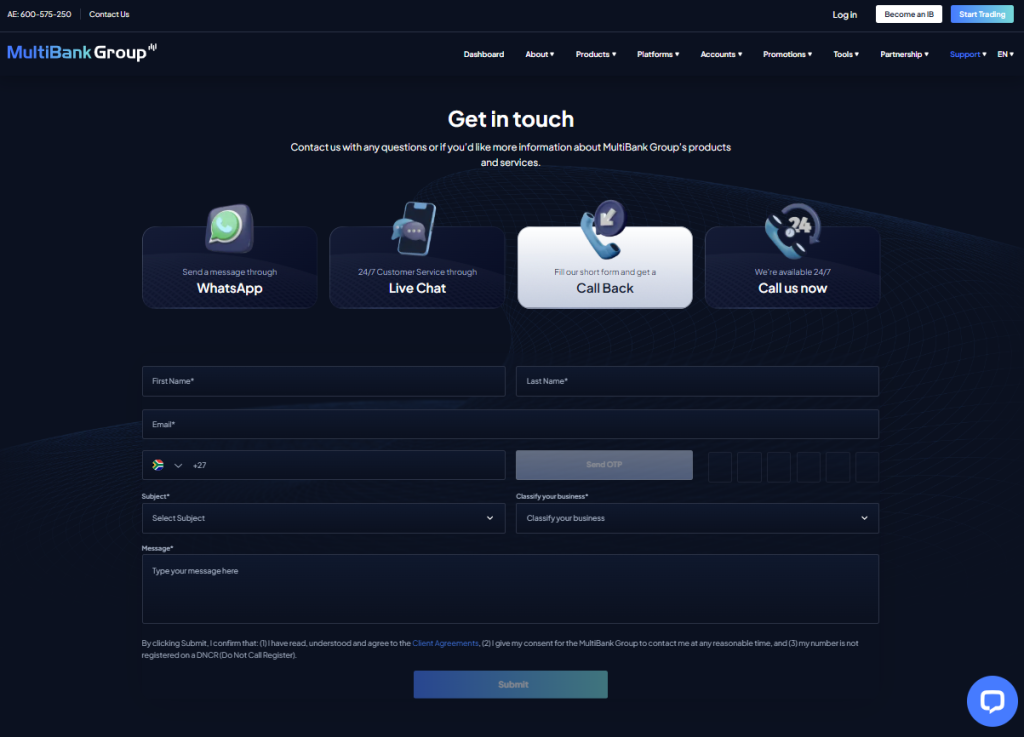

Customer Support

MultiBank Group offers multiple, convenient channels for traders and partners to connect with their support team 24/7. In addition, whether via live chat, WhatsApp, phone calls, or callback requests, clients receive prompt, professional assistance for all product and service inquiries.

| Support Channel | Availability | Features |

| Live Chat | 24/7 | Instant messaging with agents |

| WhatsApp Messaging | 24/7 | Quick mobile chat support |

| Phone Call | 24/7 | Direct voice support |

| Callback Request | Business hours | Scheduled phone callback |

Frequently Asked Questions

What customer support options does MultiBank Group offer?

MultiBank Group provides 24/7 customer service through live chat, WhatsApp messaging, phone support, and callback requests, ensuring users get timely help regardless of their location or time zone. Moreover, this multi-channel approach enhances accessibility and user satisfaction.

How can I submit a question or request to MultiBank Group?

Users can contact MultiBank Group by filling out an online contact form with their details and message. In addition, this form covers business classification and inquiry, helping route requests to the appropriate team.

Our Insights

MultiBank Group’s multi-channel support system delivers reliable and accessible assistance, enhancing client satisfaction and trust. Additionally, with 24/7 availability and diverse contact methods, users can effortlessly resolve issues and stay informed.

★★★★ | Minimum Deposit: $50 Regulated by: AUSTRAC, BAFIN, CIMA, ESCA, CySEC, FSC, FMA, MAS, TFG, VFSC Crypto: Yes |

Insights from Real Traders

⭐⭐⭐⭐

I’ve been trading with MultiBank Group for over two years, and during this time, their platform stability and fast execution have been impressive. In addition, the tight spreads and wide range of assets make trading seamless and profitable, while their customer support is consistently responsive and helpful.

Sarah

⭐⭐⭐⭐⭐

MultiBank Group stands out for its excellent customer service and comprehensive educational resources. Moreover, as a beginner, I found that their tutorials and webinars significantly helped me understand the markets better, while their support team is always available to guide me through any questions.

Michael

⭐⭐⭐⭐⭐

Joining MultiBank Group’s Introducing Broker program has been a fantastic decision. Not only does the program offer generous revenue sharing, but the user-friendly IB portal also makes managing my clients easy. Furthermore, the brand’s strong regulation and transparency give me confidence when referring traders.

JJ

★★★★ | Minimum Deposit: $50 Regulated by: AUSTRAC, BAFIN, CIMA, ESCA, CySEC, FSC, FMA, MAS, TFG, VFSC Crypto: Yes |

Customer Reviews and Trust Scores

| Platform | Trust Score (5) | Highlights | Notable Feedback |

| Trustpilot | 4.6 | Over 1,300 reviews; praised for customer support, trade execution, and spreads. | Great customer support – Tim answered the questions in no time, great executions on trades. |

| Google Play | 4.3 | 6 ratings; users appreciate the user friendly interface and real-time market data. | MultiBank Plus platform is really good for new traders like me. |

| Apple App Store | 4.6 | 21 ratings; users highlight easy crypto trading with a wide range of pairs. | Very great app, now I can buy and sell crypto easily without any complications. |

| ForexPeaceArmy | Mixed | Mixed reviews; some users report issues with withdrawals and account management. | I started making good profits, more than 5K, with a scalping strategy. |

★★★★ | Minimum Deposit: $50 Regulated by: AUSTRAC, BAFIN, CIMA, ESCA, CySEC, FSC, FMA, MAS, TFG, VFSC Crypto: Yes |

Employee Insights

| Platform | Overall Score | Pros | Cons |

| Glassdoor | 4.6 | Collaborative culture strong benefits global reach | High pressure long hours |

| AmbitionBox | 2.6 | Competitive salaries, professional team setting | Cultural mismatch job security concerns |

| Indeed | 5.0 | Supportive leadership, learning opportunities | Fast-paced and target driven environment |

★★★★ | Minimum Deposit: $50 Regulated by: AUSTRAC, BAFIN, CIMA, ESCA, CySEC, FSC, FMA, MAS, TFG, VFSC Crypto: Yes |

Pros and Cons

| ✓ Pros | ✕ Cons |

| Multiple account types | Limited research tools |

| No deposit or withdrawal fees (usually) | Restricted in some countries due to regulations |

| Supports social trading | Some spreads are higher on select accounts |

| Offers eBooks, seminars, and training content | Not all instruments available on all platforms |

Conclusion

MultiBank Group is a reputable Forex and CFD broker offering diverse account types and trading instruments. Moreover, the commitment to regulatory compliance and reasonable pricing adds to its popularity.

MultiBank Group operates from over 25 regional offices around the world, located in key financial centres, including:

- 🇦🇺 Australia

- 🇦🇪 Dubai

- 🇸🇬 Singapore

- 🇨🇾 Cyprus

- 🇩🇪 Germany

- 🇦🇹 Austria

- 🇹🇷 Turkey

- 🇨🇳 China

- 🇵🇭 Philippines

- 🇲🇽 Mexico

- 🇺🇸 United States

- 🇦🇪 United Arab Emirates

- 🇰🇾 Cayman Islands

- 🇻🇬 British Virgin Islands

- 🇸🇨 Seychelles

- 🇲🇺 Mauritius

- 🇻🇺 Vanuatu

- 🇿🇦 South Africa

In addition, MultiBank’s coverage spans more than 100 countries, providing multilingual customer support, regulatory compliance, and regional trading infrastructure across the globe.

Faq

No, MultiBank Group fully supports both scalping and hedging strategies. Traders of all account types can apply these methods without restrictions, making it suitable for active and diverse trading styles.

Withdrawals generally take between 3 and 7 business days. The exact timeframe depends on the withdrawal method chosen and the processing speed of the trader’s bank or payment provider.

Yes, MultiBank Group offers social trading solutions that allow clients to copy strategies from experienced traders. This provides an excellent way for beginners to learn while gaining exposure to different trading approaches.

The minimum deposit depends on the account type: $50 for the Standard Account, $1,000 for the Pro Account, and $10,000 for the ECN Account. This tiered structure suits both beginners and advanced traders.

Yes, MultiBank Group offers swap-free Islamic accounts. These accounts comply with Sharia law principles, ensuring interest-free trading while maintaining full access to trading features.

Yes, MultiBank Group accepts mobile money payments in selected countries, offering traders a convenient way to deposit and withdraw funds.

- Trading with MultiBank Group - Immediate Advantages and Disadvantages

- Overview

- MultiBank Group Visual, Video Overview

- MultiBank Group’s Competitive Edge

- Fees, Spreads, and Commissions

- Which MultiBank Group Account Is Right for You?

- Islamic Account

- How to Open an Account with MultiBank Group

- Safety and Security

- Trading Platforms and Software

- Mobile Trading Experience

- Leverage and Margin

- Trading Instruments and Products

- Streamlined Deposits and Withdrawals

- 20% Deposit Bonus

- Introducing Broker (IB) Program

- Free Educational Resources

- Customer Support

- Insights from Real Traders

- Employee Insights

- Pros and Cons

- Conclusion