10 Best Forex Demo Accounts

We have listed the 10 Best Forex Demo Accounts for traders who want to practice and refine their trading skills without risking real money. These demo accounts offer realistic market conditions, user-friendly platforms, and access to live price data, allowing beginners and experienced traders alike to build confidence and develop effective trading strategies before moving to live markets.

10 Best Forex Demo Accounts (2026)

- MultiBank Group – Overall, The Best Forex Demo Account

- Plus500 – User-friendly proprietary trading platform

- FP Markets – Competitive trading costs

- FOREX.com – Competitive pricing with a RAW Spread account

- Pepperstone – Lightning-fast trade execution

- OANDA – Feature-rich proprietary mobile app

- Tickmill – Robust, multi-regulated trading environment

- AvaTrade – Integrated social/copy trading capabilities

- ActivTrades – Strong regulation and client fund protection

- FXTM – Multiple account types

Top 10 Forex Brokers (Globally)

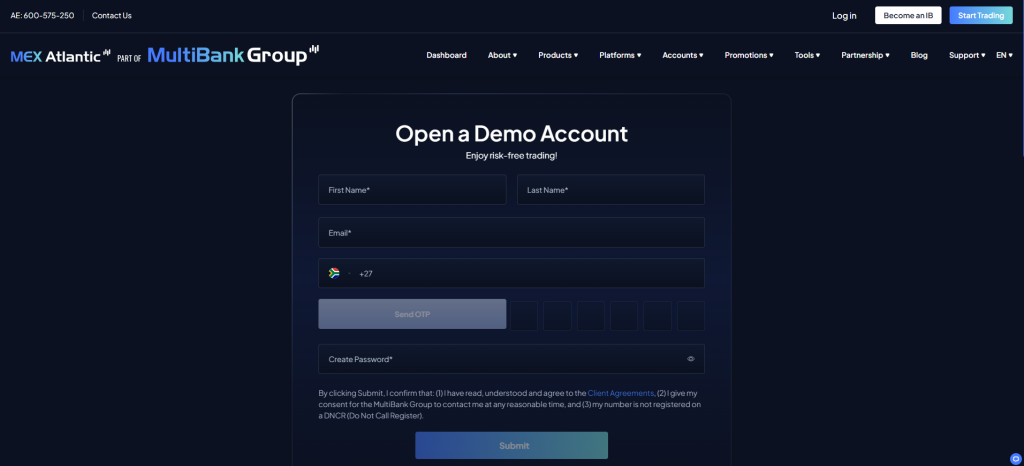

1. MultiBank Group

MultiBank Group offers a free Forex demo account that allows traders to practice trading in real market conditions without financial risk. The demo account includes virtual funds, access to MT4 and MT5 platforms, and live pricing, helping beginners develop trading skills before switching to a live account.

Frequently Asked Questions

How long can I use the MultiBank demo account?

The MultiBank Group demo account has an unlimited duration, meaning it does not expire. This allows you to practice on MT4, MT5, or their proprietary platforms for as long as you need to evaluate the trading conditions and develop your strategies.

Does the demo account include real market conditions?

Yes, the MultiBank Group demo account aims to simulate real market conditions by using live, real-time data feeds for pricing, spreads, and execution. However, it cannot replicate market depth, slippage, or the psychological pressure of trading with real money.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Authorized and well regulated broker | Limited exposure to trading psychology |

| Realistic trading environment | Virtual funds can create overconfidence |

| Access to MT4 and MT5 platforms | No real profit withdrawal |

| Free and easy setup | Platform learning curve for new users |

| Ideal for beginners and professionals | Demo conditions may slightly differ from live trading |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

MultiBank Group’s authorized demo account provides a safe, realistic, and user-friendly environment for traders to practice strategies risk-free. It’s a valuable tool for building skills and confidence before transitioning to live Forex trading.

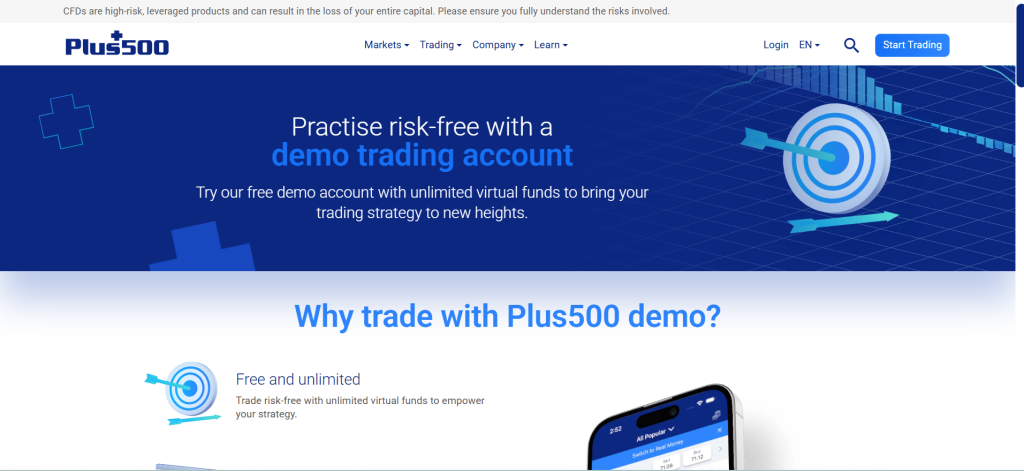

2. Plus500

Plus500 offers a free and unlimited demo account that lets traders practice Forex and CFD trading with virtual funds. The authorized broker provides real-time market conditions, an intuitive platform, and zero risk, making it ideal for beginners to learn and test strategies safely.

Frequently Asked Questions

Is Plus500 a legit trading platform?

Yes, Plus500 is a legitimate trading platform and a highly regulated global broker. It is publicly listed on the London Stock Exchange (FTSE 250) and licensed by multiple top-tier regulators worldwide, including the FCA, CySEC, and ASIC, ensuring client fund security.

How does the Plus500 demo account work?

The Plus500 demo account is free and unlimited, providing virtual funds to trade CFDs under real-time market conditions. It allows you to practice strategies and platform features risk-free, with the option to reset funds anytime.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Free and unlimited demo account | Limited educational tools |

| User-friendly trading interface | No integration with external platforms |

| Real-time market data access | Basic charting options |

| Suitable for all experience levels | Market conditions may vary slightly from live trading |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐☆☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐☆☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐☆☆☆ |

Our Insights

Plus500 is a legit broker offering a free, unlimited demo account with real-time trading conditions. It’s an excellent choice for beginners to practice strategies and gain confidence before switching to a live trading account.

3. FP Markets

FP Markets offers a free Forex demo account that allows traders to practice in real market conditions using virtual funds. The legit and regulated broker provides access to MT4, MT5, and cTrader platforms, helping users test strategies and build trading confidence without financial risk.

Frequently Asked Questions

Is FP Markets a legal Forex broker?

Yes, FP Markets is a legal and globally regulated Forex broker. It holds licenses from multiple top-tier authorities, including ASIC (Australia), CySEC (Cyprus), and the FSCA (South Africa), ensuring a robust and compliant operational framework.

Can I switch from demo to a live account easily?

Yes, the process is straightforward with FP Markets. You simply open a live trading account through their secure client area, complete the required verification/KYC documentation, and fund your account. Once funded, you can begin live trading on the same platform (MT4/MT5) you used for demo.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legal and regulated broker | No real profits from demo trading |

| Free demo account with virtual funds | Limited emotional trading experience |

| Realistic market conditions | Demo duration may expire after inactivity |

| Access to MT4, MT5, and cTrader | Market execution may differ slightly from live trading |

| Ideal for testing strategies | Requires registration to start |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms, and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐⭐ |

Our Insights

FP Markets is a legal broker offering a realistic and risk-free demo account. Traders can practice on top platforms like MT4, MT5, and cTrader, developing confidence and refining strategies before moving to live markets.

Top 3 Forex Demo Accounts – MultiBank Group vs Plus500 vs FP Markets

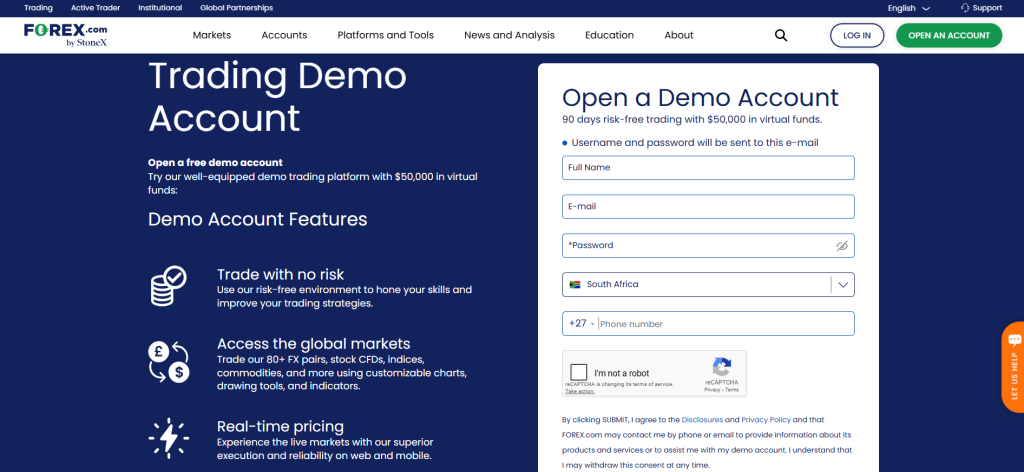

4. FOREX.com

FOREX.com offers a free demo account that lets traders practice Forex and CFD trading with virtual funds in real market conditions. The regulated and reliable broker provides access to advanced platforms, real-time data, and a safe environment to test strategies before trading live.

Frequently Asked Questions

What does the FOREX.com demo account offer?

The FOREX.com demo account offers 90 days of risk-free trading with up to $50,000 in virtual funds. It provides real-time pricing on markets like Forex, indices, and stock CFDs, plus access to professional charting tools and integrated market analysis.

How long can I use the FOREX.com demo account?

The FOREX.com demo account typically lasts for 90 days (12 weeks) after sign-up, offering risk-free practice. After it expires, you will not be able to log in. However, you can open another demo account or contact their client services team to continue practicing.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Approved and regulated global broker | Demo expires after 30 days |

| Realistic market conditions | No real profits from demo trading |

| Access to powerful trading platforms | Limited emotional trading experience |

| Free and easy to open | Requires registration to start |

| Great for beginners and experienced traders | Platform may feel complex for beginners |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

FOREX.com is an approved and trusted broker offering a realistic demo account for risk-free practice. Traders can test strategies, explore powerful tools, and gain experience before transitioning confidently to live trading.

5. Pepperstone

Pepperstone offers a free Forex demo account that allows traders to practice with virtual funds in real market conditions. The regulated and approved broker provides access to MT4, MT5, and cTrader platforms, enabling users to test strategies, analyze markets, and build confidence without financial risk.

Frequently Asked Questions

How does the Pepperstone demo account work?

The Pepperstone demo account is a risk-free simulator that uses virtual funds (up to $50,000) on platforms like MT4, MT5, or cTrader. It provides real-time pricing on Forex, indices, and shares, allowing you to practice strategies and explore the platform features. MT4/MT5 demos expire after 60 days unless you have a live, funded account.

Is the demo account free to use?

Yes, the Pepperstone demo account is completely free to use and requires no financial obligation. It offers virtual funds to practice with on platforms like MT4, MT5, or cTrader, using real-time market prices to hone your trading strategies risk-free.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Registered and regulated global broker | Demo expires after 30 days |

| Access to MT4, MT5, and cTrader | No real profits earned |

| Realistic trading environment | Limited exposure to trading psychology |

| Free and easy setup | Requires account registration |

| Excellent for testing strategies | Advanced platforms may challenge beginners |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐☆☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆☆ |

Our Insights

Pepperstone is a registered and reputable broker offering a free demo account with real market conditions. It’s perfect for traders wanting to test platforms, refine strategies, and build trading confidence before going live.

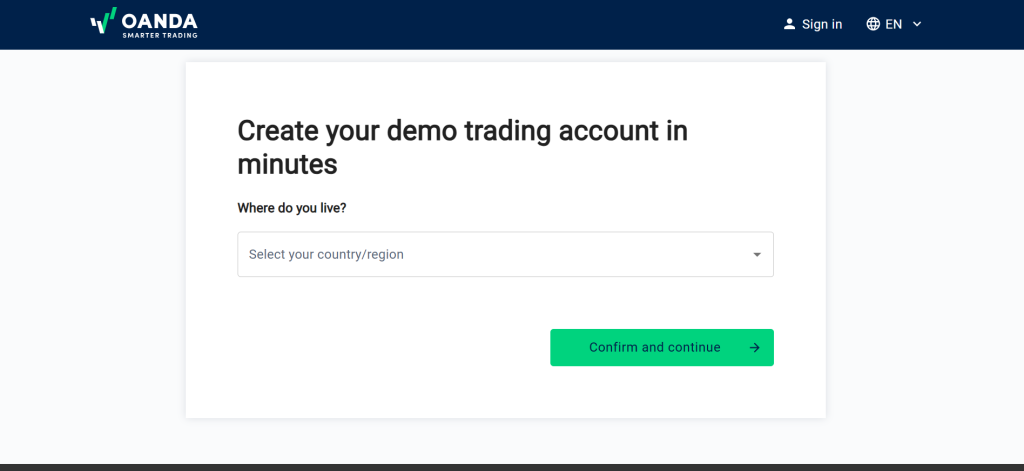

6. OANDA

OANDA offers a free Forex demo account that allows traders to practice trading with virtual funds under real market conditions. The registered and regulated broker provides access to advanced trading platforms, live pricing, and analytical tools, helping users develop and test strategies risk-free before trading live.

Frequently Asked Questions

Is OANDA an authorized Forex broker?

Yes, OANDA is a globally recognized and fully authorized Forex broker. It is overseen by numerous top-tier regulators, including the FCA (UK), CFTC/NFA (US), ASIC (Australia), and CIRO (Canada), making it one of the industry’s most trusted brokers.

What features does the OANDA demo account include?

The OANDA demo account is free and non-expiring, offering virtual funds for risk-free practice. It provides access to real-time pricing on all instruments (Forex, indices, CFDs) via the OANDA Web, Mobile App, MT4, MT5, and TradingView platforms.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Authorized and regulated global broker | No real profits from demo trading |

| Unlimited demo access | May lack emotional realism |

| Realistic market conditions | Requires registration to start |

| Access to advanced trading platforms | Platform can be complex for beginners |

| Excellent analytical and charting tools | Limited educational content |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐☆☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

OANDA is an authorized and reputable broker offering a free, unlimited demo account. It provides a realistic trading environment, advanced tools, and flexibility for traders to practice and perfect strategies without financial risk.

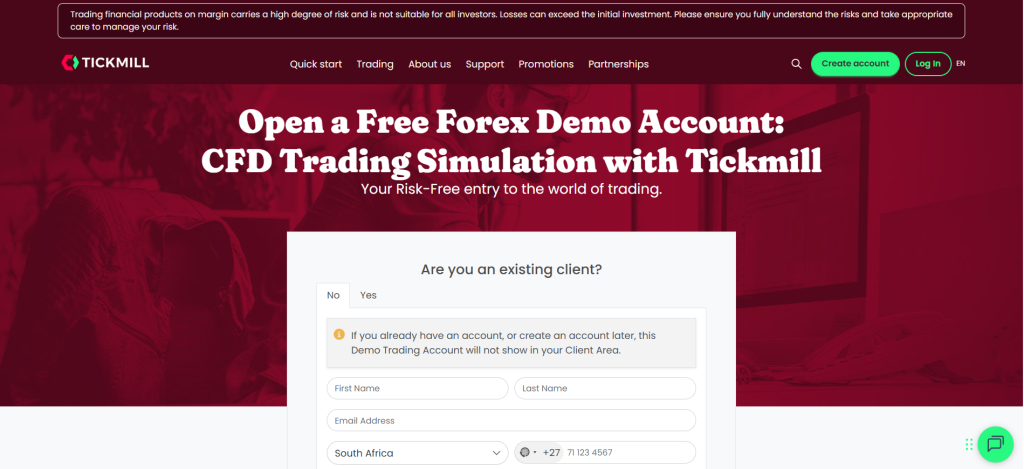

7. Tickmill

Tickmill provides a free demo account for practicing trading with virtual funds in a simulated setting. It connects to MT4 and MT5, offering real-time market data for Forex, commodities, indices, and more, all backed by a majorly regulated and authorized broker.

Frequently Asked Questions

What does the Tickmill demo account offer?

The Tickmill demo account is free and connects to MT4/MT5, offering virtual funds and real-time market data for Forex, indices, and commodities. It allows risk-free strategy practice under conditions provided by their regulated broker entities.

How long can I use the Tickmill demo account?

The duration depends on your activity. Tickmill MT4/MT5 demo accounts are archived after 60 days of inactivity. Tickmill Trader/TradingView accounts are archived after 30 days of inactivity. You can usually create a new demo account or contact support to keep it active.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legit and well regulated broker | No real profits from demo trading |

| Free demo account with virtual funds | Requires registration to start |

| Access to MT4 and MT5 platforms | Limited emotional trading experience |

| Realistic trading environment | Platform learning curve for new traders |

| Suitable for beginners and professionals | Market conditions may vary slightly from live trading |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms, and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Options | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Tickmill is a legit and trusted broker offering a free demo account with real market conditions. It’s ideal for traders to practice, refine strategies, and build confidence before moving to a live trading environment.

8. AvaTrade

AvaTrade offers a free, unlimited demo account using virtual funds under real market conditions. Backed by a multi-jurisdictionally regulated broker, it gives users access to practice on MT4, MT5, their proprietary WebTrader, and mobile app before transitioning to live trading.

Frequently Asked Questions

What does the AvaTrade demo account offer?

The AvaTrade demo account is free and unlimited, providing virtual funds to practice strategies under real market conditions. It offers access to the broker’s full range of platforms, including MT4, MT5, WebTrader, and the mobile app, for risk-free preparation.

How long can I use the AvaTrade demo account?

The standard AvaTrade demo account lasts for 21 days (or 60 days in some regions/platforms) before expiration. You can easily request an extension for unlimited use by contacting their customer service before the initial trial period ends.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Approved and regulated global broker | Demo expires after 21 days |

| Free demo account with virtual funds | No real profits earned |

| Access to MT4, MT5, and WebTrader | Limited emotional trading experience |

| Realistic trading conditions | Requires account registration |

| Ideal for beginner traders | Fewer customization options on WebTrader |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

AvaTrade is an approved and reliable broker offering a free demo account for risk-free trading practice. It helps beginners and experienced traders test strategies on MT4, MT5, and WebTrader platforms before going live.

9. ActivTrades

ActivTrades offers a free demo account for practicing strategies with virtual funds under real market conditions. Supporting platforms like MT4, MT5, and ActivTrader, the demo provides unlimited usage and closely mirrors the live market environment.

Frequently Asked Questions

Is ActivTrades a legal Forex broker?

Yes, ActivTrades is a legal and well-regulated Forex broker. It is authorized by major financial authorities, including the FCA (UK), CMVM (Portugal), and the SCB (Bahamas), ensuring strong compliance and client fund protection across multiple jurisdictions.

What does the ActivTrades demo account offer?

The ActivTrades demo account is free and uses virtual funds to offer risk-free practice under real-time market conditions. It provides access to all their platforms (MT4, MT5, and ActivTrader) and their full range of instruments. It expires after 30 days but can be easily reopened.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legal and regulated global broker | No real profits from demo trading |

| Free and unlimited demo account | May require registration to start |

| Access to MT4, MT5, and ActivTrader | Limited emotional trading experience |

| Realistic market conditions | Advanced features may overwhelm beginners |

| Excellent trading tools and analytics | Educational content could be broader |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

ActivTrades is a legal and trusted broker offering a free, unlimited demo account. It’s perfect for traders to practice strategies, explore advanced platforms, and gain experience before trading live with real capital.

10. FXTM

FXTM provides a free demo account for risk-free practice using virtual funds under real-time market conditions. Supporting MetaTrader 4 and MetaTrader 5, it allows traders to test strategies effectively before transitioning to a live trading account.

Frequently Asked Questions

What does the FXTM demo account offer?

The FXTM demo account is free and uses virtual funds (up to $1 million) to practice risk-free on MT4 or MT5 platforms under real-time market conditions. It mirrors live accounts, allowing you to test strategies on Forex, indices, and commodities CFDs.

How long can I use the FXTM demo account?

The FXTM demo account is typically valid for 90 days from the sign-up date, though some sources suggest it can be unlimited. It is best to check with FXTM directly as policies can vary by region or platform (MT4 vs. MT5).

Pros and Cons

| ✓ Pros | ✕ Cons |

| Registered and regulated global broker | No real profits from demo trades |

| Free and risk-free demo account | Requires registration to start |

| Access to MT4 and MT5 platforms | Limited emotional trading experience |

| Realistic market trading conditions | Some advanced tools restricted to live accounts |

| Ideal for beginners and advanced traders | Platform learning curve for new users |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

FXTM is a registered and trusted broker offering a free, realistic demo account. Traders can practice on MT4 or MT5, test strategies, and gain valuable experience before transitioning to live trading safely.

What is a Forex Demo Account?

A Forex Demo Account is a practice trading account that allows users to trade in real market conditions using virtual funds instead of real money. It’s offered by Forex brokers to help beginners and experienced traders test strategies, explore trading platforms, and build confidence without any financial risk.

Demo accounts simulate live market prices, spreads, and execution speeds, making them an essential tool for learning how to trade before investing real capital.

Criteria for Choosing a Forex Demo Account

| Criteria | Description | Importance |

| Realistic Market Conditions | The demo account should closely simulate real-time spreads, execution speeds, and market volatility. | ⭐⭐⭐⭐⭐ |

| Platform Availability | Access to leading trading platforms like MT4, MT5, or cTrader ensures a realistic trading experience. | ⭐⭐⭐⭐☆ |

| Duration of Access | A good demo account should offer unlimited or extended usage for continuous practice. | ⭐⭐⭐⭐☆ |

| Regulation of the Broker | Choosing a regulated broker guarantees reliability, fund safety, and fair trading conditions. | ⭐⭐⭐⭐⭐ |

| Virtual Fund Amount | Sufficient virtual capital allows users to test various strategies and risk management approaches effectively. | ⭐⭐⭐⭐☆ |

| Ease of Transition to Live Account | The ability to switch smoothly from demo to live trading is convenient for growing traders. | ⭐⭐⭐⭐☆ |

| Educational Resources | Quality tutorials, webinars, and guides help users make the most of their demo practice. | ⭐⭐⭐⭐☆ |

| Customer Support | Responsive support helps users navigate platform setup and trading queries easily. | ⭐⭐⭐⭐☆ |

| Mobile Compatibility | A demo account that works seamlessly on mobile devices allows trading practice anywhere. | ⭐⭐⭐⭐☆ |

| Account Customization | Ability to adjust leverage, lot size, or balance helps simulate different trading conditions. | ⭐⭐⭐☆☆ |

Top 10 Best Forex Demo Accounts – A Direct Comparison

What Real Traders Want to Know!

Explore the Top Questions asked by real traders across the Globe. From being able to switch from a demo account to a live account, to limitations, we provide straightforward answers to help you understand demo accounts and choose the right broker confidently.

Q: How realistic is a forex demo account compared to live trading? – James M.

A: A demo account provides real-time prices and platform functionality, but lacks the psychological stress of real money. Crucially, live accounts face slippage, varying execution, and real spreads/commissions that are often minimized or absent in the simulated, ideal conditions of a demo.

Q: Can I switch easily from a demo account to a live forex trading account? – Sarah L.

A: Yes, switching is generally easy and quick. You open a live account via the broker’s website, complete the verification/KYC process, and then fund the account. On platforms like MT4/MT5, you simply log in with the new live account credentials to trade.

Q: Are there any limitations to using a demo trading account? – Ahmed K.

A: The key limitations are the lack of emotional pressure (fear/greed) from using virtual funds, which can lead to overconfidence and poor habits. Additionally, demo accounts often fail to accurately replicate live costs like slippage, varying spreads, and commissions.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Risk-Free Practice | No Real Emotions Involved |

| Familiarization with Platforms | Unrealistic Execution |

| Strategy Testing | Overconfidence Risk |

| Confidence Building | Limited Realistic Conditions |

| Understanding Market Movements | No Real Profit |

You Might also Like:

- MultiBank Group Review

- Plus500 Review

- FP Markets Review

- FOREX.com Review

- Pepperstone Review

- OANDA Review

- Tickmill Review

- AvaTrade Review

- ActivTrades Review

- FXTM Review

In Conclusion

Forex demo accounts are ideal for learning, practicing, and testing strategies without financial risk. However, traders should remember that emotional control and execution differences make live trading a unique challenge requiring additional experience.

Faq

You should use a demo account to learn the platform’s functions, test trading strategies risk-free, and understand market mechanics using real-time data. It builds essential confidence and familiarity without risking any of your real capital.

Generally, yes, demo accounts are free to use with most major brokers. They are offered as a risk-free tool to allow potential clients to test the trading platform, features, and market conditions using virtual funds before committing real capital.

Demo account duration varies significantly by broker. Many expire after 30 or 60 days of inactivity or registration, while others, like OANDA or MultiBank, offer unlimited or non-expiring usage, often requiring you to have a live funded account to maintain access.

Yes, most high-quality demo accounts from major brokers use real, live market data for pricing, spreads, and charting. This allows you to practice under authentic price movements. However, execution may be faster than in a live account, as it lacks real-world slippage and latency.

No, you cannot make real profits from a demo account because it uses virtual, simulated funds. The purpose is risk-free practice and strategy testing, and any gains or losses generated in a demo account remain entirely virtual.

You can typically use a demo account on industry-standard platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), as well as the advanced cTrader and TradingView. Most brokers also offer a demo on their proprietary web and mobile trading apps.

Demo accounts often show faster, idealized execution speeds because they operate in a simulated environment without real market latency, liquidity issues, or slippage that affect live trading. This can create a misleading expectation compared to the real market.

Yes, beginners should use a demo account effectively to learn the platform, test basic strategies risk-free, and understand market mechanics. It’s crucial for building initial confidence and reducing the learning curve before risking real capital.

Yes, trading psychology is significantly different. Using virtual funds eliminates the fear of loss and greed associated with risking real capital. This lack of emotional pressure can lead to overconfidence, poor risk management habits, and unrealistic expectations when transitioning to live trading.