Swissquote Review

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open a Swissquote Account

- Safety and Security

- Refer a Friend

- Trading Platforms and Tools

- Markets available for Trade

- Deposit and Withdrawal

- Education and Research

- Customer Support

- Insights from Real Traders

- Customer Reviews and Trust Scores

- Discussions and Forums about Swissquote

- Employee Overview of Working for Swissquote

- Pros and Cons

- In Conclusion

Swissquote, a Swiss leader in digital banking, operates under a Swiss banking license and is regulated by the Swiss Financial Market Supervisory Authority (FINMA). Other regulations include the FCA, the DFSA, the SFC, the Malta Financial Services Authority, and MAS. It has a trust score of 94 out of 99.

Overview

Swissquote is a Swiss digital banking leader offering secure, seamless trading in forex, CFDs, stocks, ETFs, and crypto. With powerful platforms like Advanced Trader and CFXD, it combines innovation, transparency, and Swiss reliability to support traders at every level.

Frequently Asked Questions

What financial instruments can I trade with Swissquote?

Swissquote offers access to a broad range of instruments, including forex, CFDs, precious metals, stocks, ETFs, bonds, options, futures, and over 50 cryptocurrencies, ensuring a diversified portfolio is within every trader’s reach.

Is Swissquote regulated and secure?

Yes. Swissquote Bank Ltd is regulated by the Swiss Financial Market Supervisory Authority (FINMA), offering a high level of regulatory assurance, financial transparency, and operational integrity.

Our Insights

Swissquote stands out as a top-tier choice for traders seeking Swiss-grade security, platform excellence, and an all-encompassing product suite, from traditional securities to modern digital assets. With its customer-centric approach and strong regulatory backing, it offers both trust and innovation in a highly competitive trading landscape.

Fees, Spreads, and Commissions

Swissquote offers transparent, commission-free Forex trading across all retail account tiers, with spreads starting as low as 1.1 pips on the Prime account. Equity trading fees vary by region but remain competitive, especially for high-volume traders. With no hidden markups, a consistent inactivity fee, and flexible pricing for professionals, Swissquote combines cost-efficiency with institutional-grade reliability.

| Feature | Standard | Premium | Prime | Professional |

| Forex Commission | None | None | None | Custom |

| Spreads From | 1.7 pips | 1.4 pips | 1.1 pips | Custom |

| Stock Commission (US) | $0.03/share | $0.02/share | $0.01/share | Bespoke Pricing |

| Inactivity Fee | $10/month | $10/month | $10/month | $10/month |

Frequently Asked Questions

Are there commissions on Forex trades?

No, Swissquote’s Forex accounts are commission-free. You only pay the spread.

What are the typical spreads for Forex trading?

Spreads start from 1.7 pips (Standard) to 1.1 pips (Prime), depending on your account level.

Our Insights

Swissquote delivers fair and flexible pricing. With zero commissions on Forex, competitive stock rates, and no sneaky markups, the cost structure is highly appealing. Whether you’re trading FX or equities, you can trust Swissquote for clear terms and optimized spreads.

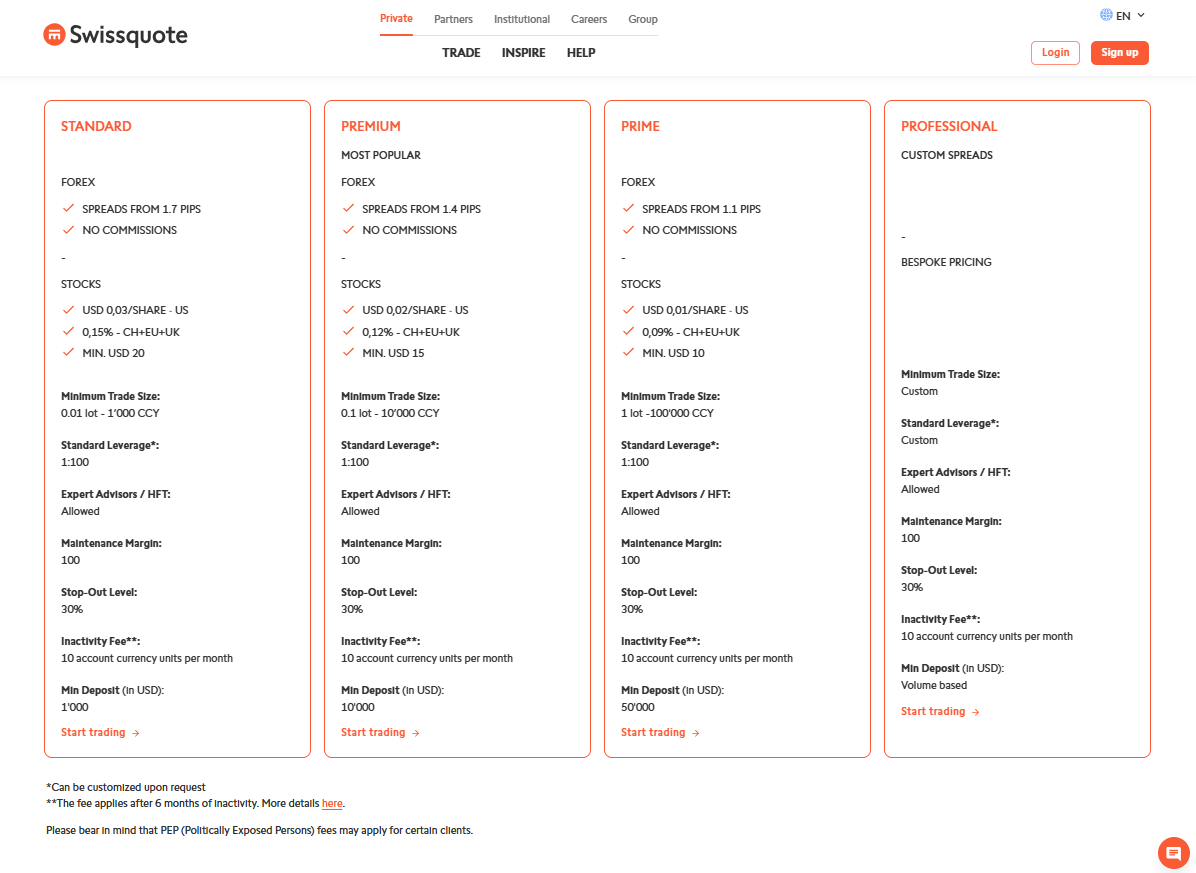

Minimum Deposit and Account Types

Swissquote offers four distinct Forex account types – Standard, Premium, Prime, and Professional – designed to cater to a range of trading volumes and experience levels. Each account scales in terms of minimum deposit, spreads, and trading conditions, giving both retail and institutional clients the flexibility they need.

Frequently Asked Questions

What is the minimum deposit to open a Swissquote trading account?

The minimum deposit ranges from $1,000 for Standard accounts to $50,000 for Prime accounts. Professional accounts are volume-based and tailored individually.

Which account type is best for beginners?

The Standard account is ideal for new traders, with low entry barriers and no commission on forex trades.

Our Insights

Swissquote’s tiered account structure ensures traders at every level – novice to pro – can access tailored features. With low starting requirements and full automation support, the flexibility and transparency stand out, especially when backed by a Swiss bank.

How to Open a Swissquote Account

To open a Swissquote Account, the following steps can be followed.

1. Step 1: Choose Your Account Type

Visit the Swissquote account opening page and select the type of account that suits your needs—options include Trading, Forex, CFDs, Smart Portfolios, and more.

2. Step 2: Complete the Online Application

Fill out the online form with your details, including your name, contact information, and financial background. This process typically takes about 5–10 minutes.

3. Step 3: Verify Your Identity

You’ll need to provide:

- A valid ID (passport or national ID card)

- Proof of residence (e.g., utility bill or bank statement not older than 3–6 months)

- Access to a device with a camera for digital authentication

These documents can be uploaded directly through the online portal.

4. Step 4: Fund Your Account

Once your account is approved, make an initial deposit. The minimum deposit varies by account type:

- Standard: $1,000

- Premium: $10,000

- Prime: $50,000

- Professional: Volume-based (custom)

Deposits must be made from a bank account in your name.

5. Step 5: Start Trading

After funding, you can access Swissquote’s trading platforms and begin trading across various markets.

Safety and Security

Swissquote is a fully regulated financial institution, operating under the supervision of several top-tier regulators. These include the Swiss Financial Market Supervisory Authority (FINMA), the UK’s Financial Conduct Authority (FCA), and Hong Kong’s Securities and Futures Commission (SFC).

This multi-jurisdictional oversight guarantees strict compliance with global financial standards, offering clients a high level of security, transparency, and trust.

| Authority | Jurisdiction | Role |

| FINMA | Switzerland | Primary financial regulator overseeing banking |

| FCA | United Kingdom | Regulates operations and protects UK clients |

| SFC | Hong Kong | Supervises financial markets in Asia |

Frequently Asked Questions

Is Swissquote a licensed and regulated broker?

Yes, Swissquote is licensed and regulated by multiple respected authorities, including FINMA (Switzerland), the FCA (UK), and the SFC (Hong Kong), ensuring a secure trading environment.

What does Swissquote’s regulation mean for traders?

Regulatory oversight ensures client fund segregation, transparent operations, and strong financial practices, reducing the risk of malpractice or fraud.

Our Insights

Swissquote’s regulation by globally respected financial authorities reinforces its status as a trustworthy broker. Its commitment to safety, transparency, and regulatory compliance makes it a top choice for security-conscious traders seeking a reliable, well-governed trading partner.

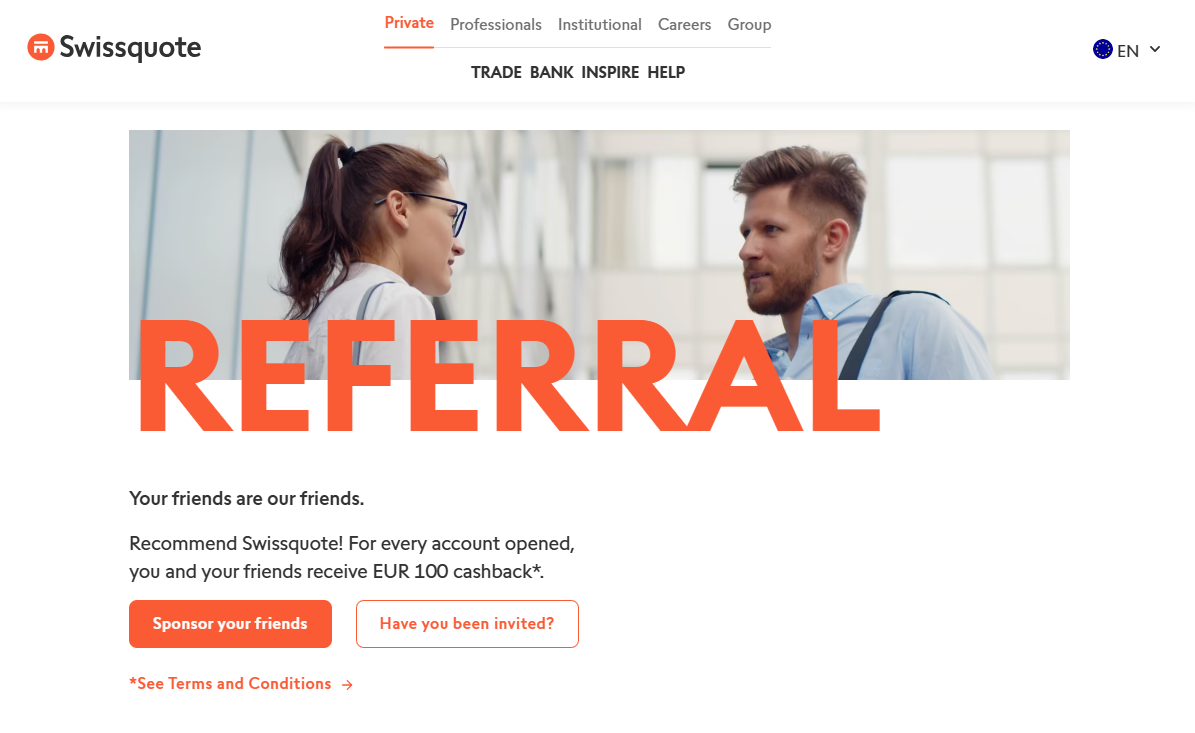

Refer a Friend

At Swissquote, sharing pays off. With the referral program, both you and your friends can earn €100 cashback when they open an account, fund it with at least €2,000 (or €5,000 for Smart Portfolio), and place a trade. Simply share your referral code – found in the Swissquote app – and start earning rewards together.

| Step | Action |

| Find Code | App > My Account > Profile |

| Referral Reward | €100 for both sponsor and friend |

| Minimum Deposit | €2,000 (€5,000 for Smart Portfolio) |

| Eligible Action | At least one trade after deposit |

Frequently Asked Questions

How do I find my Swissquote referral code?

Log in to the Swissquote app and navigate to “My Account > Profile” to access your referral code.

Can I refer multiple friends at once?

Yes, you can sponsor several people using the same referral code. Each eligible referral can earn you €100 cashback.

Our Insights

Swissquote’s referral program is a win-win for clients, rewarding loyalty while encouraging community growth. With a straightforward process and generous cashback, it’s a smart way to benefit from recommending a trusted Swiss broker.

Trading Platforms and Tools

Swissquote offers a powerful trio of trading platforms – CFXD, MetaTrader 4, and MetaTrader 5 – each tailored to different trading styles and experience levels. Whether you want cutting-edge customization, advanced automation, or intuitive charting, there’s a platform built to match your needs.

CFXD

Step into the future of Forex and CFD trading with Swissquote’s CFXD web platform – a powerful yet intuitive solution designed for all trading styles. Featuring seamless integration with TradingView, the platform offers over 50 charting tools, 80+ technical indicators, and smart order types like OCO and IF-DONE.

With Autochartist’s real-time market scanning and a fully customizable interface, you can trade with speed, insight, and full control – from desktop or mobile. Whether you’re just getting started or already a pro, Swissquote’s CFXD platform puts next-level trading at your fingertips.

MetaTrader 4

Experience the gold standard in Forex and CFD trading with Swissquote’s MetaTrader 4 platform. Renowned for its powerful analysis suite, automated trading capabilities, and smart order tools, MT4 empowers traders to take full control. Build or back-test strategies, use thousands of Expert Advisors, or follow top-performing traders via copy trading.

With customizable charts, 30+ built-in indicators, and seamless mobile/web access, Swissquote’s MT4 integration combines market-leading tech with Swiss-grade execution.

MetaTrader 5

Take your trading to the next level with Swissquote’s MetaTrader 5 – the cutting-edge platform for Forex and CFD traders seeking more tools, more data, and more flexibility. MT5 offers an expanded suite of indicators, 21 timeframes, and 44 analytical objects, allowing for deep market analysis.

Automate strategies with thousands of Expert Advisors or copy seasoned traders. Whether you prefer advanced back-testing or real-time execution, Swissquote’s MT5 delivers institutional-grade power with a user-friendly interface – on desktop, mobile, or web.

Trading Platform Comparison

| Feature | CFXD | MetaTrader 4 (MT4) | MetaTrader 5 (MT5) |

| Charting Tools | 50+ via TradingView | 30+ built-in | 80+ built-in |

| Technical Indicators | 80+ | 30+ + custom | 80+ + custom |

| Automated Trading | Limited (via Autochartist alerts) | Yes (Expert Advisors) | Yes (Advanced EAs) |

| Copy Trading | None | Yes | Yes |

| Timeframes | Multiple | 9 | 21 |

| Smart Order Types | OCO IF-DONE If-OCO | Basic | Advanced |

| Mobile Access | Yes | Yes | Yes |

Frequently Asked Questions

What is the CFXD platform best suited for?

CFXD is ideal for traders who want modern charting tools, smart order types, and a flexible, browser-based interface powered by TradingView.

How does MetaTrader 4 support automation?

MT4 supports automated trading through Expert Advisors (EAs), strategy back-testing, and copy trading via a large user community.

Our Insights

Swissquote provides a platform for every type of trader. CFXD excels in modern, browser-based trading with real-time market scanning, while MT4 and MT5 remain industry standards for in-depth technical analysis and automation. Whether you’re a beginner or an expert, there’s a tool that fits.

Markets available for Trade

Swissquote gives you access to a wide universe of tradeable markets, ranging from traditional securities like stocks, ETFs, and bonds to dynamic assets like cryptocurrencies, Forex, and CFDs. With over 60 global exchanges, 52 digital coins, and 400+ CFDs, you can diversify your portfolio and trade almost anything, all from one platform.

| Market Type | Assets Available | Starting Fees/Spreads | Key Highlights |

| Securities | Stocks ETFs Bonds Funds Options Futures | From CHF 1.50 | 50+ stock markets, 20,000+ funds 60,000+ bonds |

| Cryptocurrencies | 52+ coins staking crypto-asset products | From 0.5% | Trade on Swissquote’s own SQX exchange |

| Forex and CFDs | 400+ CFDs across currencies indices metals | Spreads from 1.1 pips | Leverage up to 1:100, advanced trading tools |

| Exclusive Products | Themes Trading Swiss DOTS Yield Boosters | From CHF 9 | 90,000+ leveraged products, barrier reverse convertibles |

Frequently Asked Questions

What asset classes can I trade with Swissquote?

Swissquote offers securities (stocks, ETFs, bonds, options, futures), cryptocurrencies, Forex, CFDs, and exclusive structured products.

How many stock markets does Swissquote give access to?

Swissquote connects you to over 50 stock markets worldwide, offering broad global exposure.

Our Insights

Whether you’re a long-term investor or an active trader, Swissquote has the markets to match your goals. With everything from traditional securities to modern crypto and derivative products, you can build, hedge, or speculate with confidence, all backed by the trust and security of a Swiss bank.

Deposit and Withdrawal

Swissquote makes payments and transfers straightforward and efficient, whether you’re funding your trading account, withdrawing funds, or moving securities. With transparent bank details, QR-bill support (in Switzerland), and templates for account transfers, the process is designed to be quick and secure. Handle your finances with ease while benefiting from Swiss banking standards.

Frequently Asked Questions

How do I transfer money to my Swissquote account?

Simply use the provided Swissquote bank details, including the correct IBAN and SWIFT code. You can also generate your IBAN using the online calculator for accuracy.

How can I withdraw money from my Swissquote account?

Log in to your account and follow the instructions in the Payments section. Make sure your recipient bank details are accurate and up to date.

Our Insights

Swissquote simplifies account funding, withdrawals, and security transfers with clear instructions, bank transparency, and helpful documentation. Whether you’re moving money locally or internationally, Swissquote’s robust infrastructure supports fast and secure transactions, backed by Swiss banking reliability.

Education and Research

Swissquote gives traders the edge with expertly curated financial insights and educational content. From daily Morning News and market blogs to in-depth podcasts and videos, Swissquote ensures you stay current, confident, and ready to act. Whether you’re just starting or refining your strategies, the platform’s learning resources and expert guidance help you master the markets at your own pace.

Frequently Asked Questions

What type of market news does Swissquote provide?

Swissquote offers daily Morning News updates, blog articles, and expert market commentary to keep you informed on the latest trading developments and trends.

How can I access Swissquote’s educational resources?

You can explore Swissquote’s webinars, blog, YouTube channel, and podcast series directly through their website under the Education or Insights sections.

Our Insights

Swissquote excels not only as a trading platform but also as a knowledge hub. With a strong focus on trader education and real-time insights, it empowers users to make smarter financial decisions and seize market opportunities confidently.

Customer Support

Swissquote goes beyond trading by offering a comprehensive support system designed to keep you informed, connected, and confident. From login help and account management to platform access and legal documentation, everything you need is just a click away. Stay up to date with real-time service updates, and rely on a dedicated Customer Care team ready to assist you at every step.

Frequently Asked Questions

I can’t log into my account. What should I do?

Check Swissquote’s troubleshooting page for common login issues and steps to reset your password or regain account access.

Where can I find my tax statements?

Tax statements and related documents are available in the Legal & Tax section of your account or under the “Documents & Forms” page.

Our Insights

Swissquote combines powerful trading tools with exceptional support. Whether you need assistance navigating platforms, handling documents, or solving login issues, their responsive Customer Care team and self-service resources ensure help is always within reach.

Insights from Real Traders

🥇 Effortless Trading Experience

Swissquote’s platform is clean, fast, and easy to use. I’ve been trading Forex and ETFs with zero issues, and everything from charting to order execution feels professional. – Lukas M.

⭐⭐⭐⭐

🥈 Reliable and Secure Banking

I moved my portfolio to Swissquote last year and haven’t looked back. Transfers are smooth, fees are fair, and I feel confident knowing my assets are with a Swiss bank. – Emma R.

⭐⭐⭐⭐⭐

🥉 Top-Notch Tools for Active Traders

The integration with TradingView and access to MT4/MT5 is a huge win. I can trade on the go, run strategies, and track performance without missing a beat. – Daniel K.

⭐⭐⭐⭐

Customer Reviews and Trust Scores

A snapshot of how Swissquote is perceived by customers and by industry watchdogs – considering both user feedback and formal trust metrics.

| Metric | Score/Insights |

| Trustpilot TrustScore | 3.5 out of 5 based on over 3,200 reviews |

| Traders Union Rating | 3.4 out of 5 from about 3,057 reviews |

| ForexBrokers.com Trust Score | 99 out of 99 "Highly Trusted" (Tier 1 regulators included: FINMA, MAS, FCA, SFC, etc.) |

Swissquote is broadly regarded as a reputable and trusted financial institution, though customer feedback shows a mix of praise and criticism around cost transparency and service responsiveness.

Discussions and Forums about Swissquote

Insights from real users on platforms like Reddit – where experiences and frustrations are discussed candidly.

| Observation Area | Example Highlights |

| High fees and poor customer service | “High fees, dividends taxed at max withholding rate… very slow customer support” |

| Cost vs. interface preference | “Swissquote is okish… just like Swiss quote and their interface… even though I work for a US Company I don’t trust IBKR” |

| Crypto withdrawal delays | “After 16 days… transaction not fulfilled… support is an absolute catastrophe, and my trust… has vanished forever.” |

The sentiment across forums is mixed: while the platform’s UI and Swiss-based stability appeal to some, others cite high fees, slow support, and frustrating processes – particularly around crypto and withdrawals.

Employee Overview of Working for Swissquote

Voices from current and former employees offer a behind-the-scenes look at the company’s culture, benefits, and challenges.

| Theme | Key Feedback |

| Positive culture perks | “Pleasant colleagues… flexibility… pub… sport facilities… good work life balance” |

| Low compensation management issues | “Salary level is below market… poor management… lack of continuous training… high inequality in salaries” |

| Fast-paced environment | “Lots of foreigners with diverse culture, English first… fast paced environment… health is a priority” |

Employees describe Swissquote as a dynamic, collegial workplace with strong camaraderie and perks—but also note concerns around compensation, career progression, and leadership transparency.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Regulated by MAS and CSSF | Minimum deposit is $1,000 |

| Offers a range of trading accounts | Higher spreads on some accounts |

| Provides a demo account | Limited leverage (up to 1:30) |

| Supports MT4 and MT5 platforms | Limited micro account options |

| Negative balance protection | Fees may apply for certain services |

References:

In Conclusion

Swissquote has established a network of physical offices and local customer support teams in key financial hubs across Europe, the Middle East, Africa, and Asia, enabling tailored assistance and regulatory compliance in those markets.

- 🇨🇭 Switzerland

- 🇬🇧 United Kingdom

- 🇱🇺 Luxembourg

- 🇲🇹 Malta

- 🇨🇾 Cyprus

- 🇷🇴 Romania

- 🇦🇪 United Arab Emirates

- 🇸🇬 Singapore

- 🇭🇰 Hong Kong

- 🇿🇦 South Africa

Swissquote’s global presence through local offices not only supports regulatory compliance in each jurisdiction but also ensures clients receive accessible and localized customer service wherever they are.

Faq

Yes. Swissquote offers user-friendly platforms, rich educational resources, and a Standard account with a manageable $1,000 minimum deposit—ideal for newcomers.

Yes, traders can open free demo accounts to practice with virtual funds before committing real capital.

Absolutely. Swissquote supports trading in over 50 cryptocurrencies through its secure and regulated crypto offering.

Through the MetaTrader platforms, users can copy top-performing traders and use automated Expert Advisors (EAs).

Swissquote’s combination of Swiss banking security, comprehensive asset classes, and innovative tools like CFXD and TradingView integration sets it apart.

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open a Swissquote Account

- Safety and Security

- Refer a Friend

- Trading Platforms and Tools

- Markets available for Trade

- Deposit and Withdrawal

- Education and Research

- Customer Support

- Insights from Real Traders

- Customer Reviews and Trust Scores

- Discussions and Forums about Swissquote

- Employee Overview of Working for Swissquote

- Pros and Cons

- In Conclusion