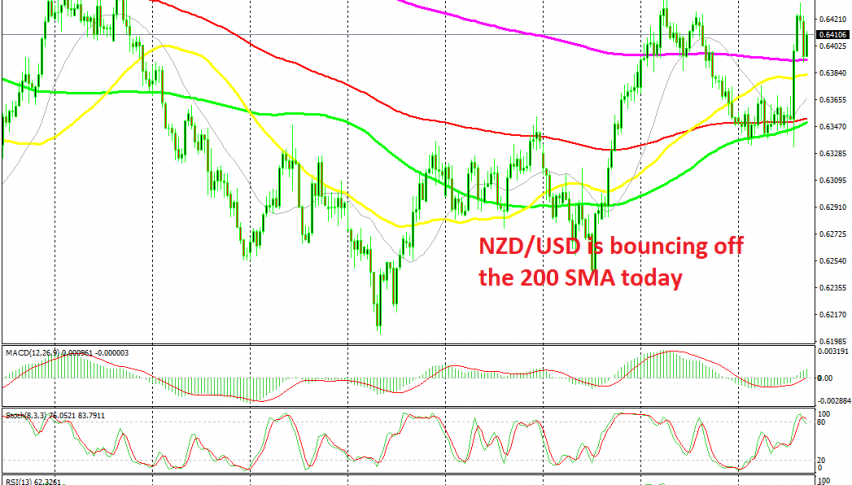

Buying NZD/USD at MAs

NZD/USD retraced lower today after the surge yesterday following the FED. But the 200 SMA stopped the retrace and reversed this pair higher

[[NZD/USD]] turned quite bullish in the third week of this month after the US-China partial trade deal, which improved the sentiment in financial markets considerably, sending risk currencies such as the Kiwi higher. This pair climbed around 200 pips higher until early last week.

Although, the USD started attracting some bids last week and NZD/USD turned lower. But, the 100 SMA (green) on the H4 time-frame held the decline for several days. it was pierced a few times, but it held as support and eventually the price reversed higher from there.

The USD turned bearish after the Powell’s press conference and NZD/USD climbed more than 100 pips higher. Although, the climb stopped right at last week’s high today at 0.6430s and after forming a doji candlestick which is a reversing signal, it retraced back down.

The retrace is not complete on the H4 chart, but it is on the H1 chart. If you switch to that time-frame, the stochastic is almost oversold. On this chart, the price found resistance at the 200 SMA (purple). This moving average provided support a couple of times last week and it is doing the same now. The price started reversing higher off the 200 SMA and we decided to take this opportunity and go long on NZD/USD. So, we opened a buy signal since the USD continues to be bearish.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account