Going Short on AUD/USD

The USD lost more than a handful of pips after the US employment report was released. That shook the forex market a bit and it opened a few

•

Last updated: Friday, December 8, 2017

The USD lost more than a handful of pips after the US employment report was released. That shook the forex market a bit and it opened a few trade opportunities for us.

We mentioned EUR/USD and AUD/USD in the previous update apart from NZD/USD where we already had an open signal. We just opened another sell forex signal, this time in AUD/USD, so let’s see the chart setup for this forex trade.

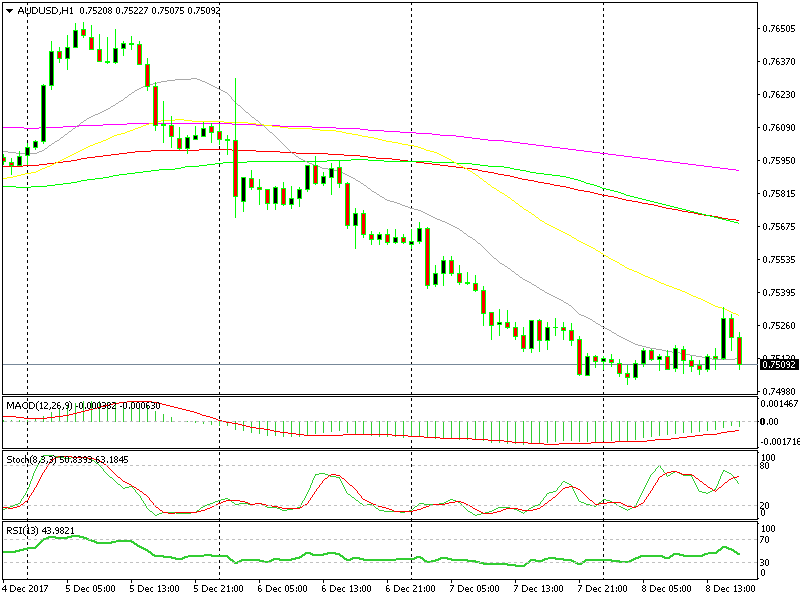

This chart looks all bearish.

- The stochastic indicator is almost overbought, which means that the H1 chart is overbought. So, the retrace up is complete according to this technical indicator.

- The 20 SMA (grey) is broken, but the 50 SMA provided solid resistance after the initial jump. That’s a strong bearish indicator in a downtrend.

- Speaking of the downtrend, it has been bearish all week and it has picked up pace recently.

- The area around 0.7530 provided resistance yesterday and it did the same during that jump.

So, here are the four technical indicators which are pointing down at the moment. We took this forex trade and are looking for another trade in EUR/USD, but we will wait a bit further before making it three forex trades long on the US Dollar.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM

ABOUT THE AUTHOR

See More

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.

Related Articles

Sidebar rates

HFM

HFM rest

Related Posts

Pu Prime

XM

Best Forex Brokers

Join 350 000+ traders receiving Free Trading Signals