OnEquity Review

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open an OnEquity Account

- Safety and Security

- Trading Platforms and Tools

- Margin and Leverage

- Markets available for Trade

- Deposits and Withdrawals

- OnEquity’s Partnership Programme

- Customer Support

- Insights from Real Traders

- Customer Reviews and Trust Scores

- Discussions and Forums about OnEquity

- Employee Overview of Working for OnEquity

- Pros and Cons

- In Conclusion

OnEquity is recognized as a reliable broker, earning a strong Trust Score of 80 out of 100. The firm is regulated by one Tier-1 authority (highly trusted), one Tier-2 authority (trusted), and one Tier-4 authority (higher risk), with no Tier-3 regulators. For retail traders, OnEquity provides three account options: Plus, Prime, and Elite.

★★★ | Minimum Deposit: $25 Regulated by: FSA, FSCA Crypto: Yes |

Overview

OnEquity is a globally recognized trading broker 🇸🇨, offering a holistic ecosystem for retail and institutional clients. The firm combines advanced technology, exceptional support, and a customer-first approach. With a focus on integrity, transparency, and performance, OnEquity empowers traders to operate confidently in financial markets worldwide.

Frequently Asked Questions

What makes OnEquity a trusted broker?

OnEquity 🇸🇨 is built on transparency, integrity, and fairness. Recognized by leading industry awards such as Most Transparent Forex Broker 2024 and Most Reliable Forex Broker 2024, it provides advanced trading technology, secure platforms, and personalized support for both retail and institutional clients.

Which trading solutions does OnEquity provide?

OnEquity 🇸🇨 offers a comprehensive ecosystem including multi-asset platforms, CFD and Forex trading, and tools for performance optimization. The firm combines innovative technology with expert support to enhance the trading experience and meet the needs of professional and high-value traders.

Our Insights

OnEquity delivers a reliable, transparent, and innovative trading environment. Its award-winning platforms, client-focused approach, and robust infrastructure make it an ideal choice for traders seeking secure, high-performance solutions and ongoing support in global markets.

★★★ | Minimum Deposit: $25 Regulated by: FSA, FSCA Crypto: Yes |

Fees, Spreads, and Commissions

OnEquity 🇸🇨 delivers competitive trading conditions with spreads from 0.0 pips and transparent fees. Clients benefit from commission-free or raw spread options depending on the account type. The platform supports MT4 and MT5 across all devices, ensuring reliable execution in a regulated and trusted trading environment.

| Account Type | Minimum Spread | Commission per Lot | Execution Type |

| Plus | 1.5 pip | 0 USD | STP / ECN |

| Prime | 0.4 pip | 5 USD | STP / ECN |

| Elite | 0.0 pip | 5 USD | STP / ECN |

Frequently Asked Questions

What types of spreads does OnEquity offer?

OnEquity 🇸🇨 provides both commission-free and raw spread accounts. Standard accounts start with spreads from 1.5 pips, while Elite accounts offer zero-spread trading. All options are transparent with no hidden fees, allowing traders to select conditions that match their trading style.

Are there commissions on OnEquity accounts?

Commissions depend on the account type. Plus accounts are commission-free, while Prime and Elite accounts charge $5 per traded lot. This setup provides flexibility for both occasional traders and professionals seeking tight spreads or zero-spread execution.

Our Insights

OnEquity 🇸🇨 offers transparent and flexible trading costs. With zero hidden fees, competitive spreads, and adjustable commissions, traders at all levels can choose the account that fits their style, while benefiting from MT4 and MT5 platforms and ultra-low latency execution.

★★★ | Minimum Deposit: $25 Regulated by: FSA, FSCA Crypto: Yes |

Minimum Deposit and Account Types

OnEquity 🇸🇨 caters to traders of all levels through three account types: Plus, Prime, and Elite. Minimum deposits start at $25, with progressively advanced accounts offering lower spreads, structured liquidity, and personalized support. Each account provides access to MT4 and MT5 with STP/ECN execution.

Frequently Asked Questions

What is the minimum deposit for OnEquity accounts?

OnEquity 🇸🇨 offers flexible entry points. Plus accounts require $25, Prime accounts require $1,000, and Elite accounts require $5,000. This allows both novice and professional traders to access the trading ecosystem according to their capital and strategy.

What features do different accounts offer?

Plus accounts offer commission-free trading with micro lots, Prime accounts provide STP/ECN execution and trading analysis access, while Elite accounts deliver zero spreads, low fixed commissions, deep liquidity, and tailored support for professional traders.

Our Insights

OnEquity ensures traders can select accounts suited to their experience and capital. From low-cost Plus accounts to professional Elite accounts, all options provide leverage up to 1:1000, micro-lots, and secure trading on MT4 and MT5 platforms.

★★★ | Minimum Deposit: $25 Regulated by: FSA, FSCA Crypto: Yes |

How to Open an OnEquity Account

Opening an OnEquity account is quick and straightforward. Follow these steps to get started:

1. Step 1: Access the OnEquity Registration Page

Visit the official OnEquity website and click on the “Open Account” button.

2. Step 2: Choose Account Type

Select between an individual or corporate account.

3. Step 3: Fill in Personal Details

Provide your first and last name, date of birth, phone number, email address, country of residence, nationality, and create a password.

4. Step 4: Verify Your Email

Check your inbox for a verification email from OnEquity and click on the verification link.

5. Step 5: Submit Identity Documents

Upload a government-issued ID and proof of address to complete the KYC process.

6. Step 6: Fund Your Account

Deposit a minimum of 25 USD to activate your account and begin trading.

The entire registration process can be completed in under 5 minutes. Once your account is active, you can access the trading dashboard and start exploring the available markets.

★★★ | Minimum Deposit: $25 Regulated by: FSA, FSCA Crypto: Yes |

Safety and Security

OnEquity prioritizes client fund security through strict safeguards, segregated bank accounts, and negative balance protection. The broker combines advanced risk management with PCI-DSS compliance, certified hosting, and institutional-grade infrastructure. Traders benefit from peace of mind knowing their funds and data are protected by cutting-edge safety standards.

| Feature | Details |

| Segregated Bank Accounts | Client funds kept separate |

| Negative Balance Protection | Prevents accounts from going below 0 |

| PCI-DSS Compliance | Secure funding and data handling |

| Certified Hosting | Equinix LD4 and LD7 in London |

Frequently Asked Questions

How does OnEquity protect client funds?

OnEquity ensures client funds are kept in segregated bank accounts, separate from company operations. In addition, negative balance protection safeguards traders from owing more than their deposits. These measures create a secure and transparent trading environment that prioritizes client peace of mind.

What safety measures support OnEquity’s infrastructure?

OnEquity hosts trading environments in certified data centers with redundant power, biometric access, and real-time monitoring. PCI-DSS compliance ensures secure funding and client data protection, while millisecond connectivity to major liquidity providers adds resilience and reliability to the trading ecosystem.

Our Insights

OnEquity stands out as a broker that takes client fund protection seriously. From segregated accounts and institutional-grade hosting to cutting-edge compliance standards, traders can operate with confidence knowing their assets and data are safeguarded under robust and transparent security frameworks.

★★★ | Minimum Deposit: $25 Regulated by: FSA, FSCA Crypto: Yes |

Trading Platforms and Tools

OnEquity provides traders with access to advanced platforms, including MetaTrader 4 and MetaTrader 5. These tools deliver fast execution, detailed charting, and automated trading features. Combined with flexible order types and mobile compatibility, the platforms empower both new and experienced traders to operate efficiently across global markets.

| Platform | Key Features | Device Access | Execution Speed |

| MetaTrader 4 | Advanced charting, Expert Advisors | Desktop Mobile Web | Low latency |

| MetaTrader 5 | Multi-asset support, economic calendar | Desktop Mobile Web | Ultra-fast |

Frequently Asked Questions

What platforms does OnEquity offer to traders?

OnEquity offers both MetaTrader 4 and MetaTrader 5. These platforms are trusted worldwide for their reliability and features such as real-time market data, advanced charting, algorithmic trading, and mobile apps, ensuring traders can manage their accounts anytime and from any device.

How do OnEquity’s platforms benefit traders?

OnEquity’s platforms enhance trading efficiency by offering fast execution speeds, customizable charting tools, and the ability to use Expert Advisors for automated strategies. Traders also benefit from mobile access and advanced order management tools, making it easier to stay connected and execute trades under any market condition.

Our Insights

OnEquity’s integration of MetaTrader 4 and MetaTrader 5 makes it a powerful choice for traders seeking advanced functionality. With reliable execution, automation tools, and mobile compatibility, the broker equips clients with everything needed to trade confidently across multiple asset classes in a secure and professional environment.

★★★ | Minimum Deposit: $25 Regulated by: FSA, FSCA Crypto: Yes |

Margin and Leverage

OnEquity enhances trading performance with dynamic leverage of up to 1:1000. This flexible model adapts by asset class, from forex to commodities and indices. It allows traders to maximize capital efficiency while maintaining risk discipline, providing greater agility in fast-changing financial markets.

| Asset Class | Maximum Leverage | Example Margin % |

| Forex Currencies | 1:1000 | 0.1% |

| Metals Commodities | 1:400 | 0.25% |

| Global Indices | 1:300 | 0.33% |

| Crypto CFDs | 1:50 | 2% |

Frequently Asked Questions

What leverage does OnEquity offer across assets?

OnEquity provides dynamic leverage based on asset class. Forex currencies offer up to 1:1000, metals and commodities up to 1:400, indices up to 1:300, and cryptocurrency CFDs up to 1:50. This approach helps traders balance opportunity with controlled risk exposure.

How does dynamic leverage benefit traders?

Dynamic leverage allows traders to open larger positions with less capital while adapting to market conditions. By using tiered structures, OnEquity ensures traders can scale effectively, optimize margin requirements, and maintain disciplined risk management across different instruments and trading volumes.

Our Insights

OnEquity’s dynamic leverage system provides a competitive edge for traders. With flexible tiers and asset-specific structures, it supports capital efficiency and disciplined trading. Whether trading forex, indices, or commodities, clients can access the right balance between opportunity and risk in a secure environment.

★★★ | Minimum Deposit: $25 Regulated by: FSA, FSCA Crypto: Yes |

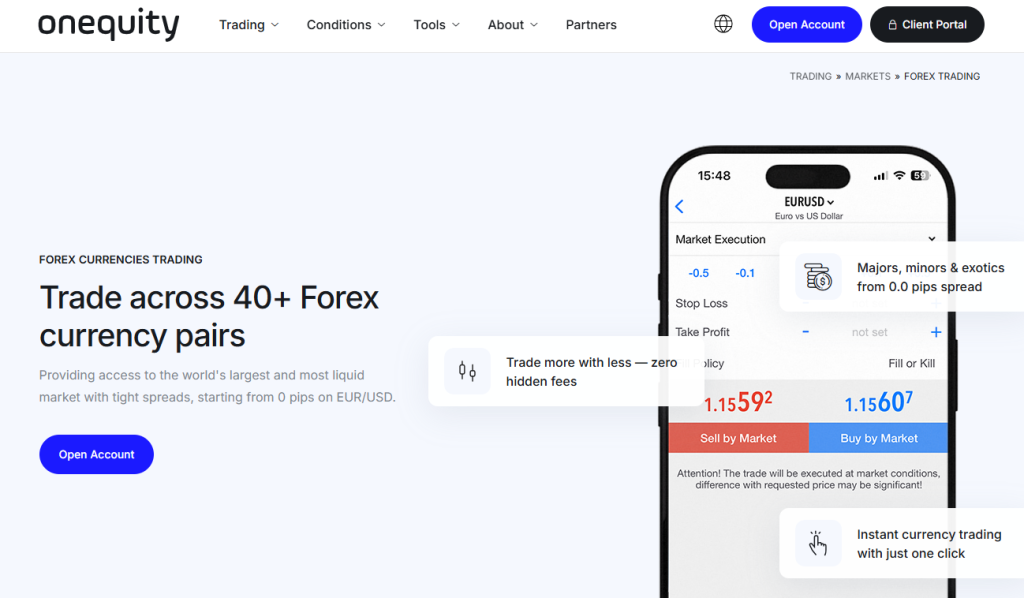

Markets available for Trade

OnEquity offers traders a single account to access a wide range of global markets, including forex, commodities, metals, stock CFDs, indices, and cryptocurrency CFDs. The platform ensures competitive conditions, fast execution, and institutional-grade infrastructure to support diversified trading strategies.

| Market Type | Key Instruments | Trading Format | Benefits |

| Forex | 40+ currency pairs | CFD | Tight spreads fast execution |

| Stock CFDs | US, UK, EU shares (250+ symbols) | CFD | Commission-free low margin |

| Indices | Major global indices (e.g. NASDAQ) | CFD | Ultra-tight spreads leverage |

| Crypto Metals | Cryptocurrencies spot metals commodities | CFD | Flexible access wide range |

Frequently Asked Questions

What markets can I trade with OnEquity?

OnEquity provides access to forex currency pairs, spot metals, commodities, stock CFDs, indices, and cryptocurrency CFDs – all within one account. The diverse offering lets traders build portfolios across major global markets from a single platform.

Does OnEquity offer competitive trading conditions across these markets?

Yes. OnEquity delivers transparent pricing, zero-hidden-fee trading, tight spreads, dynamic leverage, and fast execution through its institutional infrastructure, enabling efficient and precise trade execution across multiple markets.

Our Insights

OnEquity delivers broad market access with professional-grade trading conditions. Offering forex, indices, stocks, commodities, and cryptocurrencies under one account, it allows traders to diversify with ease while benefiting from low-latency execution, clear pricing, and robust infrastructure.

★★★ | Minimum Deposit: $25 Regulated by: FSA, FSCA Crypto: Yes |

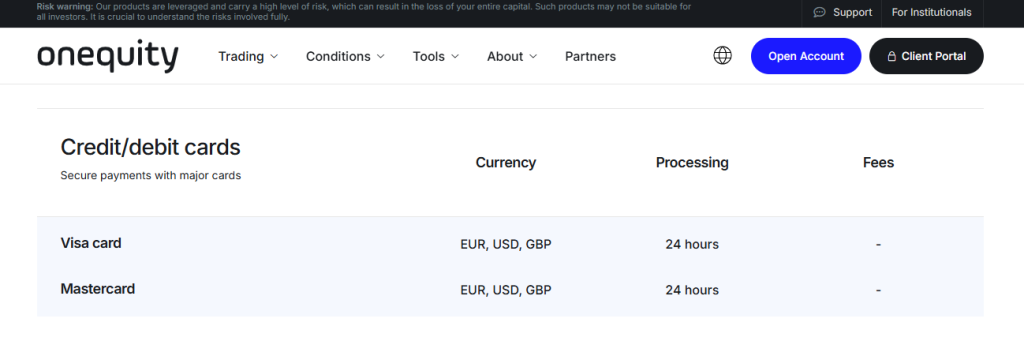

Deposits and Withdrawals

OnEquity ensures smooth funding and withdrawals with zero deposit fees and a wide variety of global payment methods. Traders benefit from fast processing times, reliable security, and access to local as well as international solutions for maximum convenience.

| Method | Currencies | Processing Time | Fees |

| Credit/Debit Card | EUR USD GBP | 24 hours | None |

| Local Payments | BRL ZAR KES GHS NGN | 30 min–3 days | None |

| E-Wallets | USD MXN PEN VND MYR Any | 30 min–3 days | None |

| Bank/Crypto | USD EUR GBP JPY Crypto | 30 min–5 days | None |

Frequently Asked Questions

Does OnEquity charge fees for deposits and withdrawals?

OnEquity does not charge fees on deposits. Most withdrawals are processed without fees as well, although processing times may vary depending on the chosen payment method. This approach makes funding and withdrawing straightforward and cost-effective for traders.

How fast are deposit and withdrawal transactions?

Deposit processing is often instant or completed within 30 minutes for cards, e-wallets, and crypto. Local payments are also processed quickly, while bank transfers may take up to 5 business days. Withdrawals generally follow similar timelines, ensuring reliable access to funds.

Our Insights

OnEquity makes deposits and withdrawals simple, fast, and secure with multiple global and local options. Zero deposit fees, instant crypto and e-wallet transfers, and reliable card payments provide traders with seamless financial flexibility to focus on trading with confidence.

★★★ | Minimum Deposit: $25 Regulated by: FSA, FSCA Crypto: Yes |

OnEquity’s Partnership Programme

OnEquity empowers affiliates and introducing brokers with flexible partnership models, high commissions, and cutting-edge tools. With over 1,200 global partners and more than 200,000 referred clients, the broker has already paid over 10 million USD in commissions, highlighting its reliability and global reach.

| Programme Type | Key Features | Earnings Potential | Tools Provided |

| Affiliates | CPA up to $500+ | Per qualified client | Landing pages banners |

| Introducing Brokers | Rebates revenue share sub-IBs | Ongoing per lot | IB Portal reporting |

| Marketing Support | Email educational content promos | Boost conversions | Custom materials |

Frequently Asked Questions

What is the OnEquity Partnership Programme?

The OnEquity Partnership Programme allows individuals and businesses to partner as affiliates or introducing brokers. Affiliates can earn through CPA deals, while IBs benefit from ongoing rebates and revenue sharing. Both options are designed to maximize partner earnings with flexible support.

How can I choose the right partnership model?

Choosing between the Affiliate Programme and the Introducing Broker Programme depends on your business model. Affiliates suit website owners, influencers, and marketers, while IBs are ideal for those building client networks and preferring revenue sharing. Both provide marketing tools, dedicated support, and reliable payment solutions.

Our Insights

OnEquity’s partnership programme delivers high-earning potential with trusted global reach. Whether you join as an affiliate or an introducing broker, you gain access to advanced tools, multi-level benefits, and tailored support that empower you to maximize results and grow alongside a leading brokerage.

★★★ | Minimum Deposit: $25 Regulated by: FSA, FSCA Crypto: Yes |

Customer Support

OnEquity strengthens its global presence with offices across multiple regions, including 🇸🇨 Seychelles, 🇿🇦 South Africa, and 🇻🇨 St. Vincent and the Grenadines. With dedicated phone, email, and live chat support, the broker ensures traders worldwide receive reliable, round-the-clock assistance.

Frequently Asked Questions

Where does OnEquity have physical offices?

OnEquity operates physical offices in 🇸🇨 Seychelles, 🇿🇦 South Africa, and 🇻🇨 St. Vincent and the Grenadines. These regional offices allow the broker to maintain a closer connection with clients while offering localized support alongside its strong online service presence.

How can I reach OnEquity support?

Traders can contact OnEquity via phone, email, or live chat. Support operates 24/5, ensuring quick responses to inquiries. In addition, a dedicated Help and FAQ section is available to address common questions, making assistance more accessible and efficient for clients globally.

★★★ | Minimum Deposit: $25 Regulated by: FSA, FSCA Crypto: Yes |

Insights from Real Traders

⭐⭐⭐⭐

I have been trading with OnEquity for over a year, and the experience has been fantastic. The platform is intuitive, execution is fast, and the support team is always responsive. I feel confident knowing my funds are secure, and the educational resources have helped me grow as a trader. –

Emma

⭐⭐⭐⭐⭐

OnEquity stands out for its professionalism and transparency. Deposits and withdrawals are smooth, and the customer service team genuinely cares about my trading needs. The spreads are competitive, and I appreciate the variety of trading instruments available. Definitely a broker I can trust. –

Eric

⭐⭐⭐

Trading with OnEquity has been a positive experience from day one. The platform is powerful yet easy to use, and the support team is always available to guide me whenever I need help. I especially value the research tools and market insights, which make trading smarter and more informed. –

Peter

★★★ | Minimum Deposit: $25 Regulated by: FSA, FSCA Crypto: Yes |

Customer Reviews and Trust Scores

OnEquity has garnered positive feedback from its user base. Clients appreciate the platform’s user-friendliness, highlighting the ease with which they can manage their operations and the efficiency of the tools provided. The customer service is consistently praised for its efficiency and attentiveness, with account managers being particularly helpful and patient in guiding users. Consumers also value the quick and reliable processing times for withdrawals.

| Platform | Trust Score (5) | Review Count |

| Trustpilot | 4.6 | 827 |

| Forex Peace Army | 2.4 | 3 |

★★★ | Minimum Deposit: $25 Regulated by: FSA, FSCA Crypto: Yes |

Discussions and Forums about OnEquity

Online discussions about OnEquity are limited. Some users have reported issues with account closures and profit cancellations, citing reasons like alleged abusive trading practices. However, these instances are not widespread and may not represent the overall user experience.

| Forum | Mentions | Sentiment |

| Forex Peace Army | 3 | Mixed |

| WikiFX | 1 | Negative |

The limited forum activity suggests that OnEquity has a relatively low online presence in trading communities.

★★★ | Minimum Deposit: $25 Regulated by: FSA, FSCA Crypto: Yes |

Employee Overview of Working for OnEquity

Information about working at OnEquity is scarce. There are no publicly available employee reviews or detailed insights into the company’s work culture. The absence of employee reviews on major platforms like Glassdoor indicates limited public information about OnEquity’s workplace culture.

★★★ | Minimum Deposit: $25 Regulated by: FSA, FSCA Crypto: Yes |

Pros and Cons

| ✓ Pros | ✕ Cons |

| User-friendly platform | Limited online forum presence |

| Efficient customer support | Scarce employee reviews |

| Quick withdrawal processing | Mixed forum sentiment |

| Positive Trustpilot ratings | Limited discussions in forums |

| Helpful account managers | No detailed employee insights |

References:

In Conclusion

OnEquity is a global multi-asset broker committed to providing comprehensive trading solutions and support to clients worldwide. OnEquity operates through various entities in multiple jurisdictions, ensuring accessibility and assistance for traders across different regions, including operations in the following countries:

- 🇸🇨 Seychelles

- 🇿🇦 South Africa

- 🇲🇾 Malaysia

- 🇲🇺 Mauritius

- 🇨🇾 Cyprus

- 🇻🇨 Saint Vincent and the Grenadines

These locations reflect OnEquity’s commitment to serving a diverse client base with tailored services and support. For more detailed information on services available in each country, it’s advisable to visit OnEquity’s official website or contact their customer support directly.

Faq

Yes, OnEquity offers cutting-edge features like signal sharing and social trading, which let traders interact with a peer community for cooperative learning and trading and instantly duplicate winning tactics.

With OnEquity, withdrawals are handled quickly, with rapid processing possible in some ways. Nevertheless, the maximum anticipated withdrawal time may exceed five days, depending on the payment method.

Yes, OnEquity offers a trial account that lets traders practice their techniques in a risk-free environment using virtual funds. However, specifics like the demo period and validity periods are not disclosed.

With a minimum investment of just USD 25 for the Plus account, OnEquity provides traders with an accessible starting point, making it a desirable choice for novices.

Yes, OnEquity allows users to trade cryptocurrencies. With 13 pairs accessible, users may make predictions about how the prices of well-known digital currencies will fluctuate.

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open an OnEquity Account

- Safety and Security

- Trading Platforms and Tools

- Margin and Leverage

- Markets available for Trade

- Deposits and Withdrawals

- OnEquity’s Partnership Programme

- Customer Support

- Insights from Real Traders

- Customer Reviews and Trust Scores

- Discussions and Forums about OnEquity

- Employee Overview of Working for OnEquity

- Pros and Cons

- In Conclusion