Get ready To Sell The Retrace In Aussie

We posted a market update yesterday about the Aussie. This forex pair has turned bearish after climbing higher for two weeks and trading sideways for another week.

The Canadian Dollar has also lost about 100 pips, so the commodity currencies are on the back foot right now, although the Kiwi is showing some resilience.

So, as we said, we have changed our view for AUD/USD, from hawkish/neutral a week ago, to bearish. Therefore, we´re looking for sell orders only on this pair, although the US employment report might change everything, so we have to wait for that report to be out of the way before going short.

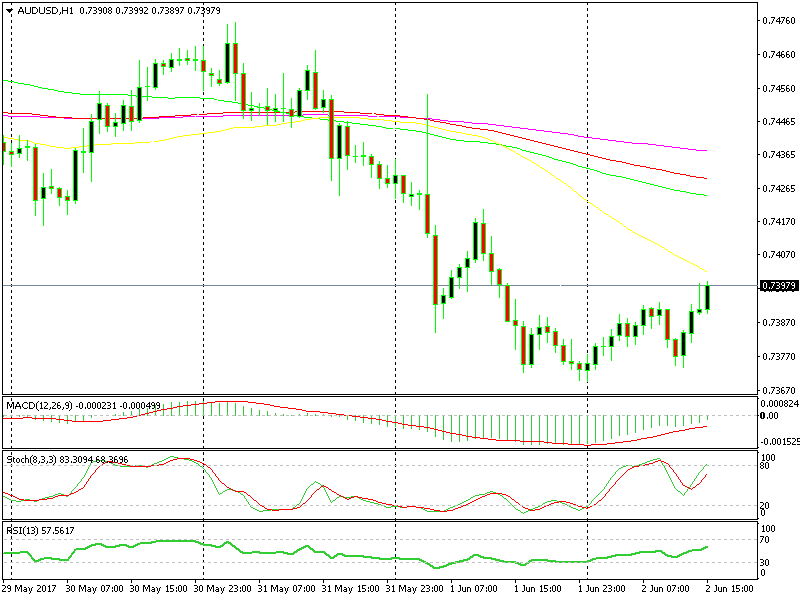

The H1 chart looks bearish

The H1 chart looks bearish

The H1 forex chart looks very luring for sellers; the trend is down, the retrace is almost completed since stochastic is almost overbought, the 50 SMA (yellow) is looming above our head and the last hourly candlestick closed as an upside down pin, which is a reversing signal.

So, there are quite a few technical indicators signalling us to sell this pair. But, let´s wait for the US labour report to be published, so we don´t get caught up by volatility and get whipsawed.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account