- Home /

- Forex Brokers /

- XM

XM Review

- Trading with XM Group - Immediate Advantages and Disadvantages

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open an XM Group Account

- Safety and Security

- Client Protection Policies

- Markets available for Trade

- Trading Platforms and Tools

- Copy Trading

- Trading Conditions

- Bonus Offers and Promotions

- Refer a Friend Program

- XM Group Traders Club - Loyalty Rewards Program

- Trading Competitions

- Trading Tools and Features

- Deposits and Withdrawals

- Leverage, Spreads, and Swap-Free Accounts

- Education and Research

- Customer Support

- Insights from Real Traders

- Customer Reviews and Trust Scores

- Pros and Cons

- In Conclusion

With over 15 years of experience and a client base exceeding 15 million across more than 190 countries, XM Group has established itself as a trusted and reliable broker. Its multi-jurisdictional regulatory framework and dedication to fair, transparent trading practices have solidified its position as a leading multi-regulated financial institution. The broker holds a strong trust score of 97 out of 99.

★★★★★ | Minimum Deposit: $5 Regulated by: FSC Crypto: Yes (not available under CySEC (EU) or DFSA (MENA). |

Important Notes:

- Leverage depends on the instrument and the applicable XM Group entity.

- Products, Services, and Features vary by entity.

- Availability of instruments, promotions, and account types depends on the XM Group entity with which the account is opened.

Trading with XM Group – Immediate Advantages and Disadvantages

| ✓ Pros | ✕ Cons |

| Regulated by multiple respected authorities. | Variable spreads may widen in volatile markets. |

| Low minimum deposit from $5. | Limited leverage for EU clients due to ESMA rules. |

| Supports MT4 and MT5 platforms. | Cryptocurrency trading options are limited. |

| Offers free educational materials and webinars. | Inactivity fees apply after 90 days. |

| Fast deposit and withdrawal processing. | Bonus programs restricted to certain regions. |

| Multiple account types to suit different traders. | Some advanced tools only available on specific accounts. |

Overview

XM Group is a trustworthy broker that delivers fast execution, stable leverage, and consistent trading conditions across global markets. With over 15 years of operation and millions of daily trades processed, it maintains strong credibility while supporting traders who value transparency, scale, and performance-driven infrastructure.

| Feature | Details |

| Industry Experience | 15 plus years |

| Daily Trade Volume | Nearly 14 million trades |

| Client Base | Over 15 million clients |

| Execution Policy | Zero requotes and rejections |

| Leverage Offering | Up to 1000:1* |

Frequently Asked Questions

How reliable is XM Group during volatile market conditions?

XM Group maintains stable leverage and execution quality during major economic events, including the release of CPI and NFP data. During active trading sessions, orders execute without requotes or rejections, while spreads remain predictable. This consistency makes XM Group suitable for traders who operate during high-volatility periods. Spreads are variable depending on market conditions.

What type of traders benefit most from XM Group?

XM Group suits traders who prioritize execution speed, leverage stability, and operational scale. Beginners benefit from reliable order handling, while experienced traders value consistent performance during news-driven volatility. The platform design supports active trading styles, therefore appealing to scalpers and intraday traders.

Expert Insight

We placed multiple market and pending orders during high-impact CPI and NFP releases. We observed zero requotes, no execution rejections, and consistent leverage levels, while execution speeds remained stable even during sharp price spikes and reduced market liquidity.

Important Notes:

- Leverage depends on the instrument and the applicable XM Group entity.

- Products, Services, and Features vary by entity.

- Availability of instruments, promotions, and account types depends on the XM Group entity with which the account is opened.

★★★★★ | Minimum Deposit: $5 Regulated by: FSC Crypto: Yes (not available under CySEC (EU) or DFSA (MENA). |

* Cryptocurrency CFDs are available only under selected XM Group entities and are not offered to clients in the EU or MENA jurisdictions.

Fees, Spreads, and Commissions

XM Group is a trustworthy broker that applies a clear and competitive pricing structure across its trading accounts. Spreads stay competitive, commissions remain absent on most accounts, and pricing transparency supports traders who require predictable costs while executing strategies across different market conditions.

| Account Type | Spread From | Commission Model | Cost Structure |

| Micro | 1.6 pips | None | Spread only |

| Standard | 1.6 pips | None | Spread only |

| Ultra-Low Micro | 0.8 pips | None | Tight spreads |

| Ultra-Low Standard | 0.8 pips | None | Tight spreads |

| Shares | Market based | Yes | Commission based |

Frequently Asked Questions

Which XM Group accounts charge commissions?

XM Group applies commissions only on the Shares Account, which provides direct access to global equities. Micro, Standard, Ultra-Low Micro, and Ultra-Low Standard accounts operate on a spread-only model, therefore keeping trading costs simple for CFD traders.

How do spreads differ between XM Group account types?

Micro and Standard accounts offer spreads from 1.6 pips, while Ultra-Low Micro and Ultra-Low Standard accounts can reach as low as 0.8 pips depending on market conditions. Spread behavior remains consistent during active sessions across all CFD account types.

Our Assessment

XM Group delivers clear and well-structured trading costs by separating spread-based CFD accounts from commission-based equity investing. With competitive spreads, zero commissions on most accounts, and transparent pricing, XM Group suits traders who value cost clarity and execution consistency.

Important Notes:

- Leverage depends on the instrument and the applicable XM Group entity.

- Products, Services, and Features vary by entity.

- Availability of instruments, promotions, and account types depends on the XM Group entity with which the account is opened.

★★★★★ | Minimum Deposit: $5 Regulated by: FSC Crypto: Yes (not available under CySEC (EU) or DFSA (MENA). |

* Cryptocurrency CFDs are available only under selected XM Group entities and are not offered to clients in the EU or MENA jurisdictions.

Minimum Deposit and Account Types

XM Group offers a flexible account structure designed for traders at every experience level. With a low minimum deposit and clearly differentiated account types, traders can select precise exposure levels, cost models, and trading objectives, therefore allowing gradual progression from small positions to advanced strategies.

| Account Type | Minimum Deposit | Lot Size | Primary Use |

| Micro | 5 dollars | 1,000 units | Low-risk trading |

| Standard | 5 dollars | 100,000 units | Balanced trading |

| Ultra-Low Micro | 5 dollars | 1,000 units | Tight spreads |

| Ultra-Low Standard | 5 dollars | 100,000 units | Cost efficiency |

| Shares | Varies | Share based | Direct investing |

Frequently Asked Questions

What is the minimum deposit for each XM Group account type?

XM Group requires a minimum deposit of 5 dollars for Micro, Standard, Ultra-Low Micro, and Ultra-Low Standard accounts. The Shares Account requires a higher deposit depending on selected equities, therefore aligning more closely with traditional investment account structures.

How do XM Group account types differ in trading purpose?

Micro accounts support reduced exposure and risk control. Standard accounts offer balanced conditions with bonuses, Ultra-Low Micro and Ultra-Low Standard focus on cost efficiency, while the Shares Account targets long-term investors seeking direct ownership of global company shares.

Trader Perspective

XM Group stands out by offering clearly segmented account types that align with different trading goals. From low-cost Micro trading to commission-based share investing, the platform allows traders to scale responsibly while maintaining consistent execution and defined trading conditions.

Important Notes:

- Leverage depends on the instrument and the applicable XM Group entity.

- Products, Services, and Features vary by entity.

- Availability of instruments, promotions, and account types depends on the XM Group entity with which the account is opened.

★★★★★ | Minimum Deposit: $5 Regulated by: FSC Crypto: Yes (not available under CySEC (EU) or DFSA (MENA). |

* Cryptocurrency CFDs are available only under selected XM Group entities and are not offered to clients in the EU or MENA jurisdictions.

How to Open an XM Group Account

Opening an XM Group account is fully online and can usually be completed in one session if your documents are ready. The process involves registration, verification, funding, and then access to live trading on MetaTrader platforms.

1. Step 1: Start Registration

Visit the XM Group homepage and select the option to open a real account. Enter your email address, create a strong password, and choose your country of residence to begin the registration process.

2. Step 2: Complete Personal Details

Fill in your full legal name, date of birth, and contact information. Choose your preferred trading platform, account type such as Micro, Standard, or Ultra-Low, and select your base currency.

3. Step 3: Verify Your Identity

Upload a clear government-issued ID and a recent proof of address document. Verification is typically completed within a few hours to one business day once documents are approved.

4. Step 4: Access Your Account

Confirm your email address and log in to the XM Group Members Area using your account credentials.

5. Step 5: Fund and Start Trading

Deposit funds using an available payment method. The minimum deposit usually starts at 5 dollars, after which you can access live trading or a demo account.

Important Notes:

- Leverage depends on the instrument and the applicable XM Group entity.

- Products, Services, and Features vary by entity.

- Availability of instruments, promotions, and account types depends on the XM Group entity with which the account is opened.

★★★★★ | Minimum Deposit: $5 Regulated by: FSC Crypto: Yes (not available under CySEC (EU) or DFSA (MENA). |

* Cryptocurrency CFDs are available only under selected XM Group entities and are not offered to clients in the EU or MENA jurisdictions.

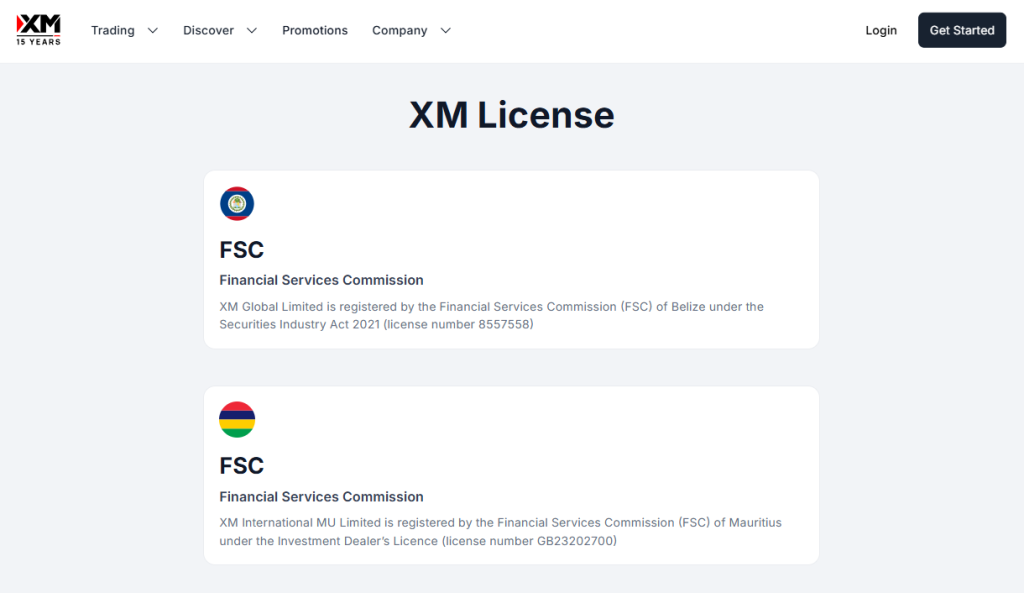

Safety and Security

XM Group is a trustworthy broker that operates under a strong multi-regulatory framework across several jurisdictions. Its structure prioritizes client protection, regulatory compliance, and transparent operations, therefore giving traders confidence through local oversight, international standards, and clearly defined legal entities.

Note: XM Group traders can access a range of risk management tools, including negative balance protection, real-time margin monitoring, and stop-loss orders, to manage positions effectively and minimise potential losses. These tools help traders maintain control, particularly during unexpected market movements.

| Entity | Regulator | Jurisdiction | Max Leverage (Retail) | Crypto CFD Availability |

| Trading Point of Financial Instruments Ltd | CySEC | 🇨🇾 Cyprus (EU) | 1:30 | Not Available |

| Trading Point of Financial Instruments Pty Ltd | ASIC | 🇦🇺 Australia | 1:30 | Not Available |

| XM ZA (Pty) Ltd | FSCA | 🇿🇦 South Africa | 1:50 | Not Available |

| Trading Point MENA Limited | DFSA | 🇦🇪 Dubai (UAE) | 1:50 | Not Available |

| XM Global Limited | FSC | 🇧🇿 Belize | Up to 1:1000–1:2000 | Available |

| XM International MU Limited | FSC | 🇲🇺 Mauritius | Up to 1:500–1:1000 | Available |

| XM (SC) Limited | FSA | 🇸🇨 Seychelles | Up to 1:1000 | Available |

Key Notes and Compliance Clarifications:

- EU (CySEC) and Australia (ASIC): Crypto CFDs are not offered to retail clients due to regulatory restrictions. Leverage is capped at 1:30.

- South Africa (FSCA): Retail leverage is typically capped at 1:50. Crypto CFDs are generally not available under the FSCA entity.

- Dubai (DFSA): Leverage is typically capped at 1:30–1:50. Crypto CFDs are not available to most retail traders.

- Offshore Entities (Belize, Mauritius, Seychelles): These entities offer higher leverage (up to 1:1000+) and crypto CFDs, but with weaker investor protection compared to Tier-1 regulators.

*XM Group does not actively offer FCA-regulated retail accounts at present.

**XM Group is not regulated by FINMA.

Frequently Asked Questions

How does XM Group protect traders through regulation?

XM Group operates multiple licensed entities regulated by recognized authorities across different regions. This structure ensures adherence to strict compliance rules, client fund protection standards, and operational transparency, while traders receive oversight aligned with the jurisdiction under which their account is registered.

Why does XM Group use multiple regulatory entities?

XM Group uses a multi-jurisdictional model to serve traders globally while complying with local regulatory requirements. This approach allows region-specific investor protections, appropriate leverage rules, and localized supervision, therefore strengthening trust and regulatory consistency across international markets.

Independent View

XM Group demonstrates strong regulatory depth by maintaining licenses across several respected authorities. With clear entity separation, verified registrations, and consistent compliance standards, it provides traders with a secure and transparent trading environment supported by regional and international regulatory oversight.

Important Notes:

- Leverage depends on the instrument and the applicable XM Group entity.

- Products, Services, and Features vary by entity.

- Availability of instruments, promotions, and account types depends on the XM Group entity with which the account is opened.

★★★★★ | Minimum Deposit: $5 Regulated by: FSC Crypto: Yes (not available under CySEC (EU) or DFSA (MENA). |

* Cryptocurrency CFDs are available only under selected XM Group entities and are not offered to clients in the EU or MENA jurisdictions.

Client Protection Policies

XM Group is a trustworthy broker that prioritizes client safety through robust protection policies and secure infrastructure. Its framework focuses on fund segregation, loss limitation, and data security, therefore creating a controlled trading environment where clients can operate with confidence and with clearly defined financial safeguards.

| Protection Measure | Purpose | Client Benefit |

| Segregated Funds | Separates client and company funds | Enhanced fund safety |

| Negative Balance Protection | Limits losses to deposits | No account debt |

| SSL Encryption | Secures data transmission | Privacy protection |

| Secure Payments | Vetted funding methods | Transaction security |

| Risk Controls | Platform level safeguards | Stable account handling |

Frequently Asked Questions

How does XM Group protect client funds?

XM Group keeps client money in segregated accounts that remain separate from company operational funds. This structure ensures funds cannot be used for business expenses, while providing an added layer of protection in the unlikely event of financial difficulties affecting the broker.

Can traders lose more than their deposit with XM Group?

XM Group applies negative balance protection across its trading accounts, ensuring traders cannot lose more than their deposited capital. Even during extreme volatility or market gaps, account balances reset to zero, therefore preventing debt accumulation beyond the initial investment.

Market Take

XM Group delivers strong client protection through practical and clearly enforced safeguards. With segregated funds, negative balance protection, encrypted data handling, and secure payment systems, the broker provides a reliable safety framework that supports confident trading across varying market conditions.

Important Notes:

- Leverage depends on the instrument and the applicable XM Group entity.

- Products, Services, and Features vary by entity.

- Availability of instruments, promotions, and account types depends on the XM Group entity with which the account is opened.

★★★★★ | Minimum Deposit: $5 Regulated by: FSC Crypto: Yes (not available under CySEC (EU) or DFSA (MENA). |

* Cryptocurrency CFDs are available only under selected XM Group entities and are not offered to clients in the EU or MENA jurisdictions.

Markets available for Trade

XM Group is a trustworthy broker that offers over 1,400 financial instruments across Forex, CFDs, commodities, cryptocurrencies, indices, and thematic markets. With competitive spreads, high leverage, and flexible lot sizes, XM Group enables traders to build diversified portfolios and access global opportunities from a single account.

| Asset Class | Instruments | Highlights | Platform Availability |

| Forex | 55+ currency pairs | Spreads from 0.8 pips | MT4 MT5 |

| Stock CFDs | 1,200+ global stocks | Trade price movements without owning shares | MT4 MT5 |

| Equity Indices | US EU Asia | Cash and futures contracts, multiple expiry options | MT4 MT5 |

| Commodities | Precious metals energies agricultural | Flexible lot sizes, competitive spreads | MT4 MT5 |

| Cryptocurrencies | 60+ coins including BTC, ETH, XRP | 24/7 trading, no wallet required | Selected entities MT5 |

| Turbo Stocks | Top brands | Leverage for intraday volatility | MT5 Standard Accounts |

| Thematic Indices | Tech, healthcare, blockchain | Track sector performance | MT5 Standard and Ultra Low Accounts |

Note: Cryptocurrency CFDs are only available under selected XM Group entities and are not offered to clients under CySEC (EU) or DFSA (MENA). Availability of cryptocurrencies, thematic indices, and Turbo Stocks varies by XM Group entity; they are not available for all clients globally.

Frequently Asked Questions

Which Forex pairs are available at XM Group?

XM Group offers over 55 currency pairs, including majors, minors, and exotics. Spreads start from 0.8 pips, leverage goes up to 1000:1 depending on region, and the market operates 24/5. These conditions allow traders to react quickly to news events and price movements efficiently.

Can I trade cryptocurrencies or thematic indices at XM Group?

Yes, cryptocurrency CFDs and thematic indices are available under selected XM Group entities. Traders can access over 60 crypto pairs and indices tracking technology, healthcare, and blockchain sectors. These instruments allow speculation on price movements without owning the underlying assets, although availability depends on regulatory jurisdiction.

Final Assessment

XM Group provides a wide range of trading instruments suitable for all levels. From Forex and stock CFDs to commodities, crypto, Turbo Stocks, and thematic indices, traders gain access to global markets with competitive spreads, flexible leverage, and reliable execution, making XM Group a versatile choice for diversified strategies.

* Turbo Stocks Available under selected entities

**Cryptocurrency CFDs are only available under selected XM Group entities and are not offered to clients under CySEC (EU) or DFSA (MENA).

Important Notes:

- Leverage depends on the instrument and the applicable XM Group entity.

- Products, Services, and Features vary by entity.

- Availability of instruments, promotions, and account types depends on the XM Group entity with which the account is opened.

★★★★★ | Minimum Deposit: $5 Regulated by: FSC Crypto: Yes (not available under CySEC (EU) or DFSA (MENA). |

* Cryptocurrency CFDs are available only under selected XM Group entities and are not offered to clients in the EU or MENA jurisdictions.

Trading Platforms and Tools

XM Group is a trustworthy broker that provides powerful and flexible trading platforms through MetaTrader 4, MetaTrader 5, and its award-winning mobile app. These platforms support fast execution, automation, and cross-device access, therefore allowing traders to manage positions efficiently across multiple markets.

| Platform | Devices Supported | Key Features |

| MT4 | PC Mac Mobile Web | Expert Advisors, low spreads |

| MT4 Multiterminal | PC | Multi-account management |

| MT5 | PC Mac Mobile Web | Multi-asset trading, automation |

| XM App | iOS Android | TradingView charts, payments |

| WebTrader | Browser based | No download required |

Frequently Asked Questions

What trading platforms does XM Group offer?

XM Group offers MetaTrader 4, MetaTrader 5, and its proprietary XM Group App. Traders can access these platforms on PC, Mac, mobile devices, and web browsers, allowing seamless transitions between devices while maintaining consistent trading conditions and account access.

Can traders use automated strategies on XM Group platforms?

XM Group fully supports automated trading through Expert Advisors on both MT4 and MT5. Traders can also access MQL4 and MQL5 help guides, making it easier to develop, test, and deploy automated strategies while relying on stable data backup and secure execution.

Bottom Line

XM Group delivers a complete trading platform suite that supports manual, automated, and mobile trading styles. With MT4, MT5, and a feature-rich mobile app, traders gain flexibility, speed, and control, making XM Group well-suited for both active traders and long-term participants.

Important Notes:

- Leverage depends on the instrument and the applicable XM Group entity.

- Products, Services, and Features vary by entity.

- Availability of instruments, promotions, and account types depends on the XM Group entity with which the account is opened.

★★★★★ | Minimum Deposit: $5 Regulated by: FSC Crypto: Yes (not available under CySEC (EU) or DFSA (MENA). |

* Cryptocurrency CFDs are available only under selected XM Group entities and are not offered to clients in the EU or MENA jurisdictions.

Copy Trading

XM Group is a trustworthy broker that offers copy trading, allowing clients to automatically follow strategies from experienced Strategy Managers. This feature provides portfolio diversification, learning opportunities for beginners, and time-saving solutions for active traders, therefore enabling access to professional trading strategies without managing every trade manually.

| Feature | Description | Benefit | Eligibility |

| Strategy Copying | Follow trades from Strategy Managers | Access professional strategies | Eligible clients |

| Multiple Strategies | Diversify across managers | Reduce risk | All participants |

| Beginner Learning | Observe professional trades | Skill development | New traders |

| Manager Fees | Performance-based earnings | Incentivizes managers | Strategy Managers |

| Automated Execution | Trades copied in real time | Time-saving | Eligible clients |

Note: Copy Trading is available to clients of selected XM Group entities and is subject to regional regulations.

Frequently Asked Questions

Who can use XM Group’s copy trading service?

Copy trading is available to clients in eligible regions who wish to replicate trades from experienced Strategy Managers. It suits beginners seeking guidance, as well as active traders who want to diversify or automate positions, therefore providing flexibility in managing multiple strategies without constant oversight.

Can Strategy Managers earn from XM Group copy trading?

Yes, Strategy Managers can earn fees based on the success of their strategies. These earnings provide incentives for professional traders to share their methods, while followers gain access to potentially profitable trades, therefore creating a mutually beneficial system for both experienced and novice participants.

Pros and Pitfalls

XM Group’s copy trading platform offers a practical way to follow proven strategies, learn from professionals, and diversify trading activity. With flexible participation and performance-based fees for Strategy Managers, the feature enhances trading efficiency while allowing both beginners and experienced traders to benefit from shared expertise.

Important Notes:

- Leverage depends on the instrument and the applicable XM Group entity.

- Products, Services, and Features vary by entity.

- Availability of instruments, promotions, and account types depends on the XM Group entity with which the account is opened.

★★★★★ | Minimum Deposit: $5 Regulated by: FSC Crypto: Yes (not available under CySEC (EU) or DFSA (MENA). |

* Cryptocurrency CFDs are available only under selected XM Group entities and are not offered to clients in the EU or MENA jurisdictions.

Trading Conditions

XM Group is a trustworthy broker that delivers fast execution, stable leverage, and competitive spreads. With built-in risk management and swap-free accounts. Leverage depends on the financial instrument and the respective XM Group entity. Clients under CySEC (EU) and DFSA (MENA) are restricted to a maximum of 30:1. XM Group provides traders with a cost-effective and reliable environment, therefore supporting both conservative strategies and high-exposure trading across global markets.

| Feature | Details | Benefit | Account Type |

| Execution | Fast with zero requotes | Trade confidently | All accounts |

| Leverage | Up to 1000:1 | Flexible risk management | All accounts (varies by entity) |

| Spreads | From 0.8 pips | Lower trading costs | Ultra Low accounts |

| Swap-Free | No overnight interest | Sharia-compliant or cost-sensitive trading | Ultra Low Standard & Micro |

| Risk Protection | Negative balance protection | Prevent losses exceeding deposit | All accounts |

| Minimum Deposit | $5 | Accessible for all traders | Micro, Standard, Ultra Low |

| Stable Leverage | Maintained during high volatility | Reliable trading even at news events | All eligible accounts |

Frequently Asked Questions

What leverage options are available at XM Group?

Leverage depends on the financial instrument and the respective XM Group entity. Clients under CySEC (EU) and DFSA (MENA) are restricted to a maximum of 30:1. Leverage remains stable even during high-impact news events, unlike some brokers. This allows traders to implement flexible strategies, manage risk effectively, and maintain exposure as intended across Forex, CFDs, and other instruments.

Does XM Group offer swap-free accounts?

Yes, XM Group’s Ultra Low Standard and Ultra Low Micro accounts provide swap-free trading for major instruments. These accounts maintain competitive spreads from 0.8 pips. Negative balance protection is included, therefore catering to traders who cannot or prefer not to incur overnight interest charges.

Expert Insight

XM Group delivers high-quality trading conditions with consistent leverage, fast execution, and competitive spreads. Swap-free accounts and built-in risk management enhance flexibility, making it suitable for both new and experienced traders. Its execution reliability and cost-effective structure support confident trading across all market environments.

- No overnight interest (swap) on positions – T&Cs apply

- Leverage Disclaimer: Leverage depends on the financial instrument traded, the account’s equity, and the respective XM Group entity with which the business relationship is established.

- Note: The leverage you select – up to 1000:1 depending on the entity and account chosen – remains consistent and available to trade at all times*, even during highly volatile markets. *Not applicable to India.

- Leverage depends on the financial instrument and the respective XM Group entity.

- Clients under CySEC (EU) and DFSA (MENA) are restricted to a maximum of 30:1.

★★★★★ | Minimum Deposit: $5 Regulated by: FSC Crypto: Yes (not available under CySEC (EU) or DFSA (MENA). |

* Cryptocurrency CFDs are available only under selected XM Group entities and are not offered to clients in the EU or MENA jurisdictions.

Bonus Offers and Promotions

XM Group is a trustworthy broker that enhances trading opportunities through a variety of deposit and no-deposit bonuses. Its offers provide extra capital, risk mitigation, and flexible trading conditions, therefore allowing new and existing clients to maximize market exposure while maintaining transparent and fair terms.

| Bonus Type | Key Benefit | Withdrawable Profits | Availability |

| No Deposit Bonus | Trade without funding | Yes | Selected regions |

| Welcome Deposit Bonus | Extra trading capital | Yes | New clients |

| Deposit Bonus Up to 100% | Increase position size | Yes | Funded accounts |

| Seasonal Promotions | Event-specific rewards | Yes | Eligible regions |

| Seminar & Event Rewards | Educational and trading incentives | Yes | Event attendees |

Note: Deposit and No Deposit Bonuses are not available to clients under XM Group’s EU-based (CySEC) or MENA (DFSA) entities.

Frequently Asked Questions

What is the XM Group Deposit Bonus?

The Deposit Bonus offers up to 100% of a client’s deposited funds in eligible regions. It increases trading capital, allows larger positions, and fully credits profits to equity. Bonuses are applied instantly and governed by clear, fair, and transparent terms without excessive volume requirements.

What is the No Deposit Bonus (NDB)?

The No Deposit Bonus allows new clients to trade without depositing their own funds. It provides real market exposure, fully withdrawable profits, and requires only account verification. This bonus is risk-free, beginner-friendly, and ideal for testing XM Group’s execution, spreads, and reliability before funding an account.

Key Takeaways

XM Group’s bonus programs provide tangible value for traders seeking extra leverage and risk management. From deposit boosts to risk-free No Deposit Bonuses and seasonal promotions, the broker offers flexible incentives that enhance trading capacity while maintaining clear, transparent, and fair terms for all eligible clients.

Important Notes:

- Leverage depends on the instrument and the applicable XM Group entity.

- Products, Services, and Features vary by entity.

- Availability of instruments, promotions, and account types depends on the XM Group entity with which the account is opened.

★★★★★ | Minimum Deposit: $5 Regulated by: FSC Crypto: Yes (not available under CySEC (EU) or DFSA (MENA). |

* Cryptocurrency CFDs are available only under selected XM Group entities and are not offered to clients in the EU or MENA jurisdictions.

Refer a Friend Program

XM Group is a trustworthy broker that rewards clients for introducing new traders through its Refer a Friend program. With unlimited earning potential and straightforward tracking, the program incentivizes referrals while providing fast, withdrawable rewards, therefore allowing clients to benefit directly from expanding XM Group’s trading community.

| Feature | Description | Benefit | Availability |

| Referral Link | Unique for each client | Simple sharing | All clients |

| Tracking Dashboard | Monitor referrals | Easy tracking | All clients |

| Cash Rewards | Paid per successful referral | Withdrawable earnings | Eligible accounts |

| Unlimited Referrals | No cap on friends | Unlimited earnings | All clients |

| Fast Payouts | Quick processing | Immediate access to funds | All clients |

Frequently Asked Questions

How does the XM Group Refer a Friend program work?

Clients invite friends using a unique referral link via email, text, or social media. Once a referred friend registers and starts trading, the referrer earns a cash reward. There is no limit to the number of friends that can be referred, allowing unlimited earning potential.

Are rewards from XM Group’s referral program withdrawable?

Yes, all cash rewards earned from successful referrals are withdrawable. Traders can track referrals and pending rewards directly from their dashboard and request payouts quickly, providing a simple and efficient way to earn extra income while helping friends access XM Group’s trading environment.

Reality Check

XM Group’s Refer a Friend program offers a simple, reliable way to earn additional income while expanding the trading network. With unlimited referrals, fast payouts, and easy tracking, the program complements XM Group’s trading services and provides tangible benefits for both referrers and new clients.

Important Notes:

- Leverage depends on the instrument and the applicable XM Group entity.

- Products, Services, and Features vary by entity.

- Availability of instruments, promotions, and account types depends on the XM Group entity with which the account is opened.

★★★★★ | Minimum Deposit: $5 Regulated by: FSC Crypto: Yes (not available under CySEC (EU) or DFSA (MENA). |

* Cryptocurrency CFDs are available only under selected XM Group entities and are not offered to clients in the EU or MENA jurisdictions.

XM Group Traders Club – Loyalty Rewards Program

XM Group is a trustworthy broker that rewards trading activity through its XM Group Traders Club. Members earn XMC Coins for every eligible trade, progress through Bronze to Elite status, and access exclusive benefits, therefore incentivizing loyalty and providing additional value for active traders across all account types.*

*XM Traders Club benefits depend on account type and trading volume.

| Membership Tier | Requirement | Reward | Key Benefits |

| Bronze | Entry level | XMC Coins | Base rewards |

| Silver | Moderate volume | XMC Coins | Increased earnings |

| Gold | Higher volume | XMC Coins | Enhanced benefits |

| Platinum | High volume | XMC Coins | Priority services, premium VPS |

| Elite | Top volume | XMC Coins | Maximum rewards, exclusive promotions |

Frequently Asked Questions

How does the XM Group Traders Club work?

Traders earn XMC Coins for every eligible position closed. Membership progresses through Bronze, Silver, Gold, Platinum, and Elite tiers based on trading volume. Higher tiers provide access to premium services, increased coin accrual, and exclusive promotions, therefore encouraging ongoing engagement with XM Group’s trading environment.

What rewards are available through the XM Group Traders Club?

XMC Coins can be redeemed for cash rewards or bonus credits. Members also gain access to exclusive promotions, advanced market analysis, premium VPS services, and tailored incentives for high-volume trading, therefore adding tangible benefits for active traders who meet the program’s quarterly volume requirements.

What You Need to Know

XM Group’s Traders Club is a compelling loyalty program that incentivizes consistent trading. With tiered membership, coin rewards, redeemable bonuses, and exclusive benefits, the program enhances trading engagement and provides measurable value, especially for high-volume traders seeking both recognition and additional rewards.

*Terms and trading volume requirements apply.

Important Notes:

- Leverage depends on the instrument and the applicable XM Group entity.

- Products, Services, and Features vary by entity.

- Availability of instruments, promotions, and account types depends on the XM Group entity with which the account is opened.

★★★★★ | Minimum Deposit: $5 Regulated by: FSC Crypto: Yes (not available under CySEC (EU) or DFSA (MENA). |

* Cryptocurrency CFDs are available only under selected XM Group entities and are not offered to clients in the EU or MENA jurisdictions.

Trading Competitions

XM Group is a trustworthy broker that offers frequent trading competitions to engage traders and reward skill. With real cash prizes, live leaderboards, and risk-free demo contests, these competitions provide motivation and learning opportunities, therefore allowing participants to refine strategies while competing in a structured environment.

| Feature | Description | Benefit | Eligibility |

| Cash Prizes | Withdrawable rewards | Real incentives | Selected regions |

| Low Entry Fees | Many competitions free or low-cost | Accessible to most traders | All clients |

| Live Leaderboards | Track rankings in real time | Competitive environment | All participants |

| Demo Competitions | Practice without risk | Strategy testing | All clients |

| Skill-Based Contests | Based on trading performance | Motivation and learning | Eligible accounts |

Frequently Asked Questions

Who can participate in XM Group trading competitions?

XM Group competitions are open to clients from eligible regions, with low or no entry fees for many events. Traders can compete using demo or live accounts, depending on the contest type, and gain exposure to competitive trading while testing strategies in real or simulated market conditions.

Are the rewards from XM Group competitions withdrawable?

Yes, cash prizes from eligible XM Group competitions are withdrawable once the competition concludes. Demo competitions provide risk-free strategy practice, while live competitions offer tangible monetary rewards, therefore giving participants both a safe learning environment and real incentives for strong trading performance.

Objective Overview

XM Group trading competitions provide both educational and financial incentives. With accessible entry, live rankings, and withdrawable prizes, they motivate traders to improve their skills. Competitions support strategy testing and reward performance, making them a valuable feature for both novice and experienced traders.

Disclaimer: Promotions and bonuses are not available for accounts registered under XM Group’s EU-based entity (CySEC) and Mena entities (DFSA). The XM Group operates globally under various entities, so the products, services, and features listed here vary between XM Group entities. For further information, please visit the XM Group website.

Important Notes:

- Leverage depends on the instrument and the applicable XM Group entity.

- Products, Services, and Features vary by entity.

- Availability of instruments, promotions, and account types depends on the XM Group entity with which the account is opened.

★★★★★ | Minimum Deposit: $5 Regulated by: FSC Crypto: Yes (not available under CySEC (EU) or DFSA (MENA). |

* Cryptocurrency CFDs are available only under selected XM Group entities and are not offered to clients in the EU or MENA jurisdictions.

Trading Tools and Features

XM Group is a trustworthy broker that provides a comprehensive suite of trading tools and features for all devices. From TradingView charts and AI analysis to notifications, watchlists, and market insights, these integrated tools enhance decision-making, flexibility, and control, therefore creating a fully equipped trading environment.

| Tool/Feature | Function | Benefit | Devices |

| TradingView Charts | Advanced charting | Precision analysis | Desktop Mobile |

| XM AI | Market analysis Q&A | Quick insights | Desktop Mobile |

| Notification Centre | Real-time alerts | Stay informed | All devices |

| Watchlists | Track instruments | Fast decision-making | All devices |

| Explore Page Market Insights | News trends | Discover opportunities | Desktop Mobile |

| Account Management | Trading funding support | Full control | All devices |

| XM Mobile App | All-in-one access | Flexibility on the go | iOS Android |

Note: Some of the services/features are not available under all XM Group entities and do not constitute investment advice.

Frequently Asked Questions

What trading tools does XM Group provide?

XM Group offers TradingView charts, XM Group AI analysis, notifications, watchlists, market insights, and full account management across devices. Traders can customise charts, track instruments, receive alerts, and analyse markets efficiently, therefore supporting informed trading decisions and seamless account control from desktop or mobile.

Is XM Group’s mobile app fully functional?

Yes, XM Group’s award-winning mobile app for iOS and Android provides access to all tools, features, and account management available on desktop. Traders can chart, analyse, fund accounts, contact support, and execute trades, therefore maintaining full control and flexibility while trading on the go.

Hands-On Review

XM Group equips traders with a powerful, integrated suite of tools that streamlines analysis, monitoring, and trading. With interactive charts, AI insights, real-time notifications, and full cross-device functionality, these features enhance decision-making, provide flexibility, and allow traders to manage accounts efficiently from any platform.

Important Notes:

- Leverage depends on the instrument and the applicable XM Group entity.

- Products, Services, and Features vary by entity.

- Availability of instruments, promotions, and account types depends on the XM Group entity with which the account is opened.

★★★★★ | Minimum Deposit: $5 Regulated by: FSC Crypto: Yes (not available under CySEC (EU) or DFSA (MENA). |

* Cryptocurrency CFDs are available only under selected XM Group entities and are not offered to clients in the EU or MENA jurisdictions.

Deposits and Withdrawals

XM Group is a trustworthy broker that provides fast, secure, and mostly fee-free deposits and withdrawals. With globally recognised payment methods, instant deposits, and 24/7 withdrawal processing, clients can manage funds efficiently, therefore enabling seamless trading execution and timely access to capital across all supported regions.

| Feature | Description | Benefit | Availability |

| Credit/Debit Cards | Visa MasterCard | Instant deposits | Global |

| Bank Wire Transfers | Secure transfers | Reliable funding | Global |

| E-Wallets | Neteller Skrill SticPay | Fast processing | Selected regions |

| Local Payment Gateways | Region-specific banks mobile money | Convenience | Asia Africa LATAM |

| Withdrawal Processing | 24/7, mostly automatic | Quick access to funds | Global |

| No Fees | XM covers most transfer costs | Cost-effective | All clients |

| Dashboard | Monitor deposits and withdrawals | Full transparency | All clients |

Note: XM Group processes deposits and withdrawals efficiently; most methods are fee-free, but third-party or bank fees may apply, particularly for wire transfers under $200.

Frequently Asked Questions

What payment methods does XM Group support?

XM Group supports credit and debit cards such as Visa and MasterCard, bank wire transfers, e-wallets including Neteller, Skrill, and SticPay, and region-specific local payment gateways. These options allow traders from Asia, Africa, Latin America, and other regions to deposit and withdraw funds efficiently and securely.

Are there fees for deposits and withdrawals at XM Group?

XM Group does not charge fees for deposits or withdrawals. Most transfer costs are covered by the broker, ensuring full credit to trading accounts. Clients should note that small fees may still apply from banks or third-party providers, particularly for wire transfers under $200, depending on the provider.

Market Verdict

XM Group offers a reliable and efficient funding system. Instant deposits, 24/7 withdrawals, and broad global payment options make it easy to access funds when needed. Fee-free transactions for most methods and a centralised dashboard ensure full transparency and control over all account movements.

Important Notes:

- Leverage depends on the instrument and the applicable XM Group entity.

- Products, Services, and Features vary by entity.

- Availability of instruments, promotions, and account types depends on the XM Group entity with which the account is opened.

★★★★★ | Minimum Deposit: $5 Regulated by: FSC Crypto: Yes (not available under CySEC (EU) or DFSA (MENA). |

* Cryptocurrency CFDs are available only under selected XM Group entities and are not offered to clients in the EU or MENA jurisdictions.

Leverage, Spreads, and Swap-Free Accounts

XM Group is a trustworthy broker that combines flexible leverage, competitive spreads, and swap-free account options. With up to 1000:1 leverage, spreads from 0.8 pips, and negative balance protection, XM Group enables traders to manage costs, control risk, and trade efficiently across major instruments without paying overnight interest.

| Feature | Details | Benefit | Account Type |

| Leverage | Up to 1000:1 | Flexible risk management | All eligible accounts |

| Spreads | From 0.8 pips | Low trading costs | Ultra Low accounts |

| Swap-Free | No overnight interest | Cost-efficient and Sharia-compliant | Ultra Low Standard & Micro |

| Negative Balance Protection | Positions cannot exceed deposit | Safety against losses | All accounts |

| Minimum Deposit | $5 | Accessible for all traders | Micro, Standard, Ultra Low |

*T&Cs Apply – Spreads are variable depending on market conditions.

Frequently Asked Questions

What leverage options does XM Group provide?

Leverage depends on the financial instrument and the respective XM Group entity. Clients under CySEC (EU) and DFSA (MENA) are restricted to a maximum of 30:1. This flexibility allows traders to implement diverse strategies, manage risk according to their preference, and maintain high exposure when needed, making XM Group suitable for both conservative and aggressive trading styles.

Does XM Group offer swap-free trading?

Yes, XM Group provides swap-free trading through Ultra Low Standard and Micro accounts. These accounts offer spreads from 0.8 pips and negative balance protection. Spreads are variable depending on market conditions.

Expert Insight

XM Group provides traders with flexible leverage, competitive spreads, and swap-free account options, making trading efficient and cost-effective. Negative balance protection and low minimum deposits further enhance accessibility. This combination ensures XM Group accommodates both conservative traders and those seeking higher-risk, higher-reward strategies.

Important Notes:

- Leverage depends on the instrument and the applicable XM Group entity.

- Products, Services, and Features vary by entity.

- Availability of instruments, promotions, and account types depends on the XM Group entity with which the account is opened.

★★★★★ | Minimum Deposit: $5 Regulated by: FSC Crypto: Yes (not available under CySEC (EU) or DFSA (MENA). |

* Cryptocurrency CFDs are available only under selected XM Group entities and are not offered to clients in the EU or MENA jurisdictions.

Education and Research

XM Group is a trustworthy broker that provides a comprehensive suite of educational and research tools. From live webinars and Tradepedia video tutorials to economic calendars, market sentiment analysis, and podcasts, XM Group equips traders at all levels with the knowledge and insights needed to trade confidently and make informed decisions.

| Resource | Format | Highlights | Accessibility |

| XM Community | Interactive network | Connect, share, follow experts | Desktop, mobile |

| Live Education | Live sessions | Q&A, multi-language support | Desktop, mobile |

| Tradepedia | On-demand video tutorials | Beginner to advanced | 24/7 access |

| Webinars | Live online events | Weekly topics in 20+ languages | Desktop, mobile |

| Economic Calendar | Interactive tool | News alerts, forecasts, impacted instruments | Desktop, mobile |

| Market Sentiment Tools | Analytical dashboard | Shows trader positioning | Desktop, mobile |

| Research Reports | Daily, weekly updates | Technical analysis, trade setups, macro insights | Registered clients |

| Podcasts | Audio series | Market recaps, strategies, psychology | Account login platforms |

Frequently Asked Questions

What educational resources does XM Group offer?

XM Group offers a broad range of resources, including live webinars in multiple languages, Tradepedia on-demand videos, podcasts, and technical research. Traders can access step-by-step tutorials, advanced strategy breakdowns, platform walkthroughs, and market insights to improve skills and make more informed trading decisions across Forex, CFDs, commodities, and indices.

How can I engage with other traders and experts at XM Group?

Traders can join the XM Group Community, an interactive network for sharing ideas, following experts, and attending live educational sessions. Personalized feeds highlight relevant discussions, live streams, and notifications for upcoming lessons, allowing clients to learn from professional traders and collaborate with peers seamlessly on desktop or mobile devices.

Our Assessment

XM Group provides an extensive, multilingual education and research ecosystem designed for traders of all levels. From live sessions, podcasts, and videos to technical and fundamental insights, the broker ensures clients have the tools, knowledge, and community support to improve their trading skills and act with confidence in global markets.

Important Notes:

- Leverage depends on the instrument and the applicable XM Group entity.

- Products, Services, and Features vary by entity.

- Availability of instruments, promotions, and account types depends on the XM Group entity with which the account is opened.

★★★★★ | Minimum Deposit: $5 Regulated by: FSC Crypto: Yes (not available under CySEC (EU) or DFSA (MENA). |

* Cryptocurrency CFDs are available only under selected XM Group entities and are not offered to clients in the EU or MENA jurisdictions.

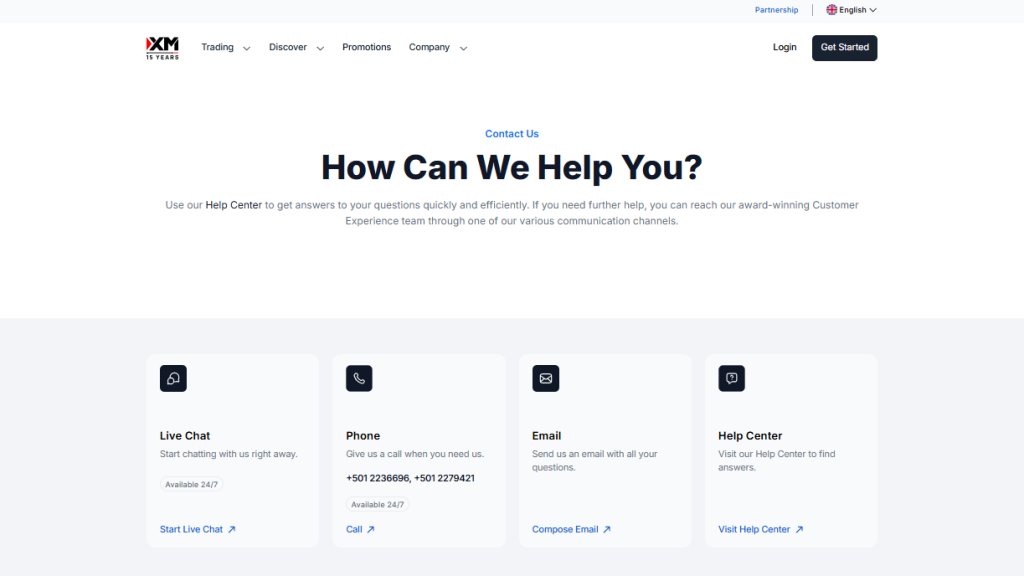

Customer Support

XM Group provides reliable, award-winning customer support with multilingual teams available 24/7. Traders benefit from live chat, email, phone, and a comprehensive help center. Dedicated Client Relations Managers ensure personalised guidance, making XM Group a broker that prioritises fast problem resolution, clear communication, and global accessibility.

| Feature | Details | Benefit | Availability |

| Live Chat | Website and app | Instant support | 24/7 |

| Email Support | Ticketing system | Trackable resolutions | 24/7 |

| Phone Support | Selected regions | Personal assistance | Hours vary by region |

| Help Center & FAQ | Self-service | Quick answers to common queries | 24/7 |

| Dedicated Client Relations Manager | Personalized guidance | Tailored support and account assistance | Assigned to each client |

| Multilingual Support | 30+ languages | Clear communication for global clients | 24/7 |

| In-App Support | Chat and tickets | Access without platform switching | 24/7 |

Frequently Asked Questions

What support channels does XM Group provide?

XM Group offers multiple customer support channels, including live chat, email ticketing, phone support in select regions, and a self-service help center with FAQs. The broker also integrates support directly into its mobile app, ensuring clients can access real-time assistance seamlessly while trading across devices.

Does XM Group provide multilingual support?

Yes, XM Group’s support team operates in over 30 languages, including English, Spanish, Portuguese, Arabic, Thai, Malay, Hindi, Vietnamese, Russian, and Chinese. This ensures that traders from non-English-speaking regions can communicate clearly, receive guidance in their native language, and access educational and account assistance efficiently.

Bottom Line

XM Group’s customer support is responsive, multilingual, and globally accessible. With 24/7 availability, dedicated client managers, and integrated app support, traders can resolve issues quickly and confidently. High ratings on review platforms and multiple industry awards highlight XM Group’s commitment to client satisfaction and effective problem-solving.

Important Notes:

- Leverage depends on the instrument and the applicable XM Group entity.

- Products, Services, and Features vary by entity.

- Availability of instruments, promotions, and account types depends on the XM Group entity with which the account is opened.

★★★★★ | Minimum Deposit: $5 Regulated by: FSC Crypto: Yes (not available under CySEC (EU) or DFSA (MENA). |

* Cryptocurrency CFDs are available only under selected XM Group entities and are not offered to clients in the EU or MENA jurisdictions.

Insights from Real Traders

⭐⭐⭐⭐

I’ve been trading with XM Group for over a year, and their platform has been nothing short of reliable. The spreads are tight, executions are fast, and I love the negative balance protection. Their customer service is incredibly responsive – available 24/7 whenever I have questions. Highly recommended!

Daniel

⭐⭐⭐⭐⭐

As someone new to trading, I found XM Group’s educational resources incredibly helpful. The live webinars and market analysis gave me the confidence to start making real trades. The 5 USD minimum deposit also made it easy to begin without pressure. Great platform for beginners!

Michael

⭐⭐⭐

XM Group’s Ultra Low Account is a game-changer for serious traders. With ultra-tight spreads, I’ve managed to reduce my trading costs significantly. Their VPS service and zero fees make the experience even more seamless. I wouldn’t trade anywhere else.

Thabo

★★★★★ | Minimum Deposit: $5 Regulated by: FSC Crypto: Yes (not available under CySEC (EU) or DFSA (MENA). |

Customer Reviews and Trust Scores

XM Group earns praise for its transparency, fast execution, and educational resources, though some traders raise concerns about withdrawal delays and pricing.

| Source | Rating | Summary |

| ForexBrokers.com | 88/99 | Strong ratings for research, platforms, education, and mobile trading |

| Trustpilot | Trustpilot 3.3/5 | Good service and conditions. |

| Google Play | Google Play 4.55/5 | Praised for strong user satisfaction. |

★★★★★ | Minimum Deposit: $5 Regulated by: FSC Crypto: Yes (not available under CySEC (EU) or DFSA (MENA). |

Pros and Cons

| ✓ Pros | ✕ Cons |

| XM has an extremely low 5 USD minimum deposit | XM charges currency conversion fees |

| There are several bonuses offered | There are strict bonus terms and conditions |

| Traders can access fee-free deposit methods | There are limited payment methods for deposits |

You might also like:

In Conclusion

With over 15 million clients and more than 15 years of industry experience, XM Group is a well-established global broker known for fast execution, strong regulation, and broad market access. It offers a solid balance of trust, flexibility, and user-friendly trading conditions for traders at all levels.

New traders benefit from bonuses, free education, demo accounts, and 24/7 support, while experienced traders enjoy fast execution, multi-asset trading, real-time data, and advanced tools. Investors can also trade real company shares via MT5 with transparent pricing.

Overall, XM Group stands out as a reliable and well-rounded broker, offering a trusted reputation, stable leverage, and a wide range of features for both beginners and experienced traders.

Faq

XM Group has over 15 years of experience in the financial markets, serving more than 15 million clients across 190+ countries.

XM Group offers Micro, Standard, Ultra-Low Micro, Ultra-Low Standard, and Shares Accounts, each tailored for different trading goals, risk levels, and cost preferences.

The minimum deposit is $5 for Micro, Standard, Ultra-Low Micro, and Ultra-Low Standard accounts. Shares Accounts require a higher deposit depending on the equities selected.

Traders can use MetaTrader 4 (MT4), MetaTrader 5 (MT5), and XM Group’s mobile app, accessible on PC, Mac, mobile, and web browsers.

Yes, XM Group offers leverage up to 1000:1 (depending on the instrument and entity) and swap-free trading on Ultra-Low Standard and Micro accounts.

- Trading with XM Group - Immediate Advantages and Disadvantages

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open an XM Group Account

- Safety and Security

- Client Protection Policies

- Markets available for Trade

- Trading Platforms and Tools

- Copy Trading

- Trading Conditions

- Bonus Offers and Promotions

- Refer a Friend Program

- XM Group Traders Club - Loyalty Rewards Program

- Trading Competitions

- Trading Tools and Features

- Deposits and Withdrawals

- Leverage, Spreads, and Swap-Free Accounts

- Education and Research

- Customer Support

- Insights from Real Traders

- Customer Reviews and Trust Scores

- Pros and Cons

- In Conclusion