10 Best Islamic (Swap-Free) Forex Accounts

We have selected the 10 Best Islamic (Swap Free) Forex Accounts for traders seeking Sharia-compliant trading conditions that avoid interest-based fees. These accounts offer transparent pricing, strict regulatory protection, and user-friendly platforms, ensuring that both beginners and experienced traders can trade with integrity and confidence in the forex market.

10 Best Islamic (Swap Free) Forex Accounts (2026)

- MultiBank Group – Overall, The Best Islamic (Swap Free) Forex Account

- Octa – Cost-effective and beginner-friendly trading experience

- IC Markets – Low spreads starting from 0.0 pips

- AvaTrade – Unique risk management tool called AvaProtect

- HFM – Extensive range of trading instruments

- Admirals – Enhanced MetaTrader Supreme Edition platform

- Pepperstone – Highly competitive pricing via its Razor account

- FP Markets – Strong emphasis on regulation and security

- Exness – Flexible leverage up to 1:Unlimited

- iUX – High performance and competitive trading conditions

Top 10 Forex Brokers (Globally)

1. MultiBank Group

MultiBank Group offers a dedicated Islamic (Swap-Free) Forex Account that allows Muslim traders to trade without incurring overnight interest (swap) charges, in line with Sharia principles. The account supports trading on MT4 and other platforms, and clients may hold either a swap-free or a standard account, with MultiBank reserves the right to revoke swap-free status in cases of abuse.

Frequently Asked Questions

Does MultiBank Group offer Islamic (Swap-Free) Accounts?

Yes, MultiBank Group offers Sharia-compliant Islamic (Swap-Free) Accounts. These accounts are available on their Standard and Pro account types in eligible countries, waiving all swap charges/credits on overnight positions to comply with Islamic finance principles.

Who can apply for a MultiBank Islamic account?

MultiBank Group primarily offers the Islamic (Swap-Free) account to Muslim traders who require their trading to be compliant with Sharia law, which prohibits interest (Riba). They may require applicants to verify their eligibility and generally limit traders to one Swap-Free account only.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Sharia-compliant, interest-free trading | Not all instruments may be swap-free |

| Regulated and authorized global broker | Swap-free status can be revoked if misused |

| Competitive spreads and fast execution | May require additional verification |

| Supports MT4/MT5 platforms | Limited availability in some regions |

| Suitable for both beginners and experienced traders | Potential restrictions during high-risk trading periods |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

MultiBank Group’s authorized Islamic (Swap-Free) Accounts provide a reliable, Sharia-compliant trading solution with competitive conditions. They suit traders seeking interest-free forex trading while benefiting from strong regulation, advanced platforms, and a stable global brokerage environment.

2. Octa

Octa offers a fully Islamic (Swap-Free) Forex Account that allows halal trading by removing all overnight interest (riba) charges to comply with Sharia law. This swap-free structure is applied across the MT4, MT5, and OctaTrader platforms while maintaining tight market spreads and no hidden fees.

Frequently Asked Questions

How do I enable swap-free status on Octa?

You do not need to manually enable the swap-free status on Octa. All trading accounts (MT4, MT5, and OctaTrader) offered by Octa are automatically Sharia-compliant and swap-free by default, meaning no overnight interest is charged or paid.

Are there any limits or hidden fees on Octa’s Islamic account?

Octa’s Islamic accounts are unique because they are swap-free by default on all account types with no time limits and no fixed substitute fees or hidden commissions. Trading fees are competitive spreads, identical to non-Islamic accounts, starting from 0.6 pips on majors.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Genuine halal compliant trading | Possible inactivity or withdrawal fees |

| No overnight interest fees | Only forex and some CFDs eligible for swap free status |

| Supports popular platforms: MT4, MT5, OctaTrader | Swap-free status may require approval or verification |

| Transparent pricing with competitive spreads | Limited leverage options for Islamic account users |

| Reliable customer support and widely used broker | Potential regional restrictions on account availability |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆☆ |

Our Insights

Octa’s Islamic (Swap-Free) Accounts are a legit option for Sharia-compliant traders, offering transparent conditions, supportive platforms, and no interest charges, ideal for both newcomers and experienced forex users seeking ethical, halal trading.

3. IC Markets

IC Markets offers a Islamic (Swap-Free) Forex Account that complies with Sharia law by removing swap or overnight interest fees. Available on popular platforms such as MetaTrader 4, MetaTrader 5, and cTrader, these accounts ensure ethical, halal trading conditions.

IC Markets is a legit and regulated broker, providing tight spreads, fast execution, and a user-friendly experience.

Frequently Asked Questions

What makes IC Markets’ Islamic account “legal”?

IC Markets’ Islamic account is considered “legal” as it is Sharia-compliant. It adheres to Islamic financial law by removing all overnight interest (Riba) charges (swaps). While it may apply a holding fee on overnight positions for some assets, this is done to substitute interest, ensuring halal trading for Muslim clients.

Are there any overnight or hidden charges on the Islamic account?

IC Markets’ Islamic accounts are swap-free, meaning no overnight interest (Riba) is charged. However, they are not free of all overnight charges. A flat-rate holding fee is applicable on certain instruments held overnight, which acts as a substitute for the swap. Standard spreads and commissions apply.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Sharia-compliant, interest-free structure | Flat overnight holding fees apply |

| Legal and regulated broker | Swap-free status can be revoked for abuse |

| Wide access | Documents or justification for religious belief may be required |

| Supports MT4, MT5, cTrader platforms | Fixed administrative fees for some long held positions |

| Leverage up to 1:500 | Additional conditions or charge variations depending on the instrument |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

IC Markets’ Islamic (Swap-Free) account is a legal, regulated solution for Muslim traders, offering Sharia-compliant trading with transparent fees, solid infrastructure, and a wide instrument range in a trusted forex environment.

Top 3 Islamic (Swap Free) Forex Accounts – MultiBank Group vs Octa vs IC Markets

5. AvaTrade

AvaTrade offers Islamic (Swap-Free) Forex Accounts designed to meet the needs of Sharia-compliant traders. These accounts are free of overnight interest (swap) fees, ensuring halal trading conditions.

AvaTrade is an authorized and regulated broker, providing access to major platforms like MetaTrader 4, MetaTrader 5, and AvaTradeGO, with competitive spreads and a wide range of instruments.

Frequently Asked Questions

Does AvaTrade offer an approved Islamic (Swap-Free) Account?

Yes, AvaTrade offers an approved Islamic (Swap-Free) Account for Muslim traders adhering to Sharia law. These accounts remove overnight interest (swaps), though trades held for longer than 5 days may incur an administration charge instead. Full verification and funding are required to apply.

Which platforms support AvaTrade’s Islamic account?

AvaTrade’s Islamic (Swap-Free) account status is available on their main platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and their proprietary AvaTradeGO App and WebTrader. This allows Sharia-compliant trading across all devices.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Sharia-compliant, swap-free trading | Administrative fees may apply on some trades |

| Approved an regulated global broker | Approval for Islamic status may take time |

| Wide range of forex and CFD instruments | Not all instruments qualify for swap-free terms |

| Supports MT4, MT5, and AvaTradeGO | Regional availability may vary |

| Competitive spreads with user-friendly features | Long-term positions may incur higher admin costs |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

AvaTrade’s approved Islamic (Swap-Free) Account offers halal, interest-free trading with solid regulation, modern platforms, and competitive spreads. It provides a reliable option for Muslim traders seeking Sharia-compliant trading conditions across forex and major CFD markets.

5. HFM

HFM offers Islamic (Swap-Free) Forex Accounts on MT4, MT5, and its platforms that remove overnight swap charges in selected accounts like Micro and Premium, ensuring ethical, Sharia-compliant trading with competitive spreads and leverage.

Frequently Asked Questions

Which HFM account types can be opened as Islamic?

HFM offers swap-free trading on several account types, including the Premium Account, Zero Account, and Pro Account. Clients who observe Sharia law can request a conversion for these selected accounts to remove all overnight interest (Riba) charges.

Are there any extra fees on HFM Islamic accounts?

HFM Islamic accounts are generally swap-free, eliminating overnight interest (Riba). However, traders should note that Carry Charges may apply to certain instruments held open for a sequential period of days. Other standard trading costs, like spreads and commissions (on Zero accounts), still apply.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Fully approved, Sharia compliant trading | Administrative fees may apply on certain instruments |

| Wide choice of account types | Approval for Islamic status may take time |

| Supports MT4 and MT5 platforms | Long-term positions can become costly |

| Competitive spreads and strong execution | Some CFDs are not eligible for swap-free trading |

| Suitable for both beginners and professionals | Regional restrictions may apply |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

HFM’s approved Islamic (Swap-Free) Accounts offer Sharia-compliant, interest-free trading across multiple platforms and account types. With competitive spreads and strong regulation, they provide a reliable option for Muslim traders seeking ethical and accessible forex trading conditions.

6. Admirals

Admirals offers an Islamic (Swap-Free) Forex Account on its Trade.MT5 platform, removing overnight swap fees while keeping tight spreads and fast execution. A fixed administration fee applies for positions held beyond three days to comply with Sharia law.

Frequently Asked Questions

Does Admirals offer a registered Islamic (Swap-Free) account?

Yes, Admirals offers a registered Islamic (Swap-Free) Account designed for Muslim traders that complies with Sharia Law. This option is available on their Trade.MT5 account and removes all overnight interest (swaps), though an administration fee may apply to positions held longer than three days.

Are there any administrative fees on the Admirals Islamic account?

Yes, Admirals’ Islamic account, which is swap-free, does have an administration fee. This flat-rate charge is applied to positions held open longer than three days (or one day for exotics and digital currencies) to compensate for the removed overnight interest (swaps).

Pros and Cons

| ✓ Pros | ✕ Cons |

| Sharia-compliant, swap-free trading | Administrative fees apply for long-held trades |

| Registered and regulated broker | Swap-free option only on certain account types |

| Low spreads even with swap-free status | Not all instruments may qualify for swap free status |

| Access via MT5 platform | Need active monitoring of fees for long-term positions |

| Wide range of forex & CFD instruments | Approval required to convert to Islamic account |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Admirals’ registered Islamic (Swap-Free) Account delivers Sharia-compliant forex and CFD trading with tight spreads, robust regulation, and a transparent fee model, making Admirals a solid choice for traders seeking ethical, interest-free conditions.

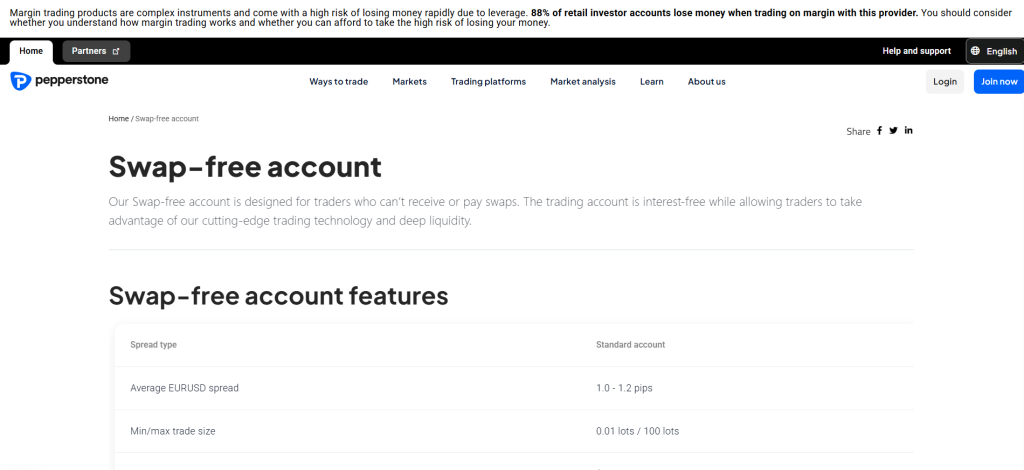

7. Pepperstone

Pepperstone provides an Islamic (Swap-Free) Forex Account removing overnight interest fees for Muslim traders. Instead, a fixed administrative fee applies after 5 or 10 days, depending on the instrument. It supports MT4, MT5, cTrader and allows scalping, hedging, and Expert Advisors.

Frequently Asked Questions

Which trading platforms support Pepperstone’s Islamic account?

Pepperstone’s Islamic (Swap-Free) account is supported across all their main platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. This allows Sharia-compliant traders to utilise their preferred desktop, web, or mobile platform with ease.

Are there any extra fees instead of swap?

Yes, on Pepperstone’s Islamic (Swap-Free) account, an administrative fee is charged as a substitute for swap interest. This fee typically applies to Forex and Precious Metal positions held open for longer than five days (or ten days in some regions) and is charged per standard lot.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Ethical, swap-free (authorized) trading | Administrative fees for long-term positions |

| Platform flexibility: MT4, MT5, cTrader | Fixed fees vary by instrument and hold duration |

| Supports hedging, scalping, and EAs | Approval may be needed to activate swap-free status |

| Regulated and well established broker | May not be available in all regions |

| Clear fee structure for long-held positions | Costs can add up for very long-term trades |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐☆☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆☆ |

Our Insights

Pepperstone’s authorized Islamic (Swap-Free) Account offers Sharia-compliant trading with robust platforms and strategies. While fixed fees replace swaps, the transparency and flexibility make it a strong choice for ethical, long-term forex traders.

8. FP Markets

FP Markets offers an Islamic (Swap-Free) Forex Account that removes overnight swap fees, charging a fixed administration fee instead. Available on MT4, MT5, and cTrader, it supports Standard and Raw accounts with transparent fees and competitive trading conditions.

Frequently Asked Questions

How do I get the FP Markets Islamic account?

First, open a standard MT4 or MT5 live trading account with FP Markets. Then, email their onboarding team from your registered email address, requesting the conversion to an Islamic/Swap-Free account and providing your account number.

Are there any swap/interest charges on overnight positions?

Yes, FP Markets charges swap or interest rates (rollover fees) on all standard accounts for positions held open overnight. These rates can be a credit or debit. Islamic (Swap-Free) Accounts are available which remove the swap but substitute it with a potential administration fee on certain instruments.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Sharia-compliant, swap-free trading structure | Requires request and proof of faith to convert account |

| Available on MT4, MT5, and cTrader platforms | Admin fees apply for long-held positions |

| Two account types: Standard and Raw Islamic | Fees differ per instrument and may change over time |

| Deep liquidity + ECN style execution with tight spreads | Triple-swap night risk (Wed/Fri) is borne by FP Markets, but admin fee is not tripled |

| Admin fee only applies after a few nights (grace period) for some instruments | Not all symbols are covered |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms, and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐⭐ |

Our Insights

FP Markets’ Islamic (Swap-Free) Account is a legit Sharia-compliant option, offering ECN-style pricing and choice of platforms. While it charges nightly admin fees after a grace period, it combines ethical trading with competitive execution.

9. Exness

Exness offers an Islamic (Swap-Free) Forex Account that removes overnight swap fees for eligible traders. Swap-free status is applied account-wide in the Personal Area and often assigned automatically to traders from Islamic countries, covering selected instruments without extra fees.

Frequently Asked Questions

Who qualifies for a legal Islamic (swap-free) account with Exness?

Exness automatically provides swap-free status to residents of Islamic countries. For those outside these regions, any trader can apply by requesting the swap-free option on a Standard, Pro, or Raw Spread account to ensure their trading complies with Sharia Law.

Can Exness revoke the legal swap-free status?

Yes, Exness reserves the right to revoke the swap-free status on any account. This action is usually taken if trading activity suggests the account is being used to exploit the swap-free advantage rather than for genuine Sharia-compliant trading purposes. You will typically be notified in your Personal Area if your status changes.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legally structured to comply with Sharia | Swap-free status may be revoked for misuse |

| Auto-assigned in many Islamic countries | Not all instruments are eligible; some still incur swap |

| Transparent trading conditions and fees | Eligibility can depend on region or religious declaration |

| Wide selection of eligible instruments | Exness may change which account types or assets are swap-free |

| No need for a separate “Islamic account”; status applies across all accounts | Long-held positions may be monitored for arbitrage or abuse |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐☆☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Exness’s legal Islamic (Swap-Free) Accounts offer a legally compliant way to trade without interest, with transparent conditions and broad coverage. But swap-free status can be revoked, and not all instruments are eligible.

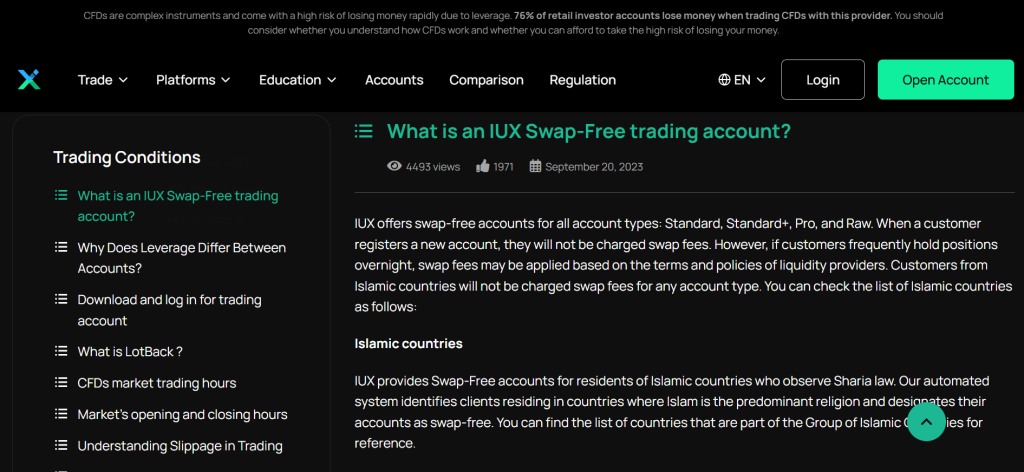

10. iUX

iUX offers Swap-Free (Islamic) trading accounts across all account types—Standard, Standard+, Pro, and Raw. Swap-free status is automatically applied for clients in Islamic countries, while others may receive it based on their trading behavior.

Frequently Asked Questions

Does iUX offer an approved Islamic (Swap‑Free) account?

Yes, iUX offers an Islamic (Swap-Free) Account that is Sharia-compliant. Interestingly, all iUX accounts are swap-free by default, meaning no overnight interest (Riba) is charged or paid on any account type, catering to all traders seeking halal conditions.

Are there any extra fees on iUX approved Islamic accounts?

No, iUX is highly regarded for its transparent, low-fee structure. All of their accounts are swap-free by default, meaning they do not charge or credit overnight interest (Riba) and do not substitute this with any flat-rate or administrative fee on Forex or Metals.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Sharia-compliant, approved swap-free structure | Approval may take verification time |

| Available across all account types | Not all instruments may qualify for swap free status |

| Supports MT4, MT5, and iUX WebTrader | Limited leverage on some approved Islamic accounts |

| Transparent spreads and trading fees | Fixed spreads may be slightly higher than standard accounts |

| Automatic swap-free status for eligible Islamic clients | Regional restrictions may apply |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐☆☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐☆☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐☆☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐☆☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐☆☆☆ |

Our Insights

iUX’s approved Swap‑Free (Islamic) Accounts provide Sharia-compliant trading across multiple platforms and account types. With transparent conditions and ethical trading, they are ideal for Muslim traders seeking an approved, interest-free forex trading solution.

What is an Islamic (Swap Free) Forex Account?

An Islamic (Swap-Free) Forex Account is a trading account designed for Muslim traders who follow Sharia law, which prohibits earning or paying interest (riba). In standard forex accounts, positions held overnight usually incur swap/rollover interest fees.

An Islamic or Swap-Free account removes these interest-based charges and replaces them with no swaps, ensuring the trading conditions remain compliant with Islamic financial principles. Traders can still access all regular trading features, like leverage, spreads, and platforms, without violating religious guidelines.

Criteria for Choosing a Islamic (Swap Free) Forex Account

| Criteria | Description | Importance |

| True Swap-Free Conditions | The account must remove all interest based overnight charges to comply with Sharia law. | ⭐⭐⭐⭐⭐ |

| Regulation & Broker Trustworthiness | Choose a regulated, well-established broker to ensure safety of funds and fair trading conditions. | ⭐⭐⭐⭐⭐ |

| Account Types Available | The broker should offer Islamic options across different account types (Standard, ECN, Raw Spread). | ⭐⭐⭐⭐☆ |

| No Hidden Fees | Ensure swap removal isn’t replaced with disguised overnight commissions or unfair administrative fees. | ⭐⭐⭐⭐⭐ |

| Range of Tradable Instruments | Brokers should allow halal-compliant trading on major forex pairs, metals, and indices. | ⭐⭐⭐⭐☆ |

| Execution Speed & Platform Quality | Fast, reliable execution on MT4/MT5 or proprietary platforms enhances the trading experience. | ⭐⭐⭐⭐☆ |

| Transparent Terms & Eligibility | Clear rules on how swap-free status is granted, maintained, or removed. | ⭐⭐⭐⭐☆ |

| Customer Support Availability | Responsive support for account setup, Sharia compliance questions, and technical issues. | ⭐⭐⭐☆☆ |

| Deposit & Withdrawal Options | Halal-friendly, fast, and low-cost funding methods are essential. | ⭐⭐⭐⭐☆ |

| Competitive Trading Costs | Tight spreads and low commissions help keep trading affordable without interest charges. | ⭐⭐⭐⭐⭐ |

Top 10 Best Islamic (Swap Free) Forex Accounts – A Direct Comparison

What Real Traders Want to Know!

Explore the Top Questions asked by real traders across the Globe. From verification to hidden fees, we provide straightforward answers to help you understand Islamic (Swap Free) Forex Accounts and choose the right broker confidently.

Q: Is it necessary to prove I’m Muslim to open a swap-free account? – Farid M.

A: It depends on the broker. Some brokers, like Octa and iUX, offer accounts that are swap-free by default, requiring no proof. Others, like FP Markets, may specifically request documentation (e.g., proof of faith) to grant the status.

Q: Do swap-free accounts charge hidden fees in place of swaps? – Jamal W.

A: Yes, many swap-free accounts replace the swap charge with a non-interest fee, often called an administration or holding fee. While some brokers (like Octa) genuinely charge no alternative fee, always check the terms, as replacement fees can sometimes be higher than the original swap.

Q: Are all instruments available on Islamic swap-free accounts? – Amina K.

A: Not all instruments are available. While major Forex pairs and many Indices are offered, some brokers exclude certain exotic currency pairs, Cryptocurrencies, or Stock CFDs from swap-free status. These exceptions often incur the standard swap or an administration fee instead.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Sharia-Compliant Trading | Possible Administrative Fees |

| No Overnight Swap Fees | Restricted Instruments |

| Fair Trading Conditions | Eligibility Requirements |

| Suitable for Long-Term Strategies | Potentially Higher Spreads |

| Available Across Major Brokers | Limited Swap-Free Duration |

You Might also Like:

- MultiBank Group Review

- Octa Review

- IC Markets Review

- AvaTrade Review

- HFM Review

- Admirals Review

- Pepperstone Review

- FP Markets Review

- Exness Review

- iUX Review

In Conclusion

Islamic (Swap-Free) Forex Accounts provide Sharia-compliant trading by removing interest-based overnight fees. They offer fair, transparent conditions for Muslim traders while maintaining standard trading features, making them a practical and ethical choice for long-term forex participation.

Faq

Muslims need a swap-free account to comply with Sharia Law, which strictly prohibits the payment or receipt of interest (Riba). Standard forex accounts charge overnight interest (swaps), making them Haram (forbidden). Swap-free accounts eliminate this interest, making trading Halal (permissible).

Yes, swap-free accounts generally allow normal trading, including scalping, hedging, and using EAs. The main difference is the elimination of overnight interest (swaps), though brokers may apply a non-interest administration fee on positions held for extended periods.

Islamic accounts are interest-free regarding swaps (overnight interest), which is prohibited by Sharia Law. However, many brokers impose an administration or holding fee on positions held for a set number of days to compensate for the removed swap, which is a key distinction.

No, a swap-free account is not automatically Halal. While removing interest (Riba) is essential, Sharia compliance also requires the trade to be immediate (spot), avoid excessive speculation (Maysir), and eliminate excessive uncertainty (Gharar). Always check the full broker terms.

No, not all brokers offer Islamic (Swap-Free) accounts. While many top-tier and international brokers do to accommodate Sharia Law requirements, some smaller or regionally focused brokers may not. Always check the “Account Types” section of a broker’s website before signing up.

It depends on the broker. Some brokers, like Octa and iUX, automatically offer swap-free accounts by default, requiring no religious proof. Others, like FP Markets and AvaTrade, require you to apply separately and may request documentation to verify Sharia compliance for the account.

Yes, administrative fees are generally allowed in Islamic accounts. Since Sharia Law prohibits interest (Riba) via swaps, many brokers replace it with a flat-rate administration or holding fee on positions held overnight for a set period. This non-interest-based charge is usually seen as Halal.

The vast majority of brokers offering Sharia-compliant trading support Islamic accounts on the industry-leading platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and the advanced ECN platform cTrader. Many also offer the status on their proprietary Web and Mobile Apps.

Halal trading, which primarily involves using a Swap-Free account to avoid interest (Riba), is not exclusively for Muslims. While created to meet Sharia Law, non-Muslim traders can also opt for these accounts if they prefer a no-interest trading model for personal or non-religious reasons.