10 Best Forex Brokers by Swaps

We have listed the 10 Best Forex Brokers by Swaps, offering traders the most favorable overnight interest rates on currency pairs. These brokers provide transparent swap conditions, strong regulation, and advanced trading platforms, allowing both beginners and professionals to manage long-term positions efficiently and maximize potential returns.

10 Best Forex Brokers by Swaps (2026)

- MultiBank Group – Overall, The Best Forex Broker by Swaps

- Pepperstone – Tight spreads on the Razor account

- HFM – High leverage up to 1:2000

- XM – Powerful trading platforms

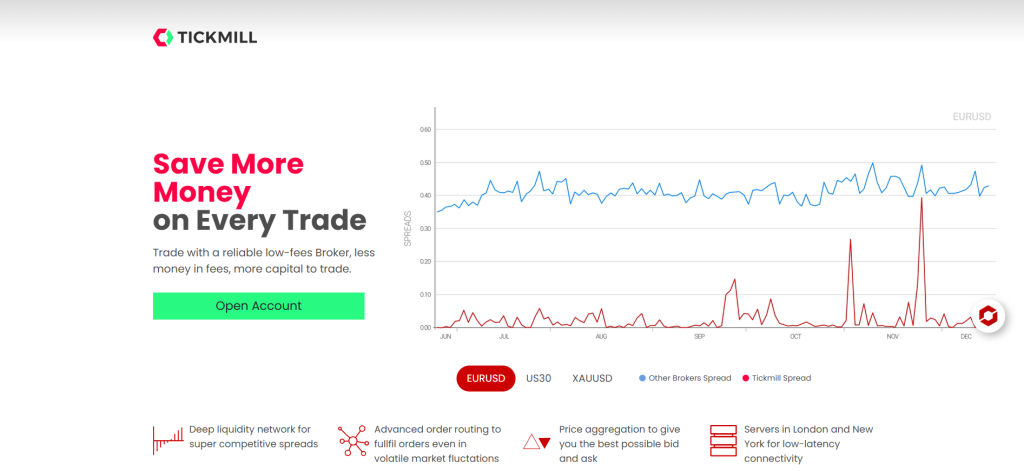

- Tickmill – Free VPS hosting for eligible clients

- Admirals – Multi-functional broker

- AvaTrade – AvaOptions for options trading

- RoboForex – CopyFX system for copy trading

- FP Markets – Trading platforms like MT4, MT5, cTrader, and TradingView

- IC Markets – Ultra-fast execution and deep liquidity

Top 10 Forex Brokers (Globally)

1. MultiBank Group

Multibank Group is a legit forex broker known for its competitive swap rates and wide range of trading instruments. It offers flexible account types, advanced platforms like MetaTrader 4 and 5, and transparent overnight financing, making it suitable for both short-term and long-term traders.

Frequently Asked Questions

Does MultiBank Group offer competitive swap rates?

Yes, MultiBank Group generally offers competitive swap rates, and is rated as having low financing rates compared to some peers. They also offer Swap-Free (Islamic) accounts on their Standard and Pro tiers in eligible countries, eliminating overnight fees for those traders.

Can I calculate swaps on the MultiBank trading platforms?

Yes, you can easily see the swap rates on MultiBank’s MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms by checking the Specification of any trading instrument in the Market Watch window.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Authorized and regulated | Higher minimum deposit compared to some brokers |

| Competitive swap rates on major and minor currency pairs | Limited educational resources for beginners |

| Advanced trading platforms | Inactivity fees may apply |

| Wide range of trading instruments | Restricted services in some regions |

| Strong fund protection and negative balance protection | Swap-free accounts may have limited availability |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

MultiBank Group is an authorized forex broker offering competitive swap rates, robust regulation, and reliable platforms. It suits traders seeking transparency, advanced tools, and efficient overnight trading while maintaining strong security and client fund protection.

2. Pepperstone

Pepperstone is an authorized forex broker known for its competitive swap rates and flexibility. They offer swap-free (Islamic) accounts in many regions, provide transparent overnight funding for standard accounts, and apply a triple swap charge on positions held through Wednesday night (5 PM New York time).

Frequently Asked Questions

Is Pepperstone a legit forex broker?

Yes, Pepperstone is considered a very legitimate and safe forex broker. It is strongly regulated by multiple top-tier financial bodies globally, including the FCA, ASIC, and CySEC.

Can I open a swap-free (Islamic) account with Pepperstone?

Yes, Pepperstone offers swap-free (Islamic) accounts for clients adhering to Sharia law. These accounts are available in a limited list of eligible countries and require approval from their customer support team.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legit and authorized | No proprietary trading platform |

| Competitive swap rates and transparent overnight charges | Limited product range beyond forex and CFDs |

| Fast trade execution and low spreads | Inactivity fees may apply |

| Swap-free Islamic accounts available | No fixed spread accounts |

| Excellent customer support and trading tools | Swap rates can vary between instruments |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐☆☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆☆ |

Our Insights

Pepperstone is a legit, authorized forex broker offering competitive swap rates, transparent conditions, and fast execution. Its advanced platforms and swap-free options make it ideal for traders seeking reliable, fair, and flexible trading conditions.

3. HFM

HFM is an authorized broker offering traders transparent swap/rollover policies. Their swap calculator shows interest paid or earned for positions held overnight. They also provide swap-free account options for eligible clients and instruments.

Frequently Asked Questions

Does HFM charge swaps on overnight positions?

Yes, HFM generally charges swaps (rollover fees) on overnight positions for most instruments. However, they offer a Swap-Free Trading feature, including specific swap-free account types like Premium, Pro, and Zero Accounts, which eliminate these charges on selected instruments.

Does HFM offer swap-free accounts?

Yes, HFM offers swap-free accounts for traders, primarily in two ways. They provide an Islamic Account option that can be applied to certain account types, and some of their regular accounts, like the Zero, Pro, and Premium, are also swap-free on specific instruments.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legal and regulated | Swap rates can vary by instrument and market conditions |

| Transparent swap and rollover policies | Higher swaps on exotic pairs |

| Swap-free Islamic accounts available | Limited product range in some regions |

| Comprehensive trading tools and calculators | Inactivity fees may apply |

| Wide range of instruments and account types | Some advanced features require higher deposits |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

HFM is a legal forex broker offering transparent swap policies, flexible account types, and swap-free options. With strong regulation and reliable platforms, it supports traders seeking secure, interest-free, and efficient overnight trading conditions.

Top 3 Forex Brokers by Swaps – MultiBank Group vs Pepperstone vs HFM

4. XM

XM is an authorized forex broker that applies swap/rollover fees to positions held overnight for most account types. However, XM offers Islamic (swap-free) accounts for eligible clients who cannot pay or receive interest due to religious beliefs, subject to approval and specific terms.

Frequently Asked Questions

Is XM an approved forex broker?

Yes, XM is an approved and regulated global forex broker. It operates under multiple entities that are overseen by several financial authorities, including CySEC (Cyprus), ASIC (Australia), DFSA (Dubai), and FSCA (South Africa).

Does XM charge swap fees?

Yes, XM charges swap fees (overnight financing) for positions held open overnight on their standard trading accounts. However, they also offer an Islamic (Swap-Free) option on all account types, which eliminates these overnight interest charges.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Approved and regulated | Swap rates can vary across instruments |

| Offers swap-free (Islamic) accounts for approved clients | Limited availability of swap-free accounts |

| Transparent swap policies and overnight fee details | Inactivity fees may apply |

| Wide range of instruments and flexible account types | Higher spreads on micro accounts |

| User-friendly platforms with strong educational support | No fixed spread options |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐⭐ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

XM is a fully regulated forex broker with flexible accounts. It offers transparent swap fees for overnight trades and swap-free (Islamic) options for eligible traders, ensuring a secure and compliant trading environment on reliable platforms.

5. Tickmill

Tickmill is an authorized forex broker offering transparent swap/rollover rates. They charge swaps each night for open positions, with triple rates on Wednesdays to cover weekend rollover. Swap-free (Islamic) accounts are available for eligible clients, though handling fees may apply for some instruments when held over several nights.

Frequently Asked Questions

Does Tickmill charge swap fees?

Yes, Tickmill generally charges swap fees (overnight financing) for positions held open overnight. However, they offer an Islamic/Swap-Free account option for eligible traders, which removes standard swap fees but may instead apply a daily handling charge on certain instruments.

Does Tickmill offer swap-free accounts?

Yes, Tickmill offers swap-free accounts, also known as Islamic accounts, which are compliant with Sharia law. This option removes the overnight interest charges (swaps) on all their account types for eligible Muslim traders.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Registered and regulated | Swap-free account availability limited by region |

| Transparent and competitive swap rates | Handling fees may apply for long-held positions |

| Offers swap-free (Islamic) trading accounts | Limited range of trading instruments |

| Low trading costs with tight spreads | No proprietary trading platform |

| Fast execution and reliable trading platforms | Educational resources could be expanded |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms, and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Options | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Tickmill is a registered forex broker providing an efficient trading environment. It features competitive costs and transparent swap rates, alongside an Islamic (swap-free) option, to secure all overnight trading positions on its reliable platforms.

6. Admirals

Admirals is an authorized forex & CFD broker that applies swap/overnight fees on positions held past a trading day. They also offer Islamic (swap-free) account options for clients who cannot pay or receive interest, subject to certain admin fees for long-held trades.

Frequently Asked Questions

Is Admirals an authorized forex broker?

Yes, Admirals is an authorized forex broker, with several entities regulated by major financial authorities globally. These include the FCA (UK), ASIC (Australia), and CySEC (Cyprus), which are considered top-tier regulators.

Does Admirals charge swap fees?

Yes, Admirals generally charges swap fees (overnight financing rates) on leveraged positions held past the daily rollover. However, they also offer an Islamic (Swap-Free) Account option for eligible traders, which replaces the standard swap fees with a flat administration fee on positions held for more than a few days.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Authorized and regulated | Swap-free accounts available only to eligible clients |

| Transparent swap and rollover policies | Administrative fees may apply on long held positions |

| Offers swap-free (Islamic) account options | Limited educational tools for beginners |

| Wide range of trading instruments and account types | Inactivity fees after prolonged account dormancy |

| Advanced tools, including MetaTrader 4 and 5 platforms | Swap rates vary by instrument and market conditions |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Admirals is an authorized forex broker offering transparent swap conditions and swap-free accounts. With advanced trading platforms, regulatory protection, and fair overnight fees, it provides a secure environment for both short- and long-term traders.

7. AvaTrade

AvaTrade is an authorized forex & CFD broker that charges overnight premium/swap fees for positions held past 22:00 GMT. Swaps depend on the instrument, trade size, and long/short direction. They offer Islamic swap-free accounts for eligible clients upon approval.

Frequently Asked Questions

Does AvaTrade offer swap-free accounts?

Yes, AvaTrade offers a Swap-Free Account (also called an Islamic Account) that adheres to Sharia law by removing overnight interest. However, be aware that trades held open for more than five days on this account will be charged swap fees.

Does AvaTrade charge swap fees?

Yes, AvaTrade does charge swap fees (also called overnight premiums) on positions held open after the market closes for the day on their standard accounts. They offer a separate, Sharia-compliant Islamic Account that is swap-free for trades held less than five days.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legit and authorized | Swap rates vary depending on the asset and position |

| Transparent swap and overnight fee structure | Inactivity fees after prolonged account dormancy |

| Offers swap-free (Islamic) trading accounts | Swap-free account eligibility limited by region |

| Supports multiple platforms, including MT4, MT5, and AvaTradeGO | Limited account customization options |

| Competitive spreads and strong global presence | Customer support could be faster during peak hours |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

AvaTrade is a globally regulated and legitimate forex broker that offers flexible overnight trading. They provide transparent swap rates on standard accounts and offer swap-free (Islamic) accounts for Sharia compliance. With advanced platforms and reliable conditions, AvaTrade is suitable for traders seeking secure and compliant trading solutions.

8. RoboForex

RoboForex is an authorized forex broker that applies swap fees (rollover interest) for holding overnight positions, which can be either charged or credited. They also provide Swap-Free (Islamic) accounts, replacing swaps with a fixed daily commission based only on the instrument and trade size.

Frequently Asked Questions

Is RoboForex a legal forex broker?

Yes, RoboForex is a legal broker, regulated by the Financial Services Commission (FSC) of Belize (license No. 000138/32). They are also a member of the Financial Commission, which offers dispute resolution and a compensation fund.

Does RoboForex charge swap fees?

Yes, RoboForex charges swap fees (overnight interest) on their standard trading accounts. However, they also offer Swap-Free (Islamic) accounts where an administrative daily commission replaces the traditional swap fee for Sharia compliance.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legal and regulated | Swap rates vary across instruments |

| Offers swap-free (Islamic) accounts for eligible traders | Swap-free accounts limited to specific regions |

| Transparent swap and rollover policies | Complex fee structure for some account types |

| Wide range of trading instruments and platforms | Limited educational materials for beginners |

| Competitive spreads and flexible account options | Inactivity fees may apply |

Final Score

| # | Criteria | Score |

| 1. | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2. | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3. | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4. | Research and Education | ⭐⭐⭐☆☆ |

| 5. | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6. | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7. | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8. | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9. | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10. | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

RoboForex is a legal forex broker offering transparent swap policies and swap-free accounts. With strong regulation, diverse platforms, and competitive conditions, it supports traders seeking secure, flexible, and interest-free overnight trading solutions.

9. FP Markets

FP Markets is an authorized forex broker that levies swap fees (overnight financing) for positions kept open after 00:00 server time. This charge is based on the interest rate difference of the currency pair and can be either a debit or credit depending on the trade direction (long or short).

Frequently Asked Questions

Does FP Markets charge swap fees?

Yes, FP Markets charges swap fees (overnight financing) for positions held past 00:00 server time on their standard accounts. They also offer a Swap-Free (Islamic) account option, which replaces the swaps with an administrative fee.

Does FP Markets offer swap-free accounts?

Yes, FP Markets offers Swap-Free (Islamic) accounts which are Sharia-compliant and do not charge or credit overnight interest (swaps). Instead, an administrative fee may be applied to positions held long-term.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Approved and regulated | Swap rates vary by instrument and trade size |

| Transparent swap and rollover policies | Swap-free accounts may incur administration fees |

| Offers swap-free (Islamic) accounts for approved clients | Limited educational content for beginners |

| Supports multiple platforms including MT4, MT5, and Iress Trader | Inactivity fees may apply |

| Competitive spreads and diverse range of instruments | Some advanced tools available only on certain platforms |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms, and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐⭐ |

Our Insights

FP Markets is an approved forex broker offering transparent swap fees and swap-free accounts. With robust regulation, multiple platforms, and competitive trading conditions, it provides a secure and flexible environment for overnight trading.

10. IC Markets

IC Markets, an authorized forex broker, applies swap fees (overnight financing) to trades kept open after the daily session closes. These charges, which can be a debit or a credit, are calculated based on the currency pair’s interest rate differential and the direction of your trade (long or short).

On MT4 and MT5, the swap rates are quoted in points and automatically converted to your account’s base currency.

Frequently Asked Questions

Is IC Markets an authorized forex broker?

Yes, IC Markets is an authorized and regulated forex broker. It operates globally through different entities regulated by multiple financial authorities, including ASIC (Australia), CySEC (Cyprus), the FSA (Seychelles), and the SCB (The Bahamas).

Does IC Markets charge swap fees?

Yes, IC Markets does charge swap fees (overnight financing) for positions in forex, metals, and other CFDs held open beyond the daily trading session. These fees are based on the interest rate difference of the currency pair.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Authorized and regulated | Swap rates can vary across different instruments |

| Offers competitive swap rates | Swap-free accounts may incur holding fees |

| Provides swap-free (Islamic) account options | Holding fees for swap free accounts are subject to change |

| Supports multiple trading platforms, including MT 4, MT 5, and cTrader. | Not all instruments may be available for swap-free trading |

| Low spreads and fast order execution | Eligibility for swap-free accounts may be limited by region |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

IC Markets is a regulated forex broker that offers both standard accounts with transparent swap fees and swap-free (Islamic) accounts for interest-free overnight trading. Its competitive conditions and robust regulation ensure a secure trading environment for clients who require interest-free positions.

What are Swaps in Forex Trading?

In Forex trading, a swap (also called a rollover) is the interest fee or credit you either pay or receive for holding a currency position overnight. It arises because each currency has its own interest rate, and when you trade one currency against another, you are effectively borrowing one currency to buy another.

Key Points:

-

Swaps are calculated at the end of the trading day, usually at 5 PM New York time.

-

A triple swap is often applied on Wednesdays to account for weekend interest.

-

Some brokers offer swap-free (Islamic) accounts, where swaps are replaced with an administrative fee to comply with Sharia law.

Swaps are the cost or gain for holding positions overnight, influenced by the interest rate difference between the two currencies in your trade.

Criteria for Choosing a Forex Broker by Swaps

| Criteria | Description | Importance |

| Swap Rates / Fees | The actual interest paid or earned for holding positions overnight; lower fees or higher credits benefit long-term trading. | ⭐⭐⭐⭐⭐ |

| Swap-Free Account Availability | Whether the broker offers Islamic (swap free) accounts for traders who cannot pay or receive interest due to religious reasons. | ⭐⭐⭐⭐☆ |

| Transparency of Swaps | Clear information on swap rates, calculation methods, and rollover schedules. Allows traders to plan positions without hidden costs. | ⭐⭐⭐⭐☆ |

| Triple Swap Policy | Brokers may apply triple swaps on Wednesdays to account for weekends; understanding this helps avoid unexpected fees. | ⭐⭐⭐⭐☆ |

| Platform Integration | Ability to view and calculate swaps directly on trading platforms (e.g., MT4, MT5, cTrader) for better planning. | ⭐⭐⭐⭐☆ |

| Consistency Across Instruments | Swap rates should be consistent and predictable for major, minor, and exotic currency pairs. | ⭐⭐⭐⭐☆ |

| Regulation and Authorization | An authorized broker ensures swaps are applied fairly and transparently, protecting traders from manipulation. | ⭐⭐⭐⭐⭐ |

| Currency Pair Coverage | Brokers should offer swaps on a wide range of currency pairs, especially those commonly traded by the user. | ⭐⭐⭐⭐☆ |

Top 10 Best Forex Brokers by Swaps – A Direct Comparison

What Real Traders Want to Know!

Explore the Top Questions asked by real traders across the Globe. From overnight trades to how often swaps are charged, we provide straightforward answers to help you understand swaps and choose the right broker confidently.

Q: How do swap rates affect my overnight forex trades? – James K.

A: Swap rates are the interest you either pay or earn for holding a forex position overnight. This is based on the interest rate differential between the two currencies in the pair.

Q: Can I choose a swap-free account with any broker? – Maria L.

A: No, not every broker offers a swap-free account (often called an Islamic account). While many major brokers do, you must check their specific account types and terms as availability varies.

Q: How often are forex swaps charged? – Lin W.

A: Brokers typically charge forex swaps (rollover fees) daily at the end of the trading day, usually at 5 PM New York Time. Critically, they apply a triple swap on Wednesdays to cover the interest for the upcoming weekend.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Earn Interest on Positions | Negative Swaps |

| Transparent Costs | Complex Calculations |

| Flexible Account Types | Triple Swap Wednesdays |

| Strategic Trading Opportunities | Limited Transparency at Some Brokers |

| Accurate Overnight Adjustments | Reduced Profit Margins |

You Might also Like:

- MultiBank Group Review

- Pepperstone Review

- HFM Review

- XM Review

- Tickmill Review

- Admirals Review

- AvaTrade Review

- RoboForex Review

- FP Markets Review

- IC Markets Review

In Conclusion

Forex brokers by swaps offer both opportunities and costs depending on position direction and interest rates. Understanding how swaps work helps traders minimize losses, optimize strategies, and choose transparent, well-regulated brokers for long-term success.

Faq

Swaps exist to account for the interest rate differential between the two currencies in a pair when a leveraged position is held overnight. Traders either pay or receive this interest (rollover).

No, not all forex brokers charge swaps. Many offer “swap-free” or “Islamic accounts,” which are exempt from overnight interest due to religious principles, but they may instead apply an administrative fee for positions held long-term.

Swap rates are calculated primarily based on the interest rate differential between the two currencies in the pair, reflecting the cost of borrowing one currency and lending the other. This differential is then factored with your trade size and the broker’s mark-up or commission.

A positive swap (or rollover) is an interest credit you receive for holding a forex position overnight. This occurs when the currency you bought has a higher interest rate than the currency you sold, allowing you to earn the net interest rate differential.

A negative swap is an interest charge you pay for holding a forex position overnight. This occurs when the currency you bought has a lower interest rate than the currency you sold, resulting in a net cost to your account.

Swaps are charged or credited daily when a position is held open past the market’s official rollover time, which is typically 5 PM Eastern Time (New York). A triple swap amount is applied on Wednesdays to account for the weekend.

The triple swap is charged on Wednesday to account for the three days of interest (Friday, Saturday, and Sunday) over the weekend. Since the forex market is closed on the weekend, the weekend’s swap is applied mid-week.

Yes, forex swap rates are variable and change daily. They fluctuate based on the interest rate differential between the two currencies, as well as market liquidity and broker-specific adjustments.

They often do not cost more upfront, but most brokers charge an administrative or holding fee for positions held overnight instead of the swap. This fixed fee can sometimes make long-term trades more expensive than on a standard account.