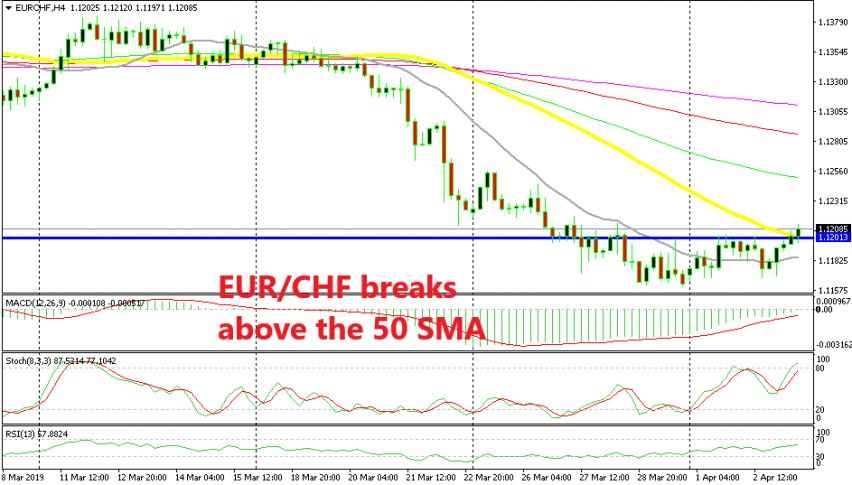

EUR/CHF Climbs Above 1.12 Anyway as SNB Continues to Threaten With Intervention

The SNB is threatening to intervene if the CHF gets too strong and the CHF is breaking resistance levels

The Swiss National Bank (SNB) has been pretty vocal this week. First, it was Chairman Jordan who said that the SNB stands ready to intervene if the market leans heavily on the CHF. That came on Monday after the risk sentiment turned pretty negative last week and EUR/CHF declined to 1.1160 towards the end of the week.

Today, an SNB member commented a while ago and he beat that drum again, saying that they are ready to intervene. Below are the comments board member Andrea Maechler made:

- The central bank is willing to intervene if necessary

- Expansive monetary policy remains necessary

- Inflation pressures remain weak

Nonetheless, EUR/CHF is continuing to crawl higher, slowly but surely, as the pressure remains to the upside. This broke above 1.120 which has formed a resistance around it. The 50 SMA (yellow) also stands at this area, so the price has broken above that moving average as well.

Now the H4 chart is overbought as stochastic suggests, but the sentiment is quite positive after the positive services data from China and the Eurozone, so until the sentiment reverses, the sellers should stand on the sidelines.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM